Finally, next trading week is going to be exciting again. The truth is going to emerge. We’ll see A) to what extent the upwards trends in the US stock markets predicted by GUNNER24 will continue or B) whether the prognosticated two week correction phase in the precious metals will really come to an end.

Among other things, in the last issue we analyzed that the NASDAQ-100 should have to fill the gap of the week before last first before becoming able to get rid of the relatively strong influence of the 4th double arc in order to take the offensive on the red dotted resistance diagonal then. We wanted to go long in case of the break of that resistance diagonal.

Observations: Last Tuesday at first the gap was filled, and on Wednesday, in one go the 4th double arc and the worked out resistance diagonal were broken. With the close at 2160 we went long with target 2234. In the zoom we recognize that the 1*1 Gann Angle above the price was confirmed as to be a resistance Gann Angle for the second time with the Wednesday high. The Friday low tested back the resistance diagonal. Rebounding from that diagonal at the day low, the diagonal changed its condition becoming a support diagonal.

We further recognize that the market should move upwards in a new Gann Angle corridor (gray hatched) up till the target. SL for our long position is the lower Gann Angle of the corridor.

Outlook for next week: We see that the Gann Angle corridor is proceeding upwards pretty flatly. Thus the market should work its way upwards step by step. As well the upper as the lower limit of the corridor should be overcome or broken with great effort only. Above the price, there’s the upper horizontal of the just passed square where actually there is still a horizontal resistance to be made out. Below the price, there is an open gap again that has to be filled. Conclusion: All in all everything is looking very changeable again. Up and down. There are moves you better gain advantage from by day trading only. A sideways move with a light upwards trend. Those moves will be accelerated only if the Gann Angle corridor is being left.

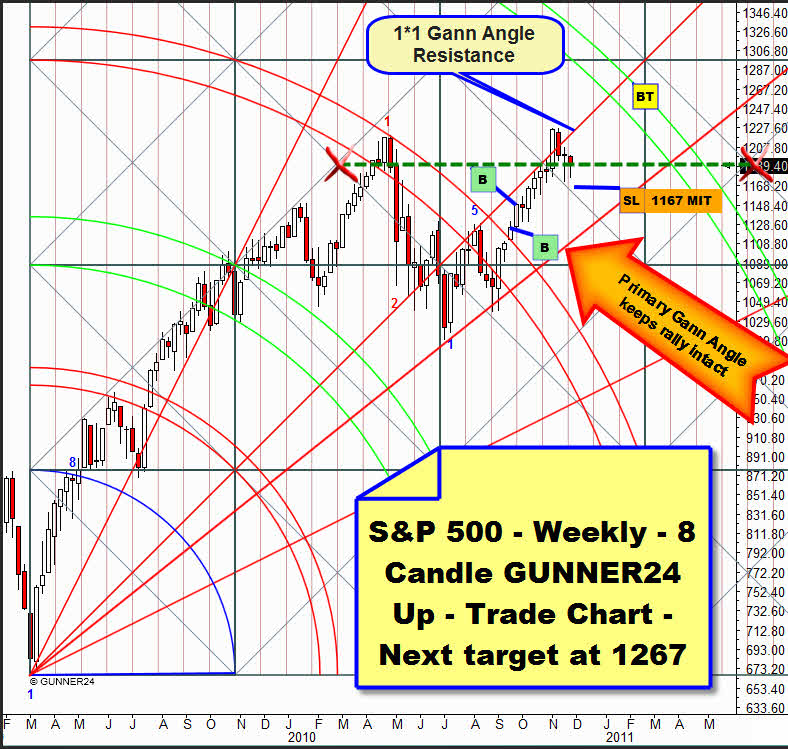

I can state the same observations and the same conclusion for the S&P 500 and the Dow Jones. The difference: in those markets the week course was negative and no long signals on daily basis were produced. To work them out let’s consider a weekly setup of the S&P 500 which was last presented in the issue of 09/19/2010 of the GUNNER24 Forecasts:

We recognize that the market started a rather weak correction after reaching the year high. For as many as three week candles it has been flirting with the setup anchored support diagonal sitting exactly on it with the week closing. Because of the seasonality Friday should actually have closed positively what only the NASDAQ-100 succeeded in doing, but neither the Dow Jones nor the S&P 500 did. We’re going to see next week what to think of the course of last Friday (last minutes sell off...).

The increased trading volume will point the way ahead next week. From the setup above we can derive that the upwards trend should be resumed if the last week high of 1199 is taken on daily closing price basis. That’s why we will have us stopped in there. If the correction goes a little lower we’ll hedge our weekly long positions at 1167(MIT). The SL for the weekly Dow Jones long positions keeps on being at 10950(MIT). Generally we are expecting the resume of the upwards trend with a new year high to happen in December. The tendency of our assumption is still that the year highs will be reached in the week from 12/06 to 12/10/2010. But in the FDAX the year high can already be seen to emerge on 12/29/2010. Next week you’ll read more on that item.

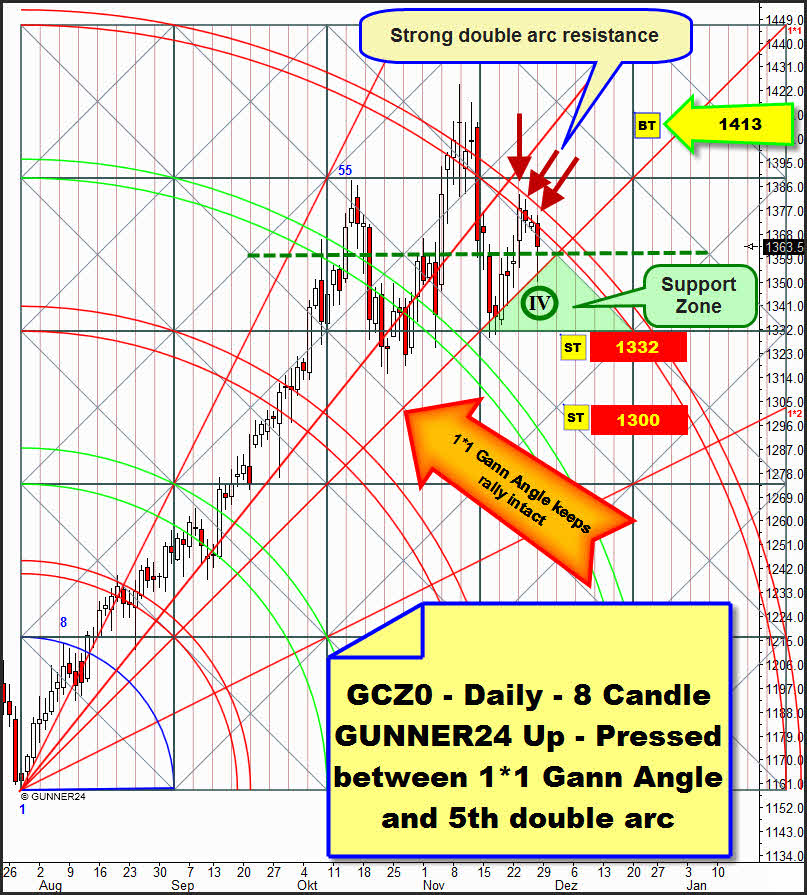

A „miserable pushing and shoving sideways" would be the perfect description of what dominated the precious metal markets last week, at least in case of the gold:

A strong day (Tuesday) took the actual contract close to the main target again. We recognize the resistance power of the 5th double arc because it was touched from Tuesday to Friday but no closing price within the 5th double arc came about. On Friday the market participants succeeded in pushing the gold until the 1*1 Gann Angle with a low volume. In contrast to silver a good and strong rebound from the lows took place.

Obviously not only the strong support area is backing the market but that forth test of the 1*1 Gann Angle makes us expect that the 5th double arc might be overcome in the course of next week. But all in all a stalemate is present: resistance of the 5th double arc vs. supporting Gann Angle and support area.

Inevitably that stalemate will have to be be dissolved next week. We expect that the 5th double arc will be broken upwards. That’s where we will enter into a long position with target 1413.

Why should an break out happen rather upwards? Well, on the one hand with the October closing gold produced an unequivocal long sign on monthly basis. Here you may trace back the analysis.

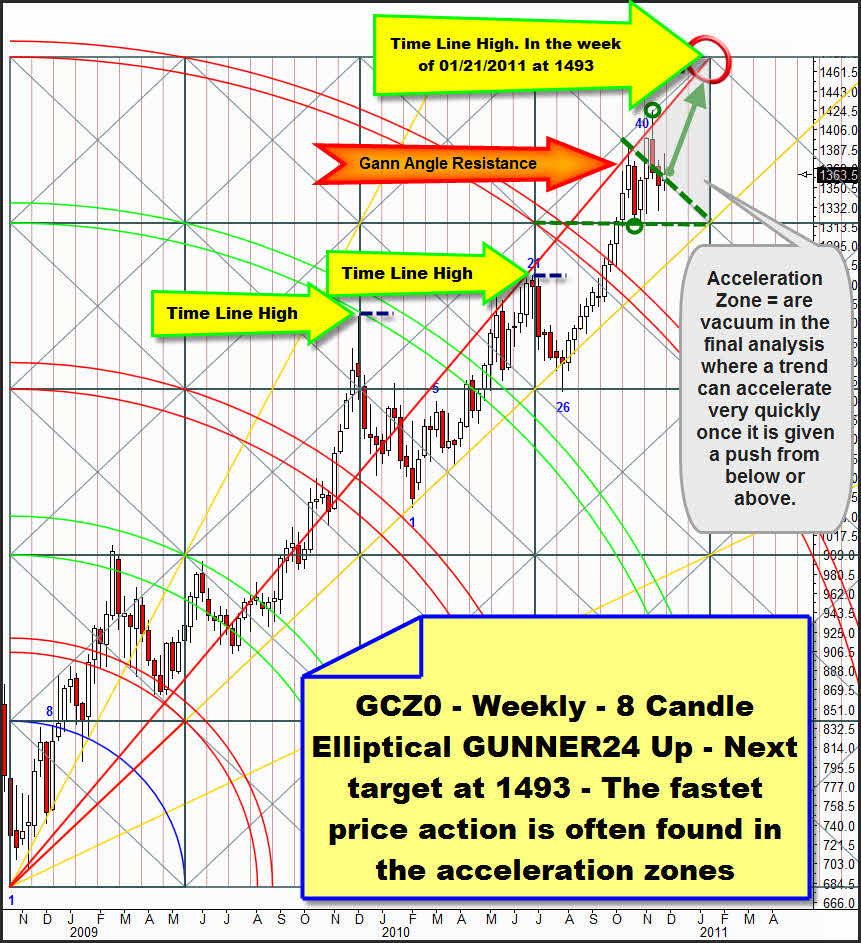

Secondly the weekly 8 Candle Elliptical GUNNER24 Up Setup may give us an answer. For many, many months it has been informing us very successfully on the further course of the market.

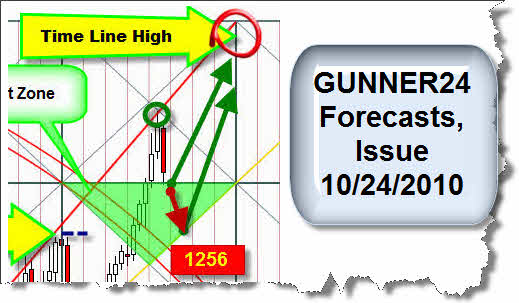

That forecast:

Gold is actually comporting as forecast weeks ago. The rebound upwards happened from the green dotted square horizontal facing considerable resistance at the Gann Angle above the price in the 41st week. That resistance is going to continue limiting the ascents.

With the last week closing we recognize that under the price there is a resistance diagonal (green dotted as well) which should inhibit a week closing price below it in future.

Gold is in an acceleration area where quick and hard moves are not unusual. (That’s why the fast and deep rebound from the all time high happened!) Now I suppose that the forth test of the 1*1 Gann Angle in the 5 Candle GUNNER24 Up above might have enough energy to break the 5th double arc in the daily setup. In that case gold might take off very soon to the 1493 target. If that take off doesn’t happen and if that 1*1 Gann Angle is broken downwards on Monday/Tuesday in the daily setup the 1332 will obviously be the first down target. If the 1332 doesn’t resist the 1315 (weekly support) and the 1300 (daily support) will be the further targets for all the gold bears.

|

"As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

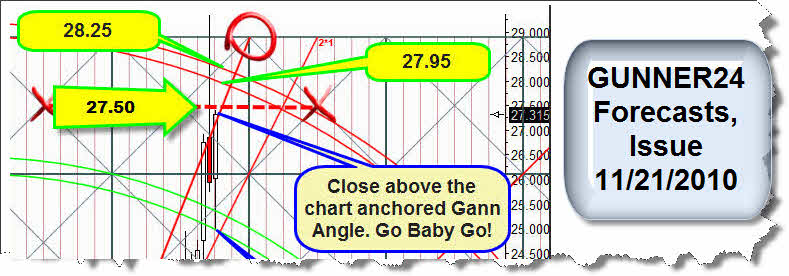

Only partially silver performed as forecast. At the beginning of the week it was alright until the wrappings were taken off by the end. At first I have to apologize with my readers because the forecast 27.95 were not reached. The mark was just 27.895. Otherwise I interpreted the rebound from the lower line of the 4th double arc and the conduct of the resistance Gann Angle too optimistically.

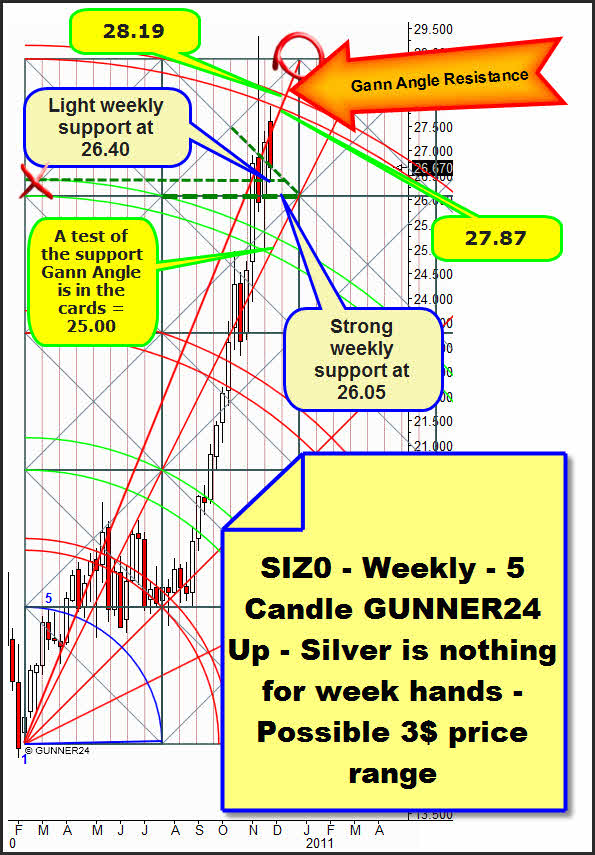

As you can see in the actual weekly 5 Candle GUNNER24 Up at the lower line of the 5th double arc, at the week high of 27.895 a counter reaction on weekly basis arose not only causing the new break of the 27.50 (after reaching the 27.90 it should really have assimilated the support quality). Even the resistance Gann Angle refused to alter its state: It didn’t become a support Gann Angle. All that makes me suppose that next week is going to remain highly volatile. In the extreme case silver can fluctuate from 28.19 to 25.00 without weakening the upwards trend at all. The bounces between the 4th and the 5th double arcs are normal corrections in an upwards trend. Even in the daily GUNNER24 Setups they are not rare at all.

But in a weekly setup I had never observed that kind of violence in the markets we use to analyze. They are that extreme so the actual advice can only be to take along only scalps or short swings in future trading. There are plenty enough possible support and resistance targets recorded in the setup above. Certainly the 25.00 would be a nice Xmas gift in the longer term (Spring 2011) trading with CFDs and SLV. In case of a daily close above 29 we will go long as well, on daily basis.

Be prepared!

Eduard Altmann