For evaluating the next strong trend moves and the pending important highs in the stock markets, for quite some time I’ve been zeroing on the NASDAQ-100. By its performance, its structure and its signals, it – still - provides us the most valuable indications to what is to come and above all, when the next powerful correction is supposed to start.

In the free GUNNER24 Forecasts of 12/06/2015 „The stock-market roller coaster into the new bull highs" then – inter alia by virtue of the NASDAQ-100 performance – we could nail that with December 2015 an extremely difficult phase with surprisingly wild, short-life up-and-down changes began being to rattle the traders and investors crazing them completely. Besides, we could show that chart-technical false signals were to increase in December the way they may often appear before important, sustainable changes.

Quotation with perspective of 12/06/2015:

This is how it came… up to the year end, many fund managers use to include into their respective portfolios briskly those stocks that had been running well the previous months. They are driven by the necessity to reveal the best performers in their annual balance sheets. Concerned in 2015 were –obviously – the leaders in the tech area like Microsoft, GOOG, Amazon, Facebook or Intel. Because of this window-dressing syndrome, the stock markets use to rise in December, often enough delivering withal the much-noticed Xmas rally.

So did they in 2015. Though, in 2015, December as well as the Xmas rally were shaped by the expected choppiness (unstable daily swings). The Xmas rally wasn’t particularly strong either. Most important for the near developments is this: The closing auctions of the leading stock market indexes – USA as well as Europe – clearly did quite a lot of damage – in chart-technical view!

With the weak last trading days in 2015, the broad equity indexes definitely dug their grave pits still deeper. Even the NASDAQ-100 is clearly at an end now.

Let’s go in medias res evaluating the developments of the last days in chart-technical view:

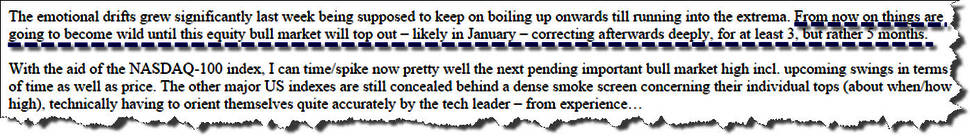

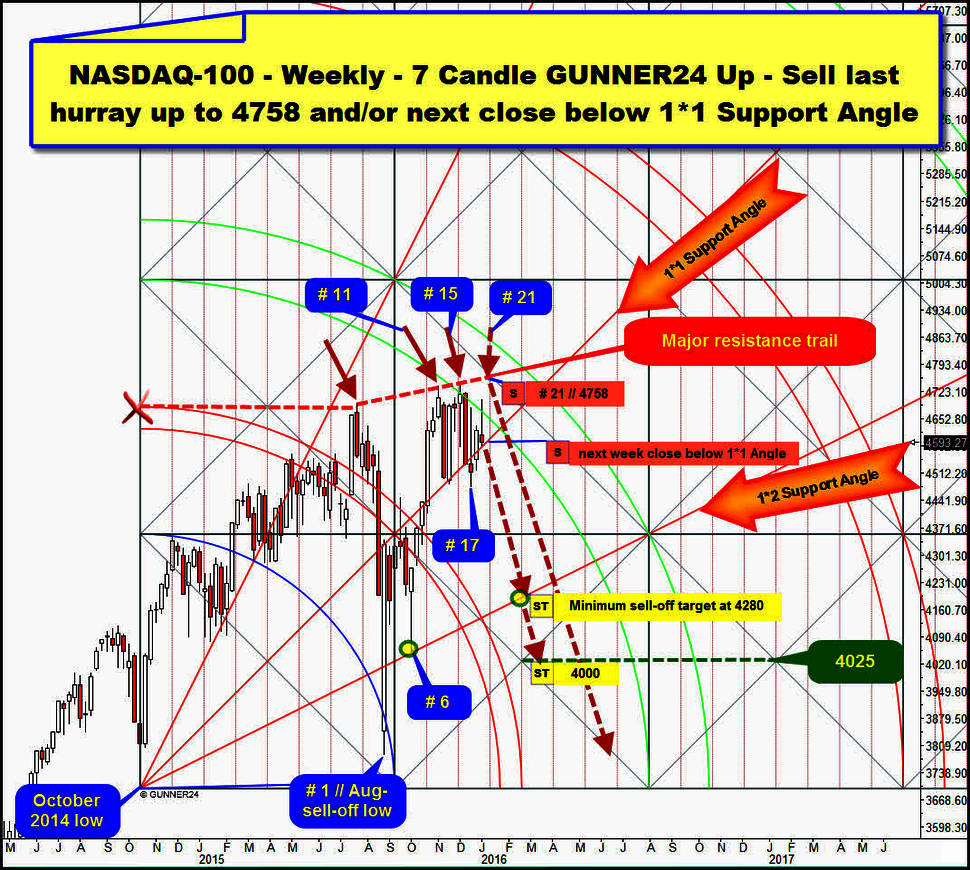

On 12/06, I expected the index being in the 16th week of its uptrend to fall from the identified + confirmed major resistance of the lower line of the 2nd double arc in the ruling 7 Candle weekly GUNNER24 Up Setup in order to test back its strongest combined support magnet between 4520 and 4490 by December 16-18, in the 17th week of its uptrend. From there and from that moment, the index was supposed to start its last weekly upleg to top out finally between 4900 and 4870 index points at the new all-time high (ATH) in the 21st resp. 22nd week of the uptrend (hence about mid-January).

The low of the uptrend week # 17 and thereby the December 2015 low was newly expected to be attained at the decade support of the index that has been presented and dramatized several times:

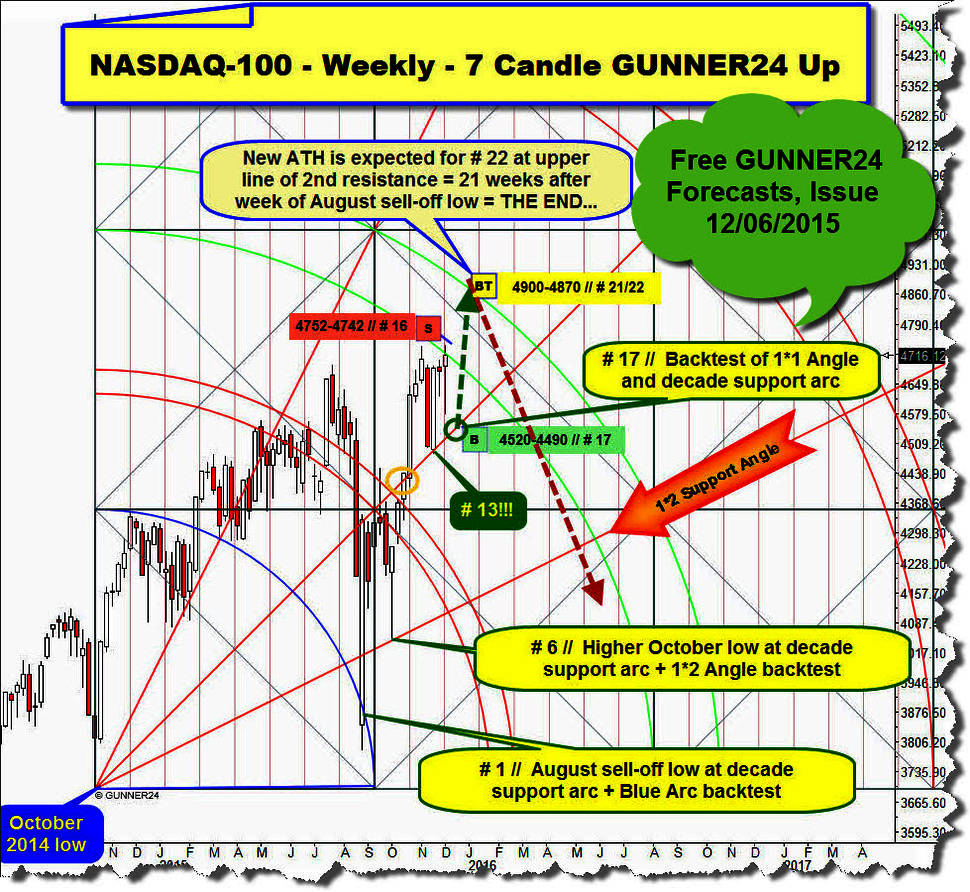

This existing support arc in the NASDAQ-100 index is the currently most important support for all the Western stock markets. This arc prevented the stock markets from falling in the second half-year 2015, supporting them, keeping them above, protracting the beginning of the next mighty and long-lasting correction wave in the bull market.

The influence of the decade support arc finishes officially in January 2016. In the chart above, it’s visualized by the orange dotted vertical. It marks the most extreme temporal extension of the arc. If the support expires in terms of time, the market will be supposed to fall. Since it is matter of a decade support the market shall decline heftily, as to the theory and chart doctrine.

The origin of the decade support is in the 2002 bear lows. In 2015 it was tested several times. During the important August 2015 sell-off, the decade support intervened in the happenings for the first time since 2002. Likewise, at the October low it supported, afterwards chasing the index ultimately into its 2015 high (12/02/2015 at 4739.75) = 15th week of the current uptrend.

As expected, the decade support arc was also responsible for the rally = Xmas rally, after the December low:

Instead of shaping its December low between 4520 and 4490 in the 17th week of the uptrend, from December 16 to 18, the leader found its spike low at 4478.25 on December 14.

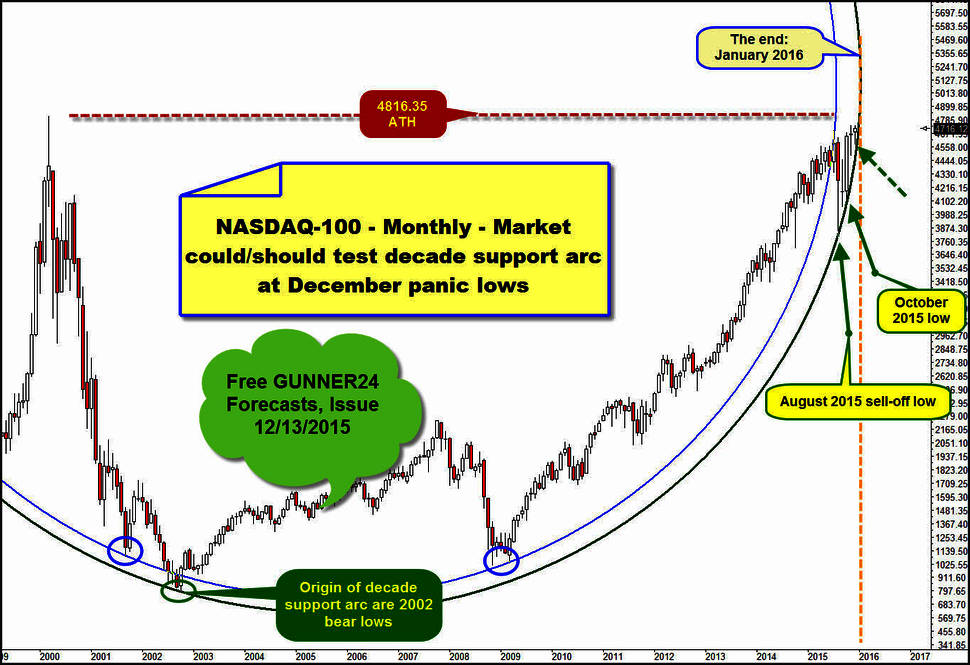

The subsequent Xmas rally topped out at 4702.74 pts. on 12/29. Now comes the problem: The weak closing auction made the index decline by more than 100 pts. the last two trading days.

This weak close of the year 2015 will make the leader open the year 2016 BELOW its decade- support arc. In the chart above, I set the likely opening price of the year 2016 with a small black horizontal. By all means, this opening will fall below the decade support.

On yearly opening base, the time factor is going to take downwards a support that has been dominating for 13 years.

==> Certainly, no sell signal is more powerful than a new year opening below a support that had supported a market for 13 years.

Conclusion 1: The index usually should soon begin to fall sharply – for at least 3 but rather 5 months. Since a decade support is fallen below, a hefty multi-month decline wave is allowed now to start with the very first trading day of the year 2016!!!

Conclusion 2: this powerful sell signal on combined monthly and yearly base should technically prevent a new NASDAQ-100 ATH from happening in the course of the current weekly + monthly uptrend. So, not any new ATH is to be expected before the next upleg on monthly base.

==> Important for us being GUNNER24 Traders + Investors is now to trade the stock markets from the short side till another proof ensues!

In the zoom of the monthly index chart above, I consigned a short-instruction at 4758. That’s where the January high might be brought in. Yet also between 4758 and 4720, an expected backtest of the now broken decade-support arc = MOST IMPORTANT AND STRONGEST RESISTANCE FOR 2016 might come to its/an end.

After their break, such important former supports are mostly/often being tested back. Besides, the Fib count of the current weekly uptrend keeps indicating that the market might be supported by upwards energies for 1-3 more weeks:

The weekly uptrend that began at # 1 will be in its 20th week tomorrow. So, a last upwards thrust is possible until the trend finally turns in the 21st, perhaps in the 22nd week.

Last week (= # 19) touched the 1*1 Support Angle precisely at the low defending the 1*1 Support Angle on closing base again. Such a clean workup of such an important bull trail is mostly a clue for the ability of the bull support to develop upwards energies.

Hence, it’s possible – the weekly time count is signaling so – that the lower line of the 2nd double arc has to be reached once more – in week # 20 resp. # 21. The lower line of the 2nd GUNNER24 Double Arc is the absolutely most important weekly resistance at the moment. There, the year high 2015 was delivered, in week # 15. From there on, week # 16 began to decline into the decade support. There, at the lower line of the 2nd, the Xmas rally topped out last week!

A forward projection of the important weekly highs I marked with red arrows reveals a major resistance trail at 4758 for week # 21 of the uptrend ==> such a high would mean a clean and textbook backtest of the decade support arc in January 2016!!!

The weekly time frame has not delivered a GUNNER24 Sell Signal!!

It won’t before next weekly close below the 1*1 Support Angle!!

Thereby – if next week the sell-off begins immediately because the decade-support arc will have gone down the drain – at the earliest with the next weekly close the weekly time frame can give a confirmation that the index will be already in the multi-month decline leg.

Minimum downtarget for the pending correction in the monthly time frame is the next test = second test of the 1*2 Support Angle at 4250-4280. Yet at least the 4000 in the very first downleg of the expected monthly correction is more likely to be tested back.

Be prepared!

Eduard Altmann