Crude Oil is most likely to have ended its last correction move in the uptrend with the last Monday low (42.20) being the November low at the same time, correspondingly being supposed to be on its direct way to the next higher high.

Crude is in good contention for ending 2016 near its year high. The final 2016 high might be attained in the last trading week of the year.

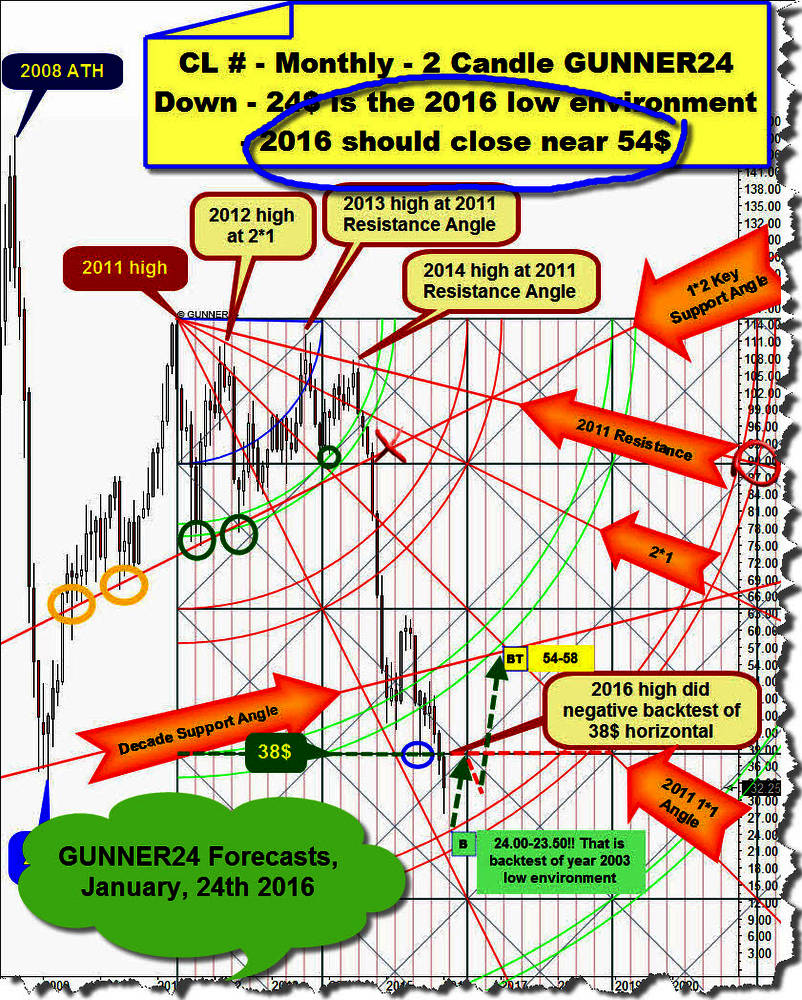

Let's start today's analysis with the bigger picture – the situation of the commodity in the monthly time frame. Including, that also helps us to evaluate the price and time targets for 2017 and 2018. Afterwards, I'll illuminate the weekly situation as proof that oil is expected to boom now through year end.

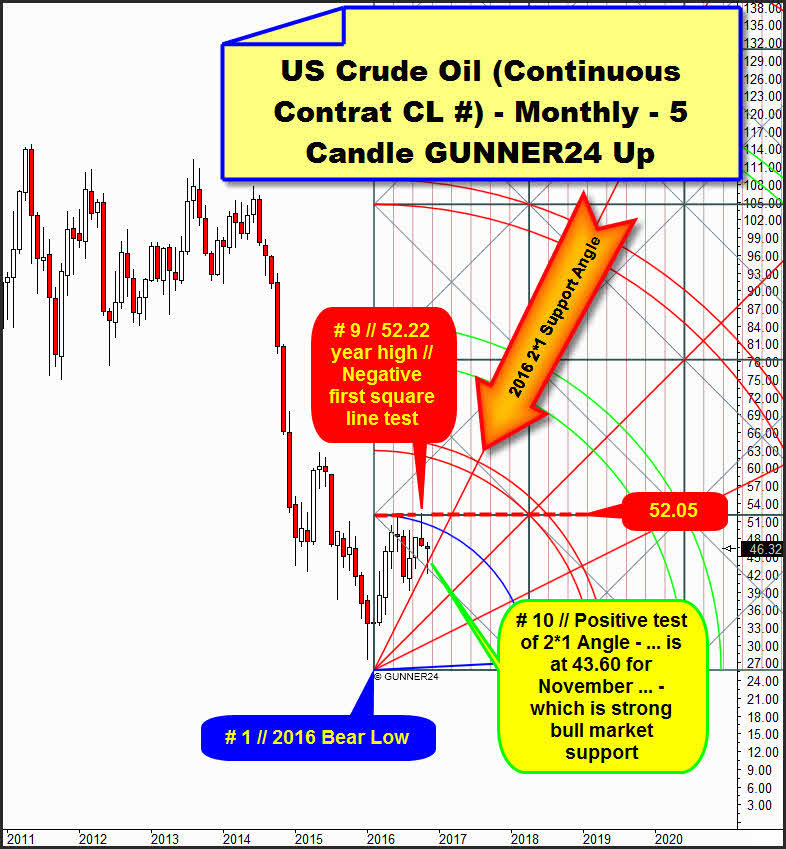

On the 11th of February, with 26.05 US Crude Oil (WTI) found its year low at # 1 and started a strong uptrend. This first monthly uptrend cycle stalled after a textbook 21 Fib number advance in the weekly time frame and a classic 5 month first initial up impulse at 51.67, the first important year 2016 high on 06/09. Then the market corrected for the summer low, followed by the next monthly upleg that dented the natural 52.05-first square line resistance at the current high of 2016:

==> Thereby, at the 52.22 year high (# 9-October) the youngest correction cycle in the daily and weekly time frames began, because that's where the natural monthly horizontal resistance came in.

This correction cycle initiated at the year high visibly dipped under the 2016 2*1 Support Angle, as to be seen with the November candle in the monthly chart above. For the current month of November, the 2016 2*1 Support Angle takes its course near 43.60! The achieved November low is at 42.20, reached past Monday. Since the last trading week closed higher than the week before, by more than 4$, crude is quoted now far above the 2016 2*1 Support Angle again. Thus, the 2016 2*1 Support Angle was able to release some very strong upforces!

==> Thereby, after this first very successful test, the 2016 2*1 Support Angle has mutated now to the completely confirmed yearly support having been approved to be the currently most important bull market support at the same time.

==> The current Crude Oil uptrend is supposed to keep on orienting itself by the rising 2016 2*1 Support Angle the next months.

==> A first monthly close below the 2016 2*1 Support Angle will be the first strong sell signal in the monthly time frame!

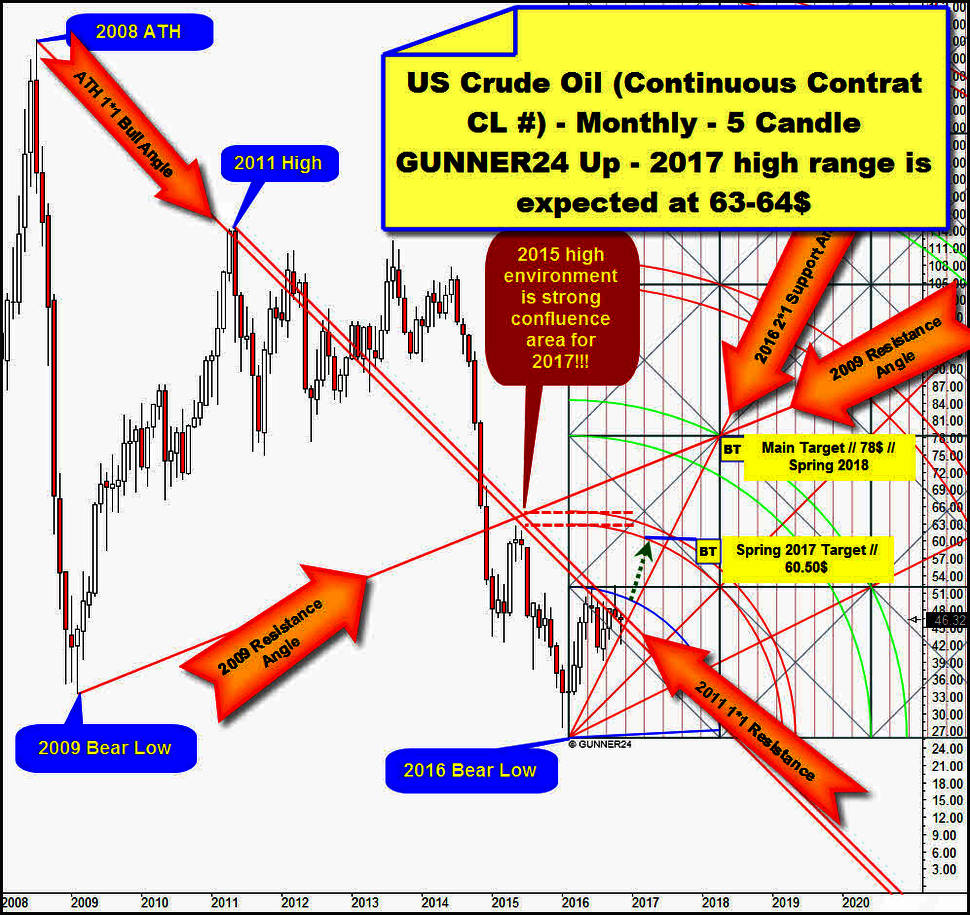

For assessing the situation, in the next step we'll add two extremely important 1*1 Angles, both from out past important highs as well as a Resistance Angle.

==> The Resistance Angle is directly derived from the bear market low 2009 = "2009 Resistance Angle".

==> The ATH 1*1 Bull Angle is directly derived from the very most important extrema of Crude Oil. It's the alltime-high (ATH) from the year 2008.

The "2011 1*1 Resistance Angle" springs from the final high of the year 2011 = the highest reached countertrend high in the current secular bear market.

The 2011 1*1 Resistance Angle as well as the ATH 1*1 Bull Angle are having enormous significance for the market and the 2016 uptrend! The first upleg of the year was able to test the ATH 1*1 Angle, still being resistance at the high then, but it was rejected for the time being!... just to make clear what it means in the very, very big picture. The ATH 1*1 Angle is matter of a magnet in the CENTURY TIME FRAME, because it arises from the very highest high of this century.

Please, pay attention to the last two candles now. We see that the bodies of both the October and the November candle are quoted between the 2011 1*1 Resistance Angle and the ATH 1*1 Bull Angle.

Yet September as well as October succeeded in closing ABOVE the ATH 1*1 Angle!!! Certainly, they did rather close and narrow in each case, but thus, it seems as if the ATH 1*1 Angle has mutated to be an extremely important support for oil now!

The November lows fell pretty deeply below the ATH 1*1 Bull Angle. But, since the body of the November candle is now above this currently most important support again, we had to work on the assumption that the ATH 1*1 Bull Angle is going to radiate super strong support now – at least on monthly closing base!

==> Thus, the November lows seem to have tested very successfully both the AHT 1*1 Bull Angle and the 2016 2*1 Support Angle. It's important Gann Angle cross support that came in there at the November low!

==> I think, with the November low, Crude Oil delivered its next higher low in the presently current uptrend! Thereby, overcoming ultimately the 2011 1*1 Resistance Angle is supposed to mean that oil should have to go upwards, strong in trend, driven by powerful upwards-power!!!

Thus:

==> If Crude Oil closes the month of November above 48$, the current year high surrounding (52$) should/will have to be reached, probably even slightly exceeded till year end.

==> If Crude Oil closes above 48$ one of the coming three weeks, the 2016 high surrounding (52$) will be reached and probably slightly exceeded till year end.

==> Both GUNNER24 Buy Signals sketched above – in the monthly, as well as in the weekly time frame – will thereby activate these medium and long-term uptargets in that case:

A) The lower line of the 1st double arc for March/April 2017 = 60.50$.

B) The highs of the year 2017 are supposed to be in the 63$-64$ surroundings. That's where the reached 2015 highs as well as some important GUNNER24 Horizontal Resistances take there courses, being directly derived from the lines of the 1st double arc. As a rule: The 1st double arcs are always important first countertrend targets after all....

C) The main uptarget of the uptrend started at the 2016-bear market low is supposed to be reached at about 78$ in spring time of the year 2018. That's where and when the very strongest upmagnet for the trend is identifiable = the 2009 Resistance Angle meets the 2016 2*1 Support Angle and the 2nd double arc double arc which is always the main target of a countertrend!.

Herewith, we've closed the monthly analysis now – with the aid of the weekly signals - being able to prove the thesis that technically Crude Oil should overcome the 2011 1*1 Resistance Angle pretty swiftly in order to finally clear the way for storming into the new higher yearly high!

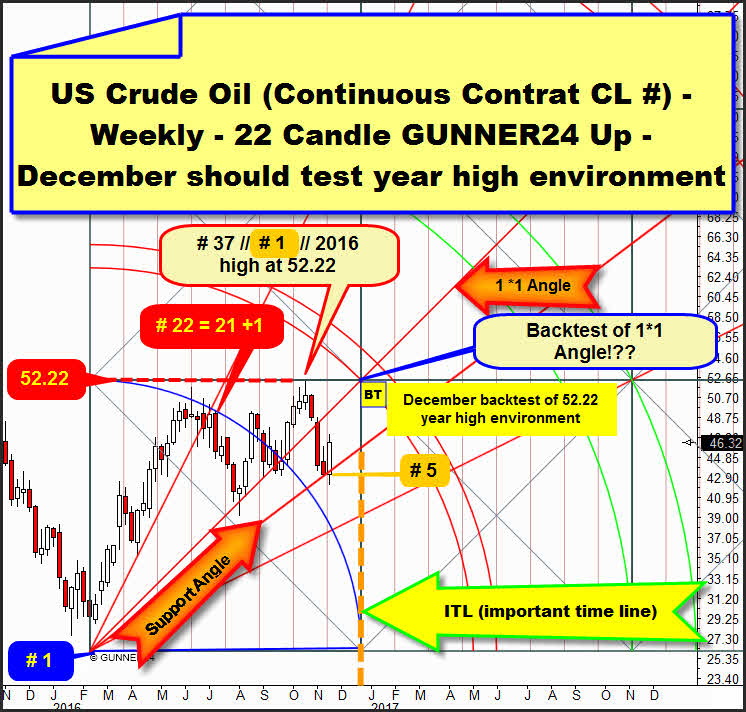

Above you see a valid oil up setup starting at the reached 2016 bear low (blue # 1) measuring up to the top of the 22nd candle, 22 = 21+1. This placement of the Blue Arc nails the 2016 year high pinpoint to the 52.22 first square line resistance. The year high was attained at the top of week # 37.

At the year high, a pullback began that is most likely to end at the low of last week, cause:

==> The pullback comprises 5 candles so far. 5 is Fib number thereby turn number! Orange # 1 - # 5.

==> The Support Angle was tested in pullback week orange # 4 on closing base and ultimately defended.

==> Last week shows a path-breaking, strong reversal candle, indeed triggered by means of existing important Gann Angle cross support in the monthly time frame, as analyzed above.

Technically, as next shortterm uptarget the normal first backtest of the 1*1 Angle is due, finally broken downwards in pullback week orange # 3.

However, in the short term, it's supposed to go much higher yet, namely till the backtest of the 52.22 first square line that – together with the lower line of the 1st and the 1*1 Angle – is forming now a very attractive triple upmagnet in the weekly time frame, around the middle of the month of December!

Yet ultimately – since only 5 days ago, the next important higher low of this uptrend was marked being probably underway thus a next multi-month upleg – the current 52.22 year high is not supposed to constitute an excessive hurdle for oil in succession.

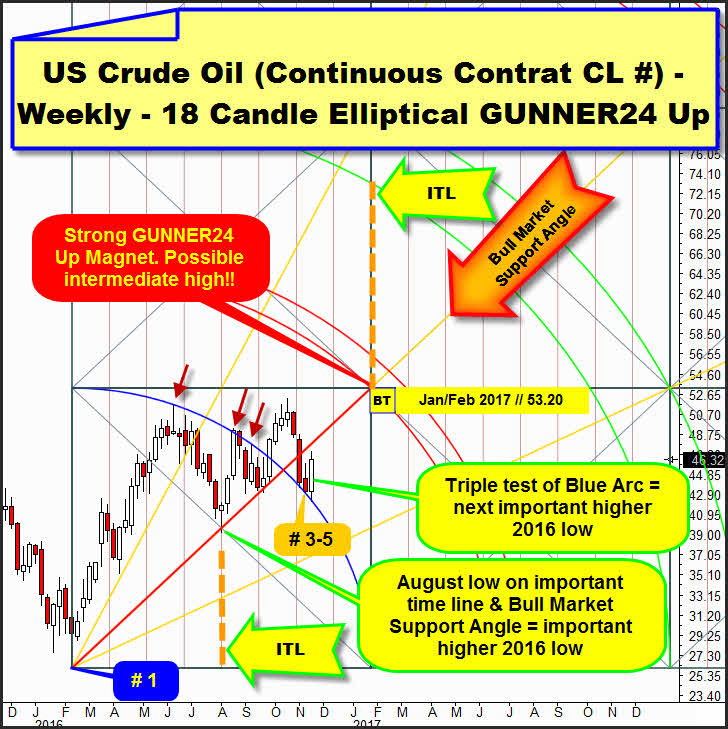

Over the weekly time frame above, this time I put the certainly most dominating GUNNER24 Up Setup. It's matter of an 18 Candle elliptical setup. So, this setup stretches from the bear low till the first important high of the year.

Please mind what price-and-time consequences the chosen elliptical Blue Arc placement implies:

A) I think, there's no doubt about Crude Oil to downright love this elliptical Blue Arc. At the beginning, we see three rebounds from the strong Blue Arc resistance at the red arrows realizing the rigor by the lows of the pullback weeks orange # 3 to # 5 in testing back just this elliptical Blue Arc.

B) We can be quite sure about the correlation there is between the positive development of the pullback week orange # 5 and the elliptical Blue Arc, now several times tested back positively, because the certainly final, next pinpoint backtest of the Blue Arc at the low of the pullback week orange # 5 triggered enormous upwards forces!

C) The conclusion is this: If the placement of the Blue Arc as chosen above is right/applies having been marked the next important higher low of the year 2016 at the low of last week, Crude Oil will likely keep on rising now till the next orange vertical situated in the future...

==> For this ITL (important time line) is supposed to gain likewise important signification as already shown by the ITL that takes its course through the center of the first square. Exactly there, in the center of the first square according to time and price, the August low and therewith the first important higher low of 2016 was cemented.

==> Cause the center of the first square delievered an important higher low, the right end of the first square might signify an important high of this uptrend by the end of January/beginning of February 2017. In terms of price, it is supposed to be reached then at the 53.20-first square resistance line.

==> 53.20 is triple upmagnet for the end of January/beginning of February 2017. It's formed by the first square line, Bull Market Support Angle as well as the lower line of the 1st double arc resistance!

I think, considering this outcome, the prediction made at the beginning of the year that Crude Oil was expected to end the year 2016 around the 54$...:

was not at all too bad...

Be prepared!

Eduard Altmann