Okay, here it is – the reason why the stock markets that should have topped are swinging into a several week pretty flat and harmless correction and why gold (as well as silver) – as already supposed in the last issue – are going to dissolve upwards their several week bottoming formation now.

The Euro-crisis drama is opening its next act with a new shit storm. Cyprus’ bank-customers are being expropriated partially to give them a share in the financial rehabilitation of the country. That was yesterday’s Brussels’ decision. To iron out the mistakes of the EU-politicians and the bankers they are drawing on the small savers and the salary earners that are not at all responsible for the crisis. We’re all in the same boat – the large and the small investors.

On Saturday they rushed the decision through the parliament that is ethically not comprehensible. A Cypriot pensioner with 100.000€ of savings on his account will have almost 10.000€ less on Monday. It’s virtually classical that this Monday will be a holiday in Cyprus on top of everything so that the ruling class has one day more to transact the whole drama by means of software.

What do the bank customer and the common European learn from this elementary taboo breaking? What will we have to recall again – just like in those days of the Lehman crisis back in 2008? It only takes 1 day to get your dough away! It only takes 1 day so that all your money or a part of it will be frozen up. You go to bed at night, and the next morning you cannot withdraw any money or just a limited amount. Forget the deposit protection funds that may exist in your country… Till last Friday also for the Cypriot pensioner at most 100.000€ of his fortune was hedged by the government.

It only takes 1 day until your country is almost or completely broke having the need to be saved at all events. It only takes 1 day to break up the Euro monetary block… just wait and see what happens when but one country leaves the eurozone. You better go to your bank as early as next week stocking up your cash hoard, for this is the only way to obviate the possible bank runs!

The effects for the different markets on Monday and the following days: Stocks down, Euro down, US dollar up, up and away. Gold and silver are supposed now to rise persistently for the coming weeks – in virtually every currency, above all in Euro terms.

As targeted in the last issue, in the S&P 500 we went short on Thursday at 1562 MIT (market if touched), at the expected high of this swing. 1562 is the combined daily, weekly and monthly GUNNER24 Resistance. Now the market is likely to correct downwards WITHIN both lines of the 3rd double arc. A weekly close below the 1*1 Gann Angle will be the confirmation that at least the horizontal resistance of the lower line of the just passed square at 1499 should be reached. The probable downtarget of the expected correction is the combined weekly and monthly monster support at 1472 index points. The importance and derivation of the 1472 monster support can be gathered from the GUNNER24 Forecasts of 03/03/2013. At 1472 it will be a must to switch into longs.

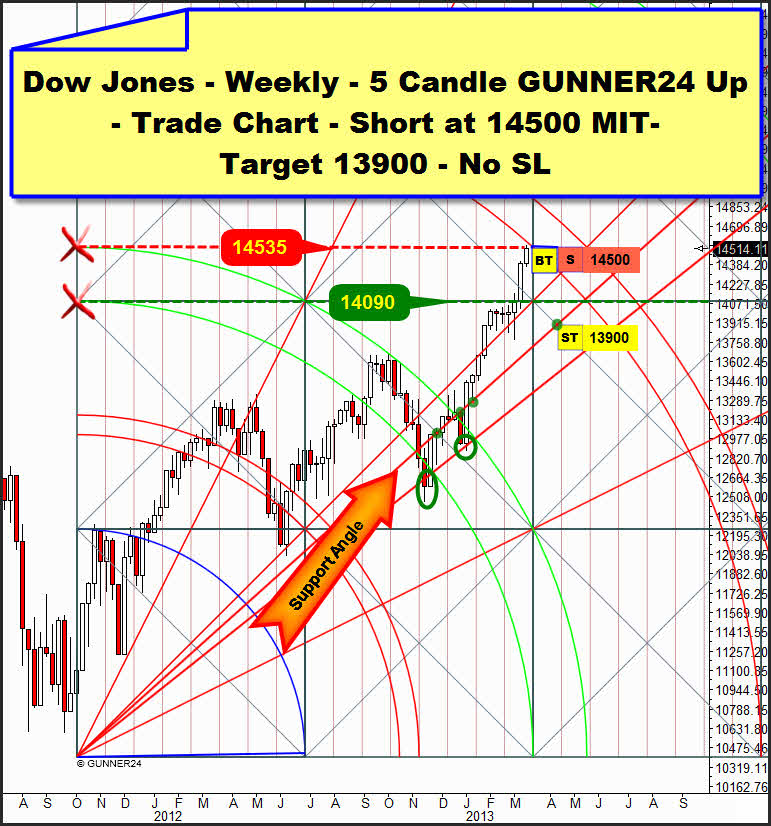

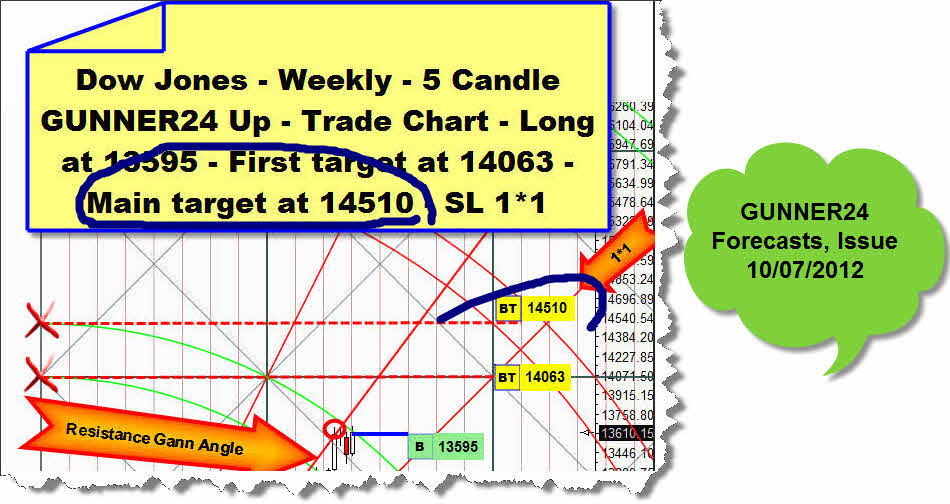

Please note the precision by which the S&P 500 reached the upper line of the 3rd at the 1563.62 high, as expected. Price meets time – not only in the S&P 500, but also the dominating weekly 5 candle up in the Dow Jones is indicating that an important GUNNER24 Magnet will be touched on Monday:

The week ended at 14514.11. And that is going to be the opening for Monday, in spite of negative futures. And this open will touch then exactly the lower line of the 3rd that was the main target of the swing, you know. Price meets time, also in the Dow Jones, and the conclusion is, according to W.D. Gann: „When price meets time, a change is imminent".

Back in October 2012 the GUNNER24 Method computed the 14510 at the lower line of the 3rd as to be the main target of this swing. The fact that the S&P 500 and the Dow Jones simultaneously reached the respective important weekly resistances is an extremely hefty clue that the party is over, the stock markets being likely to be in the correction mode next week!

We are placing now at 14500 MIT (market if touched) a "Hail Mary" sell limit into the market hoping to be still triggered. Weekly position. The order is going to be valid for the whole week – without a stop-loss. Target for the shorts will be reaching of the Support Angle at 13900. No stop-loss.

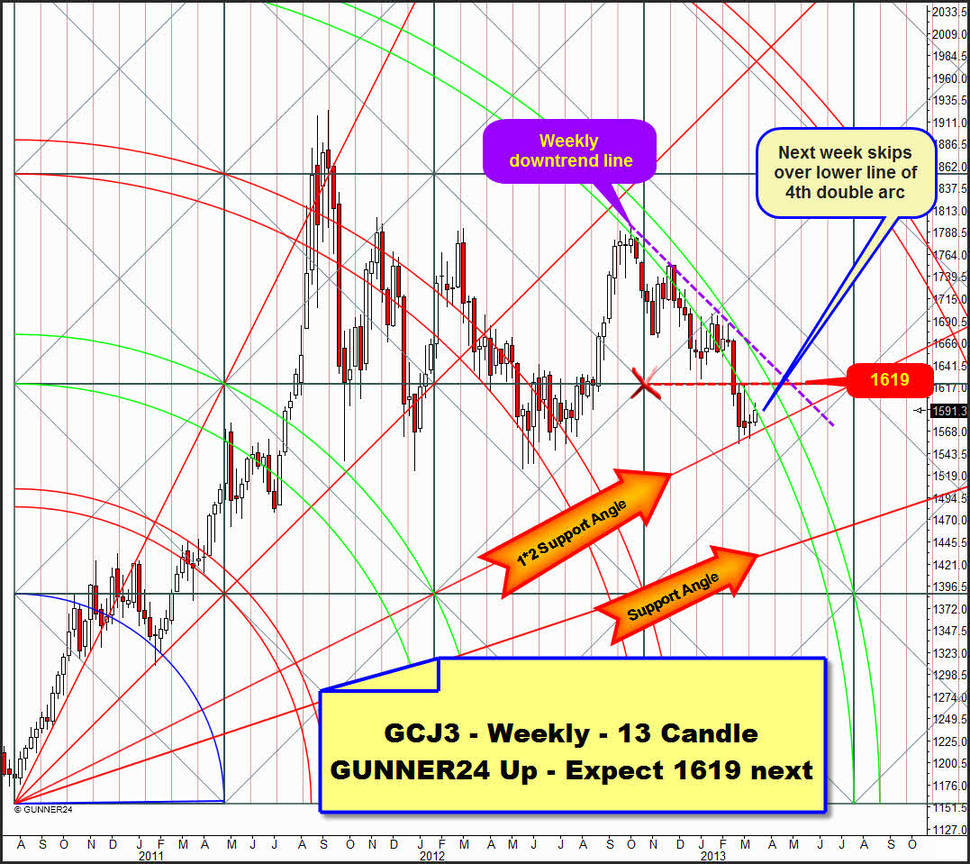

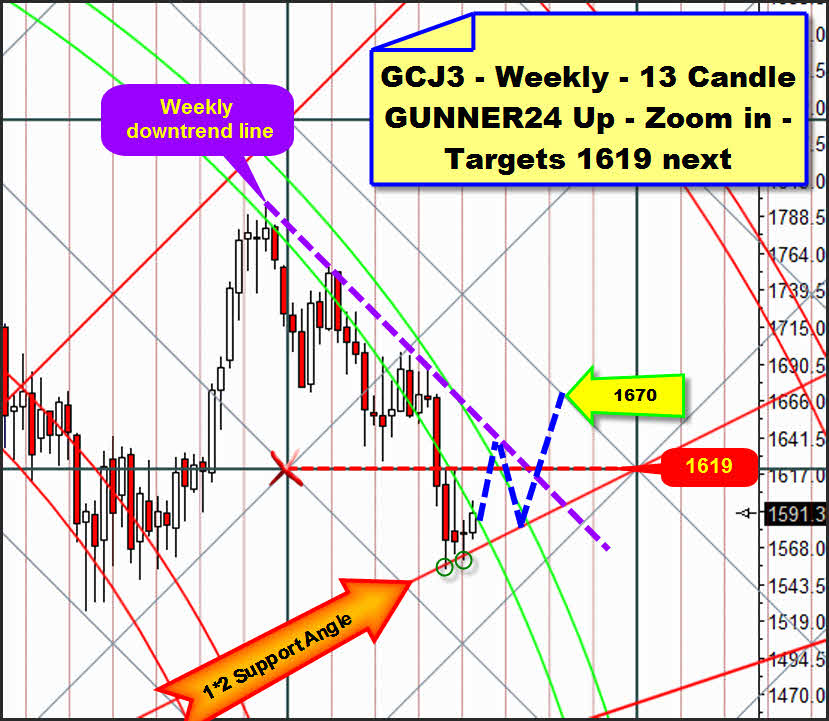

Price meets time III: In that GUNNER24 Up Setup in the weekly time frame which is actually the very most important one because it’s the most determinant, with the next opening gold is going to skip over its actually most important weekly resistance:

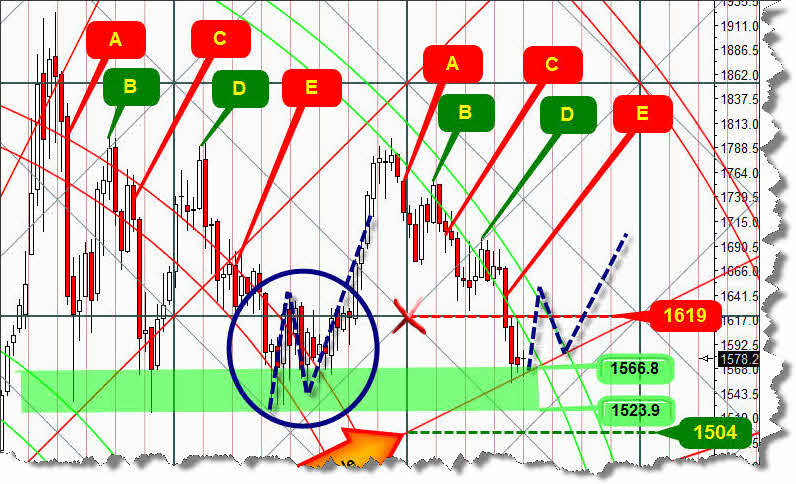

Gold seems to have made it. The bottoming process is supposed to be completed. The first visible evidence is given as some important lows at the very most important weekly support, the 1*2 Gann Angle were made and correspondingly a lasting change is coming up. The week finished positively. It’s obvious that the weekly 1*2 Gann Angle leads to positive rebound energy that is likely to be expressed/to develop in a new persistent ABC correction, as derived last week:

Among other things, last week I deduced why the 1554.30 low at the 1*2 Support Angle is supposed to be the final low of the decline that was initiated at the beginning of October 2012. Accordingly at 1554.30 another five wave ABCDE down move finished. By virtue of the clearly existing market symmetry at the important weekly resistances (3rd and 4th double arc) an ABC pattern is likely to develop again now. For today I calculated that the maximum high of this probable ABC move is supposed to be made by the beginning of June at about 1670:

To confirm this forecast furthermore, at first gold will have to overcome its most important weekly resistance, the lower line of the 4th. That is expected to succeed at once with the opening of next week. Price meets time thirdly… in the case of gold it closed – as if it were just coincidence – exactly narrow beneath the 4th, you see. Because of the Cyprus situation we have to work on the assumption that gold will open at least on the level where it closed last week – that’s at least 1591.30, but probably higher!

Thereby, as it were, it is going to skip over the price resistance of the 4th with the very opening! This is a buy signal! Correspondingly the next higher weekly resistance becomes the strongest magnet that will have to attract the price.

The next higher important weekly resistance is the upper line of the just passed square at 1619. The 1619 might have to be reached as early as next week depending on how fast the market will adjust the price with the unethical consequences of the Cyprus crisis.

I think and conclude that the actually current A wave cannot come to an end before the surroundings of the downtrend line and the upper line of the 4th – at about 1632-1635.

In these whipsaw markets of the last weeks that might confuse any trader thus leading mercilessly to burning the trading account the professional signals have got their special importance. You get them in the GUNNER24 Gold Trader!

You best register with our GUNNER24 Gold Trader now. That’s where we oversee the optimal entries and exits for you. Especially in the difficult market situations where many factors have to be considered the Gold Trader is backed by the additional GUNNER24 Signals based on the combined 1, 4 and 8 hour setups to catch the optimum entries and exits.

The GUNNER24 Gold Trader will provide you with the critical knowledge you need to forecast and analyse the precious metals with the GUNNER24 Forecasting Method. All the GUNNER24 Trading Signals you receive real-time are based on the actual Gold and Silver Future. The NEW GUNNER24 Gold Trader is a must for every actively working investor and trader who wants to trade successfully in everyday trading. The insights you receive from the head trader Eduard Altmann (and discoverer of the GUNNER24 Forecasting Method) are truly amazing sometimes. I promise!

Click the button below and order the GUNNER24 Gold Trader - $39.90 US a month. For 201 members and up - $49.90 US a month.

Be prepared!

Eduard Altmann