and get first instructions and information about the brand new and worldwide exclusive GUNNER24 Forecasting Trading Technique.

I have decided to release a Trade of the Day buy alert that I wrote for Friday trading to the public. When an uptrend starts his ascent mostly is full of energy, and the start of a new bull cycle is by far the easiest part in our trading business.

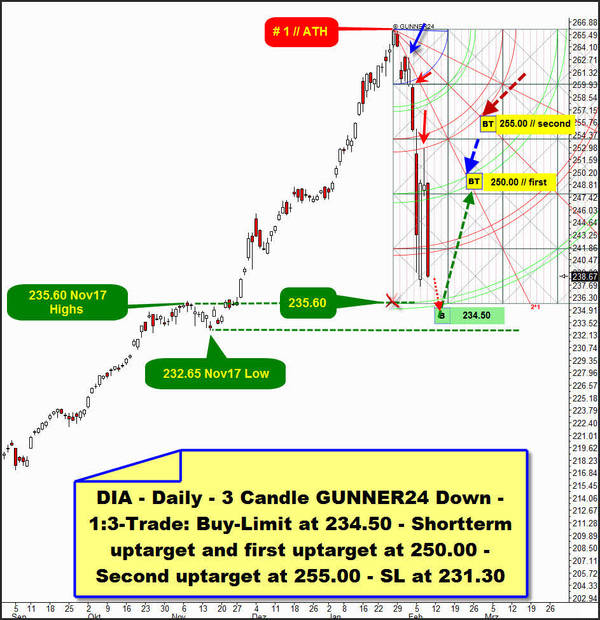

Shortly before the end of the trading week, GUNNER24 opened a small DIA long position at 234.50$ into the last downswing!

Enjoy!

========================================

The 1:3 Trade: Buy DIA ETF at 234.50

Dear GUNNER24 Traders,

The 1:3 Trade: Buy DIA ETF at 234.50

Our 1:3 trades are A) adjusted to a longer term, having a spacious stop-loss for the development not to be endangered and B) have to show a risk-reward ratio of more than 1:3.

DIA ETF (SPDR Dow Jones Industrial Average ETF corresponds to the performance of Down Jones Industrial Index = Dow Jones).

On Tuesday morning (Trade of the Day 02/06), I was very much in favor of the ECB (European Central Bank) taking massive steps to buy up European stock market futures, rescuing the stock markets from falling further apart. As a result we realized that the early-Tuesday and very deep panic lows could even mean the end of the long-awaited stock market correction and also concluded the recent panic cycle which began at current alltime-highs.

The Tuesday-panic cycle lows are at:

Dow Jones future - 23088

NASDAQ-100 future - 6260

S&P 500 future - 2529

DAX CFD-low - 11690.

A few days later, these extremes still mark the absolute low point of this correction and it may well be that these prices have printed the absolute extremes of this correction. The probability for this resolution I now set to about 60%. Thus, we have tradable market lows made on Tuesday and that`s why we`re allowed to go carefully long again.

From my point of view, only the futures markets capture this panic cycle/correction in a realistic way according price and time because only there were the strongest and thus most meaningful sentiment peeks of this downcycle. That`s why we first have to use the Dow Jones continuous future contract (YM #) as the starting point for todays DIA ETF long setup:

Above you see the YM # in the weekly. As highlighted earlier, the Dow Jones is obviously oriented to a cycle which began at the early and final low of 2017. The cycle that started at the 2017 Low finally topped after a 55-week duration at current 26684 pts alltime-high (ATH), made a candle ago. Uptrend from 2017 Low to 2018 ATH lasted 55 weeks. This is an important, cause high Fib number. This potential turn signal according time triggered indeed a correction. Correction which began at ATH is at week No. 2.

There is some more secure prove that the 2017 bear extreme is a very important low of this bull market although this doesn`t seem like it at first glance.

23088 pts correction low tested 50% Fib retracement of 2017 Low to ATH advance nearly to the T. 50% Fib retracement is at 23146 pts.

And additionally, the correction spike low tested exceptionally accurate the "Rising 2017 Support Trendline" from above! Thus YM # correction stopped, bottomed and turned at natural MEGA STRONG SUPPORT MAGNET which half springs from final 2017 Low!

Additionally, week lows have tested the 30 week Moving Average (30 MA) and it looks like the week can close well above all the highlighted supports. It all looks pretty bullish. Now and in the weekly chart! And I think you are totally with me when I commit to the fact that it is very possible that the final low of this correction was found on Tuesday at 23088 pts.

Let`s look at the course of the correction in the daily YM # chart. At ATH, a 2 Day down is recognizable and this first daily down impulse forecasted - of course among some other natural downtargets - a possible end of downswing resp. important lows at 5th double arc environment as at end of setup according price. See, where 23088 pts Tuesday-spike low is made:

7th correction day low spiked into combined natural end of setup and 5th double arc downtarget magnet just for closing the day above 4th double arc support which obviously is a stronger daily closing base support for the current underway YM # downcycle. The 4th double arc is daily closing base support. Until today...

Market respects the GUNNER24 Setup Specifications because at red and green arrows we recognize turns or extremes triggered by the setup magnets. Lower line of 4th double arc seems to be most important daily support actually because we observe 3 tests of that trail at day lows from above.

Correction low at first glance obviously successfully tested back 23205 pts November 2017 (Nov17) Low.

==> And now I think that it would have to come by no later than Tuesday to a more serious test of the # 7 // 23088-low! Why?

==> Answer: This is the result of the correction process that the DIA ETF has taken so far!

The DIA correction in the daily so far presents itself as follows:

DIA shows an initial 3 Day down impulse. Setup also works nicely. For this again watch the placed arrows. At blue arrow, we recognize a small countertrend high made at natural 2*1 Angle resistance. At red arrows, we observe 100% accurate backtests of first square line resistance and lower line of 2nd double arc resistance from below.

3rd double arc was closing base support for only a total of 2 days, then yesterday DIA finally and decisively lost and closed under the 3rd and 4th support double arcs. This is strong sell candle/sell signal and ETF is now aiming the 5th double arc main downtarget, resp. the end of setup according price main downtarget!

==> DIA should work off its next lower natural GUNNER24 Downtargets out of ATH within days, I suppose/expect and then also the Nov17 Low support environment test is due, I suppose. The exact same test that the Big Brother YM # of DIA already accomplished at Tuesday correction lows.

==> Please enter a small DIA long position at 234.50$ until Wednesday, 14th of February 2018!

I think that only after DIA has reached and worked off its activated GUNNER24 Downtargets and has tested Nov 2017 Low support environment a next daily upwards swing is allowed to begin. This swing should at least test back 2*1 Angle and 3rd double arc resistance upmagnet quite serious.

==> Shortterm and at same time first uptarget at 250.00$!

IF YM # has finally bottomed at Tuesday panic low a new Dow Jones upcycle could move up quickly and hard. Accordingly, the second uptarget for the 1:3-DIA long trade setup is a fast backtest of 1*1 Angle and 2nd double arc resistance upmagnet at 255.00$ surroundings!

==> The SL for the trade setup is placed at 231.30$!

Risk = 3.20$. Potential reward = 15.50$. Risk-reward ratio 3.30/15.50 or 1:4.84

GUNNER24 Trade of the Day orders for 02/09/2018:

Market: DIA ETF

Orders: Buy-Limit at 234.50. Stop-Loss (SL) at 231.30. Shortterm = first uptarget is 250.00. Second uptarget is 255.00. Buy-Limit order valid till 02/14/2018.

Eduard

========================

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann

Did you find the newsletter article interesting?

You can forward it on to your friends, too! Please click here!

You can subscribe the GUNNER24 Newsletter Forecasts for free:

More GUNNER24 Services – click on the links below to get more information

Complete GUNNER24 Trading and Forecasting Course – learn to use a forecasting technique that produces 70% winner trades.

GUNNER24 Forecasting Charting Software

GUNNER24 Trading Setup Examples

Membership – 7 day RISK FREE TRIAL

GUNNER24 Detailed Action Sheet

Commissioned Charting Forecast – 20 to 50-year price forecasts

Trading Manuals - Overview

GUNNER24 Products - Overview

GUNNER24 Members – Please Login here

If you have forgotten your membership password, click here, and we will send it to you via e-mail.

To ensure delivery of our forecasts to your inbox, please add gunner24-forecasts@gunner24.com to your e-mail address book or safe senders list.

E-Mail this Post

E-Mail this Post