Russia is one of the resource-richest nations. Countries that manage to exploit/max out their resources profitably adjusting the large part of their respecting gross domestic product to their abundance of natural resources use to have solid national budgets without many debts. Take Norway as an example or Saudi Arabia as well as other oil- and gas-mining nations.

In addition, Russia’s richness in resources is very widespread. In this country, there is a glut of almost everything: Oil, gas, coal, wood, steel, soft commodities, precious and non-ferrous metal, water, rare earths etc. Thus, the country has an extraordinary advantage compared with all the other countries in this world. Its abundance of natural resources is based on many, many solid pillars that can be absorbed or exhausted, depending on tactics and strategy, spottily or extensively – according to demand and market situation.

Now then, Russia has substance, a value chain based on substance, not on debts. The one who disposes of substance is able to feed on it, to budget, to await, to react and to ROUTE AND RULE effectively. He has an ace up his sleeve, so to speak.

Russia’s force is not based on Nintendo, bitcoins, servile officials and service providers, paper presses printing infinitive quantities of $ and Euros, internet, apples, Hollywood and office sitters doing a stretch of 40 years in their offices in front of their PCs through their pension. Russia’s force has always consisted of its population as well that can be activated quickly and toughly. If Putin will say tomorrow "I want 20.000 tanks within a year", they’ll manage it.

Russia’s tanks and jets and missiles work with +50 and -40 degrees centigrade. They don’t go kaput. Here in the west, some parliament has to approve and clear the budget for shifting the coat from desert to winter – and it lasts a couple of months, as a rule.

Russia’s women weed, plow, raise, harvest, herd and hunt no matter whether there is +50 or -40 degrees. Russia’s men (and many, many women!!) dig in the earth, build houses and tanks, handle with heavy metals, lay pipelines, sow, mill, construct, fight, are world champions of common partisan warfare throw themselves in waves of ten thousands into the open machine-gun fire. Hey, currently there are even bus tours in Russia where the men are taking 3 weeks of vacancies from their regular work in order to die upright for their flag and Mother Russia’s goals in the Eastern Ukraine.

By contrast, here in the West there are bus tours to wine growing regions and Disneyland, corporate headquarters, design offices…

Don’t you believe seriously that our funfair- and holiday-addicted western IPhone, Facebook, Google generation has even the touch of a chance if Russia takes the gloves off. We are rich in life quality but degenerate, office-hooked, impractical, being on a drip of constantly withholding heads of state. Literally, we are "Western-fied"...

When it really comes to the crunch here in Europe – I just imagine our pimply 20-year-old young busters – certainly they have a pretty good high-school diploma and 500 Facebook friends, but when tank trough cleaning is required (I had to do that for 2 weeks) they’ll find it disgusting texting their mother: "help, get me out of here…".

Tcha, and what do our "leaders" do, sitting in a glasshouse? They throw stones = sanctions against Russia. Just producing little waves. It’s stupid, things proceed as they did in 1914. It’s incredible! Don’t they ever learn from the past?

Well, Russia reacted with counter-sanctions. So the DAX being the atmospheric picture of Europe’s economy horse fell chilly-slackly by 500 points after Poland having to sell its apples elsewhere but in Russia… thereby I’m getting to the first loser:

I’m not fluffing the introduction trying to force any personal opinion on you. I’m adjusting my thoughts into HTML to give you the background that is necessary from my standpoint – what the current chart situation may result in and where so to say the fundamentals are to be looked for that are sticking behind what I see in the FDAX.

With its June high, the FDAX may have reached a high that is not going to be excelled for years. The present bull market started in 2003 possibly having come to an end with the June high indeed. Thus – allowed by time and price – the whole house of cards made of debts and degenerate life style may collapse completely. It may and it will if this world’s leaders won’t have found a solution for the Ukraine crisis till the end of September!

For the maximum extension = main target = 5th double arc of the up impulse of 13 months duration that had started at the bear-market low in 2003 was reached respectively worked off in the months of May, June, and July 2014.

Just as a reminder: in commodities, mostly the 4th double arc and in stock indexes, mostly the 5th double arc environment is the main target of the first initial impulse. After reaching respectively after working off the main target, we always have to reckon with a change in trend. I.e. an uptrend turns into a downtrend and vice versa. If in such an important time frame as the monthly one the main target is reached there is always the possibility that the entire bull market respectively the entire bear market comes to an end there.

With the July and the August candle we see now in the FDAX that the 5th double arc has triggered incredibly strong down-energy. We see an impulse-driven down-energy boost – an initial ignition! The first down impulse is just at candle # 3. It begins at the June high. The second candle – July – is a reversal candle thereby confirming the existing resistance effect of the 5th double arc. Since July moreover closed clearly beneath the lower line of the 5th, by falling below the 9530 on monthly closing base a strong sell signal on monthly base was released. The current August candle keeps on falling. This is another confirmation that the general trend is likely to have turned.

Please mind now the verticals, emphasized orange in the chart above. The FDAX clearly tends to develop important highs at important time lines (ITH= the center of the just passed square respectively at the transition from one square to another). In two out of three cases (see red box) this constellation led to hefty corrections. Well, the June 2014 high, too, is situated most strikingly close to an important time line. This fact is now at least pointing to a several month correction in the uptrend.

Since at the 5th double arc several sell signals are to be seen, the target is now the horizontal support at 8540. This one is supposed to be worked off between September 15 and October 3-4! I.e. this first initial down impulse should/will probably come to an end (and we hope it will in the 5th month.

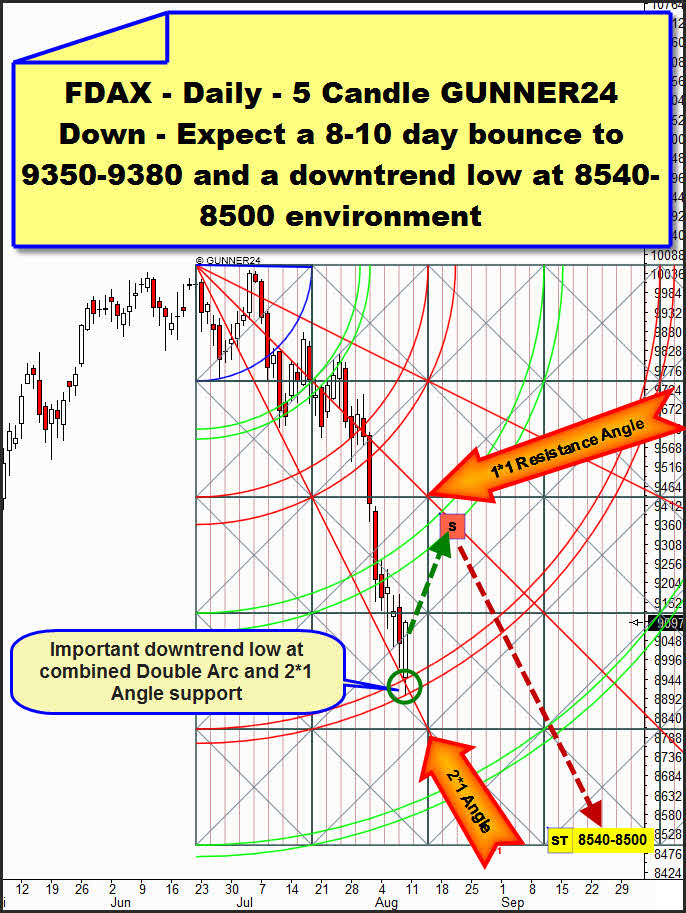

For in the daily time frame an extremely valid 5 candle down setup has arisen con firming the 8540-8500 region as target of this correction. Monthly and daily time frames are thereby revealing the same correction target:

In the daily setup, the FDAX delivered its tentatively first important correction low on Friday. The lower line of the 4th was reached and worked off to a T. Also the 2*1 Angle support was met. A combined magnet was worked off. The upwards bounce of the lower line of the 4th and 2*1 Gann Angle is visible and strong leading to an intraday reversal. The US markets likewise turned from the tentative correction lows on Friday. Thus, the FDAX as well as the important US indexes are showing in unison that the interim correction low is reached.

The 4th double arc is now confirmed daily support on closing base being supposed to hold the following 8-10 trading days and forcing the market to a back test = kiss of death of the 3rd double Arc resistance and the 1*1 Resistance Angle. From there, at the 9350 environment, another down-leg is likely to start then working off the combined daily and monthly 8540 target till the end of September/beginning of October. Then it will become thrilling.

Either the West will calm itself A) driving back the collision course with Russia around this period and seeking arbitration and/or B) Draghi and Yellen get out the liquidity-bazooka thereby finishing finally the correction in the US and European indexes or C) – and this is what I’m rather afraid of at the moment – the DAX closes below 8450 points on monthly base in September of in October 2014. Subsequently, i.e. till December 2014 at first the 6000 and a few months later, the 4500 are to be taken into consideration.

A monthly close of the FDAX below 8450 points in September/October 2014 won’t signal a correction in the bull market any longer in the end, but effectively deflation and thus a probable war in Europe. Such a close means that the first down impulse won’t last 5 months in that case but at least 8, maybe even 13 months! And that would be just the very first impulse of a new bear market.

And then ask yourself on whom to bet if worst comes to worst. Be prepared!

To the second loser – silver. It doesn’t get going.

It is clearly under-performing yet compared with gold, platinum, palladium. The reason: At present it is rather be treated as if it were a basic metal as cooper. No one knows whether the world economics rise or dive or will only the West dive? Will China together with India and the other booming Asian states intercept the decay of the West? Questions upon questions. Uncertainties upon uncertainties. This is why silver is rather aligned sideways with slightly negative bias. Gold is performing well because of the geopolitical unease= safe-haven function. Platinum and palladium are performing better than silver in 2014 because they are simply scarcer. Thus, there is a supply deficit respectively a demand surplus.

The negative bias may go up in smoke now! Soon, maybe as soon as next trading week or the week after next, let’s wait and see, silver is approaching its most important target = support. This support magnet should respectively may trigger a powerful up-rally!

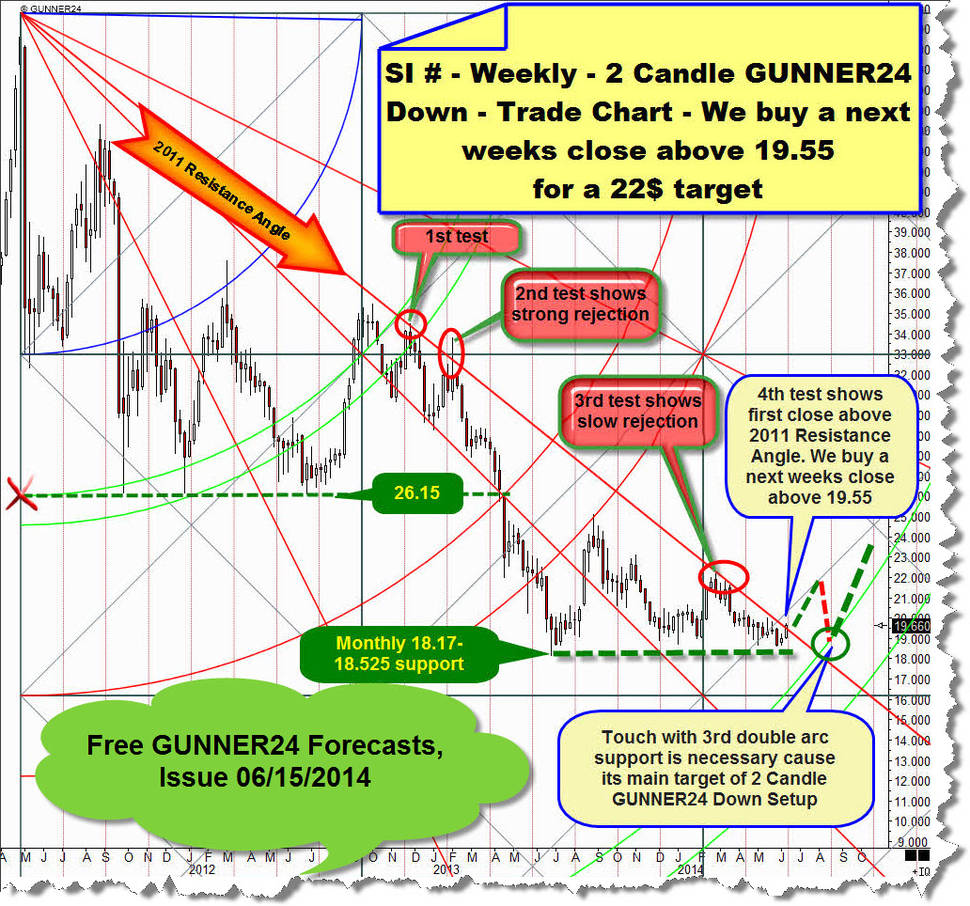

Within the free GUNNER24 Forecasts of 06/15/2014 I gave the following prognosis:

Then, silver overcame its very most important weekly resistance on closing base, the 2011 Resistance Angle. This upside break should lead silver to the 22$ at first before another downleg should start from there that has to work off the 3rd double arc before from there the first important = really strong upleg is allowed to start, out of its several year consolidation phase.

This keeps on being valid: the 3rd double arc in the weekly 2 candle down setup has to be reached. Not before that, the time will allow a strong rally leg to begin. State of today:

We see the current correction (just being in its 4th week) aiming at the upper line of the 3rd. The upper line of the 3rd is exerting magnetic effect. Silver is joining downwards another weekly resistance Gann Angle that in turn starts from the 2011 high. Thus, the current correction is newly trading at a yearly resistance. That’s why the correction is that annoyingly slow. Silver is correcting downwards extremely well-ordered however. We realize that by the fact that the red bodies of the last 4 candles have about the same length, not showing any spike at the upper and lower wicks.

I think, this condition will continue at least until the moment when the upper line of the 3rd is allowed to alter it. Silver is supposed to reach the upper line of the 3rd within 3 weeks. Either it keeps on creeping towards the important support that slowly and monotonously or there will be a hefty sell-off on daily base again. A touch down so to speak. Since in silver important lows really always go together with a hefty sell-off, this time again we’ll have to work on the assumption that silver will heftily sell off once more until it will be allowed to turn!

Hence, sell-off on the upper line of the 3rd within the next 3 trading weeks, then rally up to 25. Then again a several week correction that is likely to reach 22.50$, then next rally leg up to about 27-28. This target is likely to be reached in February 2015. At the 1*2 Resistance Angle and the 27-28 environment there will be the future pivotal point for silver. If silver succeeds in closing above the 28 on monthly base we’ll have the final confirmation that silver has begun a new bull-leg in the secular bull market. If it is rejected by the 1*2 Gann Angle, everything silver is doing at present is just a matter of a bounce in the long term downtrend, being supposed to be reached some new course lows in the course of the year 2015.

|

„As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

Be prepared!

Eduard Altmann