In a bull market the surprises often come to the upside!

Currently appears again that nothing seems to be able to stop the Tech Stocks and the Tech Indexes. The bears are being run down. Higher and higher is where Alphabet = Google, Amazon, Apple, Facebook, Intel, Microsoft, Netflix, NVIDIA have to go! Each of these tech leaders, with the exception of Google, is trading again at its all-time highs… 4 of these 8 Leaders delivered higher all-time highs on the first trading day of June. 3 of these 8 are likely to catch up tomorrow and climb a new all-time high.

The NASDAQ-100 is heading the herd again now. And not even for a second you should think in the possibility that the above mentioned companies or the NASDAQ-100 might cede again this powerful position over the course of summer cause this new bull market highs of the most important bull market drivers will release new sustainable positive energy!

In course of March, the Semiconductors (SOX) notably broke above their 18 year basing pattern which is - as far as the time factor is concerned - a COMBINED buy signal in the yearly, DECADE, CENTURY and MILLENNIUM time frame.

==> The Semis have fired the strongest imaginable buy signal in terms of sustainability, because in the next step it will lead to another, several years lasting rise!

Because of this big bull market continuation signal the Semiconductor/Chip Maker breakout cycle will be the driver for the NASDAQ-100 to tack on the next 1000 points to 8100. 8100 is minimum NASDAQ-100 future contract (NQ #) price uptarget now!

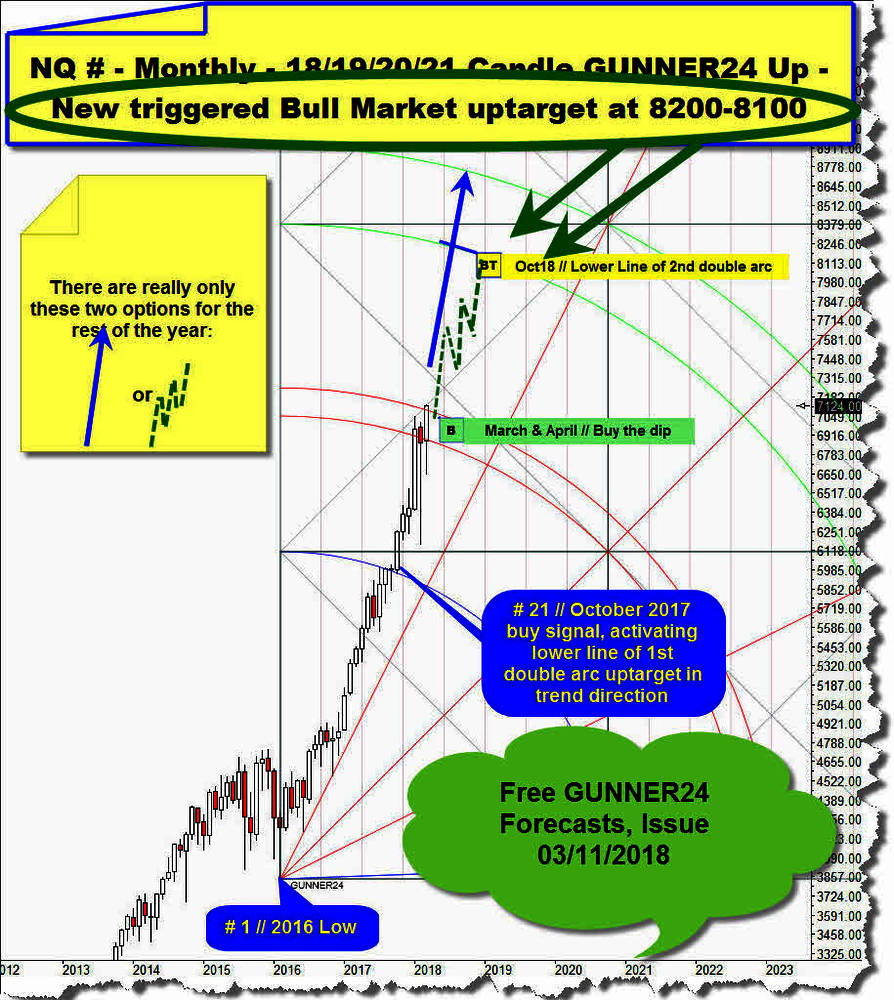

Above you see currently most determining monthly GUNNER24 NQ # up setup at the time of my last public NASDAQ-100 analysis and short-term forecast (Free GUNNER24 Forecasts, Issue 03/11/2018 "Blue Sky Breakout - New NQ price and time target"- click here to study it again...). It starts measuring at 2016 Low, that is the latest most important higher low of the entire bull market.

Setup is a 18/19/20/21 Candle up, whereby up impulse out of 2016 Low ended finally at high of rally month # 18, followed by a tight consolidation close to bull market highs, which tested the Blue Arc at three more occasions (# 19-close/# 20-close shy above Blue Arc/# 21-low backtest of Blue Arc from above).

After # 21-October 2017 closed very bullish above the first square line, NQ # should test and work off natural uptarget of lower line of 1st with a probability of +80% in course of January 2018! Arc uptarget first time was met in course of January 2018 and January 2018 close above lower line of 1st double arc initial resistance activated the imminent test of upper line of 1st double arc uptarget.

At the time of the last NASDAQ-100 analysis, also this very natural bull market target was crossed. What sets another very bullish pointer for reaching the 8100 pts in further course of 2018.

Nevertheless, mid-March we recognized that a short-term top should be due - likely at usually very strong 7250 upmagnet resistance -, thereafter the market should retrace from initial strong 1st double arc main resistance into some important higher March to April pullback lows which all bullish traders should use for shopping.

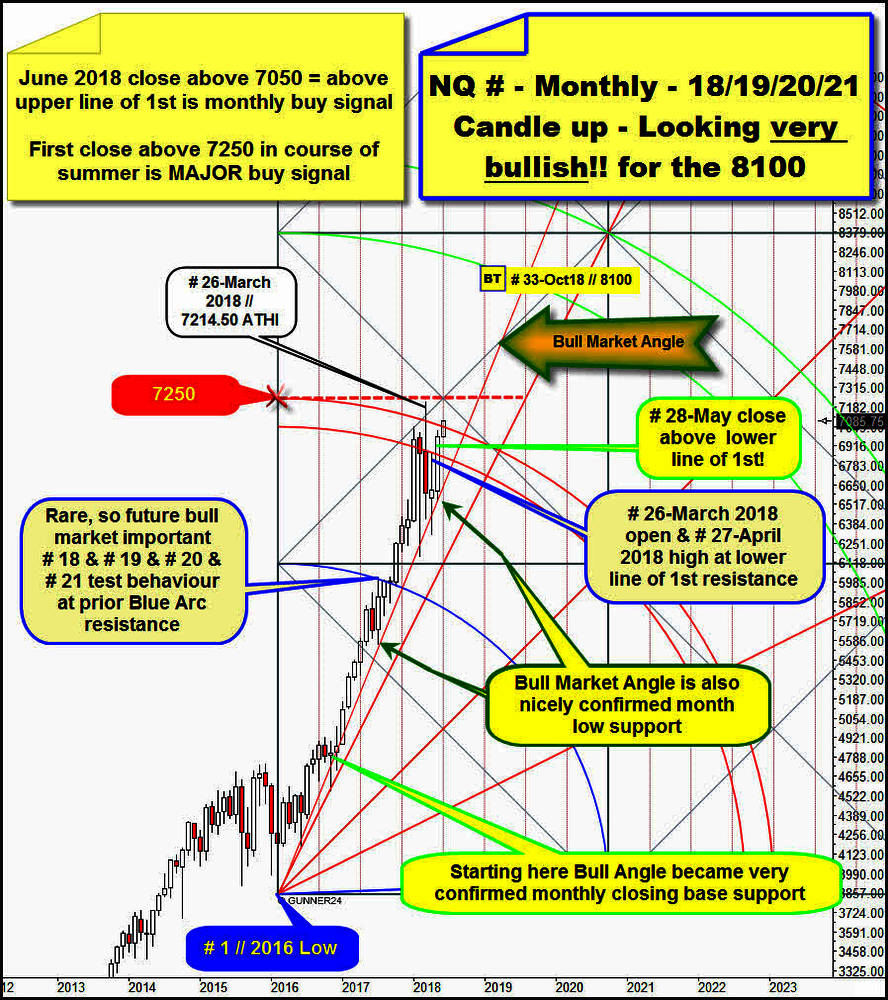

After this fundamental introduction lets jump to the current status of the monthly chart. And there is some bullish developing! I will show you the possibly upcoming bull-triggers of June 2018:

A short-lived pullback began at uptrend month # 26-March 2018 high which is alltime-high or ATH. Support Angle which is naturally anchorable within setup was responsible for the March-April 2018 pullback lows. Support Angle is most strongest bull market support on month low and month closing base. Since # 1 // 2018 Low no single month closed below the Support Angle.

Consequently, the very first close below Support Angle is a "bigger" = very important sell signal on monthly base and this should ring in a multi-month lasting bull market correction.

Bull market month # 28-May 2018 delivered highest monthly close ever. This is a big bull market continuation signal. Also, the May 2018 one more time closed above lower line of 1st double arc initial bull market resistance. Thus, also the GUNNER24 Method fired a buy signal on monthly base, that activated the QUICK & SERIOUS TEST of the 7214.50 ATH.

The next higher GUNNER24 Resistance above upper line of 1st double arc which is the 7250 horizontal wasn`t worked off at ATH. 7250 horizontal is nearest in the past activated open upwards magnet of the bull run. The 7250 pts monthly upmagnet with a +70% probability will be worked off in course of June 2018!

Derivation of this thesis:

The importance of the upper line of 1st double regarding future resistance and future signaling is finally confirmed with received # 26-March open and # 27-April 2018 high cause these both monthly auctions have tested lower line of 1st double arc resistance to the T from below. These two confirmations of the existence and importance of the lower line of 1st automatically make the upper line of 1st double arc important for the future.

But the upper line of 1st double arc initial monthly resistance rail was already skipped with the very first trading day of the new month June. At the same time, this was ALSO A WEEKLY CLOSE above confirmed monthly arc resistance!

==> Thus, more upward forces have been released as a rule! And with 7 of 8 mentioned important Tech Leaders in the bag making higher ATHs the run or serious backtest of # 26-March 2018 ATH appears almost certain and with NASDAQ-100 trading above 1st double arc initial resistance environment and still within strong bull market making higher lows and higher highs its seems almost certain that the index will be able to make some higher ATHs within current underway weekly upcycle that started at the 2018 Low, likely final low of 2018.

==> The potential forthcoming or likely fired buy signals for June 2018 in the monthly time frame accordingly are as follows:

A June 2018 close above 7050 pts upper line of 1st double arc is a next MONTHLY GUNNER24 Buy Signal. This would be a BIG BUY SIGNAL cause such first close above upper line of 1st double arc finally activates the lower line of 2nd double arc as next higher very important uptarget for the bull run. IF June 2018 will be able to close above upper line of 1st - and this is very, very likely outcome, with a round about 85% probability - the lower line of 2nd double arc GUNNER24 Uptarget should be worked off till end of October 2018 near 8100!

ANY first month close above 7250 is a MAJOR buy trigger and telegraphs a very sharp rally into lower line of 2nd double arc upmagnet resistance. Means such close should trigger a panic buying or bull panic cycle, so that the lower line of 2nd should be worked off within just 5 to 8 trading weeks.

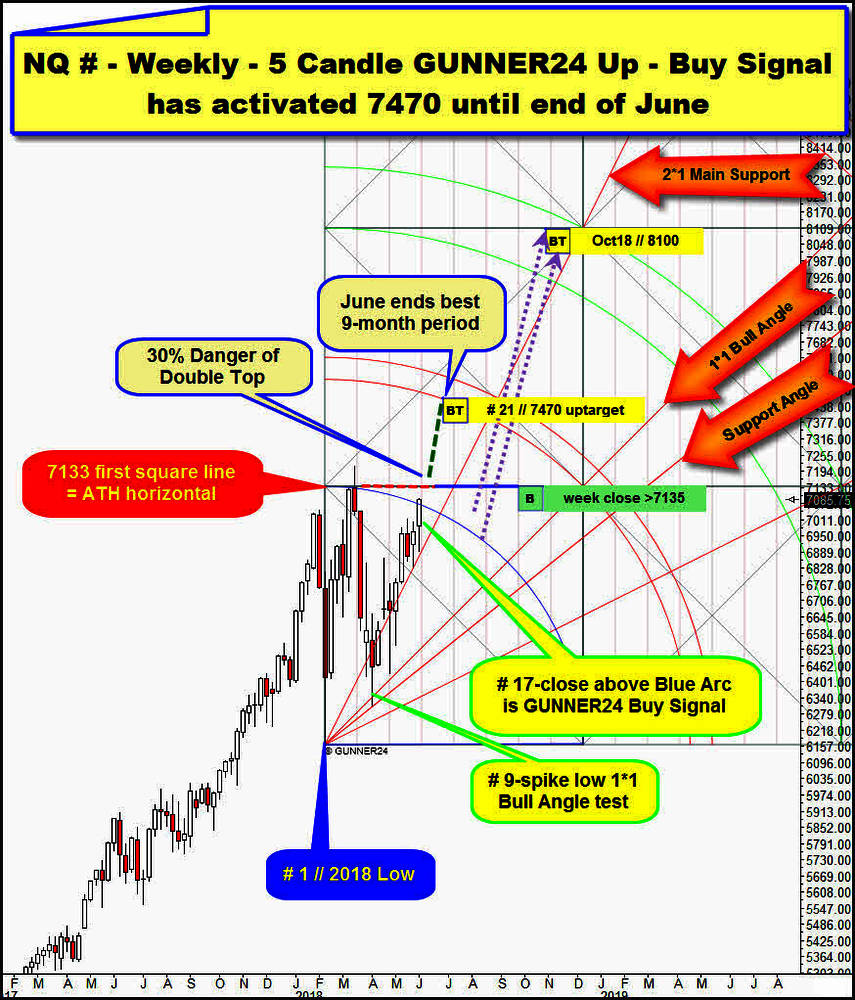

It smells somehow that the market is able to reach 7470 pts by the end of June 2018!

This allows and signals the following important setup in the weekly time frame. "Classic" 5 Fib number up setup starts measuring at # 1 // 2018 Low.

This past week first close above Blue Arc resistance is a GUNNER24 Buy Candle and activated lower line of 1st double arc as next most important bull market uptarget according price factor.

Thus, the possibility that the lower line of 1st is processed in trend direction is now at 70%. The weekly upcycle that began at # 1 // 2018 could be oriented to the high important 21 Fib number, next upcoming Fib number:

Cause June ends best 9-month Tech Stocks period upcycle count could be oriented to the 21 Fib turn number, it may well be that this time too extremely bullish 9-month bull cycle exhausts, ends or tops with a bang. June 2018 might deliver a next important intermediate cycle high, even important summer 2018 high. Which should then be corrected again for just a few weeks...

But let`s start this analysis at the most obvious which is this week # 17 very first close above Blue Arc resistance. This is a weekly buy signal, projecting uptrend continuation into week # 21 and has also activated the very fast test of 7133 first square line resistance. Please recon that the 7133 test resp. backtest is due within 24 to 36 trading hours.

>> Top of uptrend week # 5 as open of uptrend week # 6 have formed 7133 future resistance. 7133 is nicely confirmed, so very strong bull market horizontal resistance. Thus - of course - the next higher important signal generator.

I recommend to add longs if next # 18 and/or the week after next # 19 delivers a close above 7135. Such week close usually should have broken 7133 first square line finally, would be highest week close ever and finally activates 7470-lower line of 1st uptarget/potential summer 2018 high which then should be worked off within the 21st uptrend week (always give a few trading days for possible important extremes).

==> An imminent weekly close above 7135 should ignite a 350 pts rally leg into # 21 // 7470 lower line of 1st double arc uptarget! If next or the week after next is able to close > 7135 the processing of the # 21 // 7470 upmagnet has a probability of 70% according price and time factor!

Cause the signal state in the monthly is again strong bullish, pointing to some higher ATHs arriving soon, 7 of 8 most important Tech Leaders are printing new ATHs actually and additionally weekly time frame is firing on all cylinders GUNNER24 shows just a 30% odd for a Double Top cemented within next 10 trading days!

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to make you rich!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best trending stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann