The Euro collapse is going on, fueled by QE, the prospect of the arguably unavoidable Grexit, combined with the political leaders’ absolute disability to stop the loss of confidence they cause.

As part of our Trade of the Day service, last Wednesday I considered a little closer the emergent developments and the short-term perspectives for the pair. So, I don’t want to deny you the existence of the multiple decade support situated at 1.0650-10500 for March 2015. Within the daily Trade of the Day service, my associate Vic Dalmatino and I also try to sniff out some profitable trading opportunities that may operate against the existing trend. As long as this "countertrend approach" fits in our risk-reward-profile, it’s appropriate since there is an opportunity of making good money in a short time.

That’s why we have been long since Wednesday in the EURUSD with the chance of 1.11. However, much more important is now on the one hand, that I’d like show the public at large – to you – the buildup respectively the structure of this quadruple decade support – I even have to ==> because, in case the 1.05 are sustainably fallen short/broken, the Euro decline might aggravate again, ongoing. The parity might be reached in that case within a few hours yet!!

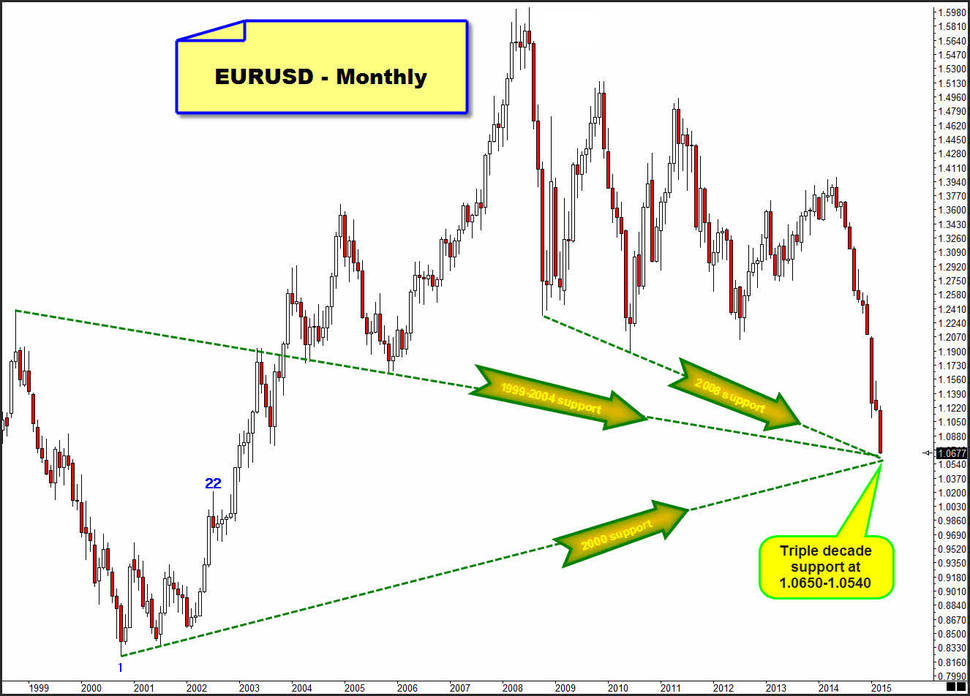

Decade supports are supports whose origin date back to the last decade – in the present example they even originate from the years 1999 and 2000 – are extremely important of course, in respect of the signaling and trend course respectively the further trend tightening!

Now and for March 2015, altogether 4 of these decade supports at 1.0650-1.0500 are bunching/ unifying for a decade cross support. If this one breaks finally, the parity will be mandatory for the pair. A final break of the 1.05 will make the downtrend accelerate again!!

As main target for this waterfall, as early as on 01/11/2015 the 0.90 (very important GUNNER24 Main Support) was worked out. That doesn’t mean by a long shot that the 0.90 would be the end of the waterfall after that! I don’t want to foment panic, just urge you to adopt all possible measures to protect your capital and your investments and perhaps even skim off a possible profit from the looming total breakdown of this key currency.

… following the Trade of the Day of last Wednesday, 03/11/2015. The charts including GUNNER24 Setups were traced on Wednesday morning when the EURUSD still quoted around 1.0670. Our buy limit was triggered the very same day. The weekly close for the pair was beneath the 1.05 already! So, please, pay attention!!!

====

1:3 Trade: Buy EURUSD at 1.0530

Our 1:3 trades A) are adjusted to a longer term, having a spacious stop-loss for the development not to be endangered and B) have to show a risk-reward ratio of more than 1:3.

EURUSD pair is now at triple decade support that starts at 1.0650 and ranges to 1.0540 for March 2015:

Not necessary to emphasize how important this decade cross support is. A triple decade support is usually a monster-support At least a multi-week upwards bounce should begin from decade support. A monthly close below 1.05 finally confirms parity first and 0.98 as a second target. GUNNER24 Main Target for this waterfall is 0.90 for the pair... Usually the 1.05 should hold for March and for April, even May. I can´t imagine that without a confirmed Grexit this support cluster is able to break. If 1.05 breaks on monthly closing base till April, the ECB/FED and the bankster bastards in US and EU know more than they say...!!! But Grexit is a sure thing I suppose: GUNNER24 Forecasting Method points strongly for a 0.98 and the 0.90. For more details about the long-term downtargets please reread free GUNNER24 Forecasts, issue 01/11/2015 "Euro 2015 – any hope? NOPE!".

Long pair with today at triple decade support, that’s a well-known support the pros know about and so it’s a target they have in the quiver. But there´s another often ignored decade support existing, an elliptical support defined by some important monthly lows:

Interesting support, uuh? Also current valid 22 Candle GUNNER24 Up starting at 2000 bear lows is indicating that waterfall should find an intermediate low in March:

First square line support exactly at 1.05. That’s also a decade support. The 2000 support line is in fact a Support Angle (= 2000 ATL Support Angle), we are able to anchor that angle at first square line for the current month! 2000 ATL Support Angle is at 1.0540 for March 2015. Last but not least, the upper line of 4th should provide support usually for the month. Upper line of 4th is at 1.0530 or so!

First square line support at 1.0500 forms together with 2000 ATL Support Angle, the elliptical decade support and two other decade support lines a quadruple decade support between 1.0650 and 1.0500. Also upper line of 4th should support market now ==> hard nuts to crack for the pair in March!

A quadruple decade support – such a strong support, the last support before parity - usually should lead to at least a 1, 2, even a 3-5 week bounce before final collapse should follow once bounce has ended, or I´m completly wrong??!! We buy at 1.0530, thats at lower end of decade support area and below 2000 ATL Support Angle and at upper line of 4th support. Buy-Limit order is valid till end of the month.

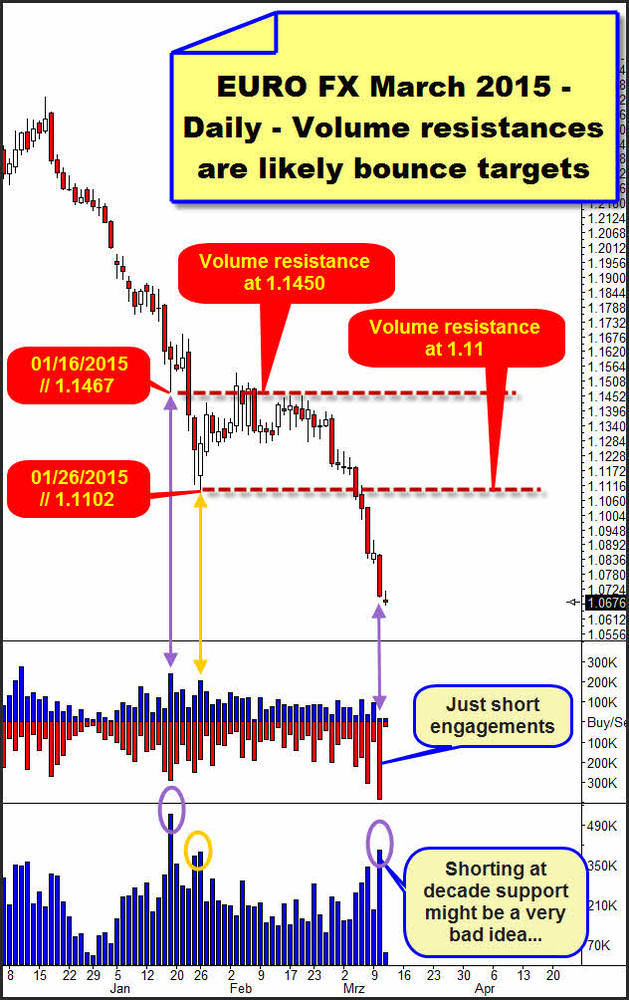

Hmm, watch current March candle, March is trading very close to an important time line. After such long waterfall events when markets are on or close to time lines time and price are in an important mathematic context. In such cases, always a strong tendency for a turn emerges. But also some extremes are allowed to happen, means for the pair in March 2015 a selling climax/exhaustion could emerge into the final low price. Probable bouncing targets are 1.1467 and 1.11. 1.11 is uptarget for our today`s 1:3 trade:

For examining the probable bouncing targets I use volume technique cause GUNNER24 Daily Setups give no clues about future developments. The volume often gives hints where – in Euro FX March 2015 contract case above – important future resistances are located. Big volume days give hints where Big Boys will defend their short engagements in future. Highest volume in 2015 was seen on 01/16, think that low of 01/16 is max any bounce from decade support is able to reach.

The second highest volume before yesterday occurred on 01/26, the low of 01/26 is at 1.1102, think this could be an obvious for any 1,2 or 3-5 week bounce starting at decade support environment. 1.11 is uptarget for today’s trade setup!

By the way, watch also yesterday’s volume. It was also huge and record selling hit market, this points to an important low arriving soon, cause traders jump on wagon close decade support area. Think shorting this market close to decade support is somehow stupid except for very short-term engagements and if very tight SL is used. Of course its always possible that Big Boys know something public doesn´t know...

If yesterday’s shorties arc caught on wrong foot cause bounce action has started they are forced to cover shorts fast, a very hard and fast short covering rally could follow once a daily close above 1.0750 occurs.

I decided to place the SL for this 1:3 trade at 1.0390. A 1.0400 might be tested on short term base within a possible extreme selling panic once the 1.0500 is fallen short of. Anything deeper as a 1.0400 should have broken 1.0650-1.0500 multi decade support area finally, in this case parity could be reached within 2 weeks.

Risk = 0.014. Potential reward = 0.057. Risk-reward ratio 0.014/0.057 or 1:4.07

GUNNER24 Trade of the Day orders for 03/11/2015:

Market: EURUSD

Orders: Buy-Limit at 1.0530. Stop-Loss (SL) at 1.0390. Uptarget is 1.1100. Buy-Limit order valid till 03/31/2014.

Be prepared!

Eduard Altmann