With a delivered week close precisely at 1222.00$ - important long trigger for the countertrend - the gold bounce finally switched to its Second Gear, after beeing flat and totally aimless for 8 long weeks.

Thus, the recent multi-month downtrend cycle had to be officially declared over and the gold should therefore continue to rise until the wide 1250$ to 1280$ resistance area (MAJOR!!) is reached in a 12 to 14 weeks lasting bullish cycle.

However, as the situation now represents, I suspect that this countertrend will not be able to reach or work off even the 1250$ lower MAJOR resistance band. In fact, on Friday, he should have finally topped at 1246$ in its 11th week. IF that is atually the case, there is now a 5 to 8 weeks lasting downcycle that should easily re-conquer the 1200$!

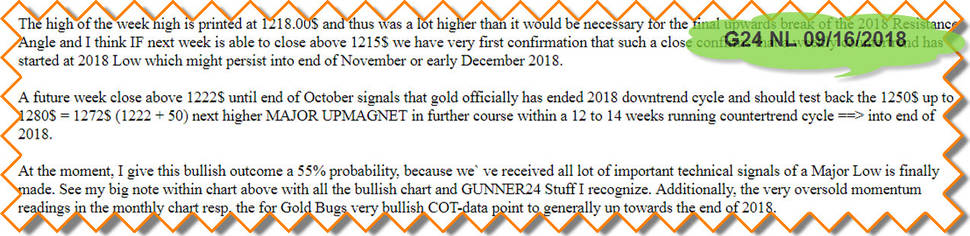

The valid bounce up setup is a "classic" 3 Fib number Candle up which starts measuring at # 1 // 2018 Low. The GUNNER24 Signals that beginning at 1240$ heavy resistances start to radiate:

The low of bounce week No. 9 shows a very successful first test of 1*1 Angle support and this was reason to switch into Second Gear. # 9-close succeeded in reached a 1222.00$, for sure not able to overcome the yearly/monthly/weekly 1222$-buy trigger finally but good enough to overcome the first square line which is at 1221.50$ by small amount and the Blue Arc which was another natural bounce resistance.

This # 9-close in one go was able to overcome two natural bounce resistances existing in the weekly, accordingly # 9 fired a double buy candle on weekly base in GUNNER24 Terms.

==> Thus, the lower line of 1st double arc finally became next important bounce target and you recognize it by your own that imminent uptarget of lower line of 1st resp. entire 1st double arc resistance uptarget is now finally worked off.

Both, Blue Arc as 1222$ horizontal now have morphed to future stronger weekly supports which should be tested and usually also will be broken to the downside in course of the next 5 to 8 weeks IF gold hast finally topped at # 11-1246$ bounce high!

The bounce cycle with the coming week is in its 12th week. Actually he should have found its price top sometime in it`s 12th to 14th week cause the weekly bounce that began at # 1 // 2018 Low with a +90% probability should have been oriented to the 13 Fib turn number.

Thus, the time factor actually allows another swing higher over the next 3 weeks (12, 13, 14). Therefore, the lower line of 2nd double arc at 1272$ can be STILL be achieved in the weekly 3 Candle up that has developed after the # 1 // 2018 Low.

The 3 weeks lasting initial up impulse automatically calculates the lower line of 2nd as possible or allowed uptarget for the upcycle which began at 2018 Low. Hmm. Its very interesting that the for the next weeks entire 2nd double arc possible bounce uptarget resides at or close to the next 50$ higher big magnet above major 1222$.

Entire 2nd double arc environment, which is future main resistance, takes course 1270$ to 1280$ for the rest of 2018!!, whereby the 1280$ uptarget possibility is in sync with the upper line of 2nd.

But right now, I do not believe that the gold can go even higher cause mostly the natural 1st double arc resistances often ring in the final end of an entire bounce cycle when a bounce began weak, as it is the case for this counter move.

This knowledge/experience together with the observation that the upper line of 1st was accurately executed at the achieved bounce high followed by the # 11-weekly closing below the lower line of the 1st double clearly indicates that the countertrend cycle has powered out in terms of the price factor.

==> 3 Candle bounce up setup offers that the 1st double arc is 1 time confirmed - downwards sloping - weekly resistance environment and upper line of 1st double arc is sharp defined week high resistance!

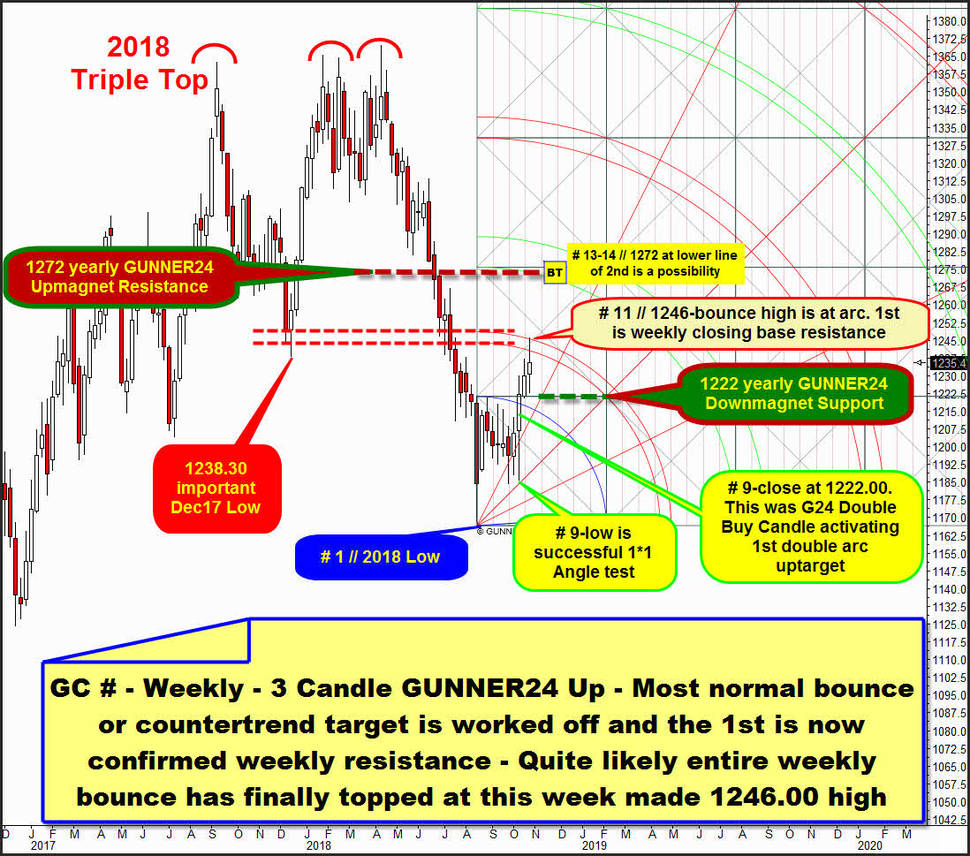

Above is a weekly 4 Candle down which starts measuring at final 2018 High. This setup brings the running relief cycle in relation to the completed 2018 downtrend cycle and for some reasons depicts some important opening and closing auctions at the arc targets. See small red and small dark-green arrows. Within we recognize massive 2nd double arc overhead resistance on weekly base starting at 1230$, ending at 1250$ or so.

1240$-1250$ is massive future resistance area! Usually strong enough to force the bounce into a final high, followed by the next test of 3rd double arc support environment towards end of 2018/early-2019.

2018 Low accurately tested a natural GUNNER24 Downtarget Horizontal out of final high of 2018 from above, thus confirming that horizontal threshold as important future horizontal support on combined weekly and yearly base.

The bounce cycle that started at 2018 Low took long 9 weeks until the NORMAL and MINIMAL backtest target of the 2nd double arc was tested for the first time. And because this backtest took soo long to reach its very first major backtest - OR OBVIOUS - target I just have to talk about a weak or weaker bounce cycle, until now.

And such "weak/weaker" trends tend to find strong resistance or final tops once 2*1 Angles are reached or tested for the first time! 2*1 Angle is of course a natural MAJOR angle resistance on yearly base because it derives from the highest price, thus strongest resistance magnet, of this year.

Obviously the 2018 2*1 Resistance Angle was nailed and precisely worked off at the actual 1246$ bounce high and also this big re-test of MAJOR = usually strong falling 2018 Resistance let the gold close 10$ below its week high. 2018 2*1 Resistance Angle together with usually strong 2nd double arc resistance may provide the final reason why gold could have topped at 1246$ and started a perhaps 5 to 8 weeks lasting down cycle which usually should trade far below "round" 1200$ Gann number support.

==> Just the first week close above 1255$ - thus finally overcoming 2nd double arc resistance within weekly 4 Candle GUNNER24 Down - UNTIL END of November 2018 will be the next BIG GUNNER24 Buy Signal and activates the still allowed test of 1272$-1280$ upmagnet. In such case the bounce cycle that began at 2018 Low should be oriented to the 21 Fib number.

Be prepared!

Eduard Altmann