Also for next week, in the stock markets and in gold the targets are well defined

Sometimes trading is very easy. Such as it was last week, everything is running smoothly as if were on rails, and it's much fun because inevitably the money is rolling in. The entry worsk, and all you got to do is to trace your stops. Next week there should not be big surprises either. In the stock markets the next targets are standing. And in gold, it's pretty clear that there will be a test of the lows. That's where the big decision is on the agenda then whether we will have to keep on assuming an intact upwards trend in gold or we'll swing into a new downwards trend.

At first to the stock markets:

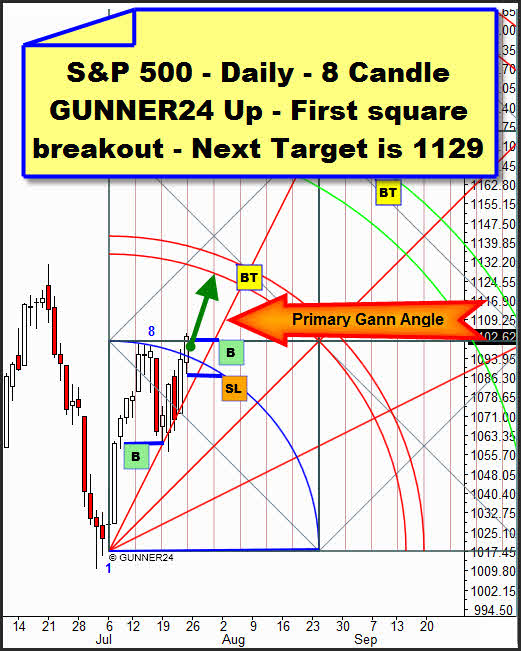

In the S&P 500, Friday produced a strong buy candle: Simultaneous break of the blue arc and the first square. The rally is given its pitch angle in price and time by the primary Gann Angle. As worked out in the last issue on Monday we succeeded in getting the entry at that very Gann angle, at 1061. Next target will be the first double arc. It's the minimum target in a GUNNER24 Up Setup. That is the place of the decision whether the long term downwards trend goes on. A retracement is to be expected on Wednesday or Thursday, respectively. We will have to consider very well the following retracement. The primary Gann angle should not be broken in the process if the rally is to continue until the 2nd double arc. If it breaks we'll have to reckon on a relapse to the first square until the blue arc.

The target for next week in the daily setup is corresponding exactly with the next weekly target in the actual weekly 2 Candle GUNNER24 Down Setup of the S&P 500: 1130.

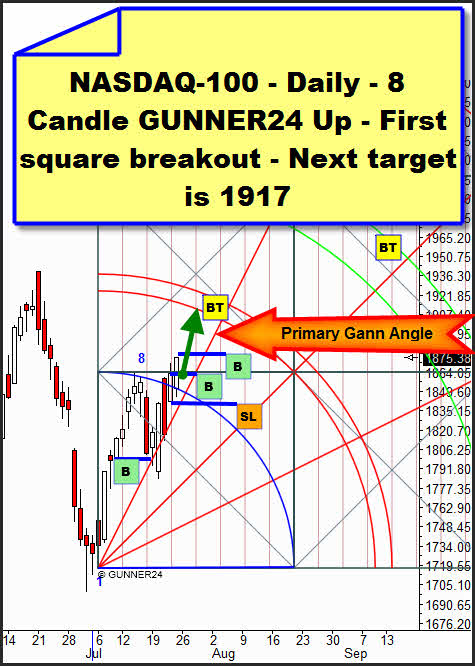

In its daily 8 Candle GUNNER24 Up the NASDAQ-100 broke the first square, as well. On Thursday at closing we had stocked up our longs already because the blue arc had been broken. Here, too, for the moment the target is the first double arc at 1917. Since Wednesday we'll have to reckon on a retracement through Thursday, there. Near 1917 we'll try to cover the longs. Re-entry will be the break of the first double arc.

Gold:

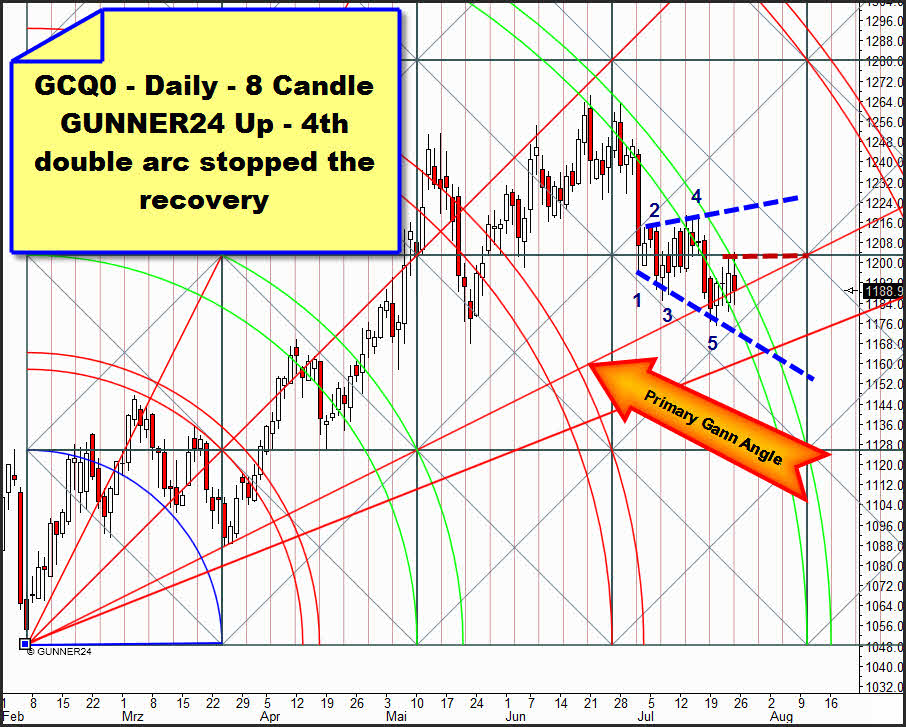

Analysis: For more than two weeks gold has been digesting the fast down swing after the all time high. It's becoming more and more obvious that the actual chart pattern is a Megaphone. That is unambiguously bullish. Another bullish sign is the fact that the last three trading days closed within the 4th double arc. But some negative signs which rather suggest a continuing falling gold price are - first: The poor rebound from the primary Gann Angle. And second: With the Friday high a relatively strong rebound from the outer line of the 4th double arc occurred. With Friday closing gold is sitting exactly upon that Gann Angle. A Monday closing price of about 1180 to 1182 would point to a prolongation of the downwards trend of the 4th double arc through the beginning of August. The break of of the primary Gann Angle opens a target at 1168-1166 for next week.

We'll use a closing price of more than 1203 with target 1228 for another long entry since thus as well the actual resistance line (red dotted line) as the 4th double arc should be broken undoubtedly.

.

We used the down target we worked out in last week's issue as a long entry. The 1175 fell exactly on the upper line of the 3rd double arc, the main target for this down trend. Corresponding to the GUNNER24 Forecasting Method now a new upwards trend should begin. If Monday doesn't reach a new high we will be able to apply a 3 Candle GUNNER24 Initial Impulse there, at the Tuesday low. If Monday produces a new high at least a 5 Candle GUNNER24 Up Setup will be present.

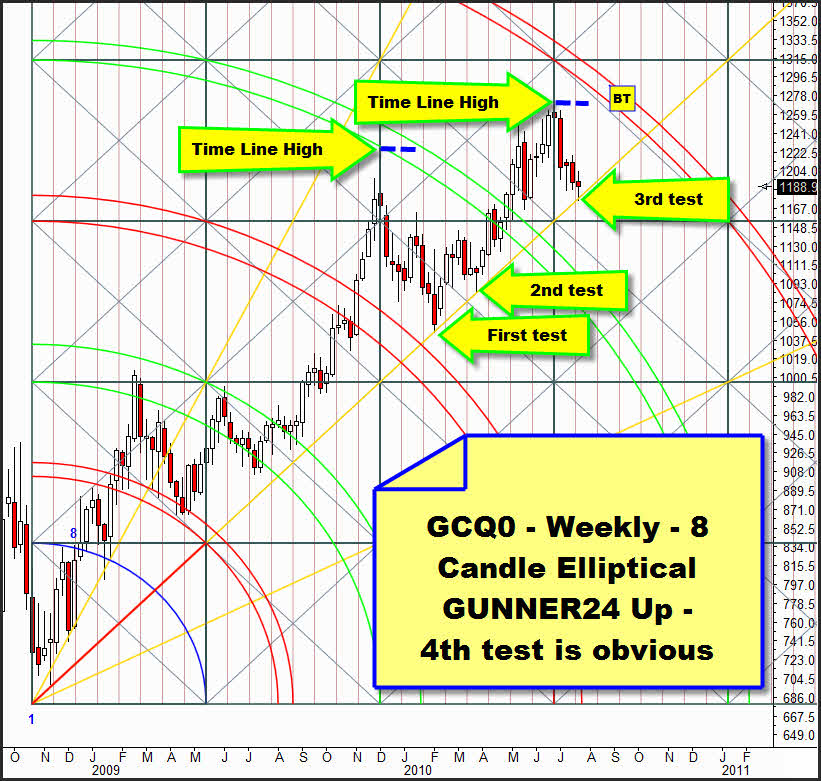

I wrote down in the chart that a test of the 3rd double arc at 1182 is due. That is corresponding with a target in the known weekly 8 Candle Elliptical GUNNER24 Up Setup that we have been deploying for our gold analysis for months:

Last week, at 1175 the primary Gann Angle was tested for the third time. As mentioned before, the rebound from it was pretty weak. But possibly that is not unusual as both first tests in the upper GUNNER24 Up Setup show. The week opening that followed after the two "test candles" was always considerably above the closing price of those "test candles". And those weeks were stable, "green" weeks!

If the short term Friday trend persists the 4th test of the angle should happen on Monday at 1182, then we'll have to see the reaction. A break of the angle next week would open a down target of 1110! We'll use a strong Monday/Tuesday with closing prices of more than 1203 for a long entry!

Be prepared!

Eduard Altmann