The number of thank you e-mails I received on the forecasts of last issue was above average. Many readers were impressed by the accuracy of the hits scored in the worked out GUNNER24 Targets:

In this forum, too, I'd like to express my MOST cordial thanks for those compliments! Today, I'd like to show you how to deal with the situation when the targets presented here in the newsletter are hit or targeted and how to double-hedge those targets very quickly in order to make the correct decision in your trades thus, always, I hope.

The targets presented in the GUNNER24 Forecasts are frequently daily targets, often they're weekly but sometimes even monthly targets. Let me go into a monthly target now. When I work out a monthly target presenting it in an issue you got to know those are the most important targets! The importance of a monthly target is higher than a weekly one which again is above the daily target.

We use to trade in our own accounts EACH and EVERY trading recommendation presented publicly in GUNNER24 Forecasts. The recommendation above mentioned was published on 10/31/2010. On 11/04/2010 the silver future closed at 26.04. That's where we went long with two contracts. In case of entries we ALWAYS wait for confirmation by candle close. A double arc, a square line or a Gann Angle are never really broken before the final close of the candle. In almost ten years of GUNNER24 Trading that procedure has turned out to be the best in the long term. It's an important rule you'll always have to observe! The 3rd double arc in the monthly SI # 5 Candle GUNNER24 Up was not broken significantly and considering the Lost Motion before the 11/04/2010 with the 26.04.

In one breath we put in the sell limit. So, as soon as a target is being just touched it will be executed automatically. That way, we will always be at the safe side pushing aside at first all the emotions. Human errors or temporal inadequacies won`t be possible any more during the following execution. In this case we did not put in any SL because in this year there haven't been many safe trades. There are reasons why in the silver analysis above mentioned we don't indicate any SL, so we give the trade more space. Whenever we indicate an SL strategy in an issue you should should ALWAYS stick to it as well as we use to.

Personally, I write the GUNNER24 Forecasts to have a plan, a week plan or a month plan. To make an issue, I consider dozens of time frames with their corresponding GUNNER24 Setups in the relevant markets. Really with one hour of time involved on Saturday, with the GUNNER24 Signals, supports and targets I'm always able to draw up all the important connections within the time frames. You gentle readers may profit from that plan as well as I do. Put the targets on a piece of paper or send an e-mail to yourself continuing there the support/resistance targets.

Always trade into the trend direction! Which in the stock markets and in the commodities is directed upwards, for months ahead! So just go long. Also in scalping or swinging or day trading, for that way, in case of a short term wrong decision – a corresponding depot size provided - you can be almost absolutely sure to always get out winning.

So I define my plan, and in case of silver it's name was long, long, long and in case of pullbacks it was get in.

Friday before last I opened an SLV long position at 25.95 and at 26.05 a second line. At 26 I bought because the 26 were an important monthly target which was tested back on this Friday, 11/05/2010.

In the 1 hour setup we see how the test took place being controlled within the 2nd double arc. Then I had to pick up my child from the kindergarten and to take her to the hospital. So I couldn't go on taking along the big Friday move to nearly 27. The break of the 2nd arc was another great long signal.

The whole last week I was traveling and teaching so I could hardly take care of trading and just now and then during the breaks I was able to take a brief look at the trade to see whether everything was okay. For checking I only just applied the 1 hour setup above.

In case you can just check briefly and you need a fast decision always use the 1 hour and the 4 hour setups. If that one corresponds/those ones correspond with an important daily, weekly or monthly target /support/resistance you will have an enormous security in your trading decisions!

On Tuesday I made out that silver was standing nearly before the 5th double arc, nearly before the important time line and nearly before the 29, so I popped out two thirds of the SLV immediately. And since I know that it has to go some higher I raised the sell limit for the SLV longs by other 10 cents. Then a meeting again. Not before the evening I saw how silver had spiked. A quite normal experience if you're not a full time trader being able to trade just now and then. In that case I experienced the same what uses to happen to you gentle readers frequently: Few or no time for trading during the regular working time... The futures were covered at 19.25 automatically. A trade of the year it was!

To the markets:

The stock markets have reached the prognosticated correction targets staying above them with the Friday closing.

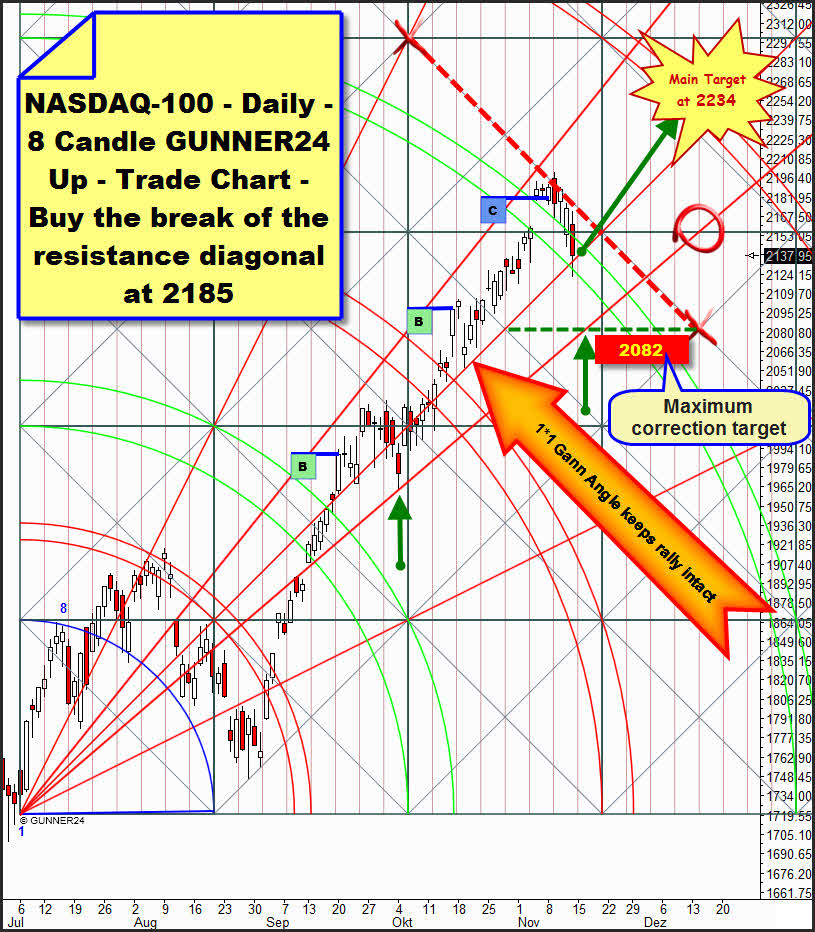

GUNNER24 prognosticated for the NASDAQ-100 an Exhaustion Gap with simultaneous gap closing, a top between 2196 and 2198 (the high was at 2200) with following 5 to 8 day correction because the setup anchored red dotted diagonal was too clearly detected to be an obvious hurdle. On Monday our longs were covered at 2179. The 1*1 Gann Angle stopped the price decay on Friday. Monday will be the fifth day of the correction, than enables the Gann Angle to be tested again extensively (5th day of correction) in the first scenario that I consider to have a 60% of probability.

And then in the course of the week the 4th double arc should be broken upwards together with the resistance diagonal. In case of a day closing of more than 2185 we would take along the last swing to the main target (2235).

I consider the 2nd scenario to have a probability of a 40%. Because it is possible that the last catch point of the bulls will have to be tested again at 2082. If on Monday or Tuesday the 1*1 Gann Angle breaks on closing price basis the 2082 will be obviously the target within the eight day correction. There, at the Gann Angle which was tested as early as by the beginning of October the next support horizontal and a pretty strong time magnet are to be seen.

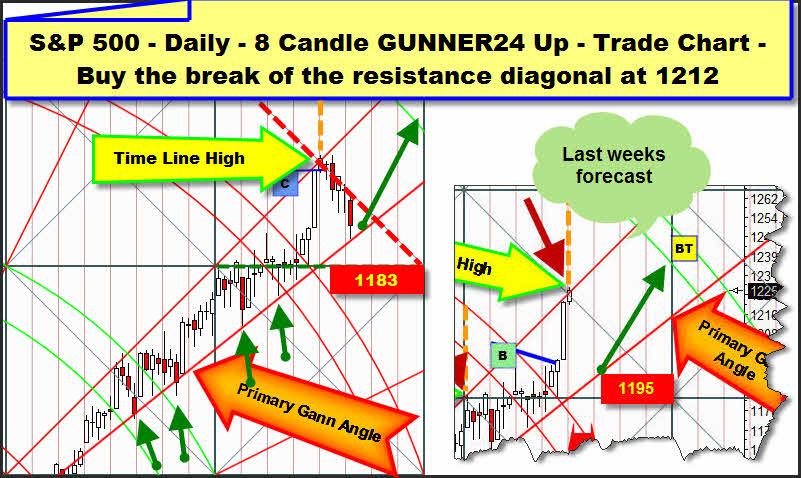

The 8 Candle GUNNER24 Up Setup at the S&P 500 would be responsible for the possible end of the correction as early as Friday.

On the left you see the actual position of the setup, on the right the position of last week. With the Friday low the market has probably reached its correction low exactly on its primary Gann Angle. Here the correction lasted 5 days. In case of the S&P 500 a rebound from the day low took place that was not s strong as in the case of the NASDAQ-100 but it was obvious and makes us suppose that we will have to test again the primary Gann Angle on Monday to overcome then the red dotted resistance diagonal.

That course will be confirmed if we reach a day closing price of more than 1212. That's where we will go long again. Target year high end of November/beginning of December at 1233-1235. If the primary Gann Angle breaks the last resort of the bulls will be at 1183, that's where the change should happen then at the latest.

In gold the air is out for the time being (the same in silver).

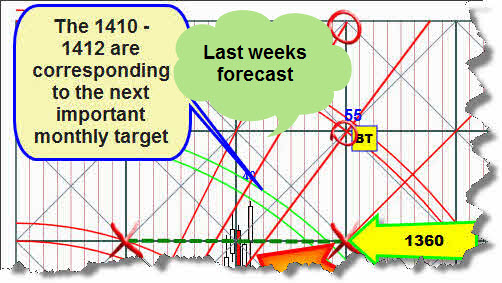

As analyzed as early as last week for gold a little correction or a sideways move is near.

With the new all time high an important month target was worked off. In the Actual weekly 5 Candle GUNNER24 Up gold has reached the congruent week target entering now into a 2 week consolidation phase at least, in my sight. The 1360 (Friday low) seem to turn out as an important daily support as well. The 1360 support is an extremely important monthly support, you know. Please investigate on it in the GUNNER24 Forecasts of 10/31/2010.

|

As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

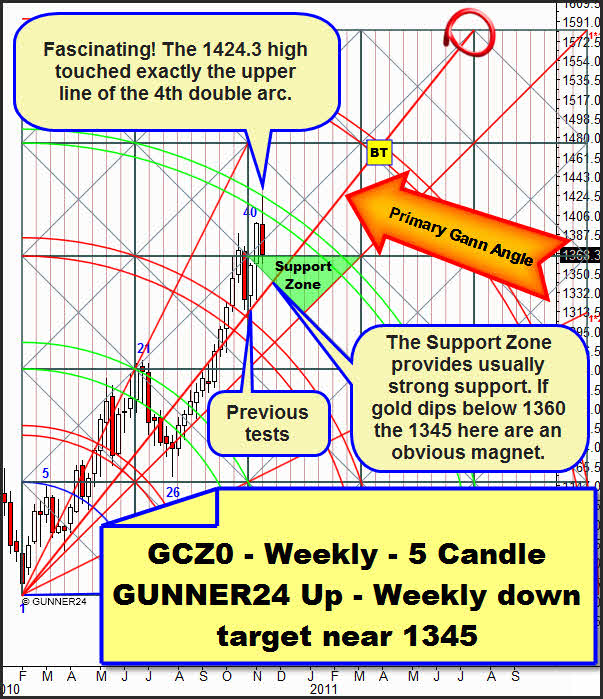

The week closing is offering the confirmation that there is a support area below the price. A little weak it is, that makes me suppose that the support area below the price could be tested until the primary Gann Angle at 1345 within the next two weeks. The primary Gann Angle should be tested for the third time there and it should actually resist. Generally, in the setup we recognize a very violent rebound from the upper line of the 4th double arc. On daily basis the lower line of the 4th double arc should really be visited in the course of a newly starting stock market rally, so to speak as a test. That's where I expect a rebound again, at 1405. But if the stock markets continue correcting during three more days gold will not be able to put it back against it. The same will happen if silver breaks its extremely important 26 support (monthly support) on daily basis.

Be prepared!

Eduard Altmann