In the course of last week the new trends picked up speed. Visible for each investor and each trader, in gold and silver the new daily uptrend is coming through. And after almost 2 weeks of bouncing around the 1680-1700 level the S&P 500 finally made a substantial move. US stock markets have been in a confirmed downtrend on daily base since Thursday.

Thus, in a virtually ideal way gold and silver as well as the US stock markets are following now their specifically seasonal practices such as: Stock markets in post-election years down or weak respectively till about November before from there a strong year-end rally starts that tops out in the spring of the next year. According to their seasonality gold and silver are now expected to be pretty well supported for 4-5 more weeks – till end of September – before they will be likely to fall heavily again.

Based on the weekly charts and a few weekly GUNNER24 Setups, in this issue I’d like to check these seasonal practices working out the possible turning points in price and time.

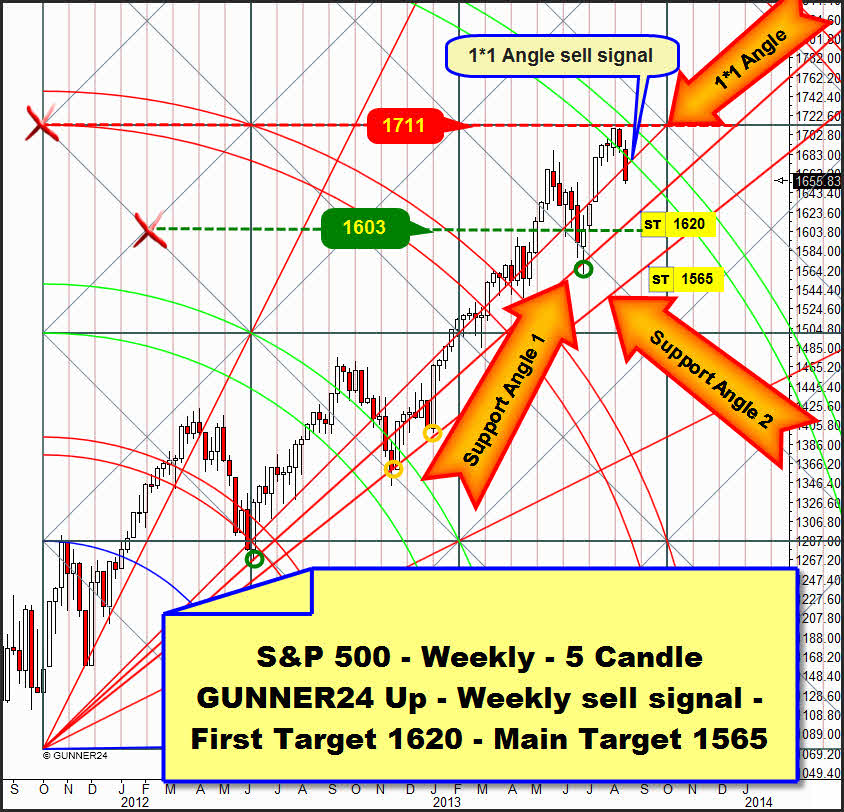

Let’s get started with the S&P 500, standing in for all the important US stock markets:

In the light of the weekly 5 Candle GUNNER24 Up Setup, last in the free GUNNER24 Forecasts of 07/21/2013 we prepared our readers for the coming change in trend. Our calculated topping marks at the 4th double arc resistance were situated at 1702 or 1711 index points respectively. Finally the market topped at about 1709 on 08/02 being still supported by the lower line of the 4th resistance double arc for the moment.

Last week brought the big bang. The S&P 500 closed the week with a double sell candle. The support of the lower line of the 4th as well as the 1*1 Gann Angle were given up with the weekly close.

With the close below the 1*1 Gann Angle an important support on weekly base is getting lost. Corresponding to the Gann Angle trading rules the next lower important Gann Angle is officially activated now as to be the next down target. First target for this correction is the Support Angle 1 at 1620 index points. It’s likely to be headed for the trading week after next resisting on closing base. Perhaps the week after next will dip in its low down to 1603, the next lower GUNNER24 Horizontal Support. That’s where – at the latest – the market is supposed to turn up again finally overcoming the resistance of the 4th double arc in the further course.

It will take a weekly close below 1610 to activate the possible deepest target of this correction. In case the market closes beneath 1610 within the coming fortnight, the support Gann Angle 2 at 1565 will become the main target of this correction. Each possible touch with this Gann Angle should lead to the change making the market turn up sharply… The moment for the change would be the second September trading week in this case.

All in all the current correction is very likely to be a matter of a short interruption in the strong uptrend again that is not expected to top out finally before May 2014 at 1875. 1620-1603 as the correction target is much, much more likely than the 1565!

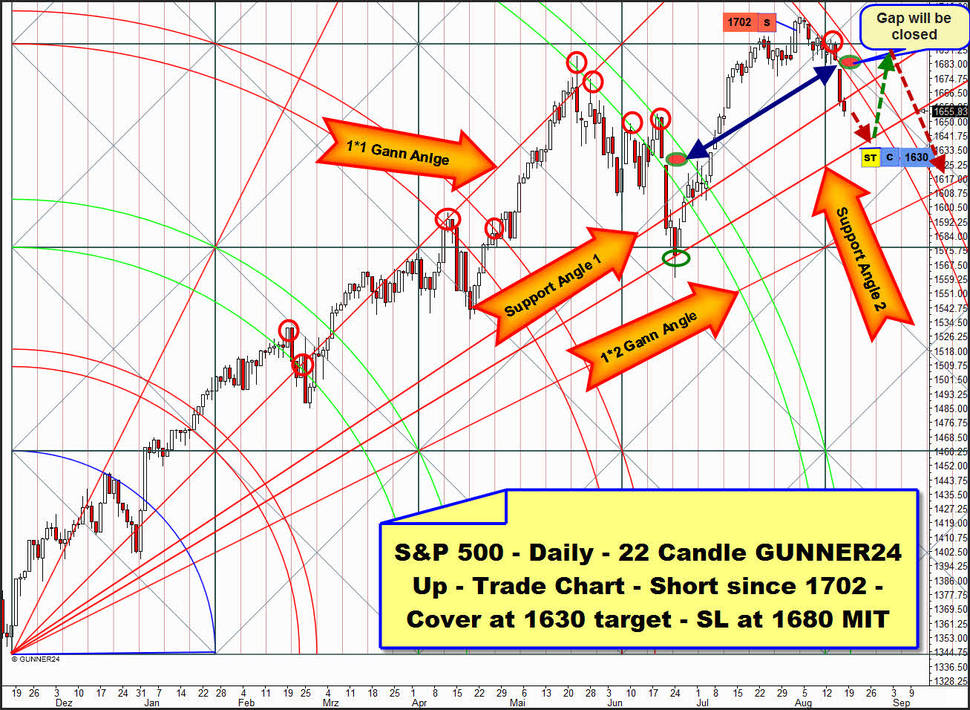

Since the current trend is a matter of a strong uptrend on weekly and monthly base, any short-position in the shorter time frames will have to be monitored well. And that’s what we’re doing hereby…:

In the daily time frame we’ve been short since 08/01/2013 and 1702. In the daily 22 candle up – never published so far – that started at the significant low of 11/16/2012 and 1343.25 index points the market had reached its main target, the 5th double arc, at the beginning of August 2013. The S&P 500 is perfectly joining the resistance of the lower line of the 5th. The first touch with the 5th occurred the day after the all-time high. This lower daily low forced the market down for the moment, following the lower line of the 5th, descending.

On Thursday the lower line of the 5th wasn’t able to support any more either. A huge gap arose. Not enough: on Friday the market closed below the important Support Angle 1. The next lower support Gann Angle (Support Angle 2) is activated thus being situated for next Friday or next Monday respectively, at 1630. That’s where we’ll cover our daily shorts MIT = market if touched.

The new SL for the short position is at 1680 MIT (market if touched). We mustn’t wait for the 1630 downtarget to be worked off, even though they happen to be headed for during this correction. The reason is this mighty "fake-away" gap of last Thursday. Only an idiot is able to interpret this gap as a breakaway gap. The energy of this gap may just only be enough to work off the Support Angle 2 and the 1630. The item might be closed quickly, as happened with the last "fake-away gap"… blue double arrow.

But afterwards, after the gap close and a new lower daily high the market should be able to fall down to the 1620 again, the weekly down target. So the whole correction in the daily time frame is likely to go extremely choppy in turn…

Expected gold and silver uptargets

As mentioned in the introduction already, gold and silver are going to be supported by the seasonality factors during the coming 4-5 weeks. After the mighty and glorious up-candles this week during the next weeks any "considerable" or "harshly lower" correction is hardly to be expected. Long-engagements will be obligatory till then. Shorts on intraday-basis will be life-threatening…

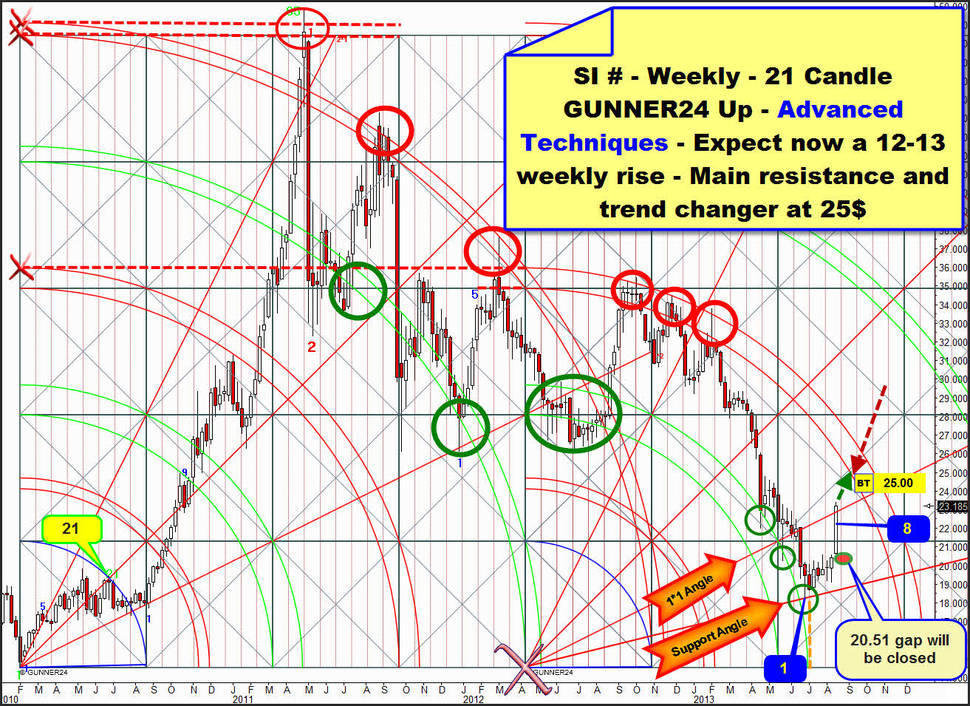

In this forecast I’m orienting myself by the following weekly silver up setup. It seems to be the key for the further course of the coming weeks.

The following chart is the continuation of the "Ugly Monster Setup" in the weekly time frame, as it were. The readers with good powers of recall certainly remember which way the "Ugly Monster" accompanied us unerringly to the new silver all-time high of the year 2011.

I’m going to apply a special technique now, an advanced one. I’m placing the original 21 Candle Ugly Monster Up Setup to its starting point, the February 2010 low at 14.65$ doubling now the original setup and simply shifting the duplicate by 4 squares to the right:

Many things are becoming obvious now. Even after the termination of the Ugly Monster Setup in price and time, silver is following the Gann Magnets that was put out originally by the Ugly Monster Setup. Even up to now it is following the natural supports and resistances of the very first initial up impulse from spring 2010 that lasted 21 weeks.

After the all-time high it is paying attention to the double arcs accurately. Red double arcs are stubborn resistances – red circles. Green double arcs are more or less important supports – green circles. Silver is swinging to and fro between the relevant red and green double arcs. After reaching a red one, a green one will be headed for. After a green one, a red one will be headed for.

Ergo: The next target is the red double arc above the price. At the red arrow silver will meet this red double arc resistance around the 25$. Not before 4-5 weeks from now this resistance is likely to be headed for by silver. The new uptrend – blue 1 – starts exactly in that week after the upper line of the green support double arc intersects the time line (orange dotted line). At the moment the actual swing has been going for 8 weeks. Added 4-5 more weeks, and silver will have completed a 13 week upswing!

The important Fibonacci number 13 indicates the end of a swing. So does the 8. A new downtrend ought to be able to start afterwards – at the red double arc and at about 25$ and in 4-5 weeks. After the super strong last trading week I consider as to be out of the question that the current swing will have topped out in week # 8 already. Please pay also attention to the following gold analysis on this topic.

Something else: The opening gap of this week is going to be closed. That’s 100% for sure! I hope it will be as early as the next 1-2 weeks, for that would allow silver to achieve the final overcoming of the next red resistance double arc in the course of the next months, thus managing to establish a new uptrend on weekly or even on monthly week. But if the gap remains open till the red double arc at 25$ will be reached, we’ll have to work on the assumption that in this case the red double arc will bring silver to its knees again being closed the 20.51$ consequently.

A possible decline from the 25$ mark down to 20.51 would be a huge potential decline. The down momentum would newly be very strong… The June lows at 18.17$ would certainly be at great risk in that case…hmm

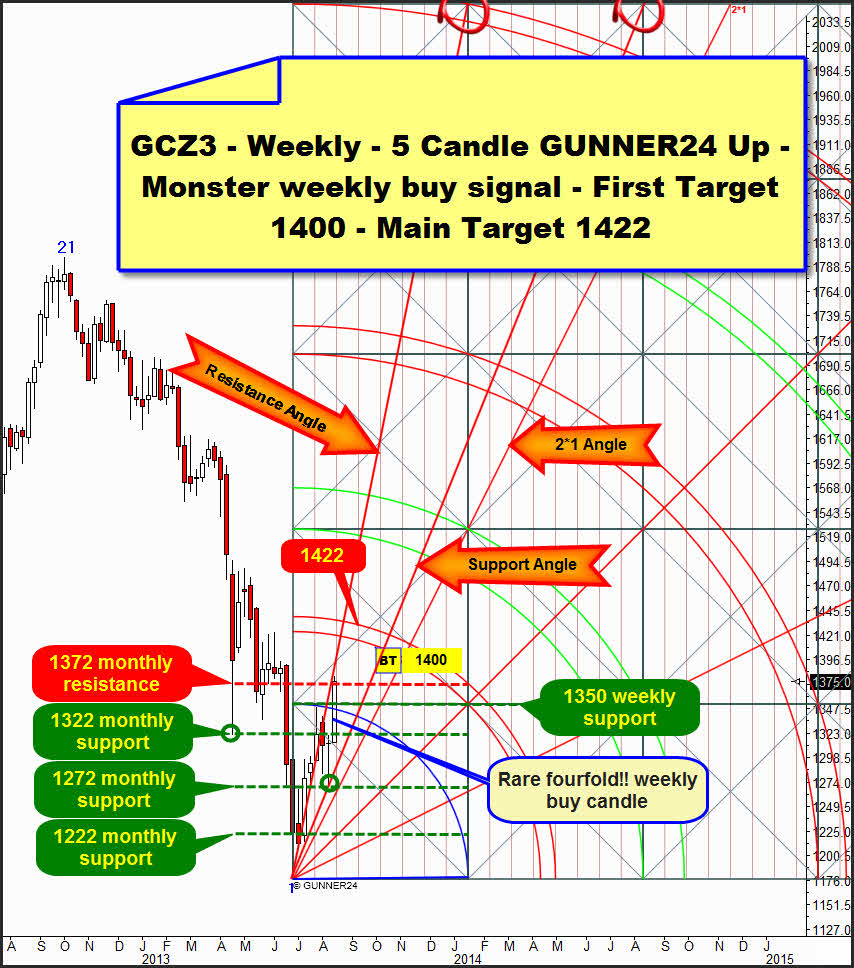

Gold weekly. This week we’re able to document an extremely uncommon occurrence – a quadruple buy candle in the weekly time frame.

There’s no doubt any more. 1400 is the minimum target for this swing. Even 1422 is likely to be headed for before the new change in trend is due. With the weekly close above the upper line of the first square in the current weekly 5 candle up = weekly buy signal, the first double arc is activated as the next uptarget.

In one go, the last candle took the 1322 monthly resistance (now strongest monthly support) as well as the Blue Arc resistance, the upper square line resistance at 1350 and the 1372 monthly resistance – quadruple buy candle!! Virtually there’s no "buy signal" considered to be stronger!

The 1372 hasn’t been cracked unambiguously, but all the same gold is not really bothered by this natural monthly resistance. Another daily close above 1375 will activate the next daily uptarget of 1387.

Gold keeps on sticking to the significance of the XX22 (mind about this the GUNNER24 Forecasts of 04/21/2013). In the daily business, since the fall of the 1522 on 04/12/2013 we’ve been able to ascertain the importance of the 1472, 1422, 1372 and lately especially the 1322 and the 1272. For weeks gold has liked to swing to and fro in these 50$ steps. Once the xx22 and xx72 are support, then they turn to be resistance and vice versa.

So it’s thoroughly possible that a lasting rebound from the 1372 next week may newly lead to a test of the 1322. This would be a "natural" test within the actually current uptrend on daily base, a natural currently "normal" swing… likewise after the final overcoming of the 1372 the 1422 should follow logically…

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann