The stocks have reached the timing band for important interim tops. As prognosticated repeatedly – for the last time past Sunday, see the detailed analysis HERE… – at Thanksgiving they produced new all-time highs or fresh year-highs, respectively. As mentioned and forecast last Sunday as well, the current bull power is pointing to the US stock market indexes being more likely to top out finally on December 2 or 3 before a 5-8 day (S&P 500 and Dow Jones, rather 10 days in the NASDAQ-100) correction starts. So on Monday (tomorrow) or on Tuesday (the day after tomorrow) the correction should start visibly.

Let’s underpin the imminent beginning of the correction now analyzing what the 3 most important US stock indexes might be doing the coming two trading days.

For the first time in several weeks shortened Friday trading ended up with a weakness before the weekly close. The Dow Jones and the S&P 500 even sold off the all-time highs so much that they produced a minus for Friday. Only the NASDAQ-100 closed in green, very narrow to the year-highs. That’s a divergence. Furthermore…

Friday weakness in a strong uptrend per se is a sign that something is cooking. Normally the smart money buys the weekly close in an uptrend expecting that the following week produces higher prices than on Friday. Even if the markets are totally overbought like the current ones are, the smart money acts like that. But if the smart money doesn’t buy the Friday close – something is brewing. So if the smart money even sells into the monthly close – Friday was the last day in November, after all – this is a signal that HAS TO alert every trader!

If in addition this weakness shows at the moment expected by GUNNER24, the conclusion is obvious that the expected important interim top is made now – at least in the Dow Jones and in the S&P 500. I think the Dow Jones and the S&P 500 decided on Friday to start their respective correction. The NASDAQ-100 (or its future) is likely to produce an other higher high again (maybe only a small lower high) on Monday or maybe Tuesday following downwards then. But also for the Dow Jones and the S&P 500 there will still be a higher high in December. But that will rather occur in the late month of December or towards the year-end:

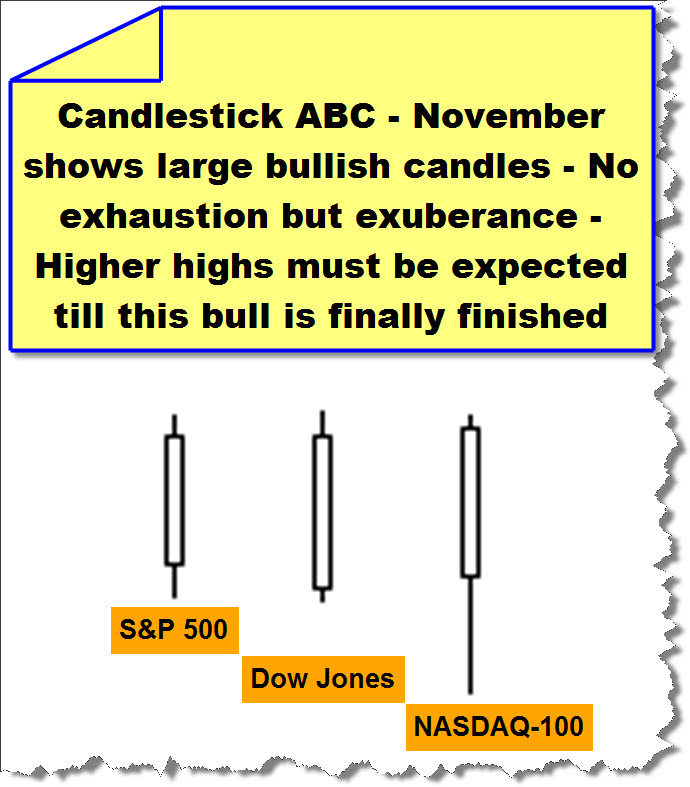

The November candles don’t show any sign of exhaustion. We see absolutely bullish candles that closed near the highs suggesting that the trend is going to keep on. As to my assessment, with a 100% of probability, in all three indexes higher highs will have to be reckoned with and expected. They are absolutely necessary for the imminent change in trend on monthly base! I continue expecting this change in trend and the top for this bull not before the beginning of January. The detailed analysis at the early year-top 2014 is to be found here again.

The exuberance candles at the supposed end of a bull market are technically the first confirmation for the imminent end of a bull market. Everybody is careless, buys like crazy into the monthly close even though those markets are absolutely overbought. "Somehow it will continue, in any case we get out of the positions…" is what the investors are thinking now and today. Frequently, just the performance or the structure of the next candle after an exuberance candle can give the final confirmation for the definite end or the near end of the bull with the candlestick analysis. Important and meaningful candlestick reversal signals mostly appear combined. Well, if December closes with a very long upper wick and/or even negatively or actually produces a reversal candle (December close is supposed to be below the November opening) we’d have a serious indication that at the high of the December candle was the top of this bull.

The threat of an exhaustion candle, a candle with a long upper wick, is extant now. I mean that especially in the NASDAQ-100, this bull’s leader, there is an extreme exhaustion risk.

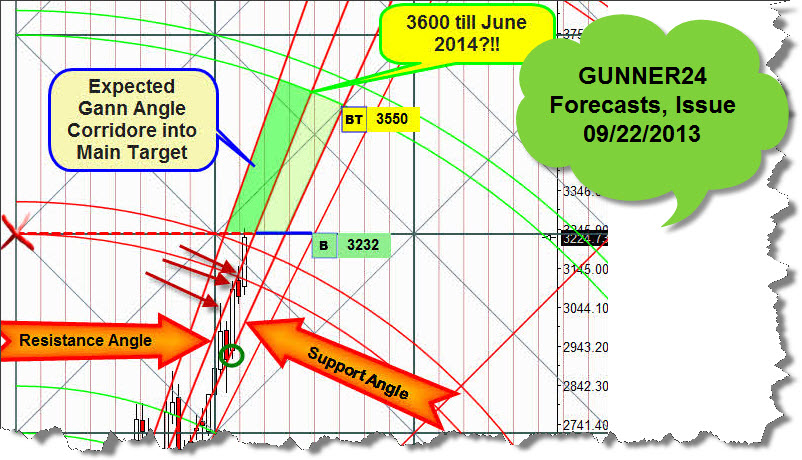

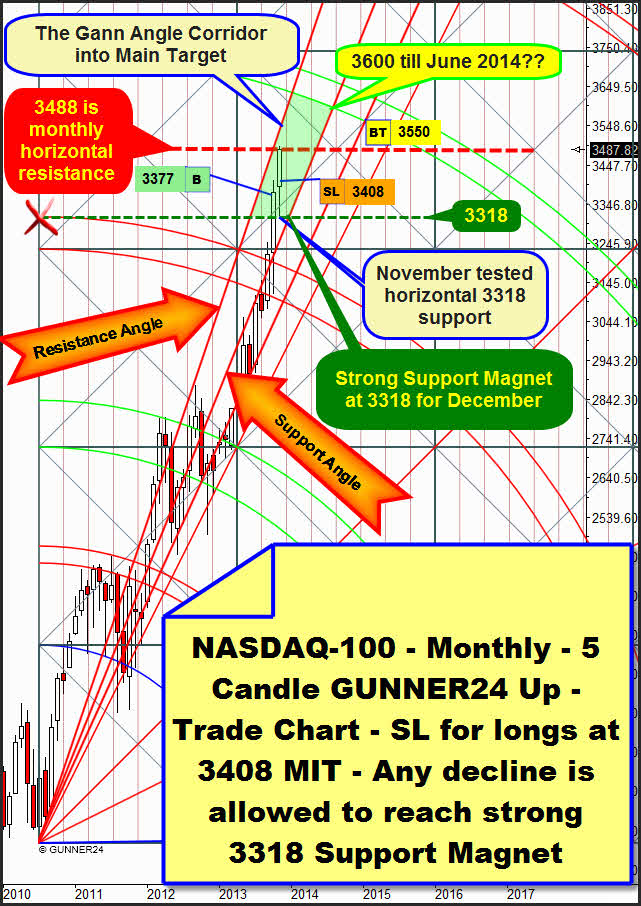

The last time I analyzed the NASDAQ-100 in the monthly time frame was the end of September. The way of the index seemed to be clear as soon as the resistance of the 3rd double arc would be overcome finally… In a narrow Gann Angle corridor the market should go up to its main target, the 4th double arc. We wanted to buy a monthly close above 3232 – the final break of the 3rd double arc:

On Friday the index reached its next important resistance above the 3rd double arc. It closed exactly at 0.18 index points below the 3488, the horizontal resistance that corresponds to the center of the just passed square:

Is it coincidence that exactly at the monthly close this resistance was reached the Dow Jones and the S&P 500 precisely at that moment beginning to show weakness when the NASDAQ-100 reached this exorbitant monthly resistance? No, it isn’t. Both, the Dow and the S&P 500 are suspecting something. I think the NASDAQ-100 is going to follow on Monday or Tuesday really reacting afterwards to this horizontal resistance. Within the coming two days it may briefly prick over the current year-high at 3495.97 thus making an even higher year-high in December and turning down then. But perhaps it will just take a narrow lower high to start the decline, let’s wait and see…

In the maximum case the correction is allowed to go from the current year-highs down to 3318. There the strongest Gann Support Magnet for the index is situated. There lies the November low. There the Support Gann Angle cuts the next lower horizontal support that springs from the intersection point of the upper line of the 3rd with the beginning of the setup. If the index rebounds harshly from the 3488 in the monthly time frame there is no support between the 3488 and the 3318 to be derived…

The 3318 means quite a lot of correction potential for this possible decline. A -5% is allowed. We place our SL for the monthly long-position till narrowly below the October high to 3408 MIT (market if touched).

A weekly close above the 3488 would newly confirm the 3550 as the main target for this bull- run. In this case the 3550 should be reached until the first week of January.

The reaction in the S&P 500 and the Dow Jones down towards the monthly close must attract the caution and attention of each trader and investor. But I would never have supposed the conflict around a couple of tatty rock isles in the South China Sea to serve as the reason for the Thanksgiving top including a following deep correction.

Well, it’s not new that mankind struggles for a couple of spots on the map that look like flies’ shit. Flies’ droppings in the sea have provoked tremendous conflicts. In this occasion there are not even people living on the rock isles called "Diaoyu" and "Senkaku". These are the names of the bird breeding sites depending on whether one lives in China or Japan. This territory quarrel as surely a matter of the existence of fish, as well. But no doubt, the cause is that every littoral state wants to bicker for rich oil and gas deposits in the big South China Sea. And again some spiritual stuff is in the game whose seed was sown into the rock heap about 600 years ago.

The threat of an armed conflict is thoroughly present in this case. The Chinese won’t put back, and wherever there are US B52 it may bang anyway. If it comes to armed incidents or the threatening behavior becomes more pronounced the markets may be shattered first. This possible conflict might make the December candles immerse from the beginning.

We better don’t imagine what happens if the Chinese and Americans shoot to each other…

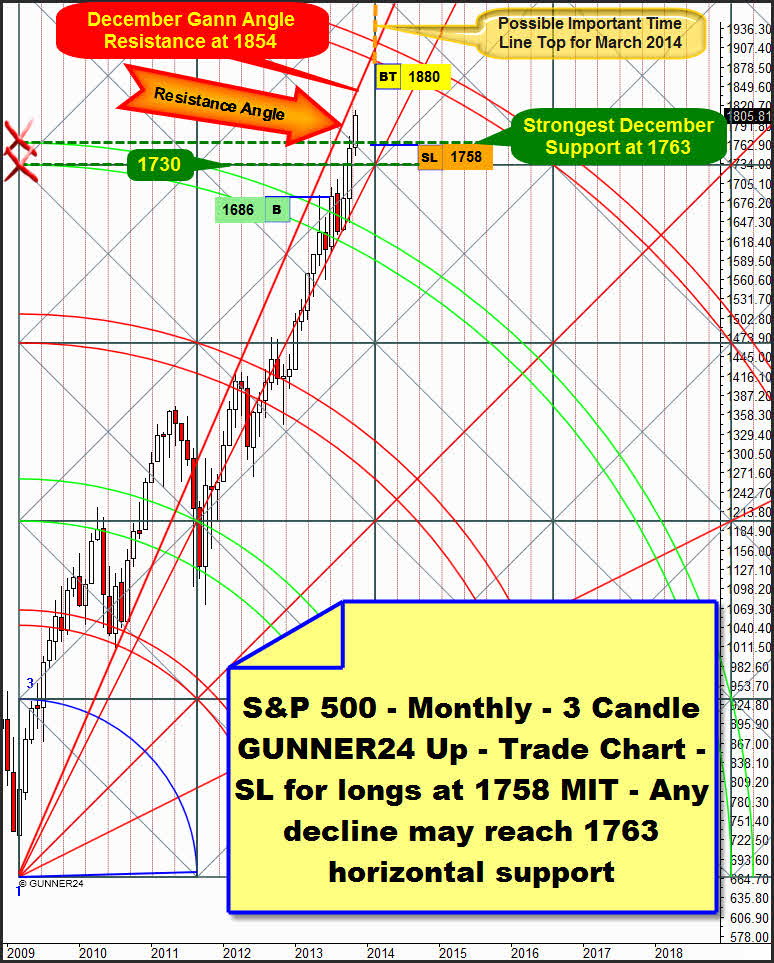

To hedge our profits, also in the S&P 500 we’ll have to put a stop on our long-term monthly long-positions as well:

Be prepared!

Eduard Altmann

Because of mere cautiousness we place the SL narrowly below the October highs at 1758 MIT. Beneath the current 1805 there is the next monthly support at 1763. This horizontal is the strongest December support being likely to stop any decline and making the market bounce again into the expected January 2014 bull-market top. Expected targets for the first important year-high in the new year keep being the 1854/1864/1880/1889.

A weekly close below the 1763 in December would make the 1730 waving at the horizon. If the conflict in the Chinese Sea eases soon, perhaps there will be a positive reaction of the market. A new exaggeration move in the bull-market will be very likely in that case having the potential to be the reason/trigger for the beginning of the X-mas rally.

A possible December top is at 1854. This 1854 is at the Resistance Angle, visible in the chart above. It should be targeted in December as soon as a weekly close above 1820 is achieved.

Short-term profiteers of the China-Japan-USA-rock-isle bickering are likely to be gold and silver. The keyword is safe haven. I think the lows of this swing are made for the time being. 2-3 weeks of recuperation for all the gold- and silver-bulls are thinkable and likely now. As supposed last Sunday, silver seems to have been the key. It looks very much like a higher weekly low for the white precious metal. How long it lasts will depend on the duration and range of the now expected countertrend swing.

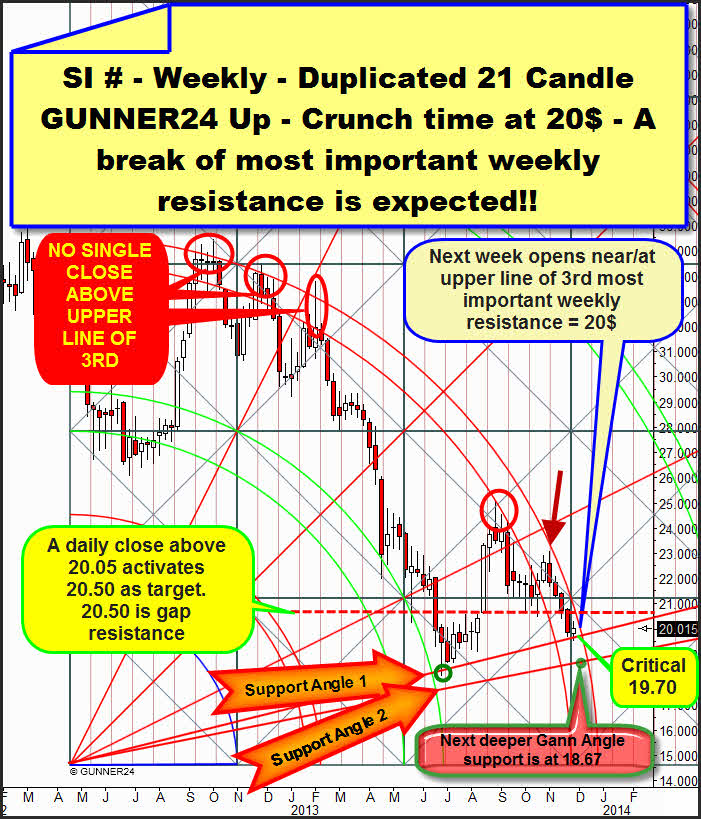

As notified last week silver reached its important Support Gann Angle in the weekly duplicated 21 candle up setup that was to stop the decline in the 5th week of the current downswing. Expected or allowed was the 19.46 as swing low, but just 19.56 was reached. The 19.56 is narrowly underneath the Support Gann Angle. From the 19.56 silver bounced up to the weekly high at 20.30 with closing price 20.015.

Now it´s CHRUNCH TIME!

If there is no surprise at opening silver is going to open at about 20$ this week.

The 20$ is exactly at the currently most important double arc resistance, the upper line of the 3rd.

A look into the past – this makes the analysis extremely easy this time – shows us that the upper line of the 3rd should technically press down silver this week. The upper line of the 3rd has been an unbridgeable resistance for silver for more than a year. A weekly close above the upper line of the 3rd has never succeeded. 10x the upper line was reached or touched. Only 5x silver succeeded to trade above the upper line in the weekly time frame. A weekly close above the upper line of the 3rd would be an unequivocal signal for us that silver is going up because thus the possible higher weekly low would be confirmed.

Unsuspected up forces might arise if the powerful all-dominating resistance of the 3rd double arc on closing base were overcome finally. That’s a fact. A close above 20.30 next week would break the monster resistance definitely. A close above 20.15 next week would overcome the resistance with high probability.

A Monday opening far above 20$ - about 20.10-20.20 would be another serious hint that it is going upwards being the 19.56 a very important low in fact!

The final overcoming of this 3rd double arc will facilitate a maximum upwards potential of about 26$. It’s a fact.

I mean silver is going to crack this resistance finally coming week or the week after next. Whether the maximum upwards potential will be reached in that case is quite another kettle of fish. Let’s wait for one thing after another…

Of course – and this wouldn’t be any surprise, because after all a trend continuation is always more likely than a change in trend – the resistance of the upper line of the 3rd may drive silver newly down, beginning on Monday, compelling again a test of the Support Gann Angle 1. This one is at 19.70 for next week. A daily close below 19.70 during the next 5 trading days may lead silver – and gold as well – to the intention to continue the downtrends till shortly before X-mas. Thus the Support Gann Angle 1 would be finally broken at the third test.

According to W.D. Gann the Gann Angles should always resist at the first and second test regularly. Scarcely the third or the fourth test are the important ones that decide about the future direction. If the Support Angle 1 broke finally at the possible third test, the next lower Support Gann Angle 2 = 18.67 would be headed for with a high probability.

Before the weekly signal, the decision will be made whether it is going up now in the daily time frame. The signalers will be the currently dominating downtrend lines. Gold and silver are standing shortly before their overcoming. As I interpret the situation, Monday already or Tuesday at the latest should be able to generate a first daily close above the currently dominating downtrend lines = confirmed change in trend on daily base:

Theoretic short-term uptarget of this simple signaler is 21.00-21.30 in the daily time frame for silver.

And the 1290-1270 for gold.

Would you, too, like to profit from this possible monster-up wave in the precious metals on a large scale? Do you require a service that monitors, controls, analyzes and signals for you all the important moves in gold and silver? If so, go ahead and order just right now the GUNNER24 Gold Trader!

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!