If the actual Gold Future closes above 1273 in September – In that case the next major gold target will be activated finally. By the end of January/beginning of February, 2012 we shall reach the 1567 then. In both actual monthly GUNNER24 Up Setups the Gold Future has reached some very important price and time magnets, you might say since Wednesday it has been parking stuck to them.

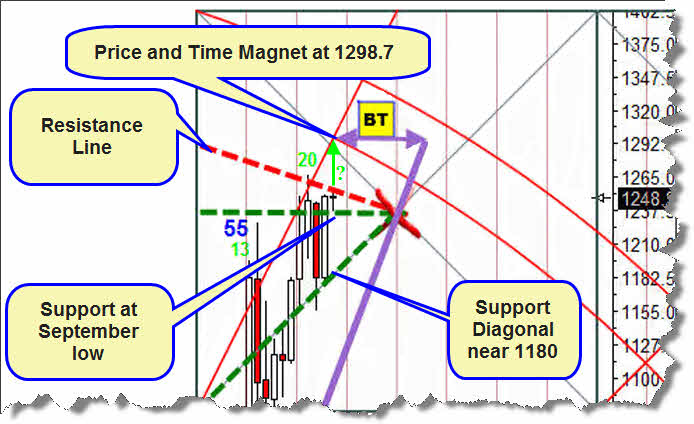

On Wednesday the target, the price and time magnet to be precise, was almost reached, and on Friday it was slightly exceeded:

The monthly GUNNER24 Setups are always the most important ones, the price reactions at all the assumed monthly horizontal, diagonal or Gann Angles or double arcs respectively have the highest significance, they determine the course of the GUNNER24 Setups in the lower time frames. That's why within the next four days the reaction of the market at that important price and time magnet at 1300 will decide whether we are going on climbing, how long the upswing is still going to last when a correction will start off and how long it will last and how low it might fall.

In the upper 13 Candle GUNNER24 Up the main target and an obvious price/time magnet is being reached. The Gann Angle above the price is cutting exactly the lower line of the 3rd double arc...

...you always have to realize how incredible it seems as far as is humanly possible to tell to derive some target marks from a first move (initial impulse) which in this case enclose the period from the low of May, 2005 to the high of May, 2006 and those target marks prove true now, absolutely exactly, more than four years later! The then impulse initiators pretty frequently went bankrupt or died, they had to close their investment firms or they have got some different markets in their sights now...

But enough on esoterics... Because of the established rules we'll cover a 50% of our long positions (or we did already) since at the main target we always have to reckon on a counter reaction of the market. According to the rules we have to continue reckoning on the possibility that a contrary GUNNER24 Setup may arise at the main target.

We let run on the half of the long term positions because there's a chance of more than a 50% that in September we'll close above the important mark of 1273 and thus a further rise until 1576 would be inevitable.

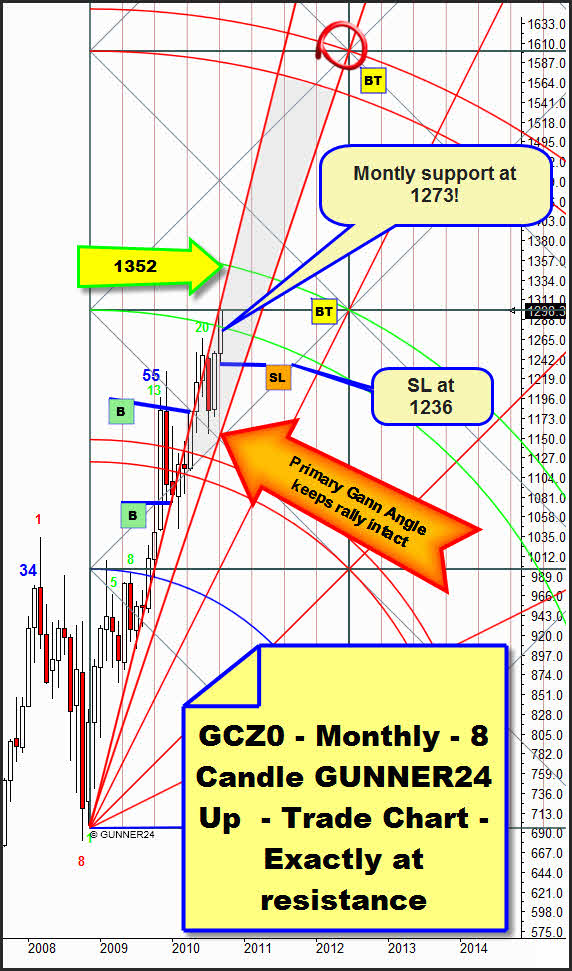

In the actual monthly 8 Candle GUNNER24 Trade Chart the future is at an important magnet as well. At the intersection point between the Gann Angle and the upper end of the 2nd passed square; a resistance.

Thus, in two monthly setups we've got the same resistance! So the preconditions for a sharp change in trend are present, but in case of a corresponding defeat of that resistance there's the possibility of an extreme tightening of the trend!

Because: If gold closes above 1273, that means between both lines of the 2nd double arc in September the 1576 will be activated. Thus it keeps on being very likely that gold will follow the gray hatched Gann Angle Corridor upwards until 2012. That makes possible for instance a high at about 1352 for October. In this setup again, the Gann Angle above the price is obviously limiting the rising potential permitting space upwards with the new candle, not before, until just 1352. With the new month the 1300 "might" fall automatically because the temporal resistance is quitting. So the enormously important 1300 magnet could be overcome. That again is supposed to provoke an acceleration of the present trend, according to Gann.

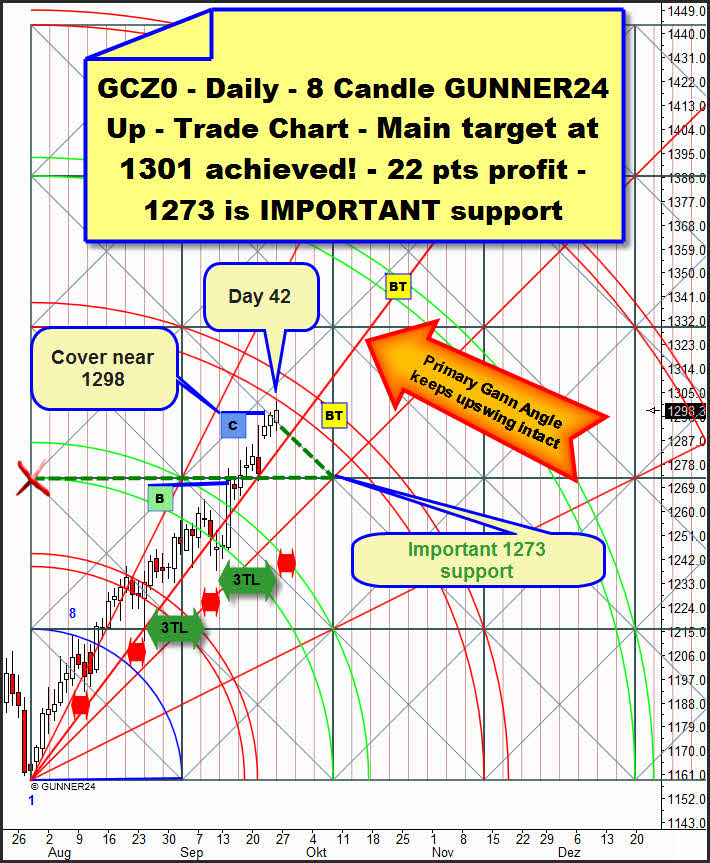

Well, the daily 8 Candle GUNNER24 Up makes it clear:

On Wednesday we covered our longs for the target of 1298 we had in sight was hit. Consider in this context the last issue of GUNNER24 Forecasts! With the Friday high the main target was reached to a T. By the trading end a little counter reaction happened. Now the time line sequence makes us assume that we will probably see another little correction along the time line. Since the middle of August the market has been performing as follows: One time line correction – three time lines rise. If that time line correction lasts longer than a time line or if the primary Gann Angle or the green broken square diagonal breaks as early as still in September the green broken support horizontal could be tested at 1273! In case the 3rd double arc breaks we'll go long again. A closing price within the 3rd double arc would be the first hint to get in sight the 1350. A break of the 1273 next week would ring in a very sharp correction on the 1*1 Gann Angle!

Nothing in the daily count is pointing to a change in trend. Friday was the 42nd day of the uptrend, so we can expect 13 more days of generally rising prices. Last week was the 8th week of rising prices. That is where the danger stems from. If gold doesn't produce a higher high next week it could lead into the correction. A new, the ninth new high would point to 13 weeks of rising prices!

As to the seasonality we are entering now into October. In the average of the last just under 40 years while crossing from the first to the second trading week in October there are always some gold tops to be seen!

|

The Complete GUNNER24 Trading and Forecasting Course will give you the critical knowledge you need to forecast and analyze the markets with the GUNNER24 Forecasting Technique. The NEW course is a must for any trader/investor who wants to understand this innovative and revolutionary forecasting method and use it successfully in everyday trading. The materials in this course are all you will ever need if you plan to trade the markets and make a living doing so.

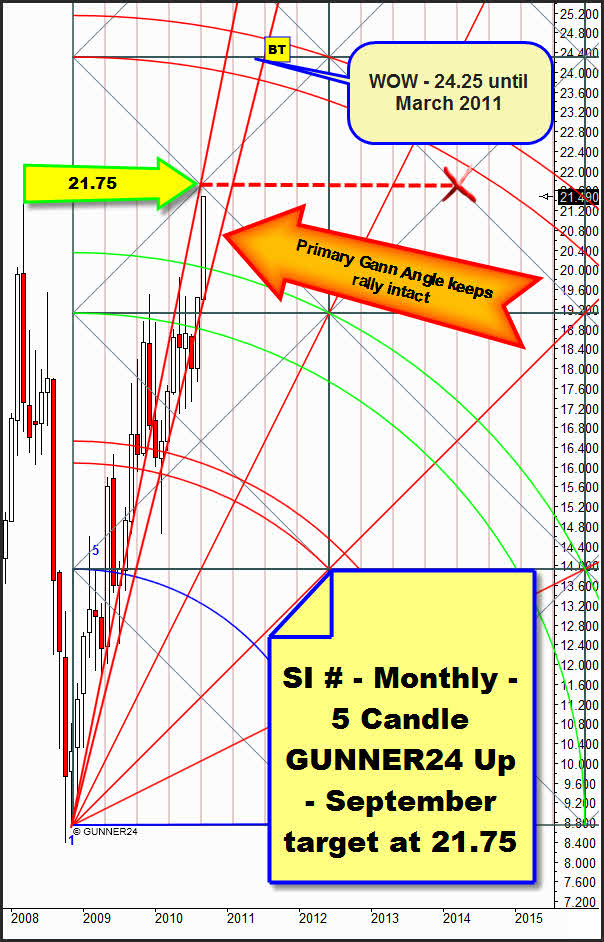

In September silver has still got a little breathing space upwards. At 21.75 there is a horizontal resistance in the actual monthly setup. If the September candle thrashes out the space upwards until the Gann Angle above the price even a "blip" at the 22.00 is possible still in September. By the end of September we enter in silver on long term. Target is 24.25 for January/February, 2011. A correction to the 2nd double arc (19.80) would be a present and one of the safest long possibilities this year...

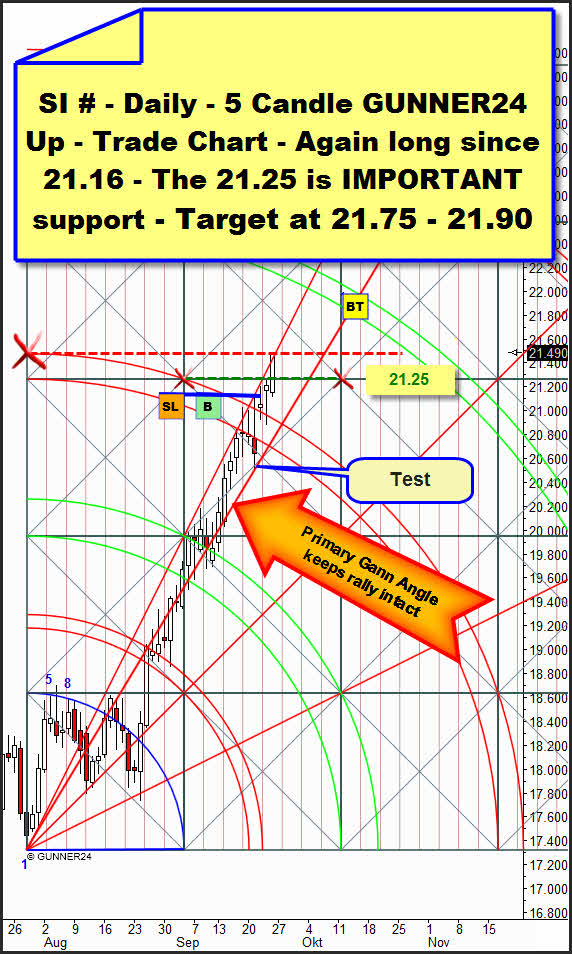

How rapidly silver is starting off at the moment is also shown in the actual daily 5 Candle GUNNER24 Up:

The silver ascent is limited by the 2*1 Gann Angle. It's astonishing how steeply the rise is going. With the Friday closing just above the 2*1 Gann Angle you might suppose that the ascent would be even steeper. Parabolic as to say. But that would also mean that the chance for a setback is growing extremely. In Germany we would say: "They all got something on their waffles". Silver has been rising virtually without any correction for three weeks. If the said 2*1 Gann Angle is really broken on Monday the mentioned "blip" on the 22.00 or the 21.75 from the monthly setup "might" happen.

But it's likewise probable that by the Friday closing an important turning point was reached which at least on closing price basis might have rung in a 3 to 4 day correction on the important support horizontal on 21.25 or on the primary Gann Angle (21.00). Then silver should be caught and get under way to the 21.90-22.00. To ensure our profits we'll have to trace the SL sensibly in these extreme times. If silver keeps on Monday for instance above 21.40 without reaching the 21.75 the SL is to be dragged to the 21.25.

Let's have a quick look on the actual long positions in the American stock markets. Everything continues being on "GO". Next week some important marks are supposed to be reached which should ring in a little correction.

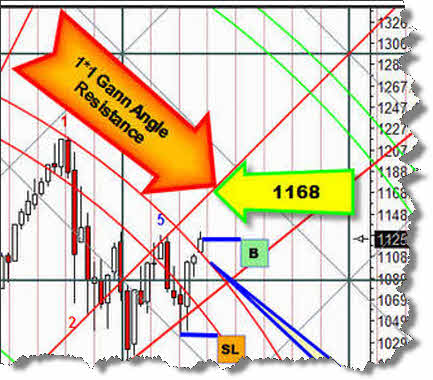

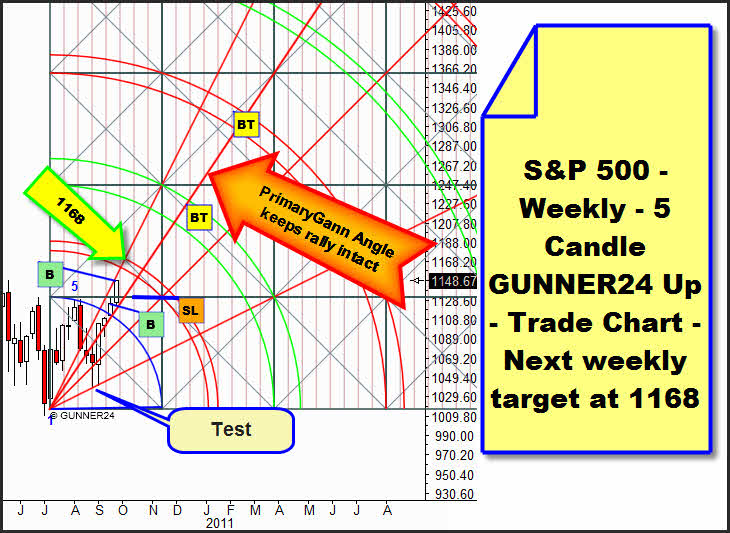

In the last issue the S&P 500 produced this buy signal in the weekly setup:

Correspondingly, through the week close we bought the second long lot. By the break of the first square all the requirements for getting to the 1235 until the end of the year are fulfilled. A weekly close within the first double arc would confirm that target. At 1168 the longs will be covered.

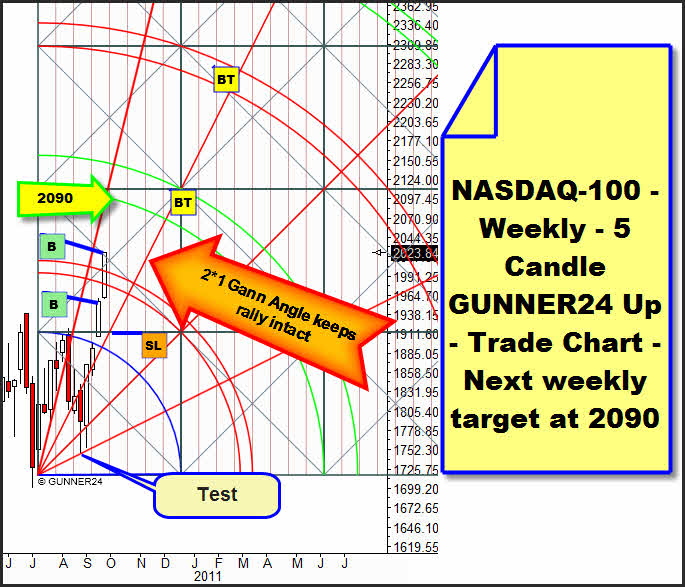

With the last week candle the NASDAQ-100 produced another long signal. First target 2090, a new year high!

By the way: The Dow Jones puts out 11480 as to be the year high and the FDAX # 6740 as year high.

In the daily 8 Candle GUNNER24 Up we see that after reaching the 2076 we'll have to reckon on a correction at the end of next week or the week after next. But the market is to be considered as very strong. With last Monday the 1*1 Gann Angle was reconquered impressively releasing a long signal, together with the final break of the 2nd double arc. On Thursday it was tested for the first time. Corresponding to the 1*1 Gann Angle you should place the stop accordingly. At the main target we should reckon on the beginning of a correction and another test of the 1*1! But next week there'll be more about that...

Be prepared!

Eduard Altmann