Likely within the next 48 trading hours, the really important resistance will be tested, which will decide on the immediate continuation of the US equities bull market.

US stock markets surged, then plunged, and then surged again ending the week with a short squeeze that cemented buy candles in the weekly index charts. This is of course very bullish behaviour and points strongly to the fact that US stock markets just made next important higher bull market lows at early February panic lows.

Still well into Thursday, I was totally convinced that on Wednesday after the FOMC minutes the Knee Jerk Reaction which started at the 9th of February course lows, had ended after an "textbook" 8 Fib number up impulse in the daily time frame.

Furthermore, the "price factor" also fired important stock market highs for Wednesday. As an example, the S&P 500 Index tested the 61.8% retracement level again after the FOMC minutes and then impulsively sold off into close as bond yields continued to rise.

For this - as another important example - please note the turbulent and volatile February development in the NASDAQ-100 e-mini future contract (NQ #) until Thursday morning, just before the regular open of the US stock markets:

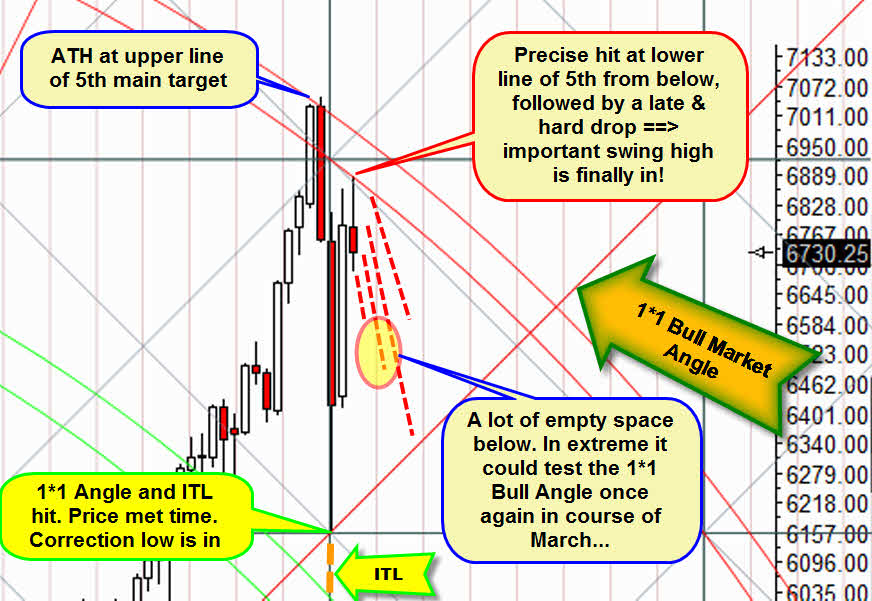

Above is the currently dominating weekly NQ # GUNNER24 Up Setup that starts measuring at important higher bull market low of the year 2016. On January 29, 2018, the NQ # futures contract found its alltime-high (ATH) extremely precise at upper line of 5th double arc. The 5th double arcs are always main targets in the equity related markets. Always when a main target is worked off, we have to recon with a trend change caused by the 5th/main target.

The very first reaction to the main target was the deepest sell-off for years. A panic cycle was triggered by upper line of 5th double arc resistance. The panic selling after the received ATH is truly the best confirmation that the falling 5th double arc is now the strongest future resistance and even allows the possibility that a new MULTI-YEAR bear market has started at ATH that was the first test of the 5th main uptarget double arc.

Let's jump now into the blue rectangle, which I zoomed up in the next picture. This tells us how exactly the market actually follows or respects the setup rails. And from that we can derive some important things!

The February 9, 2018 correction low is a 100% super exact and so too an extremely successful backtest of the 1*1 Gann Angle which naturally results from the important final high of the year 2016. So, February 9, 2018 correction low has tested back most natural and strongest imaginable bull market support out of 2016 low, which by itself is one of the most important higher lows of the entire bull market.

Correction low candle is also on an important GUNNER24 Time Line (ITL), so correction low has met a GUNNER24 Time and Price magnet. A MEGA-SUPPORT MAGNET was tested at 02/09/2018 panic lows!

Accordingly, the 5th main resistance had to be tested back quickly, as it seems and in just 8 trading days, the lower line of 5th double arc was tested back at the Wednesday top (6885.50pts) and again, the very first reaction to the identified major resistance turned out quite bearish because within just 4 trading hours NQ # dropped nearly 200pts into early Thursday lows.

All this means or meant the following:

A) Also lower line of 5th first confirmed as a future strong resistance. As initial very strong future resistance arc!

B) Every next touch/test/dent of the lower line of 5th should be sold!!, because the lower line of 5th became very important because there was usually marked an important week high.

C) On Thursday, I thought with nearly a 100% odd the final week high has arrived at 6885.50pts and lower line of 5th main resistance.

D) Consequently, I suspected that now would have begun the cycle which seriously would have to re-test the MAJOR 1*1 Bull Market Angle support, likely in course of March.

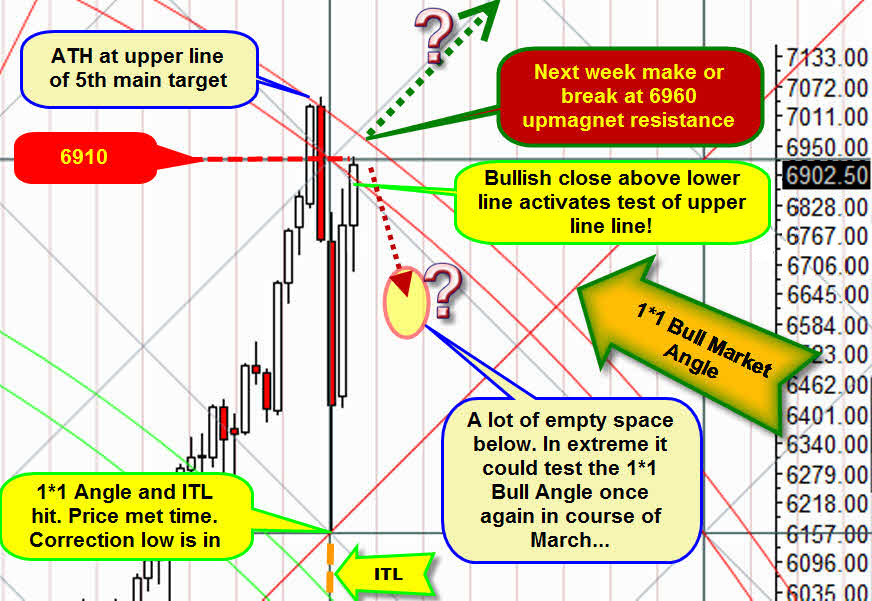

But it was totally different. Once again. Because the hard sell-off after the FOMC minutes was probably a classic bear trap and there at the final Thursday low completely surprising - at least for me - the old game started which for years makes every little bearish tuned trader or investor completely crumbly.

==> "In a bull market the surprises often come to the upside!!"

The NQ # finally closed the week (6902.50pts) far and decisively above lower line of 5th double arc main resistance after the Friday high found resistance at 6910pts natural GUNNER24 Resistance Horizonal. = 6910 is nearest confirmed weekly resistance above...

This bullish weekly close above an initial main resistance arc MUST cause the market to test the upper line of the 5th double arc main resistance within less trading hours.

==> I think that the backtest of the upper line of 5th upmagnet resistance - which is for the next week candle at 6960 exactly - must be done within the next 48 hours of trading!

However, whether the turn that started at the last Thursday low is sufficient to overcome the 5th double arc persistently will be shown in the next week. At the 6960-ATH resistance environment a Battle Royal will be carried out the whole next week. That`s where we`ll get the first clue whether the 5th main resistance double arc can be cracked.

Technically at 6960 (that`s where the upper line of 5th passes for next week) at the latested next Wednesday a new selling wave would be likely to start that should force the market again to exert a more or less serious backtest of the 1*1 Bull Market Angle. The upper line of 5th double arc is a confirmed, powerful resistance. Like at ATH, the upper line of 5th should be able to trigger a next sell wave...

But if NQ # consolidates narrowly beneath or shy above the 6960 during 1-4 days, we`d have a severe sign for the ability of the bulls to win the battle for the 5th double arc war!

I think, if the bulls succeed in producing a weekly close above 6980-6975 next and/or week after next, the NASDAQ-100 and all the other US stock indexes will roll through May 2018. We`ll buy at least the first pretty clear weekly NQ # close above the upper line of 5th. This close will be at 6980pts next week. May-target will be 7550pts then!

Enjoy and be prepared!

Eduard Altmann