The gold miners are likely to come to their final bear market low between June and October 2015. Thereby, the gold miners are blending most properly in the big picture of the final bear market low spaces worked out so far!

In memory and for looking up constantly the previously worked out bear market low terms/spaces inclusive the appropriate analyses:

Gold aims 1100$ - issue 03/08/2015 – the expected bear market low is timed on October 2015, give +1 to 2 months.

Platinum targets 748$ now – issue 03/01/2015 – the expected bear market low is supposed to be achieved at the latest till March 2016, give minus 1, 2 months.

Crude Oil outlook 2015 – issue 01/25/2015 – the calculated bear market low should technically be brought in during 4Q/2015, with less probability at the latest in 1Q/2016.

Biting November heart-shot to oil, copper, silver – issue 11/30/2014 – Copper is expected to bottom in Nov/Dec 2015 and silver is likely to be bottoming out in late summer/fall 2015.

The timing for the expected gold miners bear low (June until at the latest October) is fitting the puzzle that excellently because - together with silver - they should have to be the first of the leaders in the commodity complex to be bombed out.

As to theory and the rule of thumb, silver and the miners are often/mostly the first to turn. No matter whether it is matter of bear market bottoms or bull market highs of the last 70-80 years. Silver may finally turn upwards as early as in late summer 2015, the gold mines may do so in June already.

The NYSE Arca Gold BUGS Index, better known as HUI comprises the stocks of international gold manufacturers. The weighting of the index occurs according to the market capitalization picturing the value development of the gold stocks listed in the New York Stock Exchange, NYSE Amex and NASDAQ.

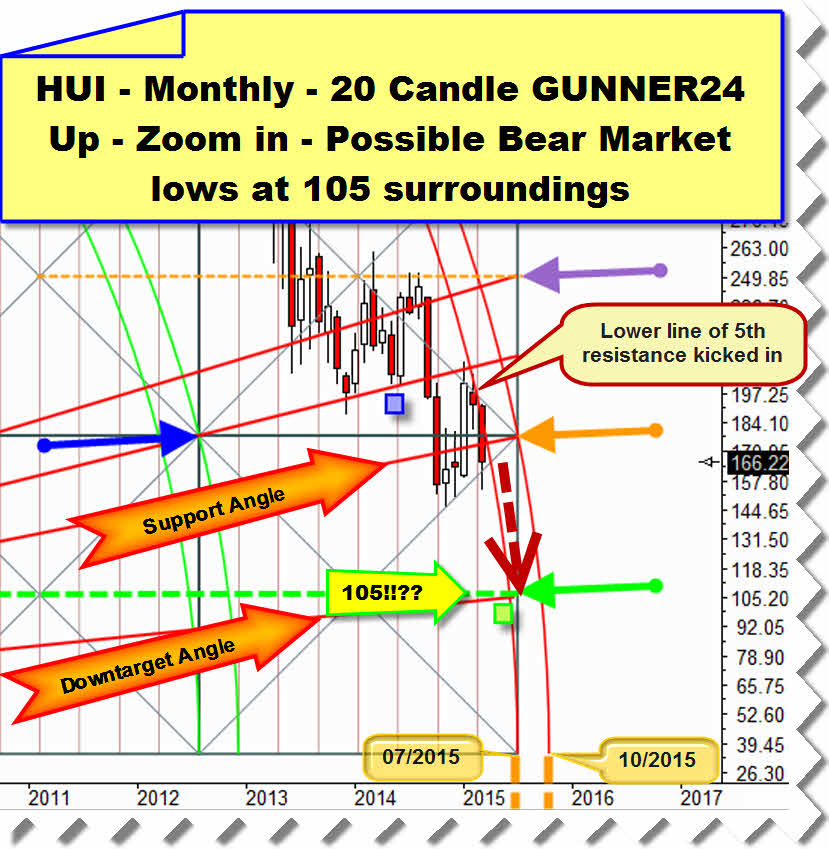

With the January 2015 highs, in the bear market running since September 2011, the HUI finished its last important countertrend on monthly base following now downwards again the main resistance long-standing since 2011.

Since the January 2015 highs, the index is now, visibly and obviously, following the resistance of the lower line of the 5th double arc in the dominating monthly 20 candle up again. This double arc resistance is now pressing the HUI again, more and more downwards.

In the next chart, you’ll find the complete overlay of the 20 Candle GUNNER24 Up Setup with the monthly resistance of the 5th double arc functioning since 2011. For the time being, to the analysis of the youngest and thereby currently most important developments. In order to summarize them and to reveal the targets more "plastically" according to time and prize, above I just zoomed into the setup.

The January 2015-high did not touch the lower line of the 5th, but narrowly above the opening, February 2015 newly found resistance at the lower line of the 5th. Likewise, the March 2015 candle met the lower line of the 5th. The resistance power of this monthly resistance makes again accelerate visibly the downtrend now. The January 2015 high is marking the current year high. February was slightly red. March is going to be dark red. This lower line of the 5th is responsible for the miners not to be able to jointhe gold- and silver-rise in March. The miners cannot respectively could not imitate the gold- and silver-rally in March, because now they are being forced into the bear market low. Thus, the gold miners are running ahead of gold and silver…

In two days, March will be through being April technically supposed to open around the 168-160 area.

March 2015 has thereby lost the fight with the important Support Angle also because the HUI will newly finish March below it. Thus, the next lower Gann Angle ==> the "Downtarget Angle" comes into play as new downtarget. Now, the "Downtarget Angle" is the next important downtarget!

The Downtarget Angle intersects the lower line of the 5th together with a GUNNER24 Horizontal Support at 105! The 105-100 (the magic of the round natural numbers!!) seem to be the obvious target of this bear.

Downtarget Angle and the 105 horizontal intersect the lower line of the 5th double arc in June 2015. ==> Thus, June 2015 is the earliest possible deadline for the bear market low.

For April 2015, the lower line of the 5th takes its course at about 168-170. Since the downtrend is accelerating again, there at 168-170 the April high should technically be marked as early as shortly after the official April opening, from there the HUI being likely to bounce strongly again to break downwards finally through the current bear market low existing since November 2014, probably just in the course of April.

This break of the current bear low will make accelerate the HUI stronger again… for sure!

Perhaps the HUI will reach the Downtarget Angle as early as in June – and then, at 100! Wait and see. That’s but fine tuning stuff…

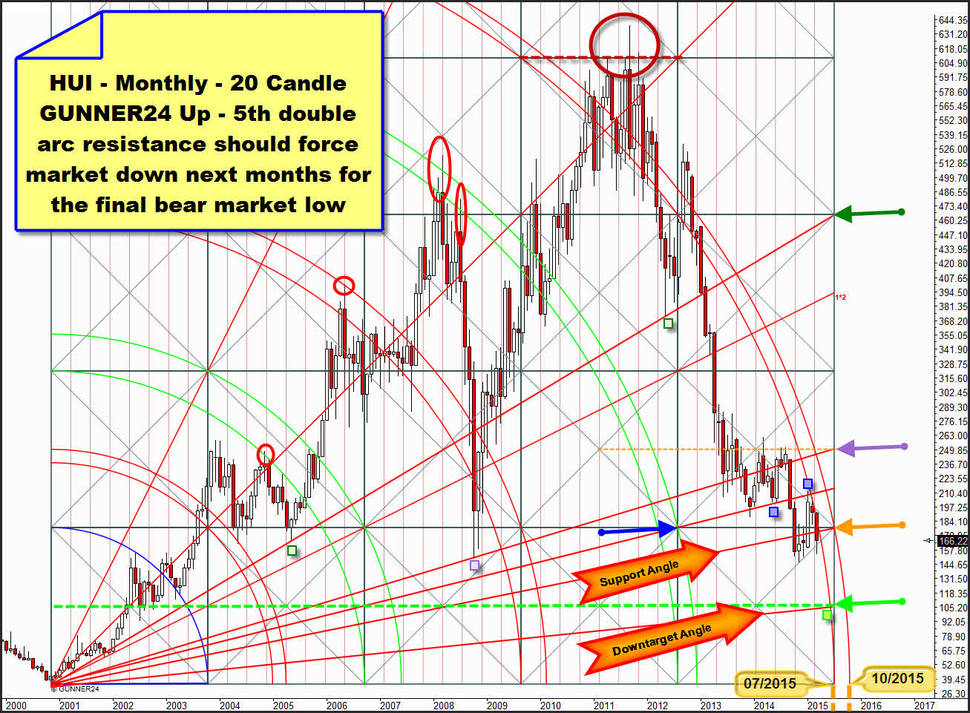

Now comes the complete monthly 20 candle up. It starts at the bear low of the year 2000. The last bull market top from September 2011 (the miners topped simultaneously with gold – silver had topped in April 2011 already) could be reached above the dominating 5th double arc resistance. In retrospect we see however that the 5th double arc has been sucking down the HUI for nearly 5 years now. It is the dominating resistance the HUI is following and being obliged to keep on following. This 5th has been sucking it down for years, and it keeps on doing as long as the final bear market is not reached.

==> The influence of the 5th double arc will end in July 2015 at the earliest. Then the lower line of the 5th will intersect the time bar. The influence of the 5th double arc will end in October 2015 at the latest. Then the upper line of the 5th intersects the time bar. Consequently, the bear low is expected to be brought in between July and October 2015. Perhaps/possibly it will be in July 2015 at 100 already… See the explanation above:

By and large, the HUI is following the resistance of the 5th double arc now.

The setup shows some peculiarities. At Gann Angles, it prognosticated some important lows/turns with extreme precision sometimes – mind on this the purple + dark green + blue boxes. These Gann Angles, important for the market, are anchored at the purple + dark green + blue arrow…

The market performance at the double arcs according to the signaling was really very exact until the year 2008, because the upper and lower lines of the double arcs used to show the turns respectively the trend direction rather exactly. After the bull market high of the year 2008 at the 4th double arc resistance, the comportment of the market at the double arcs changed however. After the 2008 top, the HUI decided to consider the double arcs rather as indicatory respectively rough-motoric supports and resistances.

==> Certainly, the 2008 bear low at the 3rd double arc as well as the important bull high of the year 2009 at the 4th double arc and the final 2011 bull high at the 5th double arc entered in the environment of these double arcs. All the same, there is not at all talk of exact consideration of the double arc magnets. The HUI is more affected than controlled by them.

==> However, after reaching the final bull market high in 2011, the resistance of the 5th double arc prevailed. So, not before the March 2015 break of the Support Angle downwards and not before and at the earliest after working off the 100-105, the HUI is "allowed" to turn up.

==> The 105 Support Horizontal is matter of the 50% correction of the first initial impulse during 20 months from the absolute low (35.31) of the market, marked in November 2000.

==>The 105 is the center of the first square, it’s a decade support! The 105-horizontal is likewise an important horizontal support in consideration of the development of the HUI since the 2011 bull market high:

The intersection point of the upper line of the 2nd double arc with the starting point of the 9 candle down is where we can derive the 105 from. Thus, from the absolute low point of the HUI (11/2000) at 35.31 as well as from the absolute high point of the HUI (09/2011 at 638.59) a magnet is deduced that lends itself as target point for the ultimate bear-market low.

The signaling of the 9 candle down is showing the following: The 1st double arc is broken downwards finally, hitherto the upper line of the 2nd double arc is activated as the next downtarget. Since the HUI is newly accelerating downwards, the question is not anymore whether or not, but how fast the upper line of the 2nd will be worked off.

For April to October 2015, the upper line of the 2nd will be between 130 and 136. There, for the time being, the next important interim low of this bear is offering itself. Maybe, after reaching the 130-136 everybody will scream that the bear will have finished. But it won’t. The 105 is the very strongest downmagnet for the bear. So, to me, it seems impossible that this one will not be worked off. It’s incredibly rare that several contrary monthly setups of a market put out to a T the same magnet as important target in unison. This signal power will always have to be taken into consideration. The 105 are extremely important downmagnet and thereby standing to reason for the bear low!

Since the 105 are near to the round 100, its working off will be very near! ==> Ergo, the likely bear market low is at closely below 100 to 105!

The 100-105 downmagnet area will be confirmed once more as soon as a weekly close below the upper line of the 2nd takes place. So, if a week closes below the 130-136 (mind the month) the HUI will see the 100-105!

If the 100 breaks finally on weekly closing base, the lower line of the 2nd should be reached and worked off between 66 and 72 (mind the month). The probability of the final bear market low to come in at 66-72 is at a 20%. Reason: This bear market can only end with limitless harm for all the bulls, I mean some brutal exhaustion lows accompanied by high volumes are to be expected for the most commodities and as well for the miners.

Just a brief announcement: Over Easter I’ll take a couple of days off. Thus, the next issue of the free GUNNER24 Forecasts will come out again on 04/12/2015.

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to protect your wealth!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann