Who would have guessed that after the official QE3 announcement on Thursday before last the volatility would turn virtually anemic? Neither the stock markets nor any of the precious metals we consider – gold and silver – did really move during the last six trading days. No correction on daily basis however small it might be, no important retracement, no sell on news, but no follow through either happened – they fell into a coma…

…Getting to the point in terms of chart-technique, we’re seeing a tough consolidation at the highs. It’s gradually reducing the overbought condition on daily basis, so to speak drawing breath and in the end taking a swing in order to overbid soon the actual course highs again. For we have to work on this assumption which is an old rule: "Consolidations at the highs break through the upside". The probability of this rule to come true is far above a 70%.

My look at this consolidation is going to be a little more precise today in order to work out the best possible entries for the continuation of the rallies, from my point of view. The long- and medium-term assessments on gold and the S&P 500 haven’t changed. In the last GUNNER24 Forecasts of 09/16/2012 you’ll find some detailed analyses on this score.

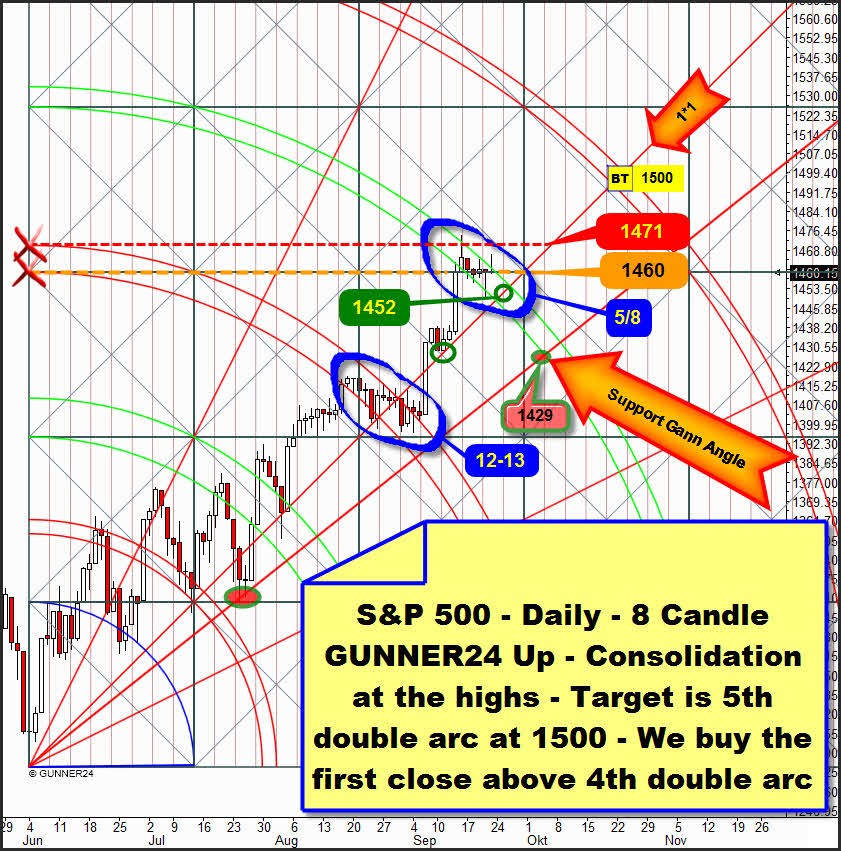

Current S&P 500 consolidation:

In the valid daily 5 Candle GUNNER24 Up the index has reached the 4th double arc. As well as at the 3rd double arc it has entered now into a consolidation phase. The closings within the lines of the 4th are to be interpreted clearly positively since any closing within a double arc prepares its final break through towards the trend.

Depending on the perspective, the consolidation at the 3rd lasted 12-13 days. Since at the end of a swing the correction and the consolidation phases use to become shorter we perhaps may assume that the actual consolidation is going to continue for two more days (it has lasted six days so far).

So it might end with a new touch of the 1*1 support Gann Angle at 1452 on Tuesday. From the 1*1 a rebound move upwards might start that might make the 4th double arc break upwards finally in the further course. The final break of the 4th on daily basis will be our buy signal since a final and visible break of the 4th double arc would definitely activate the main target of this daily setup = 1500.

Maybe last Thursday, on the fifth day of the consolidation, the low of the whole consolidation was reached already making the market willing to reach a daily close above 1466 as early as on Monday or Tuesday. Thus the 4th would be finally broken upwards.

Any close below 1450 during the next three days would turn the consolidation into a correction. In that case the market is pretty likely to get the tendency to follow the 4th double arc downwards well-ordered until the very strong support Gann Angle will be reached – 1429! At the support Gann Angle each correction will have to be finished starting the last rally from there that will target the 5th double arc. The main target would shift a little down – about 1492.

To get out of the way of this alternative we’ll buy any day close above 1466 till Wednesday – target 1500, no SL.

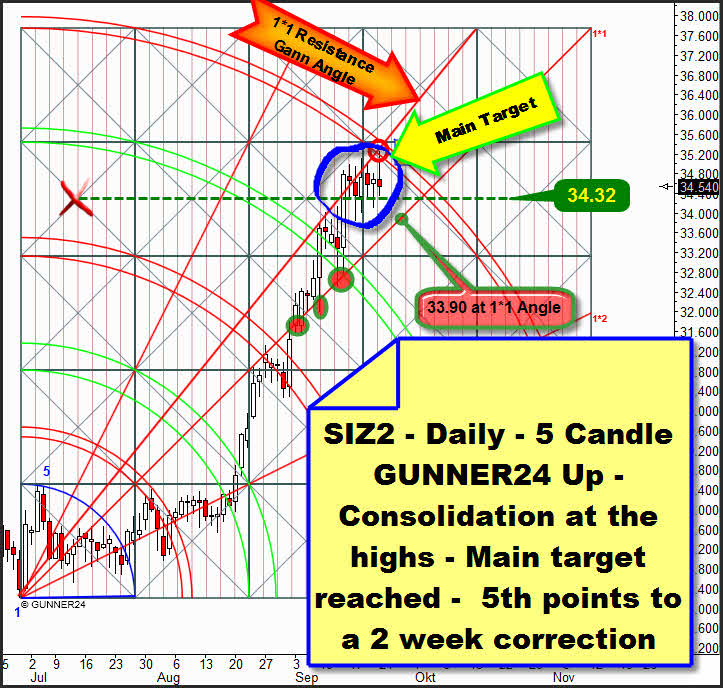

Current silver consolidation

Here again and later on in gold as well I’m going back to daily setups. This time frame simply gives us more timing information concerning the possible duration of a consolidation/correction:

Not only the S&P 500 but also silver is at a main target double arc. Whereas the stocks like very much to choose the 5th as the final target, in the commodities the 4th double arc is a most favored final target of a GUNNER24 Setup. The fact that silver has already reached the 5th in this daily setup is to be interpreted as surprisingly positive for the time being. But it also conceals big threats perhaps that silver might have topped now being thoroughly able to flow into a several week correction. Certainly here, too, the rule is valid that the consolidations at the highs should break those highs upwards finally, but as I’m interpreting this setup such cannot really happen before the beginning of the week after next in silver.

The 34.90-35.30 environs are not only visible daily but also strong weekly resistance. That’s where in the actual weekly 2 candle up the 4th double arc is passing… (watch GUNNER24 Forecasts 08/26/2012). So at 34.90 silver has got a combined weekly and daily resistance.

The daily 5 candle up above begins at the year-low. Thence it’s very, very important, and that’s why the clear, visible reaction to the 5th that arose at the Friday candle is possibly to be considered as very important and serious! We make out a spike candle. Friday spiked into the 5th being retraced then very quickly. Price met time, and the 5th is showing its possibly brutal resistance function already. So take care! It’s possible now that silver is going to maintain its actual level at least through Wednesday until it ends up touching the 5th again seriouly before it wants to turn down finally. But if a daily close within the 5th succeeds the 5th will be supposed to be broken upwards, too, sometime – technically at the beginning of the week after next.

Any daily close below the horizontal GUNNER24 Support at 34.32 during the three coming days would be a harbinger of an altogether 13 day correction to come thoroughly. And then it will be pretty sure that the 1*1 will be broken downwards. In case of a daily close below 33.90 silver should target the strongest weekly support at 32.90. The actually most important weekly support is located there being supposed to be the most likely down target of a 13 day correction.

Trade Instruction: We’ll cover our weekly silver long-position we entered on 08/24/2012 in case of any daily close below 34.32.

http://www.gunner24.com/trading-performance-forex-silver-copper/

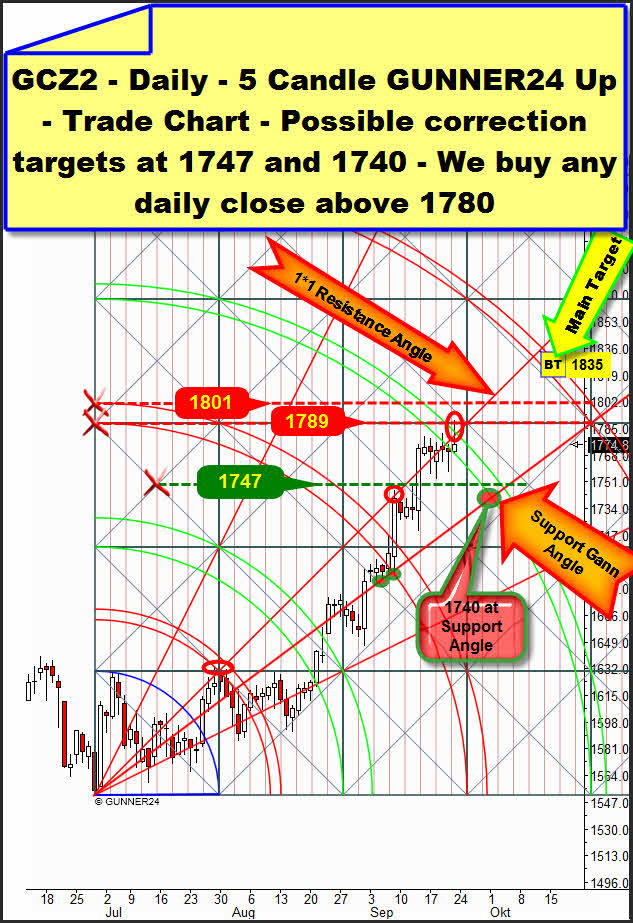

Current gold consolidation

Simultaneously S&P 500, silver and also gold have reached at the respective important daily double arc resistances. Gold even did so in two different important daily setups.

This daily 13 candle up begins at the December 2011 lows – the absolute and final correction low! The first touch with the 5th on Friday is also showing a spike candle and thus a possible strong resistance function of the 5th. There is the threat now that the market will turn down by the second touch with the 5th on Monday. Will it? I’ve got no idea – it’s not for sure yet – there’s just the threat. The 5th is the main target of the entire setup, and in terms of time this 5th is telling us that the market may turn now. And it’s just about the limit of course that Friday was the 21st of September. Equinox is a Gann date and a possible turn date…

If the market wants to follow the 5th downwards it will have to do so till October 15, that’s when the temporal sphere of influence of the 5th double arc will end. About 1720, at the support Gann Angle would be a possible down target!

Trigger for the 1720 might be a close below 1758, the actually most important daily GUNNER24 Support.

Do you still remember the last issue? I analyzed a daily long-entry in case gold achieved to close above the 1775. That close was the trigger for reaching the +1800 last week:

As ill luck would have it gold avoids this close like the devil avoids the holy water…

Gold has reached the 4th double arc in the daily 5 candle up – main target – now it’s allowed to turn down. Thus we have got two daily setups in which gold is standing at important resistances. And in addition we know that the 1775-1778 is a strong weekly resistance. Combining this recognition with the fact that silver, too, is remaining below its daily and weekly resistances we’ll really see a highly explosive situation that may resolve downwards as well as upwards.

Let’s have a concrete look at the Friday candle. We’ve got a day close within the 4th. That means gold is preparing now to break this 4th upwards. And the Friday lows are lying exactly on the lower line on the 4th. So it’s showing its support function already. This setup is indicating that gold might follow the 4th downwards for one to two days. It seems to be captured within the 4th. But if it breaks the 4th downwards on Monday or Tuesday respectively this setup, too, would indicate a correction. The first intermediate station is the 1740, followed by the 1720 (see the daily 13 Candle GUNNER24 Up above). However if gold achieves a close above the 4th one of the coming three days the 1835 main target will be activated.

We’ll buy every close above 1780 next week with main target 1835. No SL. Thereby the combined 1775-1778 weekly and daily resistance area should be overcome. In this case it would be a confirmation if the S&P 500 closes above 1466 and silver above 35.00 the same day! Likewise it’s possible of course that the same day the mentioned correction trigger marks might be released.

Conclusion: It’s not important that we always know everything. Sometimes the market has to decide releasing some determined trigger marks. Important for us is the fact that with the GUNNER24 Forecasting Method we can always assess better than with any other technical analysis method - what is the general health situation of the markets like.

The fact that simultaneously all the 3 analyzed markets in different daily setups as well as in the weekly setups are standing at the respective double arcs expresses that some important decisions concerning the continuation of the uptrend are on the agenda as early as at the beginning of the week!

If the markets achieve to trigger their respective long-entries within the next three days the rally will go on. This solution is supposed to happen because of the consolidation at the highs during the past days. On the other hand the actual multi-resistance double arcs would permit a resolution downwards. Some multi week corrections might be due – at least in gold and silver. Probable down-targets in case of day closes below 1758 and 34.32 respectively would be 1720 and 32.90.

If S&P 500 breaks the 1450 downwards until Wednesday, at least 1429 index points will be expectable.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann