The stock markets are oversold and ready for a bounce

The stock markets have been falling for as long as 5 weeks. Again the old saying "sell in May and go away" has proved true – at least for the month of May. For the first time in several months last Wednesday something like panic spread in the markets again. Almost a 2.5% loss in only one day had happened as long ago as on 03/16, the day of the Fokushima-lows. Stochastic, MACD, RSI and many other indicators are deeply oversold on daily basis. The new highs hit their lowest level since the middle of March, and the new lows have been increasing hitting some critical levels.

All in all the market action is dominated by fear. Because of that the best conditions are given for starting a new upwards move!

The situation of the S&P 500 – The actual weekly setup: In February the market broke the 4th double arc upwards significantly. Thereby the 5th double arc is going to be the next important target in trend direction. The 5th double arc was supposed to be reached in August at about 1400. After having marked its year high by the beginning of May at 1370 narrowly above the resistance Gann Angle, after 5 weeks of decline the market has now arrived at its "really very strong" support at 1298. As mentioned above already, the downswing including the top-candle has lasted 5 weeks so far – without the top-candle, an optimal moment for a significant low can be formed by a new low next week (5th correction week) – from the candle count point of view. It will take a significant break of the 1298 on weekly basis to let the market reach the support Gann Angle again.

On the one hand that might happen very fast next week – a daily close below 1294 would be the release for it leading to an immediate test of the March lows at 1250 (that’s where the support angle for the next week proceeds).

In case no quick sell-off follows and if the support Gann Angle will not be reached next week and if a weekly close of under 1298 will be produced we’ll assume an eight week decline to happen. Target would be the support Gann Angle at 1270 in that case.

But for the time being we’re working on the assumption that on Monday the rebound upwards shall begin near 1294. A weekly close above1331 would mightily confirm the end of the decline.

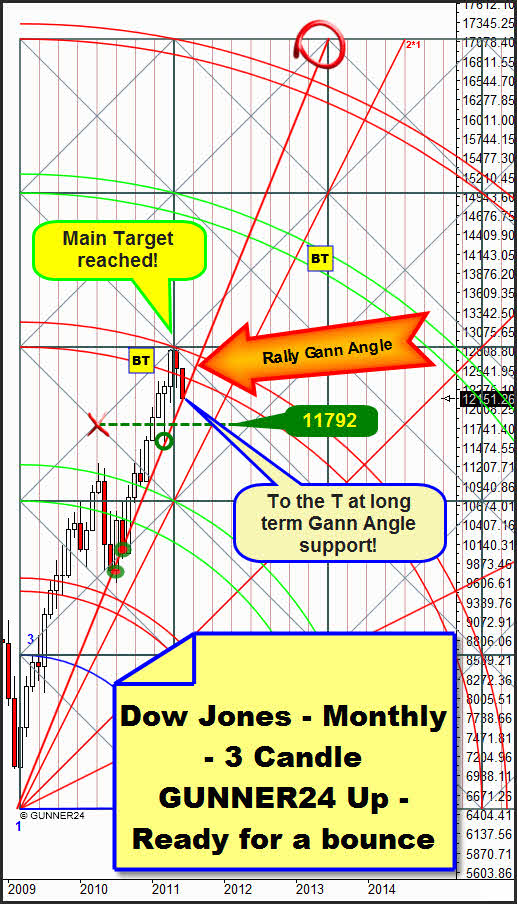

The monthly 3 Candle GUNNER24 Up Setup of the Dow Jones clarifies best how close the markets are standing before a sell-off or a powerful rebound, respectively:

The decline began after the main targets in April and May were reached. The April close within the 3rd double arc points to long-term rising prices, and we’ll have to assume that some higher highs will follow. Correspondingly, the current downwards move has to be considered as a correction in the upwards trend which may direct until the 2nd double arc in an extreme case. But it’s much more probable that it will go at most to the middle of the just passed square near 11800. On Friday the market reached an extremely important mark: Precisely by the low at 12104 the rally Gann Angle was touched that has been dominating the rise in price and time for as long as 12 months.

That happened last at the March low (green circle) – a strong rebound followed. Actually we’re experiencing the forth test of this Gann Angle. The landmark test! A break of this angle on monthly closing basis would be significant resulting in the 1*2 Gann Angle at about 11000 becoming the target…

For hedging our analysis let’s consider the actual monthly down setup of the Dow Jones.

Here we see the temporal influence of the first double arc traced the Dow upwards until May. The extension of the lower line of the first double arc is marked orange dotted. The upwards power of the first double arc has come to its end. Therefore the Dow is situated in its correction stage. The June candle is located at 12151, exactly on the 1*2 Gann Angle that was broken upwards in April acting now as a support because of that. That’s why also in this setup first of all a very soon rebound upwards is to be expected. It’s interesting that in this setup, too, the next lower support at 11800 can be identified unambiguously. So – if the 1*2 is broken unexpectedly (that would happen very quickly, hence show a sell-off nature) the market should be absorbed at 11800 at the latest.

Conclusion: From Monday on at the latest the market should be going upwards. If Monday and Tuesday perform weakly that means if we see daily close of less than 1294 in the S&P 500 and less than 12093 in the Dow, respectively, a rapid sell-off to 1250 and 11800, respectively, will be possible in the course of next week.

Traditionally at the beginning of a month we use to consider the monthly situation in order to recognize whether some fundamental changes in the markets are initiating and in which long-term phase the markets are situated, respectively.

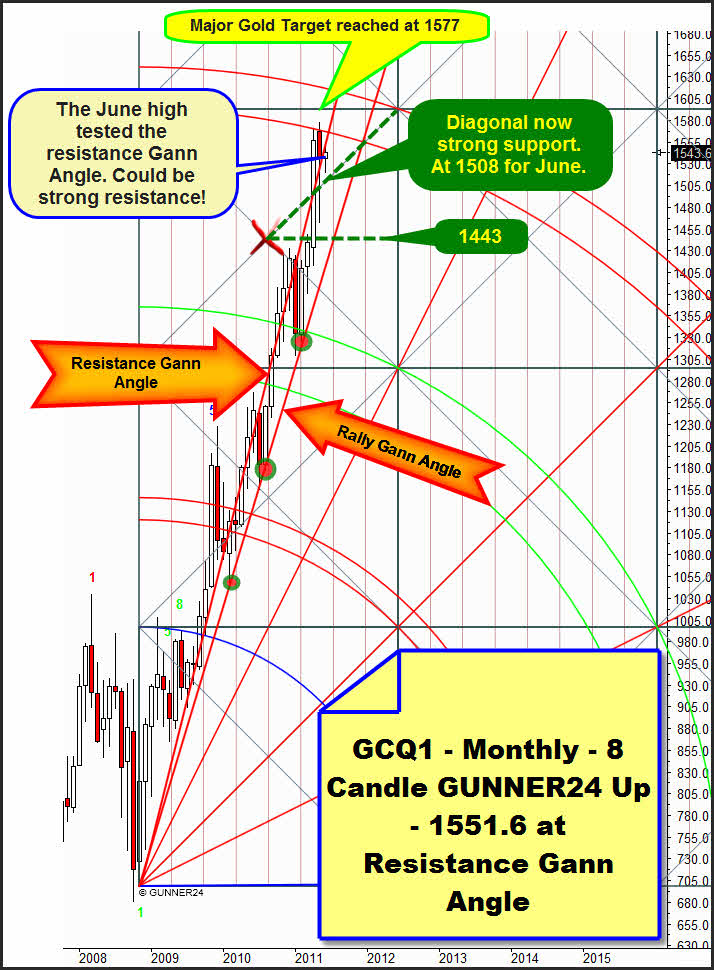

For today, I examined carefully the gold – monthly 8 Candle GUNNER24 Up:

After reaching the major gold target which was the 3rd double arc by the May lows gold has re-steadied itself. By the new burgeoning of the world-wide financial fears the investors take refuge in the safe harbors again. Finally May closed narrowly above the resistance Gann Angle again. June opened underneath that Gann Angle rather converting it into a resistance angle from the actual point of view. At any rate it’s clearly recognizable that gold has been moving around it for many, many months, without ever being able to break it upwards finally we presume. But we can always use it to make at least our short term decisions. The "relatively strong" rebound that followed after it had been tested from below shows us that it might emit a strong resistance for June. From the Wednesday high at 1551.6 a decline of more than 30$ followed. There, at the Thursday low at 1520.4 a speedy upwards move started until the 1548.4, which was the Friday high.

All in all the market really wants to go up. The sell-offs are quickly being bought again on daily basis. All the same the long term resistances are simply too violent to make out another swift upwards trend. Even though the 1551.6 in June were definitely taken on daily basis the 3rd double arc above would threaten that during the whole summer is expected to form a tough mass, hard to penetrate. Looking at the candles of the last months I think that a consolidation at the highs is to be made out – and, yeah, some time in summer a closing within the 3rd might happen possibly preparing the next long term target being the 4th double arc (not visible). But actually we can work on the assumption that gold is going to consolidate quoting between 1600 and 1500 during the coming months.

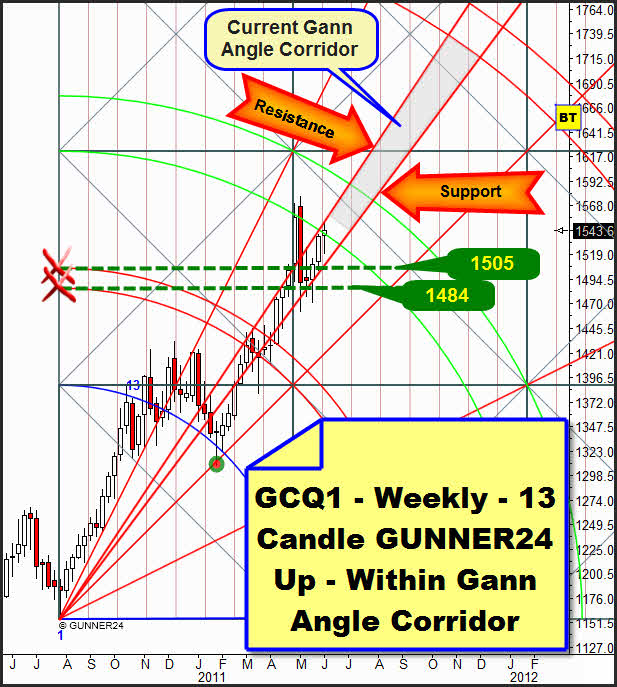

The weekly setup is showing us which temporal course the upwards trend is taking. The last four weeks gold has been working its way upwards in a very narrowly defined Gann Angle corridor.

Also for the next week we can assume that gold should go on in this corridor. The entire range between the lower line and the upper line of the 2nd double arc is lying above the price. It can’t be overcome rapidly. By the closing within the 2nd gold confirmed the long term target being the 3rd double arc, after all. 1660… But that isn’t to be expected before the spring of 2012. So, upwards some broad resistance areas are impeding a fast ascent. On the other hand we can expect that the sell-offs will be re-bought quickly as shown already by the sell-off candle at the beginning of May.

All in all that’s rather a market for day trading or swinging (3 to 4 days of durability), probably through the whole summer – some profitable trades will be possible as well on the long as on the short side. The long term investments into physical gold are not recommendable at the moment. And it won’t be before in the monthly 13 candle up setup either the rally Gann Angle will be reached on the tide of an extensive correction or the 3rd double arc will clearly be broken upwards.

Just a brief announcement: Next week, over Pentecost, I’ll take a couple of days off, so I won’t make the issue of Sunday 06/12. Those three to four days will be my 2011 vacations, I hope you’ll understand. Thus, the next issue of the GUNNER24 Forecasts will come out again on 06/19/2011.

Be prepared!

Eduard Altmann