In the short-term term, I am skeptical to bearish as far as the setup for a break of the yearly key resistance in the price of gold - ~1350$-1360$ - is concerned, even though the gold in most foreign currencies climbed multi-year bull market highs.

Shortterm the gold futures in $US are heavily overbought after a next small higher 2019 High made at 1262.2$ on Friday which came in at 6-years lasting main resistance. Followed by ugly looking bearish intraday reversals or telling topping action on Friday in the Precious Metals Sector across the board. June is part of the soft demand season for gold. The strong demand season typically runs from August to February.

The odds of gold start dropping here are hugely enhanced by its latest COT data. COT data shows that the Large Specs have evaluated their long-positions in the course of last three weeks blatantly striking. This must be viewed as exceptionally bearish because the Large Specs are overall always wrong.

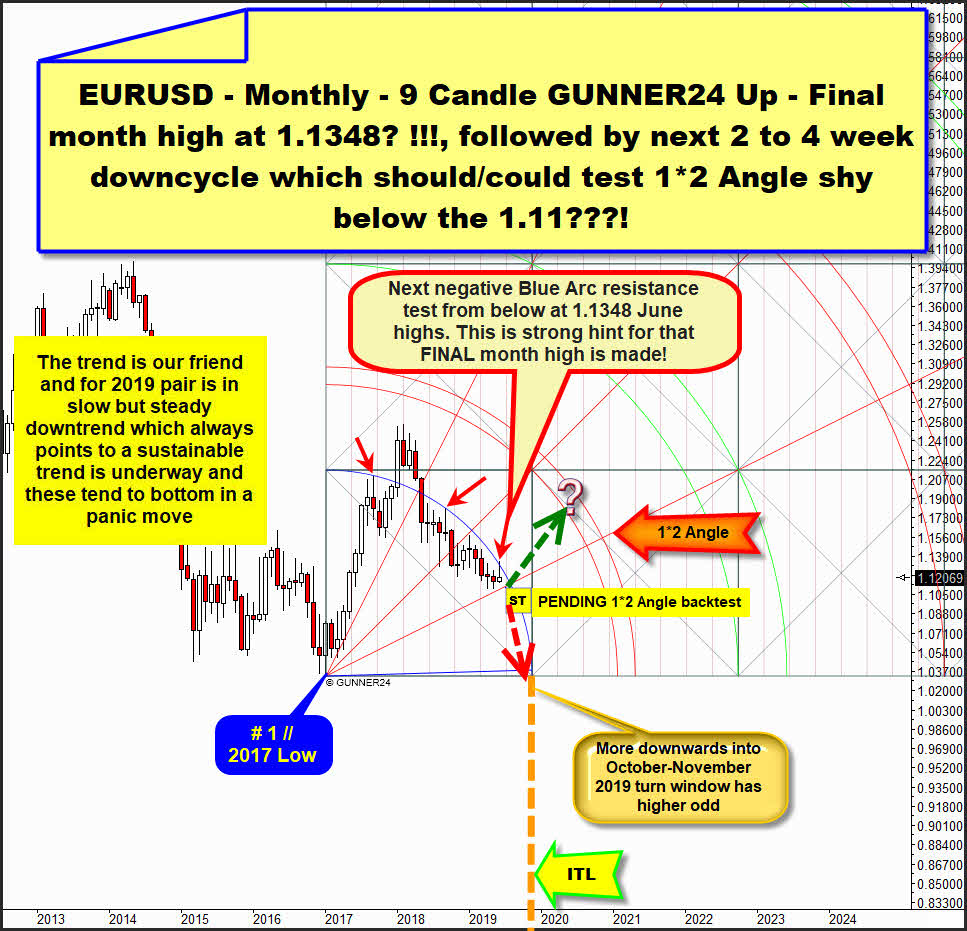

EURUSD with 99% odd printed its final high of entire June at 1.1348. Pair spiked into this Blue Arc in the monthly chart which represented pinpoint month high resistance at two former occasions since 2017:

Above circular 9 Candle GUNNER24 Up Setup on monthly base, starting at # 1 // 2017 Low, determines the latest price developments as it seems. Pair spiked from below into Blue Arc resistance and printed June highs at 1.1348. Afterwards market within just 5 trading days sold-off into 1.12069-Friday close, thus confirming that Blue Arc above STILL radiates a lot of bearish power on monthly base once tested. Cause rebound from Blue Arc was hard or sharp at first step it is very likely that final June highs are in and market has started it`s next weekly downtrend.

Cause all the prior up and down cycles legs within still determining yearlong bear channel have ended after about 3 to 5 weeks and recent weekly upcycle likely finally has topped in course of third upcycle week the time factor likely has met price (Blue Arc) at 1.1348 top and there likely the weekly trend again has turned from up to down.

And that`s why within this perhaps now running weekly downcycle the still PENDING & ACTIVATED first test of 1*2 Angle out of 2017 Low finally could come true.

EURUSD points lower for some weeks or the US Dollar Index points to important higher June lows are finally in and smells higher for the coming weeks and this usually should put a lot of pressure on the Gold and Silver sector, which has been doing pretty well since end of May.

But..., I think just after the very first test or FINAL work off of EURUSD monthly 1*2 Angle above the Precious Metals Complex will be allowed to rally above since years braking main resistances. Just when EURUSD strong yearly downtrend signals an end the gold and silver and related stocks should rally further substantially...

Problem for possibly more sustainable gold and silver and Miners Stocks rallies is that setup above signals that the EURUSD bear market usually should to continue towards end of 2019. Just then the very confirmed downwards-pushing monthly Blue Arc influence ends at next coming ITL, the orange-dotted highlighted important time line vertical.

The SPDR Gold Shares ETF (GLD) reflects the performance of the price of gold bullion held in London less the expenses of the ETF.

A W.D. Gann main rule is to sell a Double Top. And especially when it arrives - again - at a 6-years lasting very strong DECADE resistance environment, like in the case of gold, it promises some bear success.

This 21 Fib number weekly up, starting at # 1 // 2018 Low has taken the lead because it currently has the biggest influence on the gold price as it seems. Scaling is 100% confirmed cause we observe sharp successful backtests of 1*2 Angle and 2018 1*1 Bull Market Angle which triggered the recent 4 week – surprisingly, at least for me... - rally. Last but not least the initial 21 week up impulse forecasted possible important resistance at lower line of 1st double arc GUNNER24 Uptarget and precisely there the prior 127.21$-2019 High was printed at top of uptrend week # 28. Watch Blue Arc which was falling weekly closing base support after prior #28-2019 High.

The 1st double arc still is important price-brake cause after fresh made higher yearly highs made on Friday at 172.63$, thus denting 1st resistance area in the end price was halted by upper line of 1st double arc on weekly closing base.

Means, it is allowed that this upper line of 1st double arc might hold on weekly closing base resistance for some more weeks.

And all this topping signs are seen at gold`s 6-years braking Main Resistance Band. Above I`ve just have highlighted the slightly declining 2016 to 2019 Yearly Resistance Band..., where already after the achieved Double Top of the year 2018, all bull energy exhausted finally, followed by a sustainable -14% decline into final lows of trading year.

There is incredible massive resistance here at swing highs and cause gold on 6 year sight is more or less just trading sideways on the monthly and the yearly charts and now is back at 6-year long DECADE resistance band a possible Double Top here at Main Resistance Band should be sold.

Recent 4 week advance is unusual steep event. Breakdown of existing 4-week rally support caused by combined 2019 Double Top and Yearly Resistance Band will probably open the way for a major sell-off that may test back the 2018 1*1 Bull Market Angle at 121.50$ towards mid of July.

Well, actually, the gold should be bullish backed until the next upcoming FOMC meeting June 18-19/Tuesday-Wednesday, before this always important time trigger normally starts the next expected sell-off.

==> GUNNER24 Shortterm Downtargets for GLD EFT are at minimum 123.25$-first square line support/mid-July.

Rejections from a Double Top on weekly and monthly base and on yearly base usually turn out to be somewhat stronger consequently a weekly cycle decline starting at 2019 Double Top and 6-year DECADE Resistance Band usually has to test back 2018 1*1 Bull Market Angle at 121.50$/mid-July...

==> On the flip side, JUST a FIRST weekly close resp. the VERY FIRST month close above 128$, confirms that GLD EFT is in a super bull!

Be prepared!

Eduard Altmann