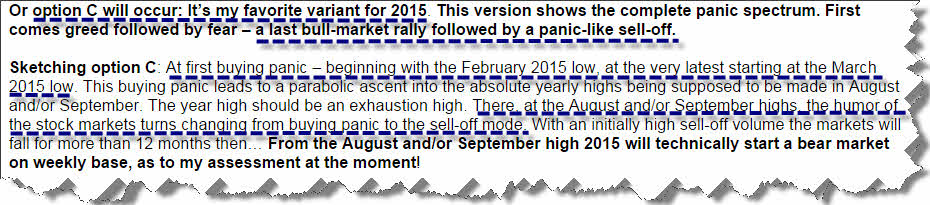

The party has begun. In my previous view at the US stock markets 2 weeks ago I expressed my expectation of a tough, hefty runaway move to start with the February 2015 low or at the very latest with the March 2015 low disemboguing in a parabolic ascent into the absolute highs of the year 2015, presumably by August/September:

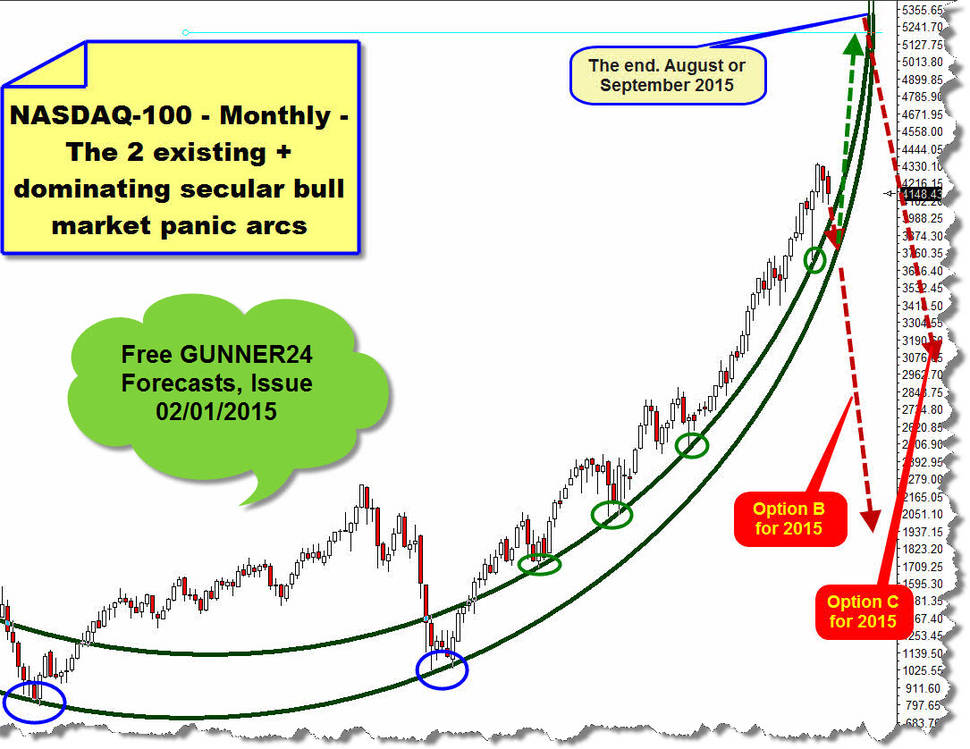

Trigger/start respectively our observation point for a coming runaway move or the beginning of a final buying panic in the US stock markets was supposed to be a touch of the NASDAQ-100 index with one of its both determining secular bull market support arcs in the monthly time frame. These two arcs have been supporting and pushing the leading index since 2002.

For the complete survey what was in store for the markets in terms of price and time – after the most recent developments in positive respect, of course – please look it up again in the free GUNNER24 Forecasts of 02/01/2015:

Since 2010, the upper one of both existing support arcs was touched at the monthly lows as many as 4 times. At these opportunities, always some extensive correction phases were brought to an end and rally phases were rung in that lasted several months. From touch to touch, the support power of the arc escalated being extended the lower wicks of the corresponding monthly candles from touch to touch. The last time the index met its arc support was at the October 2014 lows…

I call this arc support a "panic arc" because the next touch with the support arc will have to release another hefty panic-like price move at any rate. With the final break of the panic arc, the current bull market would come to an end being sold off the market in panic. However was the touch of the market at the February 2015 low the starting signal for another up-move = rally leg – actually lasting several months.

In terms of price, the present rally leg may turn out tremendous, just panic-like, it may come to an extreme exhaustion move perhaps reaching unforeseen heights that are hardly to be prognosticated reliably.

See here now the present state of the market related to the panic arcs:

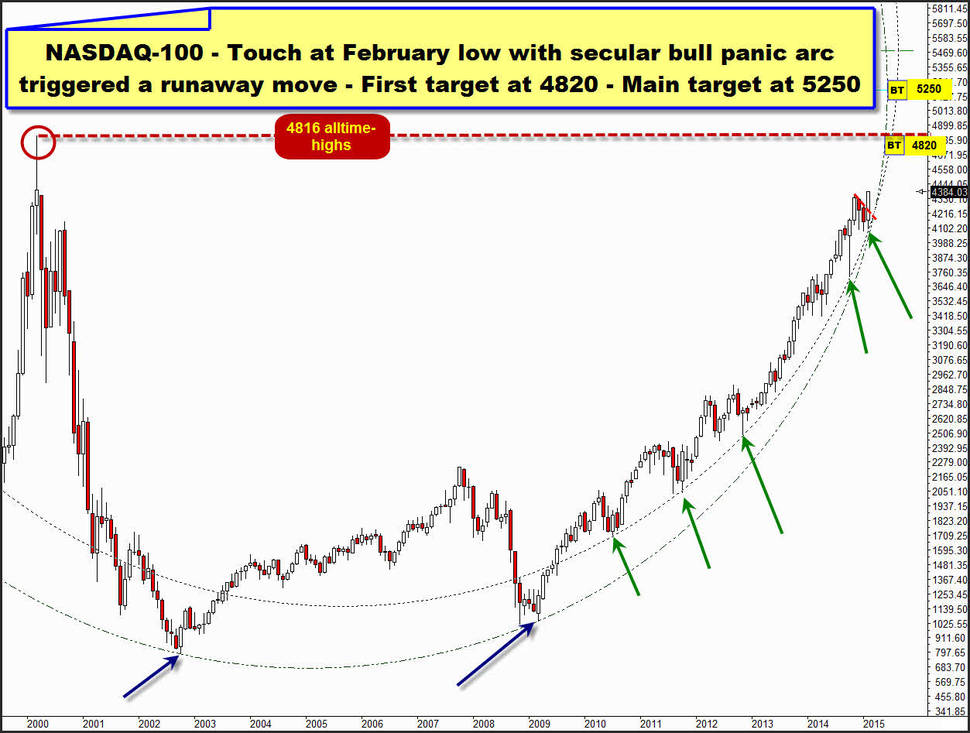

The February 2015 low touched the upper one of both panic arcs at 1980.91 index points again. With last week and the new bull market highs the "short-term" red resistance line defined by the highs of the months of November, December and January is unambiguously overcome.

The current bounce move from the panic arc seems to have triggered an enormously strong upwards push this time as well, since the current month low was marked on the very first trading day of the month of February.

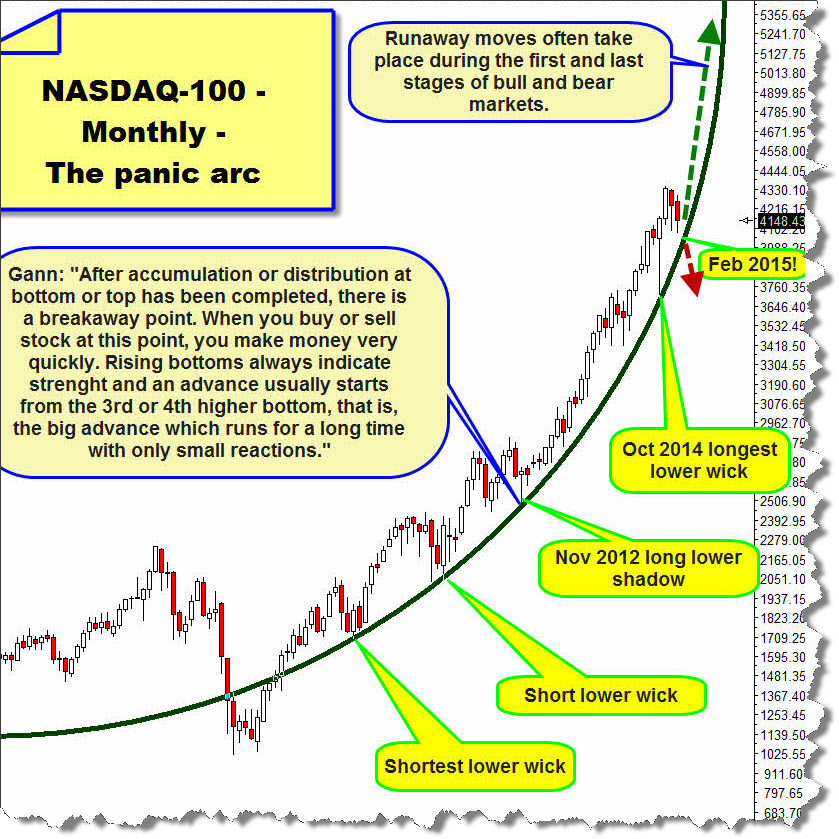

Yeah, the rebound is extremely likely to last smoothly till – our first important waypoint – for the moment till the last day of the month of February ==> since the February low was not only produced on the very first day but in addition in the first trading hour of the month, an uptrend month seems to be coming due now! That means concretely that the monthly low is supposed to be on the agenda for the beginning and the monthly high at/close to the end of the whole month. Well, technically the entire month of February should thereby be characterized by a strong, perhaps merciless upwards dynamic!!

Thus, each 1-3 day pullback – over the entire February – means a nearly 100% safe entry chance into profitable long positions! Go ahead and buy pullbacks until the all-time high will be reached at 4816 by mid-March 2015. Then we’ll see what the market is going to do in the all-time high surroundings…:

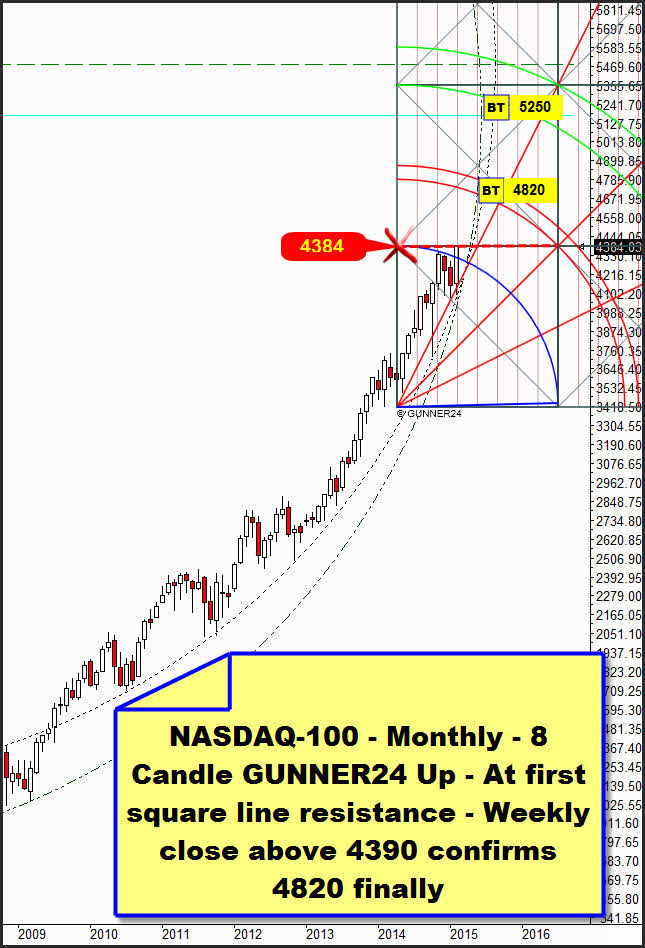

Above is the currently dominating monthly up setup. It was likewise analyzed in detail on 01/02/2015 already. I call it a "panic setup" because we can use it until the bull market will have topped out, probably in August/September.

The first up impulse comprises 8 months and this last rally went from the absolute 2014 low to the absolute high of the year 2014.

Since we measure the 8 months of the 2014 rally with the Blue Arc, we automatically define the first square line. Thus, the first square line is the most important and strongest resistance on monthly base.

Since from the 8 month rally of the year 2014 the further future magnets of this panic setup are deriving by themselves, and that the next higher GUNNER24 Resistance corresponds completely harmonically to the March 2000 ATH is an astonishing conjuncture = law of vibration!

With Friday, the index closed exactly at 4384 and therewith at its now most important existing resistance. If the market goes above it the 4620, all-time high surroundings will be finally activated!

In my opinion, there is no doubt about the all-time being reached till mid-March. The 4620 will finally be activated if A) two consecutive daily closings above 4390 index points take place. The cautious kidney of traders may B) wait for a weekly close above the 4390.

However, the fact that the NASDAQ-100 closed at the first square line resistance on Friday may once more permit a minimum pullback down to 4320-4300. In case such a pullback really happens at the beginning of next week, please grab liberally!!! In the other case, just ride on the trend that is supposed to last until mid-March toughly and steadily attaining then 4620.

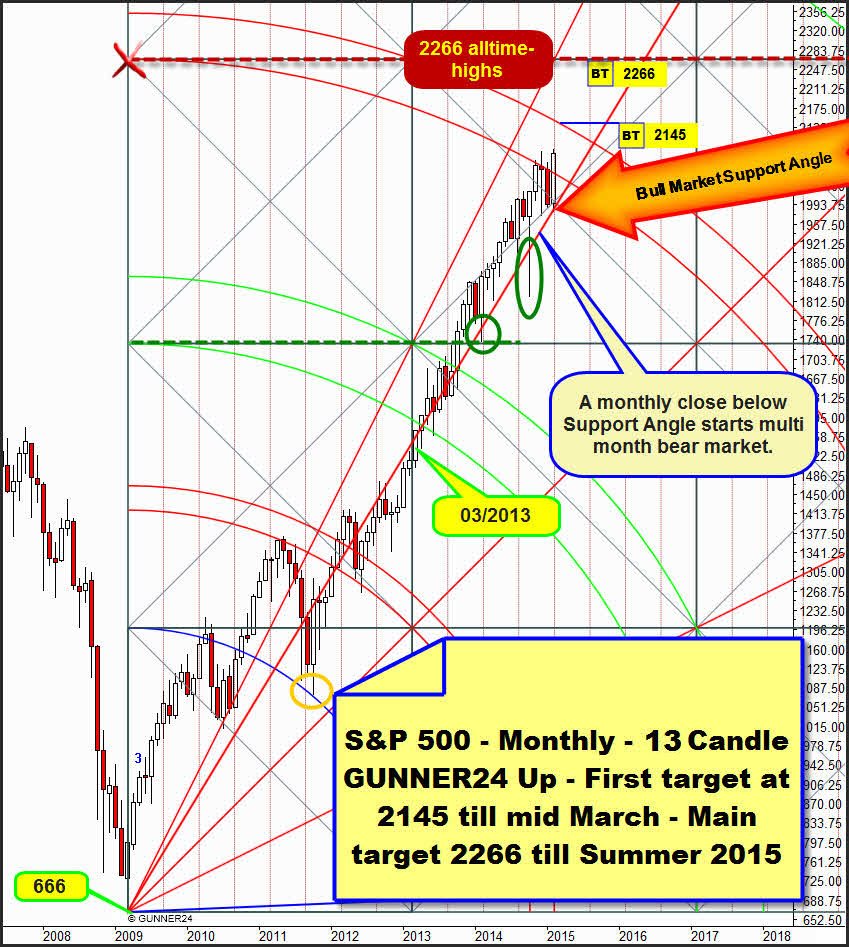

With the current February rally, the S&P 500 now activated the upper line of the 3rd double arc resistance in the dominating 13 candle up on monthly base:

The upper line of the 3rd takes its course at 2145 index points for the month of March 2015. The 2145 of the S&P 500 is about consistent with the 4620 of the NASDAQ-100.

The lower line of the 3rd double arc gave resistance in November, December and January. This one is overcome now with the clear weekly close above the lower line of the 3rd. The February 2015 rally started at the Bull Market Support Angle. The 1980.90 February 2015 low touched the Bull Market Support Angle exactly.

This angle has been providing strong monthly support on closing base after its re-conquest in March 2013.

Now, for almost 2 years the bull market has been oriented by this angle. The current bull market will officially be finished at the VERY FIRST MONTHLY CLOSE to be 30 index points below the Bull Market Support Angle.

Where might be situated a possible top of this bull for August/September 2015? Perhaps at 2266 (666+1600=2266). That’s where the next higher important monthly resistance magnet of this bulls will take its course after the upper line of the 3rd is overcome… this is very likely to happen!... The 2266 will be finally activated as main target of this bull market if a monthly close above 2145 succeeds.

Be a part of our exclusive sworn GUNNER24 Trader Community – now... I try to protect your wealth!

- with daily trades – quick, safe and profitable…

- in well-chosen precious metals, commodities, indexes, currencies and in the best stocks worldwide...

- in both rising and falling markets…

- with little use of capital…

Be prepared!

Eduard Altmann