Ride the parabolic gold blow off

As mentioned several times already in the former GUNNER24 Forecasts, just in the uncharted territory the Forecasting Method based on the techniques of W.D. Gann offers some excellent possibilities for determining the targets precisely. Frequently, not only the expected price can be forecast in advance, but especially the very moment when the expected price should be reached can be projected as well.

Since recently the gold target of 1320 – which has been prognosticated by GUNNER24 for more than a year – gradually seems to gain acceptance by the fellow Technical Analysts today I'd like to impart to you some new little subtleties for more exact target determination. Be sure here it's going to be the first time you read this ;-)).

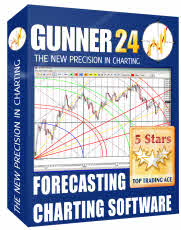

Once again, gold has soared up to new highs. All the resistances worked out in GUNNER24 Forecasts, Issue 05/16/2010 (monthly 1239, weekly 1232, daily 1247) were broken last week. As we see in the upper daily setup gold is still kept back by the 2nd double arc. The 3rd double arc was activated being the main target with a price objective of AT LEAST 1285 (3rd double arc) for next week. Our urgent goal is now to make the most of the parabolic blow off, effectively. Actually that means – we've got to make safe money:

A) Accumulate for next week your long position at any possible long signal in the 4 or 8 hour setups respectively (significant breaks of the double arcs). In the upper daily chart, accumulate in case of a significant break of the 2nd or 3rd or even the 4th double arc and in case of a possible break of the 2*1 Gann Angle. That's pretty likely in the blow off...

B) Always drag the SL sensibly. In the daily time frame it is the Primary Gann Angle marked above. That is extremely important in a blow off and especially in the gold market because at the end of the blow off there are considerable dominating volatilities, and particularly in the commodities they watch out for ransacking any trader. That means at the end of the blow off (could/should begin on Thursday 06/24 and last until Wednesday 06/30) the last ones still have to jump up having to cover then their longs quickly because after reaching the price targets the direction turns downwards rapidly.

C) The day traders and the scalpers should buy at any shortcoming at the double arcs – depending on the time frame – and at the double arcs lying above, they should take along their profits.

D) Even the day traders and the scalpers, still on Monday and Tuesday should put up their positions keeping them until the end of the week.

Time and price targets of the gold blow off:

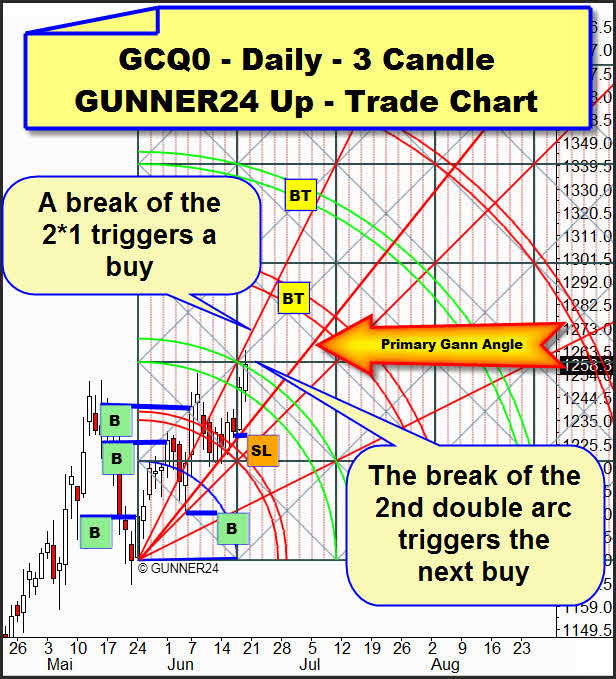

Next week, we are lying exactly on an important time line. The 5th double arc will be the target, well, the main target for the entire move. The duration from the last significant high (December 2009/top, see the dotted blue line) to the June 2010 high would amount to one square precisely, then. The week after next, the price is in the 8th(!!) passed square where we will always have to reckon on a change in trend: Complete GUNNER24 Trading and Forecasting Course Rule 21.5.

But now I found three hints which in price and time may shift the high to the back pointing to an extension, i.e. exceeding the main target (next week minimum 1285/maximum 1320):

1. In the upper weekly 8 Candle Elliptical GUNNER24 Up, at the intersection point we install an elliptical counter setup.

And we find out that in all the little green squares the price is touching the upper line of the red double arc, defining it in terms of its extension to the right (time), you might say. But the last trading week produced a low that was really lower than allowed. Since in the market nothing happens by pure chance the orange time line that is marking the normal high might have to shift to the right. How far and whether or not is what we'll make out next week because then we will see another week low that should give us an additional clue.

June 28 to August 13: Normally the period between the lines of the double arcs is the space where a counter move to the former move takes place. When it comes to gold that would mean within that period a clear correction and even a change in trend should be rung in. But sometimes a definition of the absolute high happens to occur not before the beginning of that period. In 20 to 30 % of the cases. Since we have not seen any exhaustion gap during the last weeks and days the high MIGHT occur in that period with wide, wild moves and with a target much higher than those 1320.

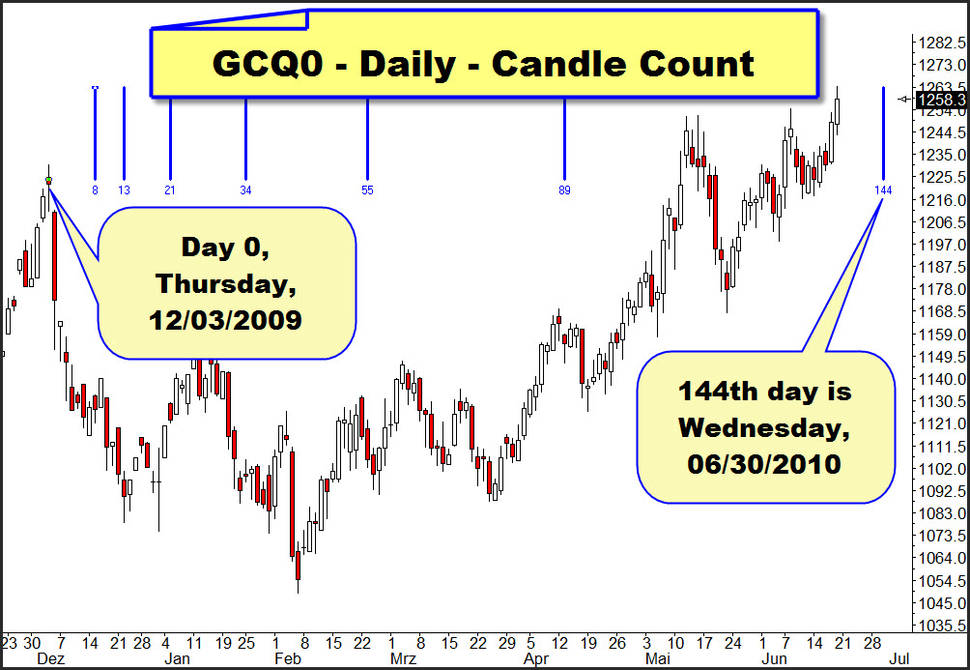

2. This Fibonacci Count is pointing to a significant high on 06/30/2010:

So, not before the week after next. But that means further: If gold briefly after the 06/30/2010 produces a new higher high we will be allowed to expect a time extension of the upwards trend through August.

3. The monthly Fibonacci Count is pointing to a high in July, possibly extending through August.

If the actual upwards trend that has lasted for 20 months (November 2008 to June 2010) following the candle count pattern performs the same way as the first upwards move did from May 2005 (May 2005 to March 2008) so the final high is not going to be produced before August (new red 1). June 2010 is actually candle green 20. July 2010 (candle green 21) would produce the normal high at 1320 and a maximum high at 1350. And the extension in August 2010 would make the final high at about 1407.

If A=B the normal price target is at 1298.7. But the weekly GUNNER24 Setups and the daily one show 1320. I suppose this week we are going to those 1298 pretty quickly and calmly, seeing there a violent counter reaction that will look as if the move had ended. Then, the week after next, for one day possibly we will go until 1320... You see we will have to watch many, many targets in this blow off. But I think the week after next many things will clear up. Especially as far as the monthly count with its final targets is concerned.

Just a brief look at the stock markets:

Actually, for this issue I had given the same precedence and space to the stock markets as to the gold forecast, but sometimes things turn out very differently. And I think this week and the following weeks with gold simply there will be many more profits to be made than in the stock markets. How frequently we are handed on a platter a move that is so easily to be traded? Seldom! That's why I'm giving here just a very brief outline of my point of view on the stock markets next week:

Generally bullish!

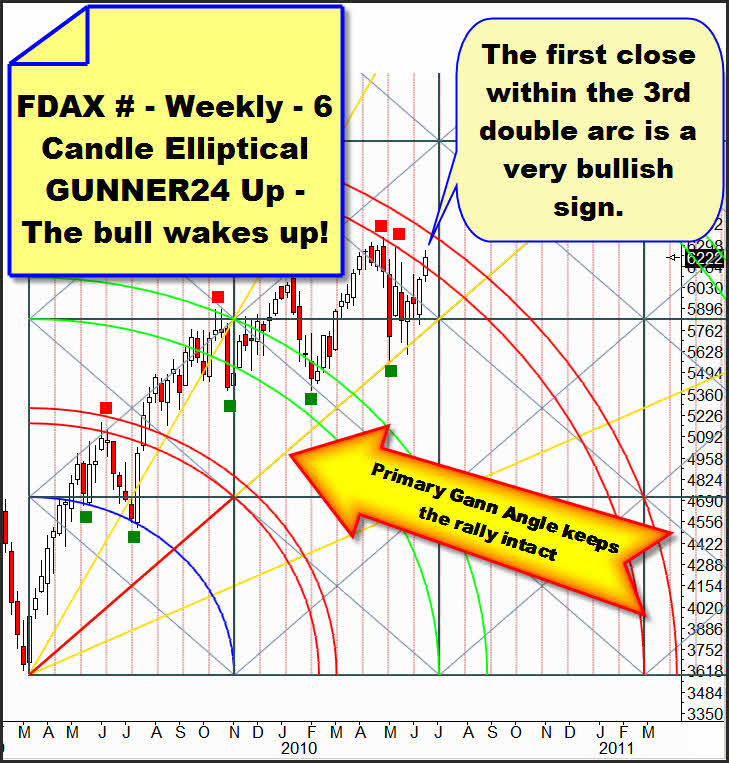

The FDAX # is waking up. The very first closing price within the 3rd double arc is making that clear, promising the break of that double arc in the long term. In case the double arc is broken we are going long with our long term positions.

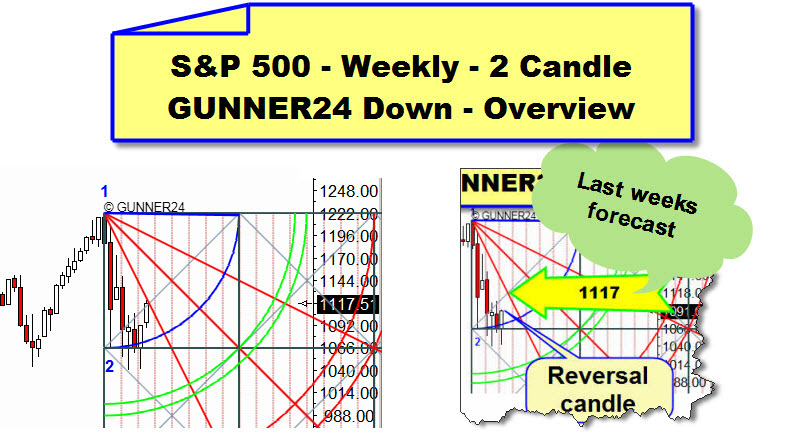

Last week we prognosticated the high at the S&P 500 at 1117. Hit!

In the upper weekly GUNNER24 Down Setup the market has come to a critical point now, the 2*1 Gann Angle that generally should form a resistance at first being followed by the market on daily basis.

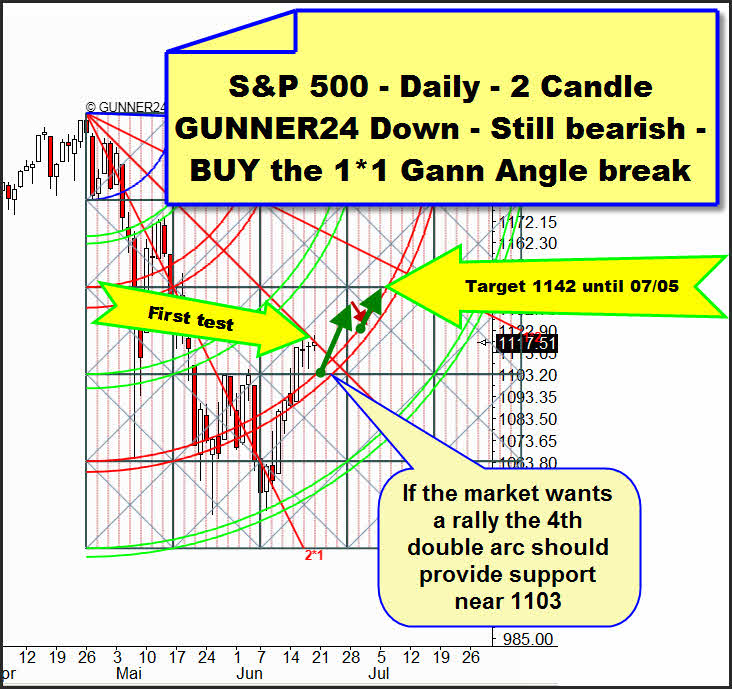

Also the following daily 2 Candle GUNNER24 Down Setup is pointing to that:

For the time being, with the expiration day we seem to have seen the end of the up swing. (We covered the half part of our little long positions at 1117). At first we should fall down to the 4th double arc before we take a new run for breaking the 1*1 Gann Angle by midweek. The 4th double arc at 1103 is offering support. If it resists the 1*1 Gann Angle should be broken as well. In that case we will go long again.

The actual 2 Candle GUNNER24 Down Setup at the NQ # is showing a similar picture. The price has been working its way upwards for three days within the 3rd double arc. That one is offering resistance as well as support. But since we rebounded from the 1*1 Gann Angle on Friday and since that important Gann Angle cannot be broken on the first go a new attempt for its break should not be taken before a retracement. There are supports lying as well at the green dotted square diagonal at 1880-1890 as at the 4th double arc at 1850-1865.

Be prepared!

Eduard Altmann