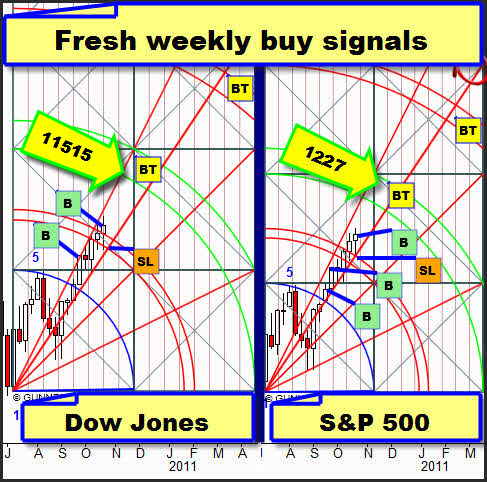

In the respective 5 Candle GUNNER24 Setups both indexes have overcome the first double arcs even considering the lost motion. For as long as 8 weeks they have been rising slowly and steadily in their respective Gann Angle corridor. On Friday by market closing time we accumulated our long positions.

The situation: Beginning with a initial impulse that lasted 5 weeks the markets corrected during 3 weeks before having risen slowly but steadily for 8 weeks so far. 5+3+8 makes 16. Added other 5 weeks makes 21 – the week from 11/22 -11/28/2010. At that period we expect both targets marked in both GUNNER24 Up Setups (year high) to happen. The indexes are working their ways upwards in a clearly limited Gann Angle corridor. The 2*1 Gann Angle above the markets is limiting the ascent. The primary Gann Angle below the markets is giving support.

By the low of the last trading week the S&P 500 tested its support exactly at the intersection point of the primary Gann Angle and the upper line of the first double arc which was a price and time magnet. Since that test took place exactly at a price and time magnet and since the market obviously rebounded from it another rise should be preprogrammed.

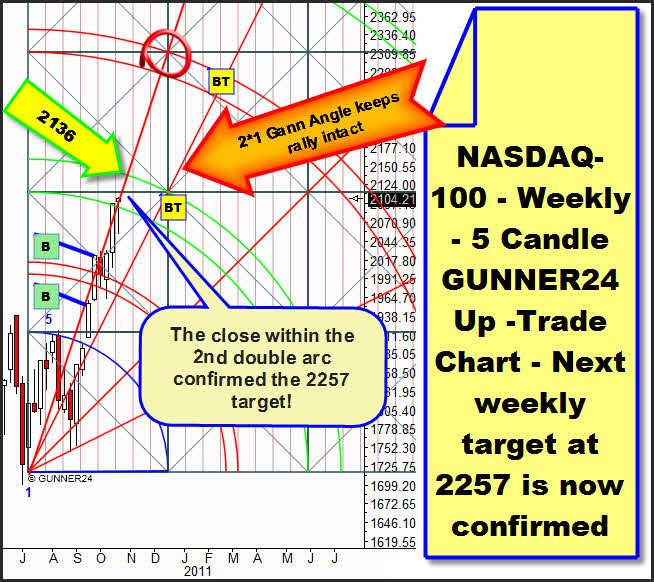

Compared with both other US indexes, the NASDAQ-100 is rising much steeper. The price is limited by the setup-anchored primary Gann Angle. Last week closed within the 2nd double arc. So the 2257 are confirmed. The market closed above the primary Gann Angle for the second time. But it's still kept back by the resistance condition of the Gann Angle. The possible high for next week is at 2136. That's where the market should take a breather at least temporarily.

And there a violent rebound on daily basis may happen which may result in the test or in the break of the 1*1 Gann Angle in the following daily 8 Candle GUNNER24 Up Setup:

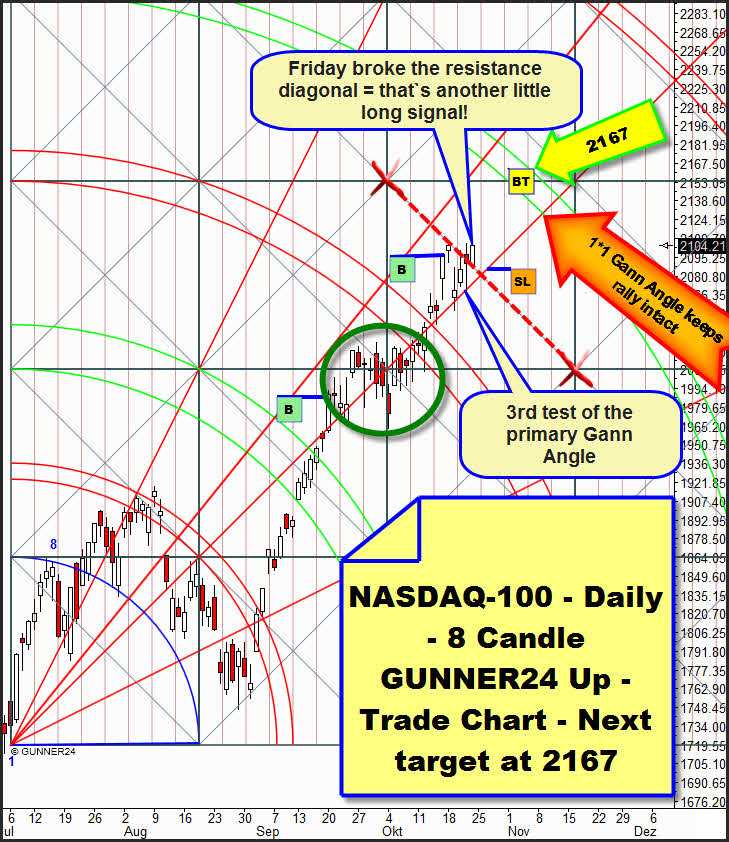

Last Thursday it came to the 3rd test of the 1*1 Gann Angle which has been supporting the market since the final break of the 3rd double arc. According to Gann the third and the forth test of a Gann Angle mean an acceleration of the move. In this case we can work on the assumption that the rise is going on because it is a matter of the third test with the following resume of the original move.

The break of the resistance diagonal anchored in the daily setup on Friday confirms that. Targets are the 2136 in the weekly setup, then the 2153 (the horizontal limitation of the just passed square above the price) as well as the 2167 thrown up by GUNNER24.

But since in the weekly setup the market is being in the area of influence of the 2nd double arc which generally represents a resistance before the run-up to the targets a 4th test of the 1*1 Gann Angle might occur, you might say as a "last" test of that important support. Since that would be the 4th test of that Gann Angle according to Gann it MAY break. That's why it is very important for us to consider the SL. A daily close below the 1*1 would end the rally resulting in a 2 week consolidation.

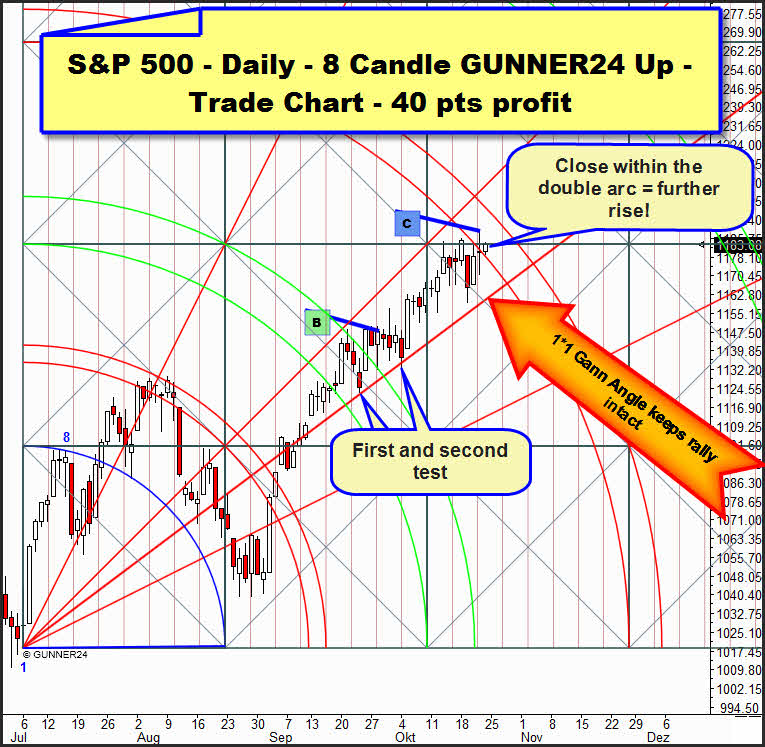

You may ask yourself how can they even up their longs on daily basis and at the same time go long in weekly sight? The weekly trades should occur without a considerable correction in the long term. But also on daily basis a target is a target! And after all as well from the temporal as from the price point of view we're exactly on a point where we have always to reckon on a bigger correction. We have to take into consideration the possibility that there, at the main target, a contrary GUNNER24 Down might arise.

It is not foreseeable how deep a correction goes and how long it will last. Since the GUNNER24 Forecast, Issue of 10/04/2010 on daily basis we expect the price to go for the 3rd double arc. After the 1193 calculated in that issue by the planer angle of the price rise in the last issue the price target was revised down to 1187.

By logic and because how the way the S&P 500 is approaching that main target I expect – as mentioned in the last issue already:

That the daily course of the S&P 500 is going to perform the way the NASDAQ-100 does in the environment of its main target (mirror image, see big green circle). So it's going to be a relatively quick break of the main target in the S&P 500. Maybe we'll give away 10 to 15 points of profit until the re-entry. But we haven't got yet the final confirmation for further durable longs on daily basis.

Gold analysis:

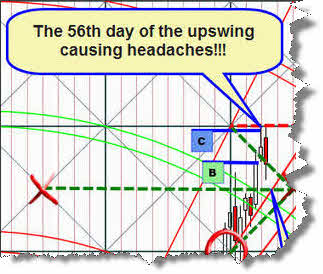

GUNNER24 Forecasts, Issue of 10/17/2010 after having covered all our longs near the all time high:

gold joined a correction in the upwards trend. The probabilities we analyzed proved true all in all. GUNNER24 Forecasts, Issue 10/17/2010:

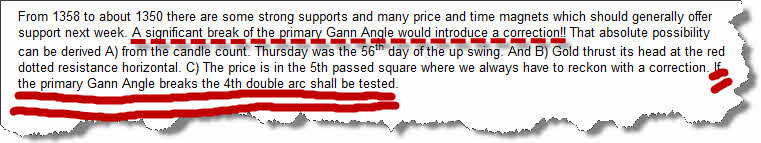

Last Tuesday at first the primary Gann Angle and simultaneously the 4th double arc were broken. The supports between 1358 and 1350 did not resist. The price came to its first low at candle red 3 at 1328.8. Wednesday and Thursday a test of the 4th double arc took place resulting negative. On Friday a new correction low was reached. With the Friday close gold is parking below the new resistance horizontal which is the square horizontal at 1328 above the price. In addition we should be aware that the 4th double arc is rather a resistance double arc now from which the gold is really supposed to rebound in the further course. From candle 1 to 3 a 3 candle initial impulse of the new GUNNER24 Down Setup has formed. The corresponding first target for the down swing is the green double arc at 1300-1305. All in all gold is looking pretty bearish on daily basis! But shorts are not recommendable so far!!!

What is coming now may be a hard call for you. But at a 60% of probability that was it already speaking of the correction. Since Monday/Tuesday gold should start to resume its main trend.

The reason why are the monthly supports at 1320 which should actually be mighty enough to catch the correction there finally.

For our memory: In a former issue we worked out the 1320 as an important monthly target. In the course of October as well the 1320 as the 1352 were reached and with the all time high at 1388 they were surpassed by far. The 1352 were broken in two last Tuesday, the 1320 "might" represent an important support. Those 1320 must resist to continue the monthly uptrend.

Let's consider the actually decisive GUNNER24 Up. It's one we considered the last time in the GUNNER24 Forecast of 09/12/2010 which for almost two years has depicted the course of the gold future almost perfectly. The weekly 8 Candle Elliptical GUNNER24 Up:

We make out that the future with the all time high touched the Gann Angle above the price for the third time. For the third time a violent rebound from it took place. I marked both former reactionswith the dotted blue and the dotted red arrow respectively. The question now is whether we will get a "blue one week" or a "red several week" correction.

Let's consider now the last week. Exactly at the week low there is the square horizontal with the logical support area positioned. I call it logical because we saw a first rebound from it with the Friday low. That means there is something backing in the market, just support. And the conclusion is that the whole triangle under the low should have to be the support area. So at narrowly below 1320 we make out an important support in the weekly time frame as well. A problem for the gold is its recent past. 11 weeks of strong rise and then that "all time high" exactly at the mentioned Gann Angle. That week high is suspiciously close to an important time line, too (middle of the just passed square!) which would cry out for a correction of at least three weeks until the target 1256.

On the other hand the respective absolute highs have always been lying exactly on the ends of the respective squares.

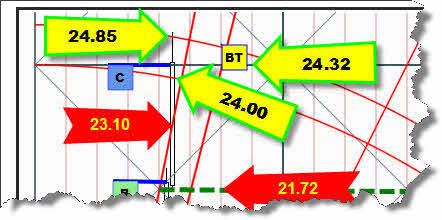

See here the monthly silver targets. On Thursday and Friday the silver future fell short of the important 23.10 support closing above it yet with 23.29. Here again first signals that the 23.10 may resist.

Those two supports, 1320 in gold and 23.10 in silver are the important supports we'll have to pay attention to. We expect gold and silver to begin rising from Monday on. We'll go long in gold if the 4th double arc is broken back.. That ought to happen at a close of about 1340. The maximum low is allowed to be at 1300-1305, then a strong rebound should happen.

A day closing price below 1300 negates the long call since there the important monthly and weekly supports of 1320 shall have been broken finally. In addition the 1*1 Gann Angle in the daily GUNNER24 Up Setup would have been broken. Afterwards we shall reckon on a several week correction to at least 1256!

Be prepared!

Eduard Altmann