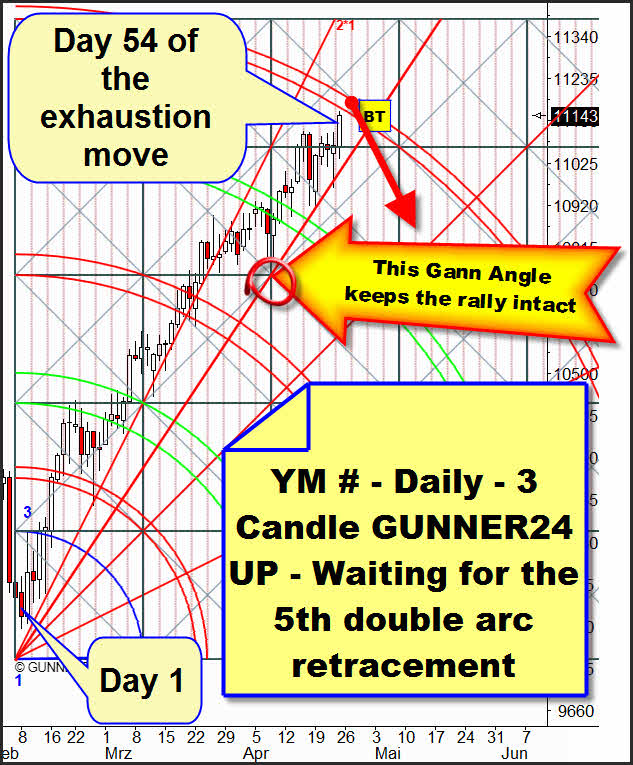

Will we have to expect the Dow Jones high on the 55 day of the exhaustion move?

If so, the final high might happen as early as tomorrow which is going to be the 55th day of the actual up wave. Last week, the YM # contract - the Dow Jones e-mini performed exactly as prognosticated in the last issue. Immediately on Monday, the up swing continued. Further, last Friday besides the Dow Jones all the other important American stock markets produced marginally higher year highs.

The actual situation: In the daily 3 Candle GUNNER24 Up Setup we are narrowly at the main target where we may always expect a change in trend. The primary Gann Angle that is marked in the chart is giving the up move time. Last Monday and last Thursday that Gann Angle was tested for the second time and for the third. In each occasion the price was rebounded upwards impressively. According to Gann, the forth test should cause the final break of the primary Gann Angle. Monday is expected to become the 55th (important Fibonacci number) day of the exhaustion move. That's why we can expect a "natural and important" high.

Target 1 is the lower line of the 5th double arc at: 11166.

Target 2 is the upper line of the 5th double arc at: 11200

That is why our last issue estimate remains valid:

"If the 5th double arc is touched we should go rapidly downwards again, anyway. If the 5th double arc is broken upwards we will go long again on daily basis."

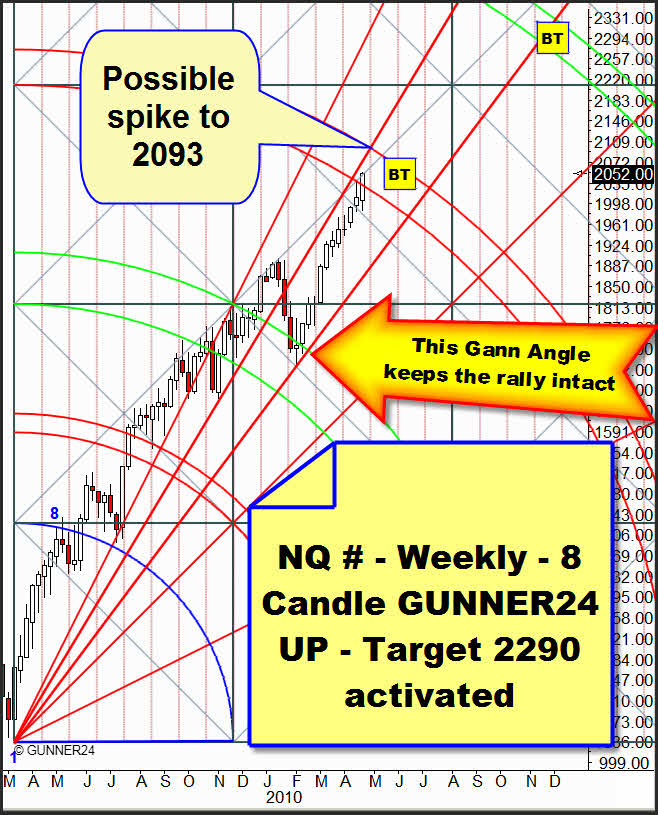

Zooming into the 5 Candle Elliptical GUNNER24 Down of the NQ # we presented repeatedly, we ascertain that the price has captured the broken red diagonal impressively, is now in the gray acceleration sphere going on following the 4th double arc upwards like clockwork. The broken orange important time line is temporally limiting the exhaustion move to the 05/05/2010. That means, until that date the double arc is going to offer support!

Having just a look at the NASDAQ-100, a target of until 2142 is quite likely to be next on the agenda...

Looking at the actual weekly 8 Candle GUNNER24 Up of the NQ # contract we realize that the next target at 2290!! was activated by closing the last candle within the main target - the 3rd double arc! The obvious target for next week is going to be the price and time magnet at 2093, just where the upper line of the 3rd double arc meets the Gann Angle that is lying above the price.

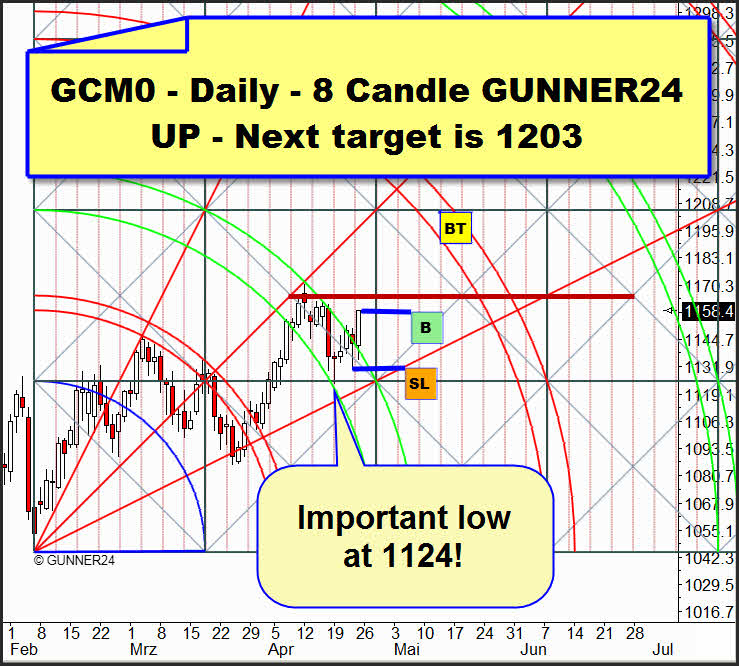

The precious metals gold and silver are producing strong break out signals.

You have been familiar with our estimate of gold for a long time - strong buy with target 1320. Please, check for that among other things the penultimate issue of the GUNNER24 Forecasts of 04/11/2010.

In the daily setup we prefer, the gold has resumed the upwards trend generating a strong buy sign on Friday closing.

The situation: The 2nd double arc is broken also taking into consideration the lost motion. The 1165 is looked upon as the next strong hurdle where on Monday or Tuesday I expect at least a stop or a little reflux. Not before the 1165 will have been broken there will be a lift-off with target 1203!

Silver:

In the actual daily GUNNER24 Up Setup, silver has not broken the 3rd double arc yet. But the break is announcing itself very strongly since for Monday we can expect a strong upwards day which should break that 3rd double arc significantly.

When on Monday the 3rd double arc will have been broken what I assume the next obvious target will be the 19.35.

This target is corresponding with the next target in the weekly time frame.

The situation: Since the February low the price has approached the main target of the setup with mighty steps. In February, the price rebounded impressively from the primary Gann Angle upwards, and last week for the first time it closed narrowly above the upper line of the 5th double arc. IF the next candle breaks that 5th double arc the first break out target is the monthly target at 18.70 (GUNNER24 Forecasts, Issue 03/07/2010). The second GUNNER24 breakout target will be 19.35 which is corresponding with the actual daily 8 Candle GUNNER24!

Tactics for next week: In the American stock markets we will go short as soon as the primary Gann Angle in the actual daily setup of the YM # is broken downwards. As early as Monday we can expect the week high, according to the Fibonacci Count. That Monday or Tuesday, respectively could produce a spike of the price. Important targets for that spike will be 11200 in the YM # and 2093 as well as 2122-2142 in the NQ #.

A spike day with an intraday reversal is very important for our short. Such a day course with the typical signs of a daily exhaustion (combined with a volume ascent!) is really a "must" for the exhaustion of the trend for that's where the last remaining idiots are driven into the stocks! That spike day should happen Monday, Tuesday, Wednesday or Friday. Since in an upwards trend Thursday is always the short sell day. In case next week the spike day happens on Thursday, we will have to reassess the situation in the next issue.

Our long entries: We are going long again in the daily time frame if in the YM # the 5th double arc is broken upwards, because in that case everything would point to an extension of the exhaustion at least until the 05/05. The coming break outs in gold and silver are pointing to the same thing.

But attention: Gold as well as silver is shortly before the break through of the 4th double arc on weekly basis (Please study the GUNNER24 Forecasts, Issue 04/11/2010) but there is an important resistance there for gold and for silver too. If the stock markets produce a reversal this week, it will be absolutely necessary to observe for sure that the break out attempts of gold and silver are no "fakes". As to speak the last rear up before all the commodities together with the equity markets are sent to hit rock bottom. All the long entries are to be hedged by an extremely narrow SL!

Be prepared!

Eduard Altmann