If there were a yardstick for the high hazard potential of the Crimea crisis it would be the palladium market. The precious metal ranking among the platinum metals is costly worked out of nickel and copper ore in Russia. For decades, the main producer has been Russia, followed by South Africa. The world’s remainder production is just trickling along. In addition, Russia has at its disposal the worldwide highest inventory.

Because of the time and again flaring up minor’s strikes in South Africa and the thereto connected constant production decline we’ve got to state that Russia has largely been meeting the worldwide palladium need for several years also significantly controlling and determining the palladium price by its sale and supply policy. The supply deficit in 2013 amounted to estimated 23 tons.

Contrary to the more familiar precious metals gold, silver and platinum, that are used by the determining central banks and governments to conceal their monetary disgrace and money printing messes, the persistent supply deficit of the last years in primary industrial sphere (catalysts, films, relays, PCBs, medical instruments) enabled and allowed palladium to tinker with its Symmetrical Triangle over three years undisturbed an absolutely quit of those manipulations:

By overcoming the 750$ mark, last Tuesday the bulky and sustained symmetrical triangle breakout started. During a trend the pattern usually forms as a continuation or as a halfway pattern as well. The first target of the triangle breakout is the 1077$ for the time being. Considering the triangle as a harbinger of a truly gigantic halfway pattern we have to reckon with a target of 1400$...

The dissolution of the palladium triangle releases the inconsistency of the existing divergences regarding the US stock markets and the leading European stock markets. Of course this breakout is going to lead to the commitment of the other precious metals to orient to palladium thereby hardly being able yet to correct really low the coming days. No sir, gold and silver and platinum too will have to join palladium upwards now – at least for the next 2-3 months…

Whereas the US stock markets are racing from one all-time high to the next, the EU stock markets haven’t followed suit for several weeks seeming to produce lower highs and being close to the intention to swing into a downtrend. To me, this divergence is explained on fundamental basis now.

The Smart Money has obviously been fleeing from Europe, plainly going into the safe haven USA, on the one hand being invested there into the - relatively seen - still well performing stock market. For sure, the US companies aren’t running the risk of being cut from the gas supply and going down the drain many of their orders and business with Russia and its littoral states.

In economic terms the EU with its spineless politician elite is tied to mother Russia’s apron strings and its main ally China. Any interference of the economical collaboration with Russia and China, however small it may be means for the EU area an Armageddon unequalled. Recession, higher energy costs, even more cheap money are in store for the EU that is threatened with much, much more… so I would and we all have to see about how to feather our nests…

A bang on Crimea would mean out and over for many governments in Europe because in that case unrest would follow inevitably. But the big question is: Is it going to bang??? Is it really going to???

I can only give you the palladium chart with its powerful uptargets and some hints on the timing. Which conclusions you should draw… privately and/or financially will have to be left to you. I anyway don’t have either space or leisure for that today, and I personally have to process all the inconsistency and think through all the indications for palladium in the GUNNER24 Setups.

Personally I am going to buy the metal or buy more for the moment – physically and paper. A) I am because it is going to rise now for a couple of months. There’s no doubt about it. B) I am because it may virtually explode, so to speak as a financial hedge against all the imponderables that the Crimea crisis might cause to all my other investments/properties. C) If the precious metals mutate to a safe haven again now, palladium is supposed to belong to the top 2 of the best performing precious metals just like it did during the last years. D) Attention is to be paid to really pocket the expected paper gains in palladium or to secure them because in this EU crisis/world crisis someday the expropriation or closing of the bank-, company- and trading-accounts may be in store.

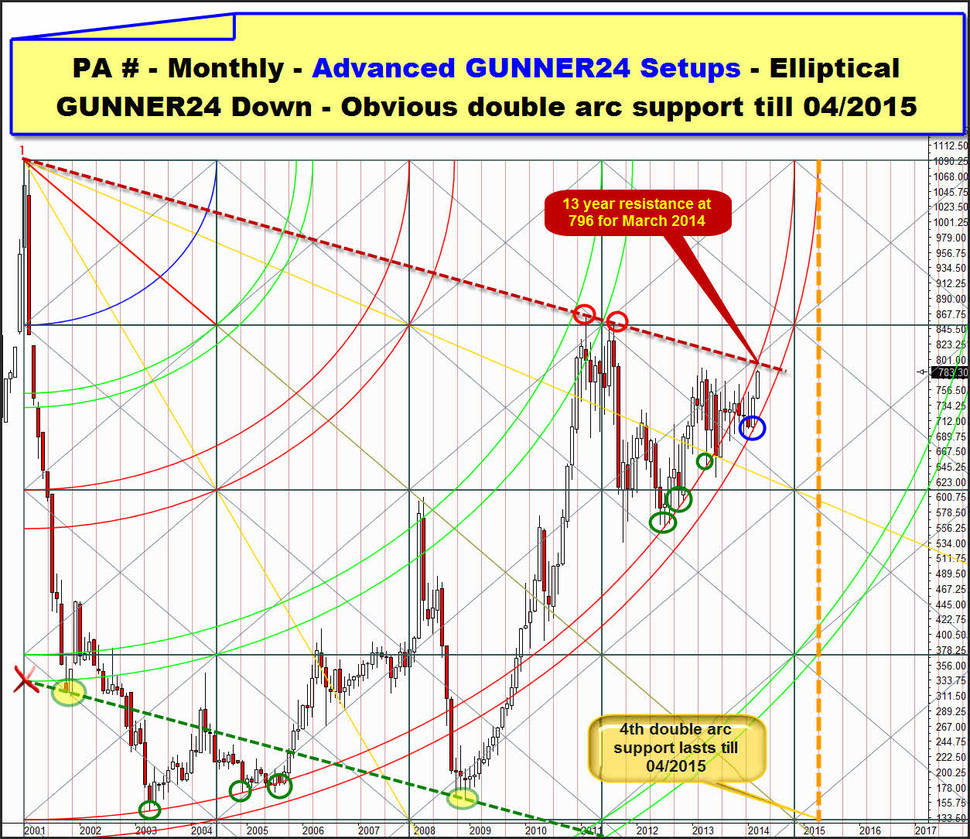

The first hint how long the crisis may last till its solution or till its end however it may look like, i.e. how long palladium might/must rise now is given by this elliptical GUNNER24 Down Setup. This advanced GUNNER24 Technique is giving us optically as it were, to which elliptical double arc support the metal has been orienting since the 2003 lows.

As early as on 05/12/2013 I presented this setup reporting already on the dominance of this double arc support and the sustained consequences to the metal…

From 2003-2005 and again from 2012-2013 marked with the green circles, we clearly make out the upper line of the 4th double arc support in the monthly time frame. At the end of 2013/beginning of 2014 the support didn’t hold yet, and at the blue circle, with the February low the market met the support of the lower line of the 4th. There, at the February low the current up-move is beginning and starting, released by the touch with the lower line of the 4th. This touch seems to result in an enormous up-energy development.

We may presume that now the lower line of the 4th will force the market persistently upwards, supporting it there. Since after all, on monthly base the triangle is dissolved upwards thereby signaling a monthly buy signal, this is concrete evidence that a long, constant several month up-move is due.

If the lower line of the 4th wants to support palladium only as long as it is allowed to by this setup, the currently started new trend on monthly base may last through April 2015. Please mind now the 13 year resistance line. It is at 796 in March 2014. And this is where it is going to go next week…

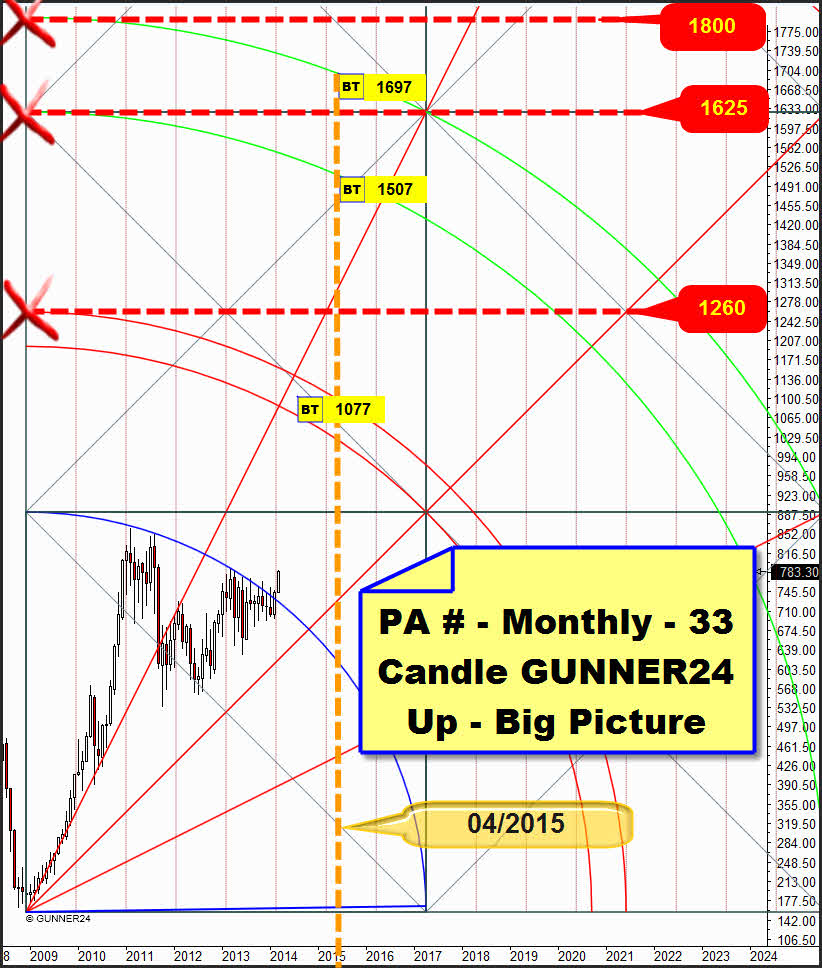

From the December low of the year 2008 we may measure an initial impulse lasting 33 months:

March 2014 is breaking upwards now the Blue Arc resistance of this impulse persistently. Thus, the next target is the 13 year resistance trendline. The 796-800 are likely to be worked off till next Wednesday/Thursday at the latest. Then PA will be supposed to have to fight with it for the moment. But this resistance will technically be overcome as early as this March, or in the worst case March will close at 706-800 because the triangle breakout and the Blue Arc breakout are indicating so.

February newly reached the Blue Arc resistance at the top. But March opened above the Blue Arc for the first time, and thereby the price is allowed to orient itself upwards. So to speak the Blue Arc resistance was skipped over by the March opening. Thus we have to classify the March candle clearly as a breakout candle. And as a rule, those ones nearly always close at the monthly highs. So, in the worst case March will close at 796-800, at best above it!

Since March should be just the first out of at least 3-4 white candles (new lasting monthly trend move!!!) at the latest in April the 706-800 is supposed to be overcome persistently.

After the 796-800 the next higher resistance is not threatening before 890= surroundings of the first square line resistance = first important uptarget. The 890 will be headed for extremely speedily after overcoming the 796-800. Not before that palladium is likely to take a break that might/should last 2-3 weeks. A monthly close above 900 will activate the GUNNER24 Main Target of the current blue arc resistance breakout then, the first double arc at 1070-1090. These surroundings are nearly one by one corresponding to the symmetrical triangle target being supposed to be worked off till September if everything is going normally.

In my opinion, reaching the 1077 till September 2014 is not yet an indication to any sprawling ugly Crimea conflict. Until then (first double arc environment) only the eventualities of a military confrontation and the hope that Russia will go on delivering at least some palladium into the economic circulation will be priced in.

What make me really nervous are the other targets that might arise from the current development. We know from above that the new uptrend in its infancy may/can technically go till April 2015 after all. I put this important moment optically above the monthly 33 candle up. The orange vertical makes clear at which monthly double arc the price targets of this breakout will be situated in case the 1077 are overcome on monthly base still in 2014:

I’d like to guess that a monthly close above 1100 till September 2014 would mean a persistent up swing that may last through April 2015. If till September 2014 the 1100 mark is overcome the next higher double arc will be prepared as target. It is situated at 1500-1800.

Please ponder yourself which impact a palladium price of 1500-1800 (or even higher??...) until February 2015, might have to all of us…

Be prepared!!

Eduard Altmann