Beautifully confirmed, strong uptrend in Crude Oil, which has long respected important G24 Turning Magnets. The next few weeks should be the last really important correction, before the oil should continue its rally to the magical 80$ upmagnet, strongest yearly resistance ahead. So it predicts the GUNNER24 Method. The processing of the 80$ should actually be in the course of the month of October!

My last Crude Oil forecast (Free GUNNER24 Forecasts, Issue 04/15/2018) was a no brainer bull market continuation call into 70.30$, which was due for completition at the end of April 2018. At that time oil traded at 67.39$ and fired a simple and very trustworthy long signal in the weekly time frame:

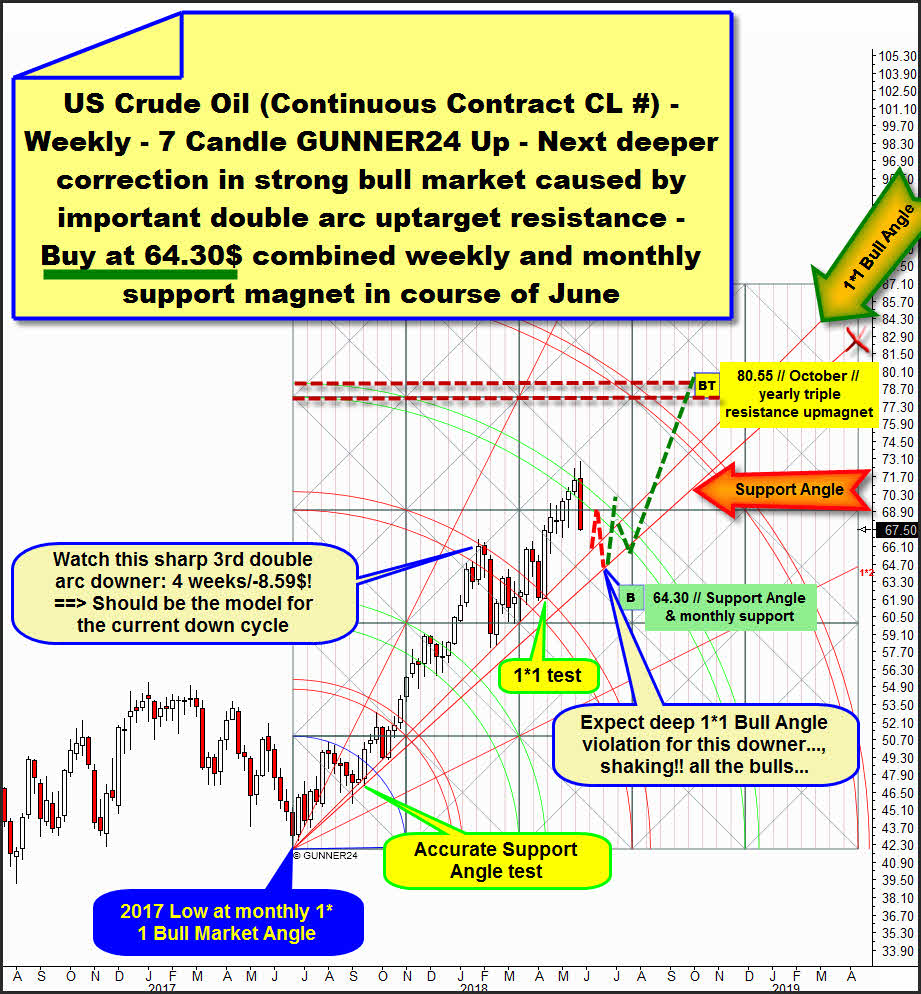

7 Candle up out of 2017 Low. After next classic backtest of 1*1 Bull Market Angle out of 2017 Low, that was a higher low in the yearly time frame, the oil closed above an important slightly rising Yearly Resistance threshold.

This was a mega strong GUNNER24 Buy Signal and activated the imminent test of the 4th double arc in trend direction.

==> Mid-April, at 67.39$, the 4th double arc became most attracting nearest important upwards magnet and was expected to work off at the end of April. 4th double arc magnet or 70.30$ late-April uptarget was worked off on May, 7th.

Let`s look at the recent happenings of the weekly chart. The market topped Tuesday to a new high for the year at 72.90$, after which it sold off sharply for the rest of the week. Crude Oil panicked by a hefty -5.40$ into the week close:

This and past week candle managed to dent the upper line of 4th double arc resistance at week highs or 2018, but did not manage to close above that now confirmed falling arc resistance in the weekly.

==> Accordingly, the upper line of 4th double arc is future - strong! - closing base resistance. ==> It automatically deduces that the VERY FIRST week close above the upper line of 4th is a big bull market continuation signal!, thus finally activating 80.55$//October 2018 yearly triple resistance upmagnet also in the weekly chart!

The 80.55$ became next higher bull market uptarget in the monthly chart after April 2018 closed above 65$, for this strong bull market signal watch next chart below which is the monthly.

Well, the week dropped hard and sold off -5.40$ from 2018 Top, producing big bearish reversal after hitting important GUNNER24 Bull Market uptarget and natural bull market resistance. This is a GUNNER24 Sell Signal in the weekly, activating imminent next test of 1*1 Bull Angle which is 7!!! times SUCCESSFULLY tested bull market support since 2017 Low. Since June 2017, the Crude Oil bull never showed a week close below this most strongest bull market support.

==> Expect the next test of 1*1 Bull Market Angles within next 2 week candles. Then 1*1 Bull Market Angle is at round about 65.50$. 65.50$ is first downtarget. Afterwards the market should snap back and should test back the 4th double arc resistance at round about 69$-69.30$!

But I mean that this downcycle or the current correction in the bull market at the end of June 2018 has to reach at least the 64.30$ and would therefore have to violate and fall well below the 1*1 Bull Market Angle to shock all the bulls! 64.30$ is combined weekly and monthly GUNNER24 Support Magnet. Shaping there and then a pretty attractive downcycle magnet - ideal and obvious backtest magnet!

Within weekly setup above the 64.30$-end of June down magnet is at naturally anchorable Support Angle, which has just been tested twice very early (September 2017) in the bull market! Support Angle is LAST BULL RESORT! and timewise should be tested at least once in course of 2018.

==> Actually, the current correction cycle should be able to test this last bull resort again - probably again very successfully!

I strongly suspect that the now ongoing oil correction cycle will develop in terms of its price discount, its duration and its chart pattern almost as much as the last weekly correction cycle which was launched at the early 2018 February year high after the very first (negative...) test of the natural 3rd double arc resistance upmagnet.

==> For this reason, please note above the dashed red/green path for this correction cycle or the probable route to the 2018 main target.

==> Gentleman`s long-entry for the 80.50$/October 2018 bull market uptarget is Support Angle at 64.30$!

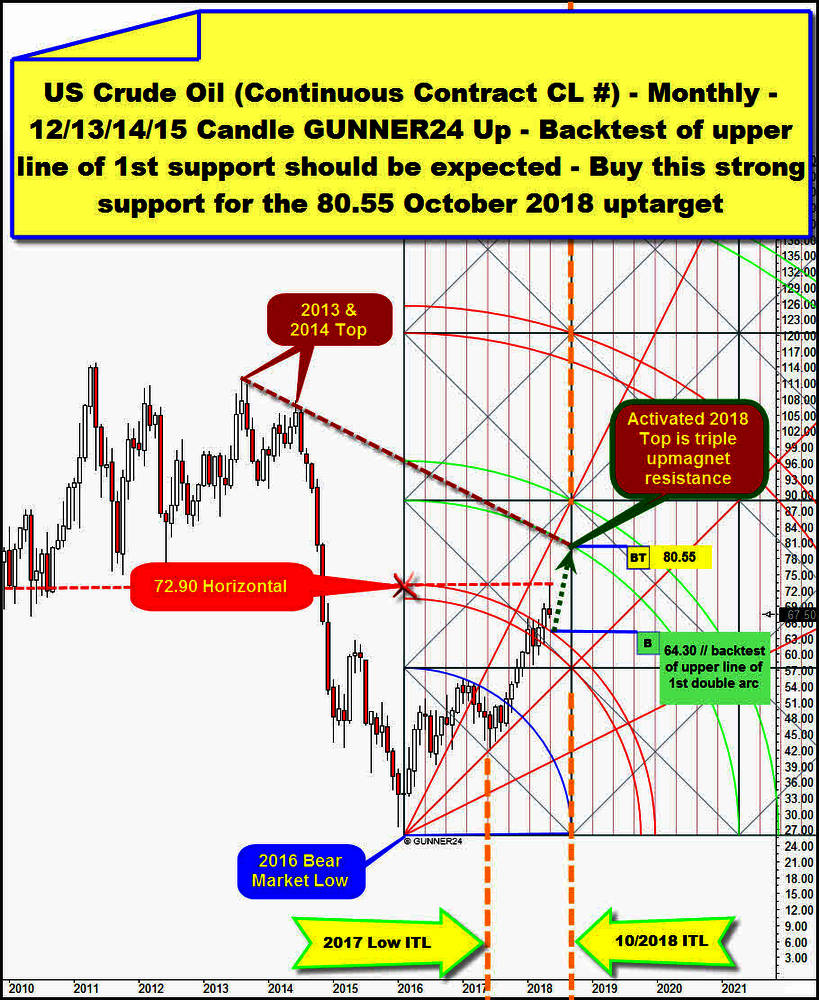

A strong daily and a new uptrend cycle in the weekly was triggered at final April 2018 low. Consequently, the April 2018 was a strong uptrend month which closed near highs and so was able to close far above the upper line of 1st double arc within still totally dominating monthly 12/13/14/15 Candle up:

Watch, that April 2018 low tested back lower line of 1st double arc support to the T. Then important support out of 2016 Bear Market Low was tested back successfully. April 2018 for the first time closed above quite strong 1st double arc resistance environment, thus finally activating lower line of 2nd double arc in trend direction. Cause 2017 Low was marked at the center of first square ITL (important time line) the next ITL, end of first square ITL, likewise should attract the bull market according time.

Because the oil so far behaves exactly as the classic uptrend year pattern pretends, it is now more and more likely that the market will deliver a very strong uptrend year 2018 according the price - very similar to 2016, likely reaching the 80.5$ monthly triple GUNNER24 Uptarget Magnet resistance at some point!

==> Possible final 2018 Top at or near 80.50$ combined yearly and monthly triple upmagnet resistance build by 10/2018 ITL, & activated lower line of 2nd double arc and falling 2013 Top & 2014 Top resistance threshold!

OK, April 2018 delivered strong monthly buy signal cause month closed far above prior confirmed upper line of 1st. In the month of May, the uptrend continued and tested natural 72.90$ GUNNER24 Horizontal out of upper line of 1st (confirmed important...!) at this week, this month and this year high! So very important combined resistance was met at 2018 high!

==> That`s why the last 4 trading days sold off unusual strong...

==> And that`s why it`s very likely that the next 5 to 8-week correction cycle started!

And now, as you know, these are very keen to reach and test strong support down magnets, because they have to be confirmed as important future supports.

==> The upper line of 1st double arc offers itself as natural test target for a 5-8-week downcycle. Formerly finally upwards broken 1st double arc line is nearest - and perhaps - stroooooong future support in the monthly time frame. For the June 2018 candle the upper line of 1st support takes course at 64.30$ thus forming usually strong and attractive combined weekly and monthly downmagnet support towards the end of the month. The ideal, cause most natural support magnet for the downer is 64.30$/end of June 2018!

Privacy Policy/Personal Data Storage update

As is true of most Web sites, we gather certain information

automatically and store it in log files. This information includes

internet protocol (IP) addresses, browser type, internet service

provider (ISP), referring/exit pages, operating system,date/time stamp,

and clickstream data.

We use this information, which does not identify individual users, to

analyze trends, to administer the site, to track users’ movements

around the site and to gather demographic information about our user

base as a whole.

GUNNER24 does not collect and store personal data except the e-mail address voluntarily provided by the customer and the names and forenames and passwords of the registered members. Names, forenames and passwords of the registered members are stored by our computer system only until the business relationship ends. Afterwards they are automatically deleted by the computer system. About the end of the business relationship, we will be informed by PayPal very promptly automatically. The e-mail address voluntarily provided by the GUNNER24 customer is not automatically deleted at the end of the business relationship, but automatically set to inactive, so that further internal use, as well as erroneous transmission from the computer system is prevented. E-mail addresses, names and forenames and the passwords of registered members are never analyzed internally or externally during their storage and never evaluated to third parties.

If you wish to have the e-mail address provided by you, but in the meantime already set to inactive, finally deleted from our database, please send an e-mail to: support@GUNNER24.com.

Eduard Altmann