Revising the GUNNER24 Setups for this issue, I saw such an accumulation of different signals in the daily, weekly and monthly time frames in those markets we use to consider that I had rarely seen before.

For you gentle readers I always try to connect the markets together, to work out a logical context inside, to filter the arising important signals and trends for you, to introduce you to the resulting targets and to make pretty wise assessments of the market, I hope.

That's why for this issue I've decided to consider the markets above all by means of the longest time frame we analyze for you in public which is the monthly one deriving from it the developments which are going to come up to us next week. The monthly time frame gives us the best survey of the really important GUNNER24 Signals.

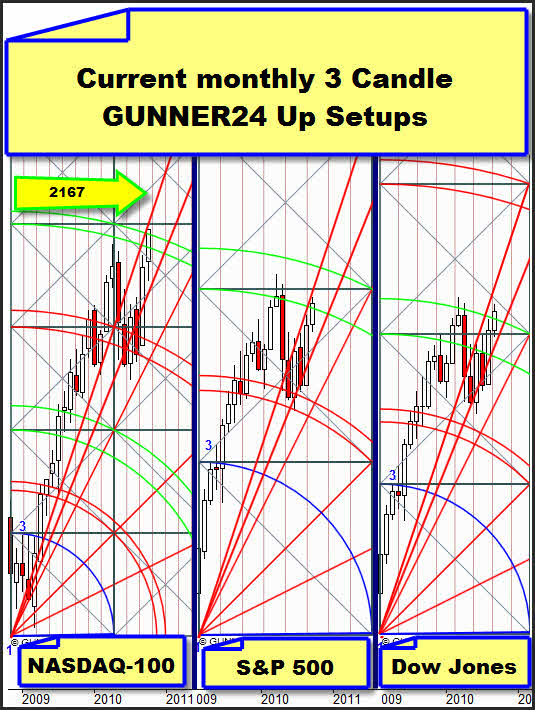

Let's begin with the US stock markets:

In each of the three markets we recognize that the Gann Angle lying narrowly above the price should limit the rise. The Dow is preparing to break the double arc in October. Because of the faintness in the financials, the S&P 500 is performing poorest. Undoubtedly the NASDAQ-100 is the strongest market. Last Friday a new year high at 2097.73 was marked, thus the monthly target of 2090 (GUNNER24 Forecasts, Issue 10/04/2010) and the congruent weekly target of 2087 (GUNNER24 Forecasts, Issue 09/19/2010) were exceeded. The Friday close was extremely strong, the rally should go on.

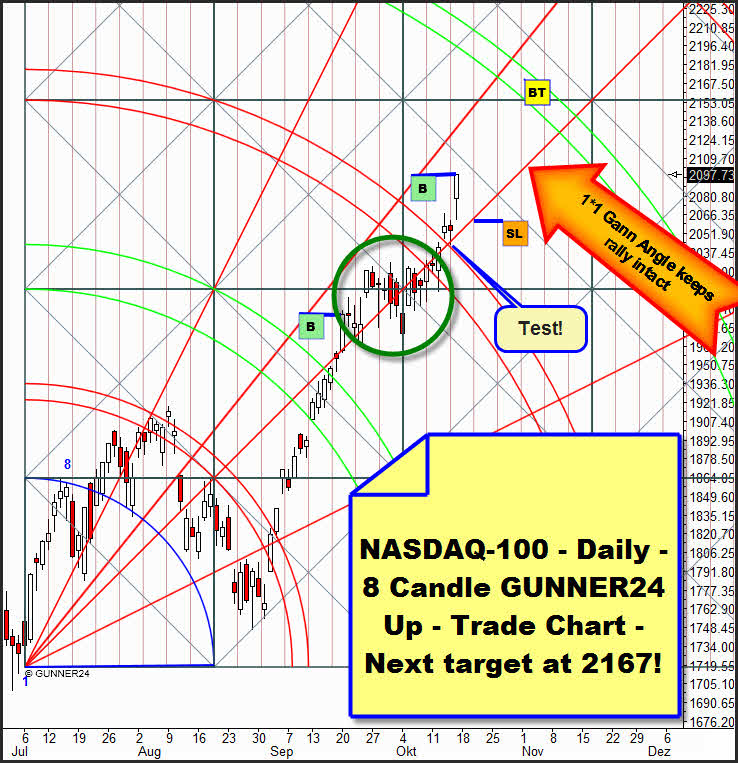

Strong: The actual daily 8 Candle GUNNER24 Setup is putting out an incredibly high target for the NASDAQ-100:

2167. On Friday another Breakaway Gap was produced. We went long with another tranche. SL is the 1*1 Gann Angle, it's always to be traced. On Thursday that Gann Angle was tested successfully at a price and time magnet. We are expecting the high to happen by November 1st.

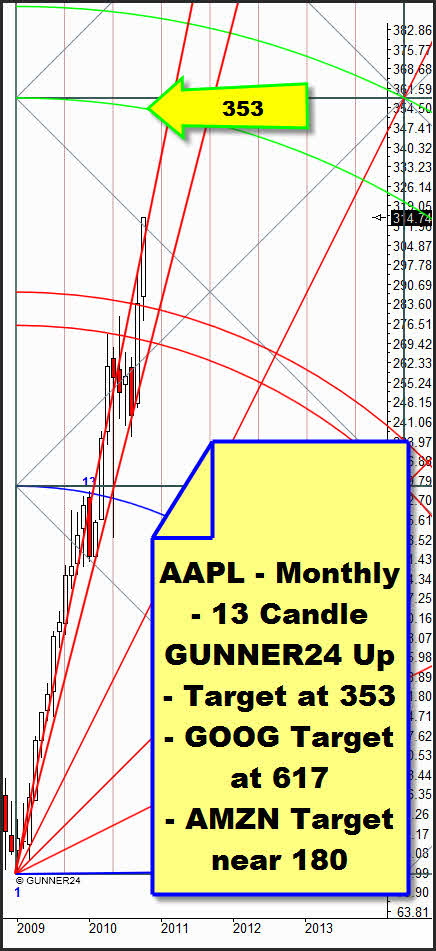

The really strange thing about this rise is that it's but owing to a handful of stocks in the index: Apple, Google, Amazon, Yahoo and a couple of others. But you mustn't underestimate the signal effect of those leaders. Just remember the technology stock boom ten years ago. There was that fantasy about technology which ought to be the fuel for rapid rises in the world wide stock markets this time again.

Apple is announcing his earnings after the closing bell on Tuesday, October 19, 2010. Just imagine now what another Apple rise by a ten per cent until Wednesday would mean for the markets! Sick!! Talking about Google and Amazon, the possible monthly targets for October are not to be sneezed at, either.

And as well in the weekly as in the monthly GUNNER24 Up we can make out a 13 candle initial impulse! For Apple, the first main target (3rd double arc) in the monthly GUNNER24 Up is lying at 565!

What we'll have to take into consideration for next week unconditionally are the reaction on the Apple earnings. From Wednesday on the long expected correction in the markets might start, simply because there is an exhaustion.

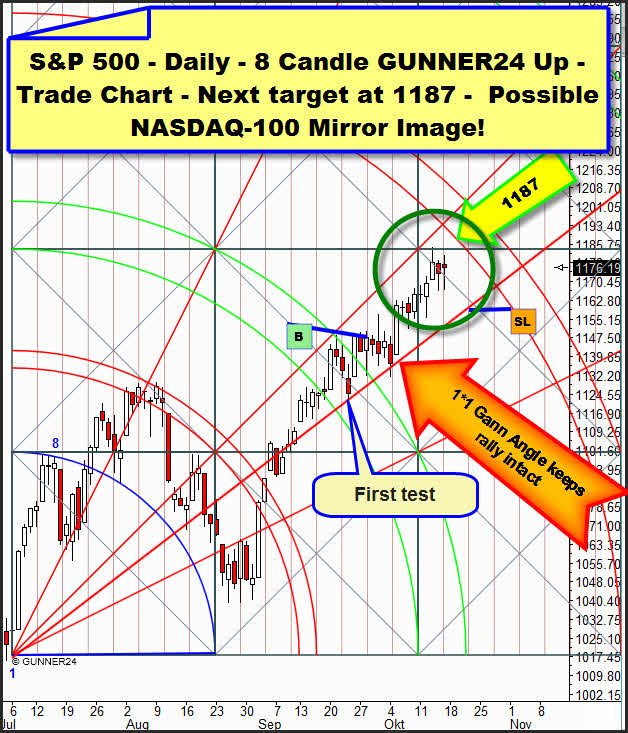

How strange the markets are presenting themselves right now is elucidated by the 8 Candle GUNNER24 Up in the S&P 500. Nothing is happening there. As analyzed in the last issue we are supposed to be going to the 3rd double arc. The target has moved a little bit downwards. At 1187 we should get a last higher high and then correct. As to the timing, Wednesday is presenting itself as a high.

But now...! What will happen if the S&P in terms of its course performs the same way as the NASDAQ-100 does? See the big green circle in the chart. I don't want to exclude the possibility. Nor that one of a coming correction. A nice sell signal should be produced by a significant break of the 1*1 Gann Angle, at any rate. But please don't reckon with more than a brief short swing. As mentioned several times, we expect the year high in all the stock markets to happen around the beginning of December.

|

The Complete GUNNER24 Trading and Forecasting Course will give you the critical knowledge you need to forecast and analyze the markets with the GUNNER24 Forecasting Technique. The NEW course is a must for any trader/investor who wants to understand this innovative and revolutionary forecasting method and use it successfully in everyday trading. The materials in this course are all you will ever need if you plan to trade the markets and make a living doing so.

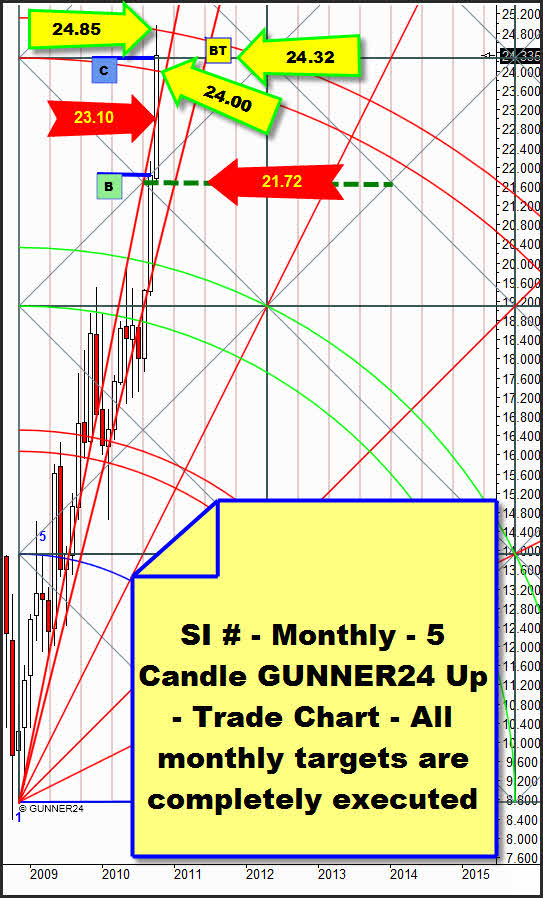

In silver all the monthly targets are worked out. Mission accomplished! Next week the correction might occur but the breakout upwards as well, that depends on the USD performance. Read more on that item below.

The situation: The targets worked out in the issue of 09/26/2010 were reached as early as last week instead of being reached in March 2011... Strange. Sorry about the wrong timing of GUNNER24. As to silver, the targets registered in the monthly up above are extremely important because they're confirmed and so they're giving us some relatively sure marks as far as a possible breakout or breakthrough downwards is concerned:

The Friday closing price of 24.335 is corresponding to the monthly target of 24.32.

The Thursday low was at 23.995, corresponding to the monthly target of 24.00.

The Friday high was at 24.885, corresponding to the monthly target of 24.85.

I could present you many different GUNNER24 Up Setups for silver now. Daily, weekly or 8 hour. In each case at first on Thursday silver rebounded from the respective important resistance double arcs. The price performance of Friday rather points to a consolidation in the highs. What again is pointing to a breakout. In case of the break of the 24.00 on daily basis I wouldn't like to recommend any longer short but maximally a brief daily swing. Since on grounds of the high volatility the short targets might be reached within two to three days. On the other hand a daily close of more than 25.20 next week would mean quite certainly that a good number of traders will have to turn their respective monitors from a horizontal to a vertical position...

Gold is backing the thesis of a further silver rise:

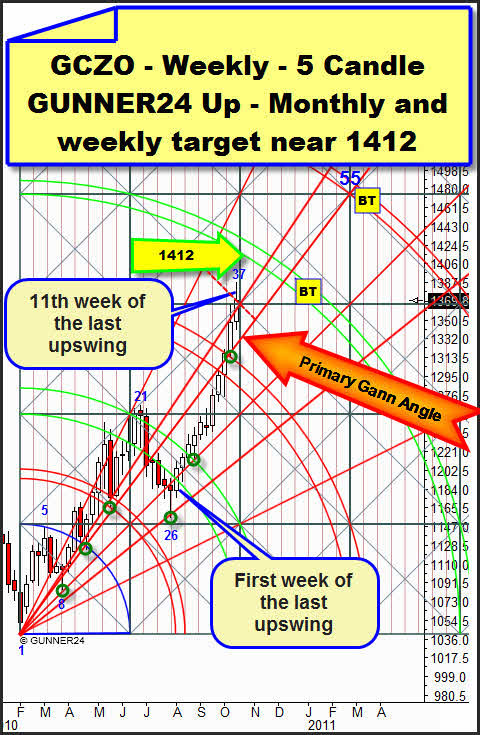

In the weekly candle count gold is in its 11th week of the last up swing. Thus the next week or the week after next we will be able to reckon on the top. The 55th week will be in March, 2011. The long term target is near 1480.

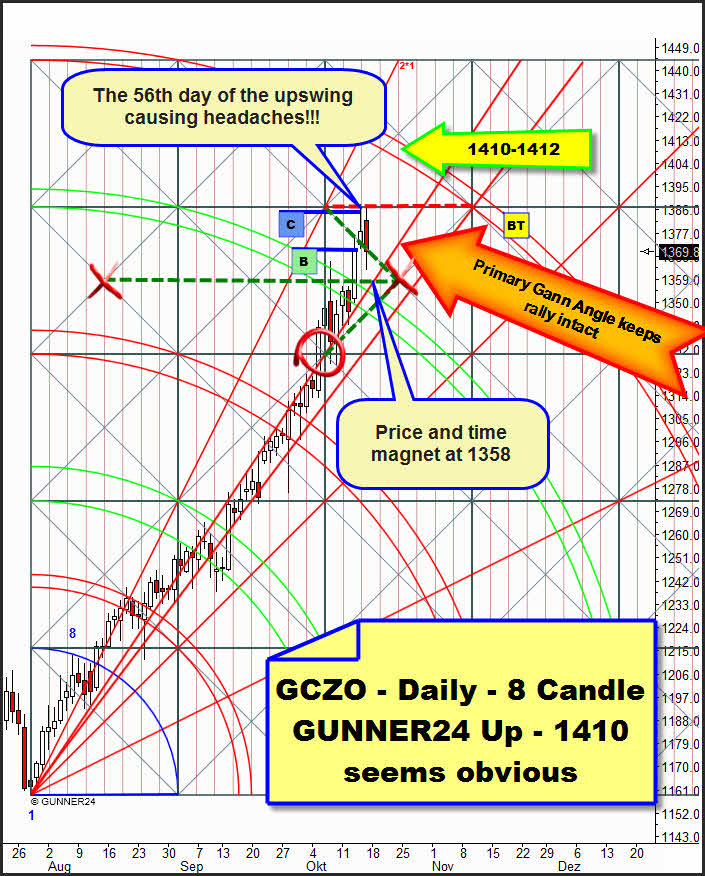

In spite of the relatively violent rebound from the Thursday all time high of 1388 until 1362.7 the last week candle on closing price basis "possibly" broke the Gann Angle which had been lying above the price so far, but it is parking directly below the resistance diagonal sketched red in the setup. On Monday we shall make out pretty fast how important that resistance diagonal is. A daily close of more than 1374 could clear the way for the 1412. The 1410-1412 is a target we also worked out in the monthly 13 Candle GUNNER24 Up (GUNNER24 Forecasts, Issue 10/10/2010). But after the unambiguous break of the monthly target of 1352 last week it's really possible that on Monday/Tuesday that breakout area will have to be tested back to confirm the breakout.

From 1358 to about 1350 there are some strong supports and many price and time magnets which should generally offer support next week. A significant break of the primary Gann Angle would introduce a correction!! That absolute possibility can be derived A) from the candle count. Thursday was the 56th day of the up swing. And B) Gold thrust its head at the red dotted resistance horizontal. C) The price is in the 5th passed square where we always have to reckon with a correction. If the primary Gann Angle breaks the 4th double arc shall be tested.

From the actual make or brake situation of the EUR/USD we can infer the further direction of the precious metals. Maybe our last issue call to buy a daily close of more than 1.4028 was a little precipitate. But maybe it wasn't... Just apply a 5 Candle GUNNER24 Up at the sketched low and perhaps you will join my opinion that a further dollar decline is more likely than a long lasting euro correction. In any case the market is always right. And the EUR/USD breakout or breakthrough respectively should keep on determining the development of the precious metals.

Be prepared!

Eduard Altmann