The downgrade from AAA to AA+ wasn’t announced before Friday after closing. The opinions on the consequences published in the internet are diverging completely. Some of the experts assume an imminent crash on Monday – stock shares down, gold and silver up instead. But many others think that the downgrade was beforehand taken into consideration by the price decay of the past days, so nothing really dramatic is going to happen and the stocks are expected to start a counter reaction to the severe price losses because finally the cat was let out of the bag… It’s anyway for sure that gold is climbing to 1845 – about that please pay attention to the long term gold buy signal that GUNNER24 gave us last week. Click here.

I’m rather tending to the expectation that a relatively strong counter reaction to the recent panic sales is due. Buy on bad news…

The reason is given by the 2*1 Gann Angles at the S&P 500 and the Dow Jones which should "actually" provide strong support.

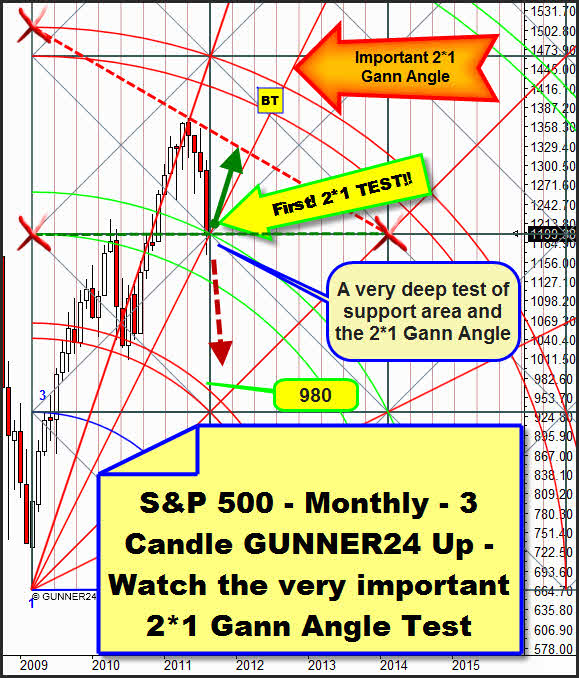

Monthly S&P 500 3 Candle GUNNER24 Up Setup:

In March 2009 an initial impulse began that lasted three months. Its extension primarily resulted in the break of the first and then the second double arc. After the break of the second double arc the third one becomes the target. Probability of a 70%! In May, the year high was being marked, at a relatively "strict" resistance that’s to say a rather seldom important GUNNER24 Resistance Diagonal at 1370.58. That’s where the market is rebounding from violently. Now the index is quoting near 1200 where a simultaneous square-line support is passing, the support of the 2nd double arc and the 2*1 Gann Angle. It’s a so-called price and time magnet. That’s to say temporally the price is situated at a point where it comes up for decision on the further price course. So to speak the market is mature for a decision now.

What in the public perception seems to be total panic is nothing else but a quite normal reaction of the market to the resistances and supports established in the past. Just go a little bit back in the chart observing the reaction of the market after reaching the 2nd double arc. Then it tested the first double arc which resisted having the market rebound upwards again. Such may happen again now. Being really an extremely important support the second one is able to cause a new rebound upwards by its mere existence! Because of the probability of a 70% we even have to suppose that the 3rd double arc WILL HAVE TO be reached in the trend direction!

To the 2*1 Gann Angle now:

Gann Angles use to set the speed and the angle of a trend (how fast does the market rise or fall within the considered time frame on average!). So the markets orient themselves by the Gann Angles. And whenever a Gann Angle is being reached a decision will be made…

Being touched by the price the Gann Angles are not able to show more than two different reactions. A) They have the price rebound. B) They break, thus ACCELERATING the existing trend! For all that it doesn’t matter how fast or how slow the market approaches to the Gann Angle now, the Gann Angle doesn’t care about the magnitude of panic or euphoria before its meeting with the market, it’s the Gann Angle’s decision whether the market stops at it in order to turn or whether the market is allowed to intensify its trend move.

The following dogma by W. D. Gann is most important: Gann Angles really cannot break before the third or the fourth test. Well, as we can see in the chart above, what we observe now is clearly the very first test! A market will just arrive at an important Gann Angle someday. In the setup above we also see that the 2*1 is one out of three important Gann Angles of a setup. The market has got to meet it by-and-by. – And now, after more than two years of an upwards trend, for the very first time the decision is due whether the upwards trend is going to be continued or not. Next week will come up for decision pointing the short term way. It’ll be rebound or breakthrough!

I suppose that on Monday at the most some lows will be marked which are but marginally lower than on Friday, simply following the rule that in the first test of an important Gann Angle at a 95% a rebound must happen!!

If the index opens narrowly below or narrowly above the Friday lows it’ll be almost for sure that the gap will be closed. By virtue of the price constellations there was some panic to be observed before the lows on Friday. And briefly after the lows a jolt shook the markets when the buying programs started to strike. About that, Friday showed a doji candle and during the last days a southern doji candle stick formation which may point to a significant low. Only a down gap to about 1145-1148 (nearly 20 points below the Friday low) would turn the final break of the 2*1 Gann Angle to become likely! Target is 980.

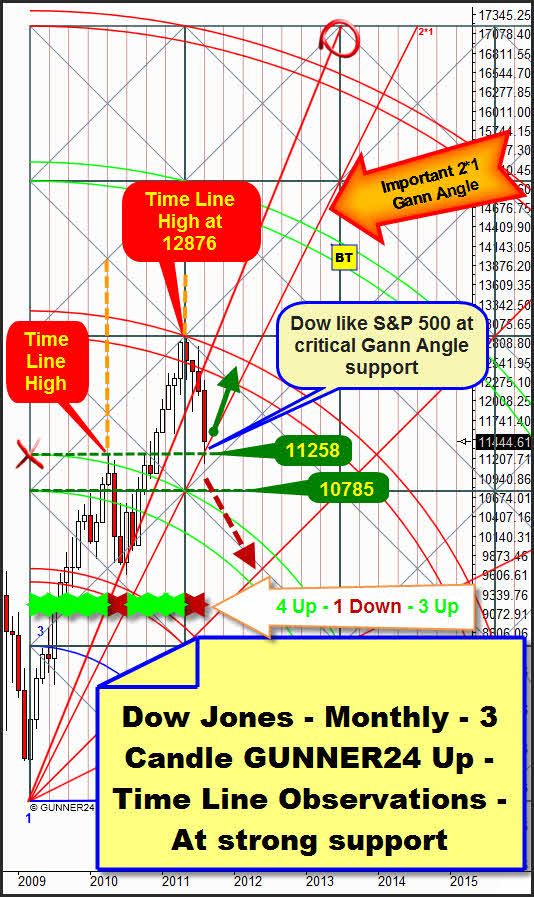

The Dow Jones is standing at the important monthly 2*1 Gann Angle as well:

Even though the initial impulse also lasted 3 months it had a different pitch angle and a different price extension than the S&P 500. This setup is simply perfect. The initial impulse predicted us merely perfectly a possible change in trend. The extension of the initial impulse ended at the 3rd double arc. Here, at the upper line of the 3rd, a visible rebound happened. July closed below the Gann Angle that had been provided support for years (anchored in the setup above). Thereby the next important Gann Angle HAS TO be headed for. Here again it’s the 2*1 Gann Angle. Do you think that is just coincidence? I don’t… Just the fact is being emphasized that the two stock markets with the biggest trading volume are facing the same landmark decision now.

So, together with the S&P 500, on monthly basis the Dow is testing the point of decision whether the upwards trend is possibly willing to be continued or not.

Now it’s time to enter more profoundly into the "body of rule" of GUNNER24: Since the March 2009 upwards trend was CLEARLY VISIBLY stopped at the 3rd double arc followed by a visible reaction downwards at first we have to work on the assumption that the trend has changed. Correspondingly, above at the year high we can apply a new GUNNER24 Down Setup. Since the setup always comprises 1,2,3,5,8 etc. candles and since we don’t count more than 4 candles with August the initial impulse won’t be ended before the lapse of at least one month. From there at least until September the Dow is supposed to show some weakness. Anyway, in September no lower low will have to be marked, the low may even be a little higher than the August low.

Looking at the time line count now – 4 time lines high, 1 time line counter reaction, 3 time lines high – August will facilitate the end of a further counter reaction. So, with the August low another upwards move may start that comprises 3 or 4 more time lines taking the market to new year highs.

Well, how are things supposed to go on…? What I expect now is a counter reaction to the last losses because the 2*1 simply has to resist (Dow Jones up to 12000 and the S&P500 up to 1250-1260). During the next 4-5 weeks this 2*1 Gann Angle will be tested on weekly basis for the second, third or fourth time. Not before that third or fourth test, maybe at the end of August, beginning of September we’ll see the decision whether it wants to break significantly or the 2*1 resists forcing the Dow to ancient or new highs.

This is for sure: If Monday opens at 10800 or even lower the 2*1 will be broken definitively, in that case its support and rebound functions would be temporally "skipped over" as it were, at the first test. Since, according to GUNNER24 and W. D. Gann, something like that is actually not allowed to happen we’d see an abnormal aggravation in that case. Target then would be the 1*1 Gann Angle… How fast does that one want to be reached? Well, that might be very quick then – crash or until the end of the year – we would have to calculate that with help of the weekly GUNNER24 Setups.

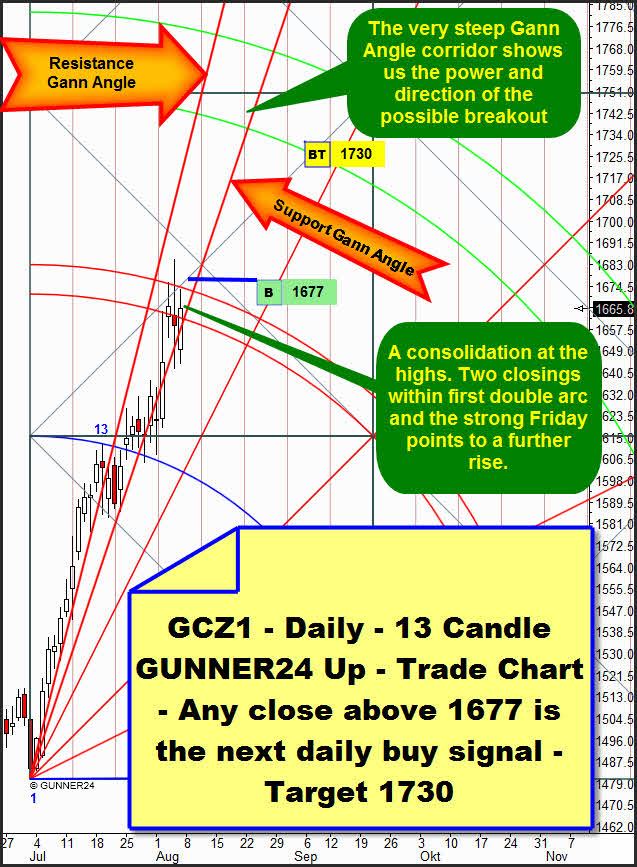

It’s simply wonderful that we can follow this daily 13 Candle GUNNER Up in gold:

It’s perfect. 13 day initial impulse, then gold marched into the 2nd square. Then a consolidation at the highs being tested extensively the upper horizontal of the first square, and then up to the first double arc. That’s where we see a consolidation at the highs again and on Friday we’ll see the second closing price within the 2nd double arc already. All the preconditions are given to go newly long with target 1730 in case of a close above 1677 on daily basis. If gold wants to go on following the Gann Angle corridor which is extraordinarily steep even 1750 will be possible. The 1750 is not only the next important daily resistance but also the next visible monthly resistance!

Consulting the Indian markets which use to trade on Saturdays being able thus to take into consideration the downgrading last Saturday gold might open with a gap of about +1 % – that would be approximately 1682 with a following attack of the all-time high and more. The next important weekly resistance I recognize is at 1705!!!

An opening around 1675 or below would be a present since the all-time high will want to be headed for very soon, I suppose. After reaching the all-time high or more we’ll just have to hope for a gap-closing on Monday or Tuesday. In any case we should put in the market a future position between 1664 and 1667 because gold doesn’t like open gaps. After closing the gap gold is expected to go on upwards rapidly!

Barbara who is a loyal GUNNER24 Gold Trader also thinks with this setup we’ve got a money printing machine:

Thanks Barbara for allowing me to publish this statement! For, being a GUNNER24 Gold Trader you’ll be able to surpass the performance of the gold and silver signals of the free GUNNER24 Forecasts

by far! Whenever there are important signals on gold or silver, long or short – Intraday, day trading or swing trading – you’ll be alarmed immediately by e-mail. Our ingenious investment risk and position management will help you additionally to practice durably profitable gold and silver trading.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the acual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

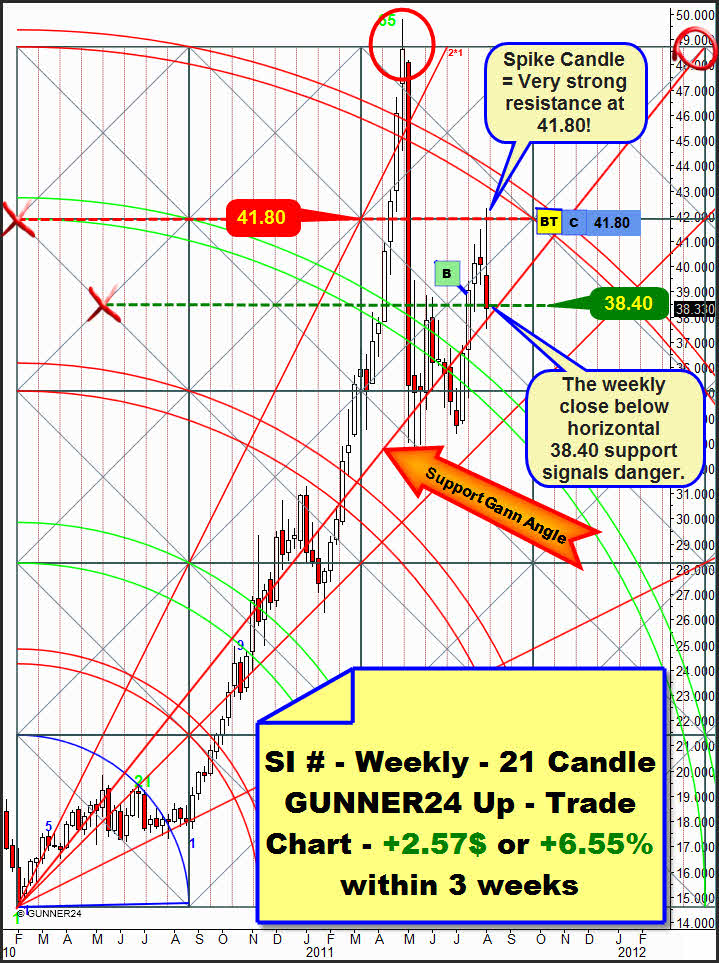

After receiving a clear buy signal on weekly basis four weeks ago we covered the longs on 08/03 at the obvious 41.80 target. The reaction to the horizontal resistance at 41.80 was very violent. Unlike the safe harbor of gold, silver is rather being traded as an industrial metal at the moment. Silver didn’t suffer the same severe deductions as some other industrial metals but compared with gold it seems to be going to under perform the coming weeks. I think that silver will target the 5th double arc in the trend direction certainly touching it – that may happen as early as next week or the week after next between 43 and 42.70. But that is it, for the time being. Because I suppose that the 5th double arc will trigger a very violent reaction downwards.

Be prepared!

Eduard Altmann