It’s a little while ago that we last had a detailed look at the stock markets. Exactly two weeks ago (GUNNER24 Forecasts, issue 10/28), I prognosticated the markets to finish their correction by the beginning of November with Obama’s expected re-election, being supposed to start a rally through Thanksgiving (November 22) – according to a normal course of the election years and the strongest market phase of the whole year that uses to start at the beginning of November.

As predicted we saw a rally into election day. But instead of a continued rally after the election, the general correction worsened noticeably as soon as Obama`s re-election was out. By the negative performance of the last 2-3 days a lot of blood was left on the carpet in terms of chart technique. Some even lower correction targets are to be reckoned with for the coming 5-7 trading days. But nothing has changed respecting the medium- and long-term excellent chart-technical condition and prospects of newly rising stock markets towards the end of the year and above.

The expected correction targets are not far away any more as well in terms of time (as mentioned within the 5-7 trading days) as of price. For the Dow Jones and the S&P 500 the GUNNER24 Forecasting Method is throwing up a common correction target cluster that is positioned by about a

1.6% and a 1.8% respectively, lower than the actual levels are.

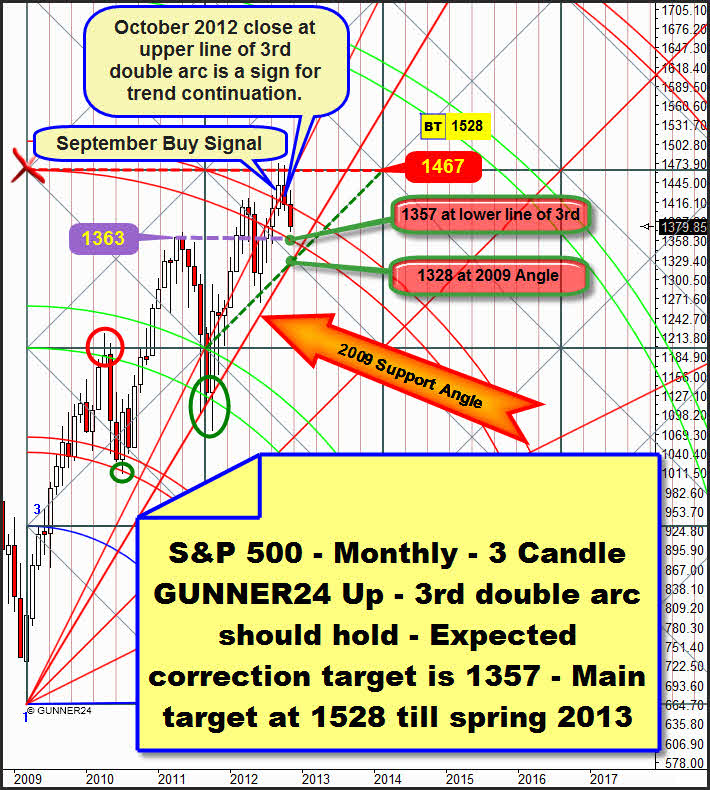

The S&P 500 shall give off about a 1.6% of the actual level yet. In the valid monthly 3 Candle GUNNER24 Up Setup, last Wednesday the upper line of the 3rd was broken downwards on daily basis. The upper line of the 3rd is positioned at 1409 for November 2012, and the close of Wednesday – at 1394.53 – ignited the propellant charge for aggravating the correction that has lasted as many as 8 weeks.

Target for the correction is now the lower line of the 3rd at 1357, the next important Gann magnet underneath.

A weekly close below 1357 would activate the strongest monthly support of the entire uptrend going on since March 2009. The 2009 Support Angle passing at 1328 for November 2012 is cutting there the visible support diagonal of the actual square. Even if the very lowest correction target at 1328 wants to be headed for, the actual correction – in the general context of all the previous corrections of the uptrend going on since March 2009 – will proceed in an absolutely normal way being the second shortest in terms of price and not entailing a change in trend.

Even in case of reaching the 1328 magnet, the uptrend will be kept completely intact. Higher monthly lows und higher monthly highs... clear signs for a healthy uptrend. The uptrend won’t be finished before the June 2012 lows of 1266.74 in the actual down swing will be fallen below.

With the final close above the 3rd September 2012 produced a fresh buy signal with main target at 1528 until spring 2013. With the close exactly at the upper line of the 3rd October 2012 confirmed this buy signal. It’s nothing unusual at all that November tests back now the last buy signal, the spring highs of the year 2011 – mind about that the horizontal purple support line – and the 3rd double arc. For the continuation of the uptrend it’s even sound because the weak hands are being bowled out of the market just right now.

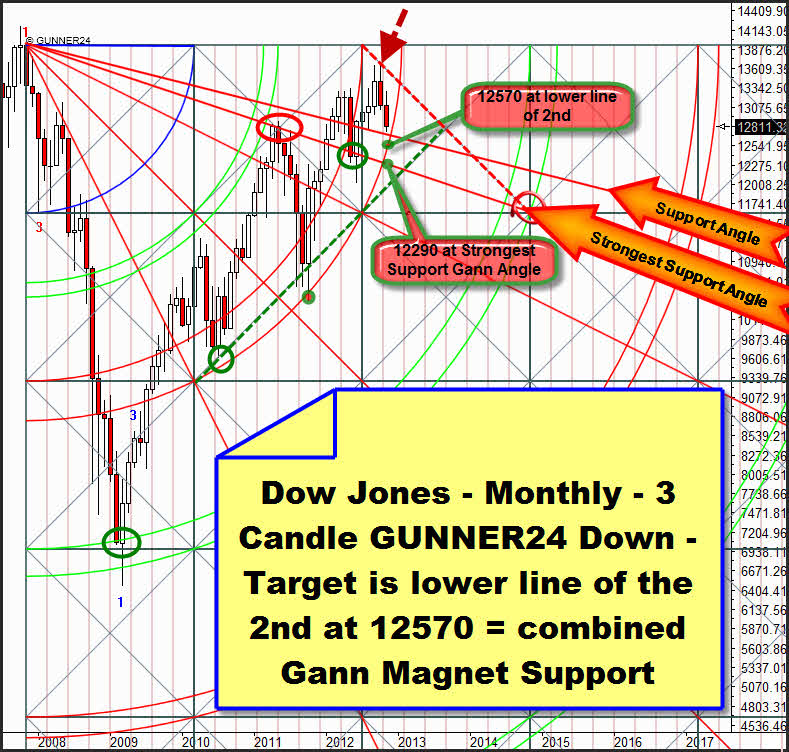

For the Dow Jones there are two opposite monthly setups that are pointing to an end of the correction at 12575-12570 index points at the same time. So it’s still 1.8% off the actual level. Let’s consider first the existing monthly down setup that starts at the November 2007 highs comprising 3 candles and reaching its first initial impulse till the low 01/2008:

From the all-time high the index fell to the 3rd double arc until spring 2009. The rebound from it made the market rise back to the area beyond the first double arc. Since then the market has been dwelling between the first and the second double arc.

The whole trend is backed by the 2nd double arc that is forcing the market upwards by and large. During the last months the market traded again within the lines of the 2nd. After being reached last month a GUNNER24 Support Diagonal that had been the trigger of the correction now the lower line of the 2nd is being aimed again. This one is at 12570 for November. And from there a very significant and severe rebound was technically expected to happen - like in the case of the last significant correction low of this uptrend (10/2011 at the red/green circle) - and to hunt up the market for 2-3 months again.

If the 12290 are reached in November 2012, for my taste that would actually be too low. In that case the uptrend would be called into question because the visible support area radiated by the 2nd double arc would have been abandoned. All the same the 12290 would be thoroughly the lowest logical target for the correction, especially because a back-test of the Strongest Support Gann Angle is offering itself as well. But I’m still working on the assumption that the 12570 in this setup mean the end of the correction. In the actual monthly 3 candle up setup in parallel an important Gann magnet at 12575 is present… and that means we can identify the same Gann magnet in two monthly setups. And that means again that we’ll have to reckon increasingly with a trend acceleration there:

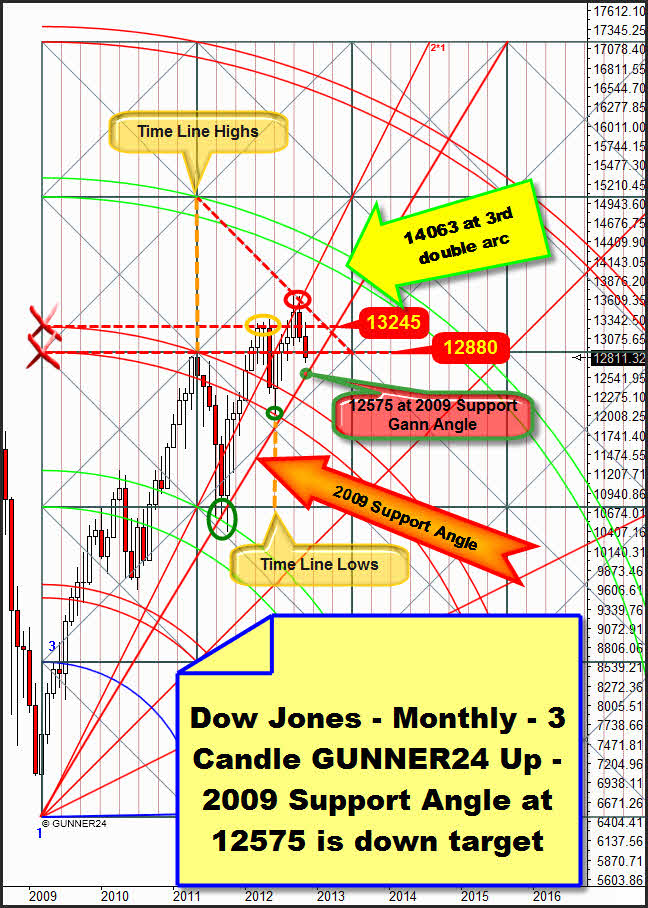

The 2009 Support Gann Angle is the next important monthly Gann magnet below current levels in this up setup. The decline can’t usually be finished before reaching that point. Last the angle provided excellent long-term support at the big green oval in autumn 2011. I’m expecting the same to happen in the now following test of the 2009 Angle. This angle is going to be tested now for the second or third time, respectively. According to W.D. Gann these important angles can’t be broken before the third or fourth test. Now there’s really the threat for the angle to be broken. The question is actually whether the test in autumn 2011 was just an extended first test, or were it altogether two successful tests because the angle was touched by two months…

A successful test of this angle would have to be the trigger for the rally until spring 2013. Main target for the entire uptrend in the Dow Jones remains being the 4th double arc in the setup above at 14063.

Gold – the market is playing the Obama card

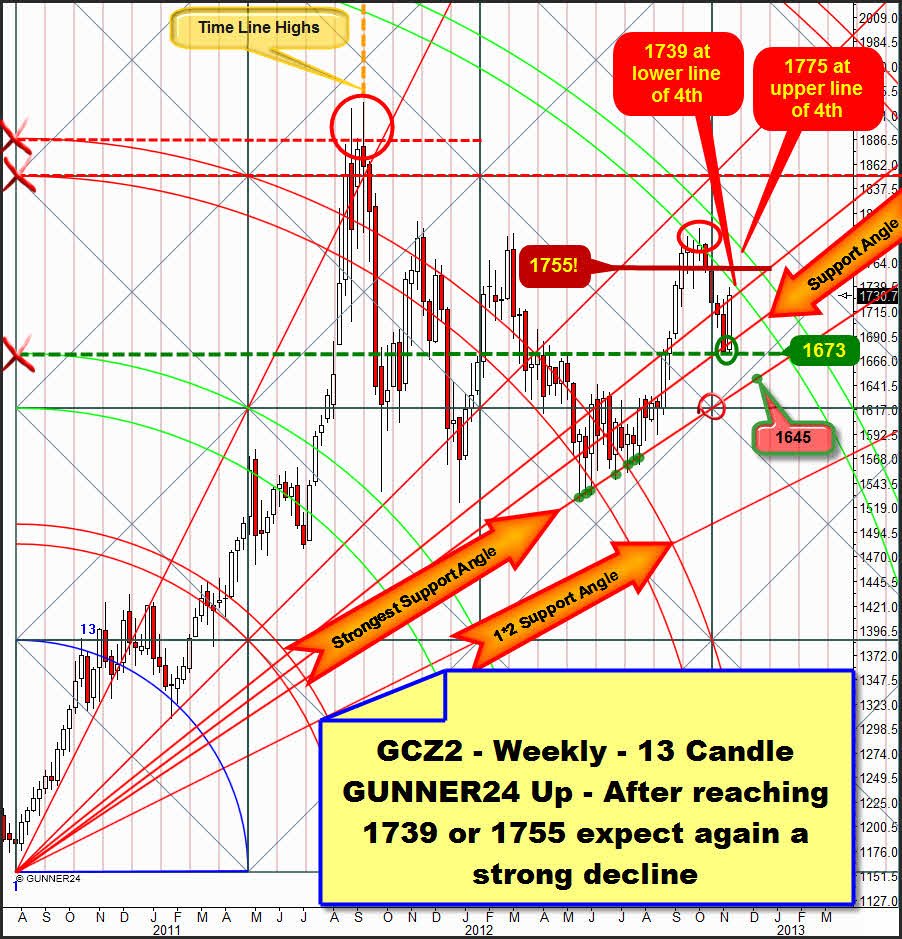

Let’s go very briefly to the yellow metal that seems to have rather gained by Obama’s re-election. As forecast in the last issue, Monday marked the correction low in the 1672 surroundings. And since then, for as many as 5 days we saw higher daily highs and higher daily lows. I really expected just a 2-3 day countertrend before the market should have turned downwards again:

The press and the internet is in a flurry again: 1800, 1900, 2100 and so on. Yes, I admit last week’s performance was really impressive. It was a reversal week combined with huge buy volume. Compared with the big US markets the gold miners are maintaining their position brutally strong = positive divergence. And their actual corrective chart pattern makes us conclude there’ll soon be a continuation of the uptrend. In addition, following its seasonal pattern, gold seems to have marked an important seasonal low… Besides, in the last decades November really abounded with extraordinary performance… yet:

The analysis of last week keeps on being valid. – B-trend days mostly lead to a countertrend rally lasting 2-5 days. That doesn’t mean the countertrend rallies cannot keep up 8 days as well… before a new violent decline follows that really falls below the last significant low again!

Moreover in the weekly setup above gold is narrowly in front of the important 4th double arc whose resistance was responsible for the October 2012 decline already.

So, presumably gold wants to rebound from it, according to the motto "The trend is your friend". Perhaps it will be very, very severe again maybe happening at the beginning of next week at 1739 already (lower line of the 4th). Alternatively it’s going a whit up to the well-known monthly 1755 mark (see lately GUNNER24 Forecasts, issue 09/30) that should now exercise its monthly resistance function after being broken downwards in the course of the actual correction.

I won’t be convinced that the correction lows were made before next week closes within both lines of the 4th!! That would prepare the final break of the double arc in trend direction. And then, in the worst case the 1672.5 lows of last Monday should tentatively be tested but not fallen below any more. But if next week newly rebounds downwards from the 4th technically the 1672.5 should have to fall being headed for the 1659-1654, according to the analysis of last Sunday.

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann