These days, the requests on US crude oil are increasing again. Certainly, the new bear lows in the course of the current selling wave are piling the pressure to our readers and traders whose wishes regarding an update/revised forecast I’m going to fulfil with pleasure today.

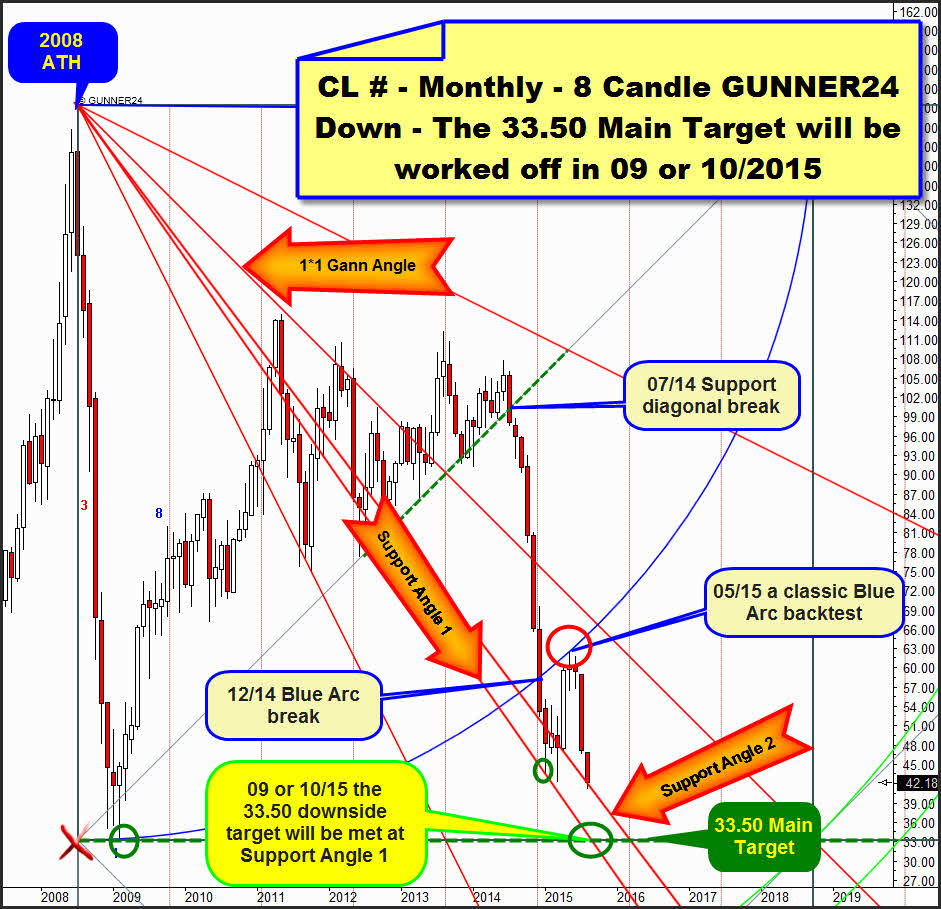

I think, crude oil will have reached and worked off its 33.50 main target in September, or at the latest in October. Afterwards, the cards will be shuffled newly.

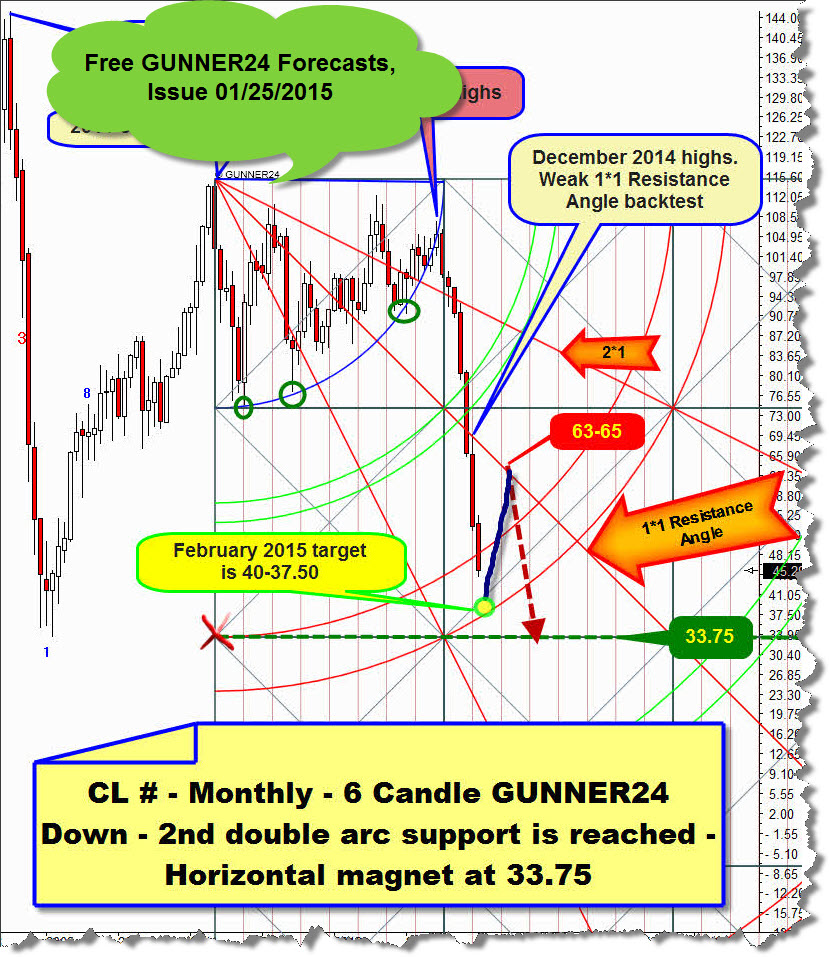

In the chart above – published within free GUNNER24 Forecasts, issue 01/25/2015 – you see the presumed course/forecast for the beginning of the year – working on the assumption that crude oil would have to start a countertrend from below the 40$ mark up to the 1*1 Resistance Angle in February. Target area was thereby on the one hand the 63-65$ supposed to be reached in May 2015, at latest June 2015. Within the issue of 01/25/2015, „Crude Oil outlook 2015" in addition an alternate price target at 57$ was worked out, but the countertrend top always expected to occur in May, possibly June.

The May/June countertrend top notified that crude oil was to fall swiftly into the main target that was supposed to be worked off still in 2015.

In reality, crude oil turned upwards from 42.41 by mid-March in order to end up the countertrend move at 62.58 on 05/06/2015. After a couple of weeks of sideways movement, the current - newly very strong – selling wave started:

The first important monthly down setup that prognosticates the main target to be worked off as early as in 2015 is the 6 candle down just shown above starting at the important countertrend high of the year 2011.

Subsequently, both other important monthly down setups that likewise notify the 2009 low to be reached during this downtrend are going to be assessed anew. Thus, we have available as many as 3 setups in the monthly time frame that altogether forecast the 33.50-33.75 to be worked off. This is an overly seldom constellation in the high time frame making nearly compelling the 33.50 main target to be worked off.

==> 33.50 was and continue being target for 2015: In the 6 candle down above we make out how narrow on a knife edge the situation of crude oil is at present. After the 1*1 Resistance Angle was classically worked off at the 62.58 countertrend high, the long, deep July sell-off candle followed. This one is signaling strong negative energy starting from the 1*1 Resistance Angle. With the new bear market low, the current August candle is already trading closely beneath the lower line of 2nd double arc. As it were, the lower line of the 2nd is thereby really the very last support in the monthly time frame before the next lower target, the horizontal support is notified at 33.75.

I think, if crude oil trades below the 40$ mark in August, it will rapidly and unceremoniously go on submerging down to the main target within a few weeks. With the current weekly close below the lower line of the 2nd – even though very narrowly – a sell signal has formed in the weekly time frame.

Thus, the first active sell signal – in the subordinated weekly time frame – and the first clear indication that the 33.75 and the due test of the 2009 lows is inescapable now.

In the 3 candle down applied at the all-time high we realize really classical pinpoint performance of the price at important magnets and targets. Measuring the first 3 month impulse trapped the 2009 bear lows at the upper line of the 2nd double arc to a hair – a marvelously defined support of the 1st double arc at the orange ovals.

Then, the final break of the upper line of the 1st support in 07/14 kicked off the current downtrend… To a T and thereby classically, the formerly broken upper line of the 2nd support was tested back at the 05/15 countertrend high.

The existence of the lower line of the 2nd as important monthly support was confirmed by the July close exactly thereon. The current August opened with a down gap beneath the lower line of th2 2nd – thus skipping over this important monthly arc support with the turn of the month! This is another sell signal, this time in the monthly time frame. Then, the so far not yet closed downside gap led the downtrend to be intensified compellingly with the beginning of August. I almost rule out the possibility that August will escape again above the support of the lower line of the 2nd double arc.

==> Ergo, also this setup puts out – now almost finally confirmed – the main target to be worked off soon!

The Friday close = weekly close still defends the Support Angle 2!

A weekly close below the Support Angle 2 will be supposed to make this one break finally as well, releasing more negative power. Thereby, the 33.50 main target can certainly be reached fast. The Support Angle 1 intersects the 33.50 support horizontal in the month of September 2015!

Since the Support Angle 1 is successfully tested monthly support – watch the green arrow – it is also future support now, forming the very strongest monthly support magnet, together with the 33.50 horizontal. ==> Therefore I conclude that crude oil will reach the 33.50 in September 2015! October is allowed too, however.

This countertrend high attained at 62.58 in May 2015 is a real phenomenon. In the 3 candle as well as in the 6 candle down we recognize classical backtesting of formerly broken monthly supports. Also the following 8 candle down, the very most important setup for crude oil, likewise applied at the all-time high, makes us realize there an important backtest at the most important monthly resistance:

At the 05/15 high we recognize the pinpoint backtest of the Blue Arc, finally broken in 12/14. The signaling is clearly defined!!: the final break of the Blue Arc in 12/14 makes a test of the first square line = 33.50 = 2009 bear lows necessary. Since in May 2015 the backtest of the Blue Arc turned out negatively crude oil since then being in the sell-off mode again, I conclude that the 33.50 will necessarily be headed for now! About the time when it will be reached, above I derived already 09/2015, perhaps 10/2015!

If in 2015 the 33.50 is defended on monthly closing base, from there a new up leg will be supposed to start, lasting several years.

A monthly closing price below 32.80 in the course of the year 2015 would keep on mobilizing defense forces. In this case the 20$ surroundings will be activated as next downtarget for the 1Q/2016.

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to protect your wealth!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann