The blood left on the carpet last week from the chart-technical point of view, meant the knockout of the US stock markets in the medium term. To any extent, the bull-market swing highs attained in March and April are extremely unlikely to be tested seriously within the coming months. In the short term, beginning as early as Monday, a several day weak bounce is to be reckoned with, since the S&P 500 is supposed to be hoven by an important weekly GUNNER24 Support and the NASDAQ-100 by an important monthly GUNNER24 Support again for a short time.

In the medium term, i.e. in the weekly time frame, the recent releasing pressure led to unequivocal and lasting sell signals. Short-term rallies will have to be shorted now. In the long-term monthly time frame we should reckon with clear GUNNER24 Sell Signals as well. These ones just need to be confirmed finally by the corresponding April reversal candles. If so, the then finally confirmed markets are supposed to correct through summer. The correction targets according price and time for the S&P 500 and the NASDAQ-100 you’ll find in this issue.

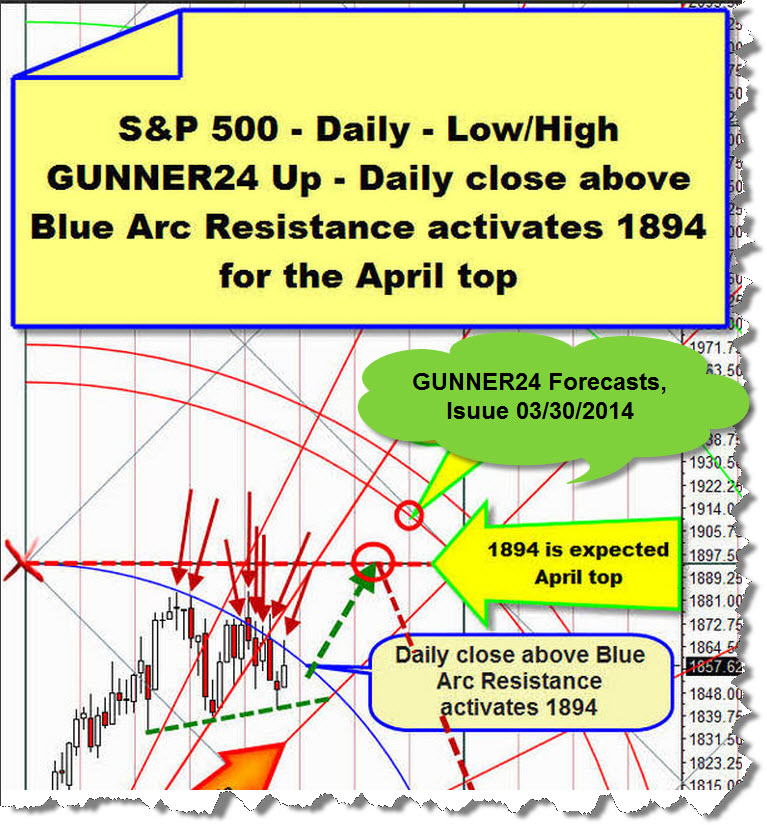

The last time I analyzed the US stock markets for you was 03/30/2014 notifying therewith the important April 2014 bull-market swing high at 1894 index point for the S&P 500:

Subsequently, on 04/02 the S&P 500 could reach the highest daily close of the bull at 1890.90. On 04/03, an even higher high was attained at 1893.80. The final bull-market swing high was marked then another day later, Friday 04/04 at 1897.28 index points. Beginning at this top the index started its correction, likely to go on till a first important correction low will be marked.

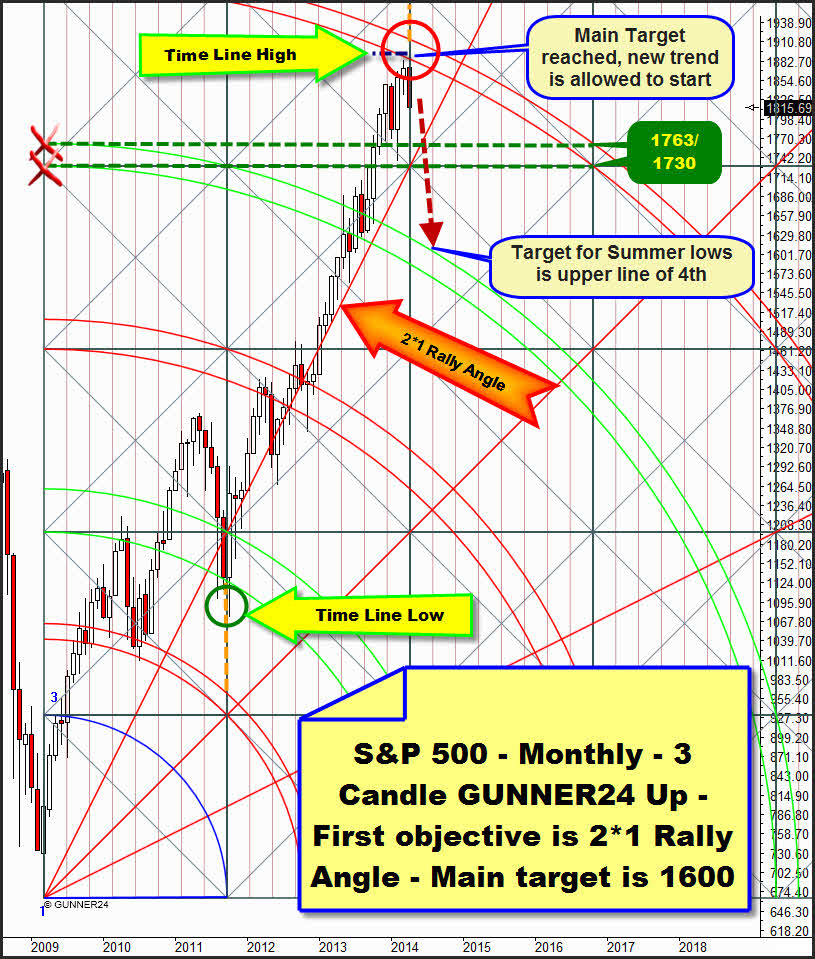

On monthly base the index is presenting itself as follows:

Needless to say that the monthly indicators and oscillators are oversold, at the rev limiter… You’ll see it by yourself applying and checking them in the monthly time frame. Just because of that a correction is and has been necessary for long, most healthy for the further course of the bull. December 2013 closed at 1849 whereas the last 4 monthly candles just managed to lift the market by another 50 points. The miserable trudging around from the beginning of the year to the top was extremely enervating in my opinion. The long time it took to work off the important resistance of the 5th double arc is to be assessed as most negative because thereby also the time of the upcoming correction may turn out long. I mean it may thoroughly last 5-6 months.

We see that April - as expected since early March – yet still did touch the 5th double arc. That was necessary. The 5th double arc was and keeps being the main target of this setup and a logical objective. From the point of view of the GUNNER24 Method it’s allowed now – and above all to be expected – that a new trend will develop at the main target. This new trend, a 15-20% correction in the uptrend should technically test the 4th double arc confirming it as an important future support since this one is representing now the strongest magnet = support beneath the current prices.

All in all it seems most compelling and likely that the bull topped finally now in April. The 5th double arc shows us an important price resistance, the main target of the bull to be reached. The entire last up-leg being interrupted only by some mini-correction with a maximum duration of 3 months, lasted exactly a whole square, in terms of time: From the important time line low of October 2011 sketched above till just April 2014 that is situated exactly on an important time line again.

The trend is supposed to change now. It will take the April candle to deliver the confirmation of the change in trend. The closing price of April must be underneath the March opening to trigger a monthly reverse candle and thus an official GUNNER24 Sell Signal. Ergo. If April closes below 1857.68 the monthly trend will have changed according to the GUNNER24 Forecasting Method.

Then, in case of a completed April reversal - assumed as matters stand - the main target for the correction is at 1600 index points being likely to be attained until August respectively September 2014.

This main target of the correction will be activated however only in case the 2*1 Rally Angle is fallen short on monthly closing base. This one, together with both horizontals springing from the intersection point of the upper and the lower lines of the 4th double arc with the beginning of the setup, is forming a super strong monster support being between 1764 and 1730 index points for May and July. Only in case the 2*1 Rally Angle is fallen short finally until July, the 1600 will be activated finally! If the 2*1 Rally Angle falls – as to my forecast – there’ll be a super quick sell-off down to the 1600 area = PANIC!!

Perhaps during the whole summer through September the area around 1763-1730 will hold! That would be then an extremely strong correction at the highs! So to speak, we’d see the ideal springboard to the 2000 till the end of 2014!

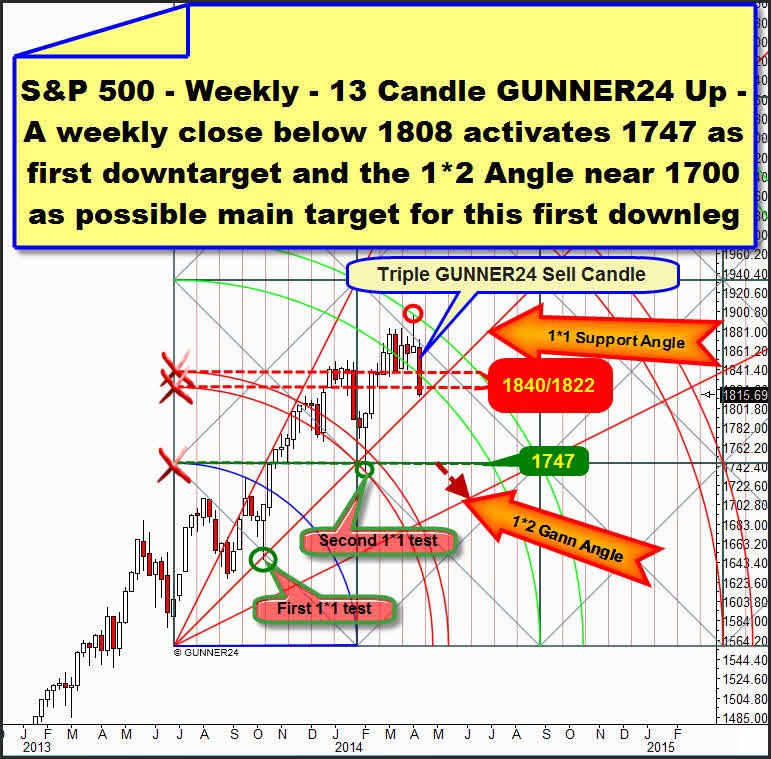

Beginning Monday or Tuesday next week a 5-8 day rebound is likely to start leading the market to 1845:

In the weekly time frame the 13 Candle GUNNER24 Up Setup is to be applied now. In regard to the signaling in the medium-term weekly time frame into the summer it should be best. The continuation of the first 13 week up impulse starting at 1560.33 June 2013 low, nails very exactly the bull-market high at the upper line of the 2nd.

It’s also noticeable how harmonic the last rally-leg according price and time is. Starting from the lower line support of the first double arc the leg went to the bull-market top at the resistance of the upper line of the 2nd. The multiple weekly closings within the lines of the 2nd are pointing to only one correction in the long-term weekly uptrend to be imminent now being overcome the 2nd double arc resistance in trend direction in future. A weekly close above the upper line of the 2nd will be the next weekly buy signal.

The 1*1 Gann Angle we must consider as the very most important short-trigger. So far it was tested successfully twice. The last week candle did not reach the 1*1 Angle. That’s why the 1*1 will have to be touched at least next week. The 1*1 Angle is at 1816.50 for next week. It will be allowed and to be expected to be penetrated on Monday or perhaps Tuesday as well. In a daily setup of the S&P 500 the 1810 surrounding is put out as an important daily support! From there a 5-8 day bounce should start. Since it’s the third test of the 1*1 it seems quite possible that the market will be newly forced upwards, by and large – becoming able to advance into the area of the 1845 once more. From there a new decline wave is supposed to break the 1*1 Support Angle finally, then targeting and working off the 1747 support horizontal.

The 1747 is situated between the strong 1763 and 1730 monthly support zones. The 1747 is a very hot candidate for a first important low of the correction. It might be worked off until the middle of May. If the 1747 is taken on weekly closing base till May 2014, the 1*2 Support Angle will be targeted and worked off by all means = 1700 till June 2014.

If the 1*1 Angle breaks finally next week already, i.e. in case of a weekly close below 1808, the 1600 will be very likely to have to be worked off in the current correction until September. May the 1*1 fall as early as next week? Well, let’s just consider the current signaling power of the last week candle.

In one go the lower line of the 2nd as well as both important weekly supports broke at 1840 and 1822 respectively. With the weekly close below this horizontal they are mutating thereby becoming resistance. This is how they are sketched in the chart above. Furthermore, the 1822 horizontal is an extremely strong Gann Magnet in another important weekly up setup thus being a double weekly support. Thereby the last weekly candle is technically a matter of a quadruple sell candle within the GUNNER24 Methodology. That’s a blooming hefty signal. More "sell-signal" is impossible!!!

Integrating now into our analysis the indicator situation in the weekly time frame we’ll have to state…:

…that may turn out pretty evil for the market. In fact, those hefty divergences mostly happen at important tops. Someway however we are in the age of the blogs, the free charting softwares and the entire social-media trading. So everybody may see that the trudging around of the last months cannot/won’t take a good end, can it/will it...!?I?

Well, in any case I think I’ve got to ascertain that in case the 1808 on weekly closing base do fall next week the bad indicator situation and all the GUNNER24 Reversal Signals in all the important time frames will permit a sell-off that is super severe in terms of price, lasting many weeks. So, it is pretty stale that the weekly support trend-line for the coming two weeks takes a course at about 1795 index points. If next week the 1808 falls on closing base, this uptrend line will be virtually pulverized.

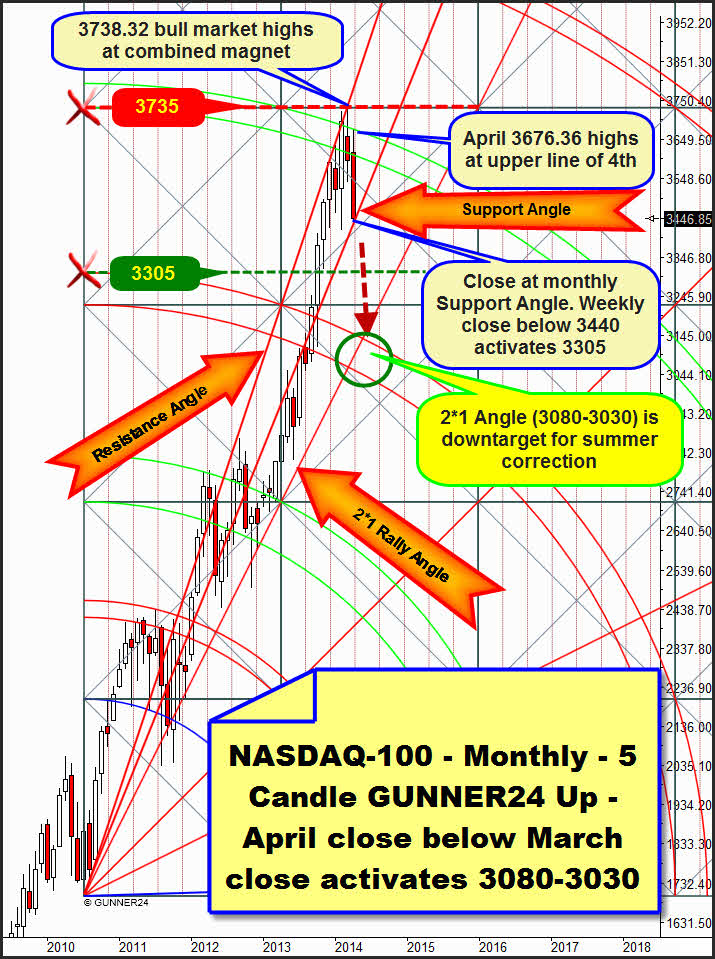

If we still adduce now the next and most important sell-off trigger in the NASDAQ-100 we’ll see how close to the cliff the markets are actually as of today:

In the monthly 5 Candle GUNNER24 Up the leader closed on Friday, to a T at its most important monthly support that allows a very quick slipping down to 3030 in case it is broken finally in April yet. As lately supposed here already, the leader topped finally in March. We also pointed then to the important 3675 resistance at the upper line of the 4th that might be reached again in April. The April top was worked off at this important resistance super accurately. From then on the marked has been falling like a stone. The monthly reversal candle, necessary for the confirmation of the trend seems to be willing April to deliver. We will keep on selling the market into the April close if April closes below the March 2014 closing (3595.74) = short NASDAQ-100 on monthly base with target 3080-3030.

The currently most important monthly support is the 3440. That’s where for April 2014 a strong monthly Gann Angle support takes its course. If this one has fallen short on weekly closing base in April thus falling the 3440 on weekly base, therewith another important sell signal will be produced. I think that in this case the strongest and most important support magnet will get the market in its clutches pretty fast. The strongest support magnet is the 3080-3030 region where the 2*1 Rally Angle intersects the support of the 3rd double arc in summer. This is the main target of the whole NASDAQ-100 correction. Until around August 2014 the 3080-3030 will be expected. But if the index closes below the 3440 as early as next week, the 3030 will be able to be worked off at the 2*1 Rally Angle in May 2014 already. A weekly close below the 3440 before Eastern may release enormous downwards forces. In that case the index may laxly loose a 10% in 4 weeks.

Be a part of our exclusive sworn GUNNER24 Trader Community – now…

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

- with constantly more than 70% profit – year by year…

Be prepared!

Eduard Altmann