My last intensive Gold Miners forecast is dating back now more than a month. I advised then to re-enter immediately into the severely stricken Gold and Silver Miners resp. the well-known leaders of this sector with prospect to a lush 100% performance within 2-3 months.

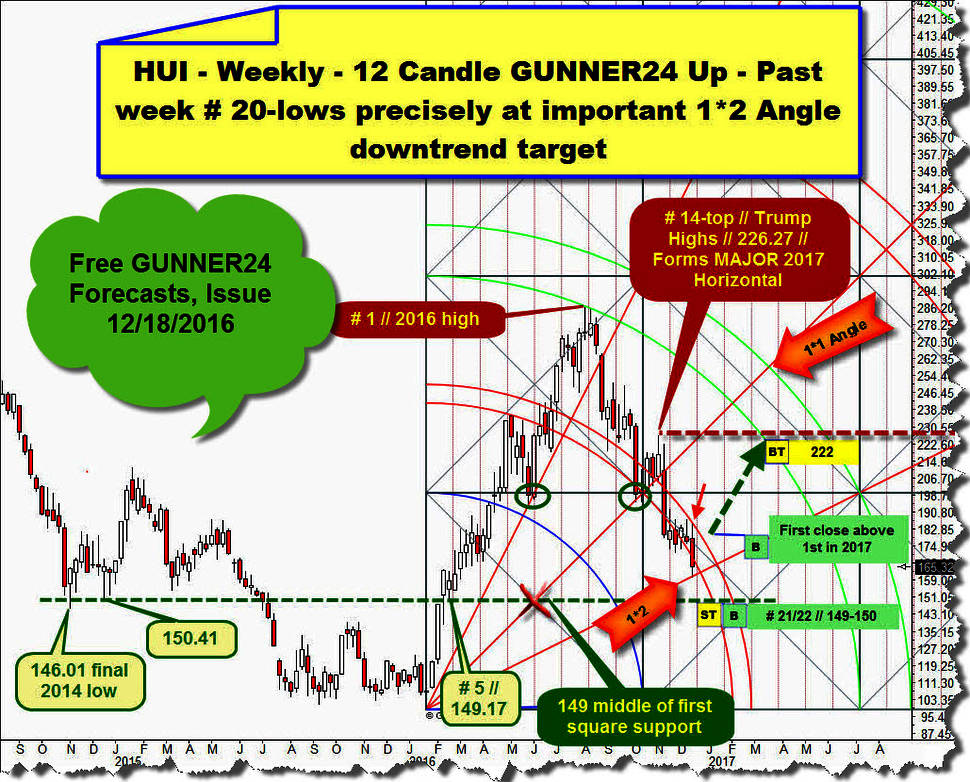

On 12/18/2016, in the "Days of Hope" analysis, the bottom of the painful correction that had started with the year high at the beginning of August 2016 was foreseeable, even tangible.

A) The Precious Metals Mining Sector was most heavily oversold in both the daily and the weekly time frames.

B) The time factor was pointing to an important low since the correction in the monthly time frame lasted 5 (Fib number) candles, in the weekly time frame 20 (close to 21 Fib number) candles, and in the daily time frame it quoted near the 89th (Fib number) day.

C) The sentiment war as bearish as it had last been almost a year before. That hinted to some higher 1-year-cycle lows not being far to seek.

D) At the NUGT ETF as well as the JNUG ETF – both being 3x leveraged ETFs – in the weekly time frame the highest ever traded volumes could be noticed. That indicated to exaggerate panic and – as we’re aware of now – to the final capitulation at the attained December 2016 lows:

E) Furthermore, on 12/15/2016 the HUI, the NYSE Arca Gold BUGS INDEX, had worked off to a T the important 1*2 Gann Angle support at the reached 160.25 pts downtrend low. The 1*2 Support Angle - please check it above – derives directly from the bear market low of the year 2016, attained in January 2016. Thereby, at the final December 2016 low, the HUI tested an important Gann Angle support on yearly base.

As we know now, it didn’t come any more to the possible and in respect to the time factor allowed further panic sell-off into the "best" long-entry at # 21/22 and 149-150 index points.

The downtrend that had begun at the 2016 highs (# 1), triggered by the natural yearly arc resistance of the lower line of the 2nd, finished at 160.25 after a 20 week down cycle:

Update of the 12 (close enough to the Fib number 13) Candle GUNNER24 Up Setup in the weekly graph, anchored at the January 2016 bear market low:

Since the low of the red # 20 was brought in at the 1*2 Support Angle, it is the final higher 1-year-cycle low that is likely to have triggered a 3 to 4 month upmove = monthly and weekly bounce & daily uptrend. The support of the 1*2 Gann Angle was reached and tested once more in the 21st week of the down cycle. Thus, the low of the red # 21 (161.38 pts) was a small higher low compared to the red # 20-low, and since the 21 Fib turn number was worked off there, it was the starting price of a new up impulse.

==> Thereby, the red # 21-low is to be identified with the green # 1-low marking the beginning of a weekly up impulse. The green # 1-low is where we may apply a new GUNNER24 Up Setup.

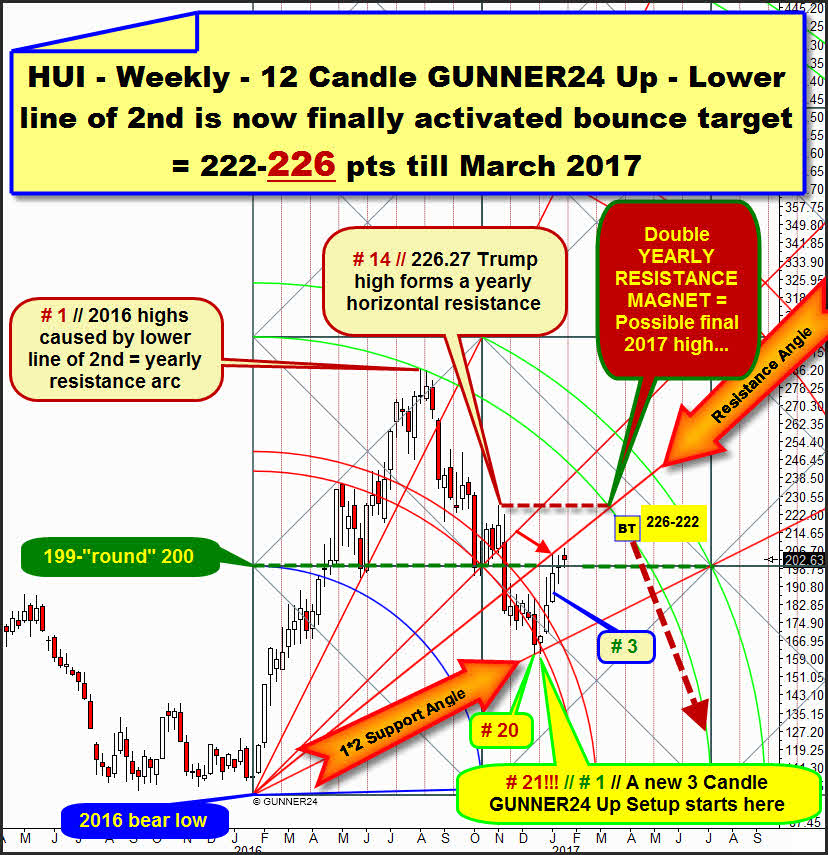

==> With the weekly close of the 2nd bounce week above the upper line of the 1st double arc, the initial up impulse that started at the green #1-low was already able to generate a timid weekly GUNNER24 Buy Candle. I call it timid cause this close above the upper line of the 1st came about just very scarcely above the upper line of the 1st. I still remember the way I judged the close of the # 2 then, somehow only 50/50, by all means still pretty risky.

As announced on 12/18/2016, a first weekly close above the natural strong 1st resistance arc would have been a further good long entry. I made it conditional on the time factor however recommending to buy the first weekly close above the 1st in 2017. Well it was reached without fail with the close of the green # 3.

==> At the latest with the clear close above the 1st double arc of the green # 3-close, the HUI finally activated the second test of the lower line of the 2nd double arc = existent arc resistance for the rest of the year 2017.

==> Confirmed long signal!!: This bounce is supposed to reach at least 222 pts, but more likely 226 pts, indeed at the latest end of March 2017!

As worked out as early as on 12/18/2016, both the lower line of the 2nd and the Trump high attained at the red # 14 are resistance marks in the yearly time frame. The lower line of the 2nd caused the final high of the year 2016. So, since the 2nd double arc yearly resistance area won’t lose its resistance influence before the fall 2017, we’ll have to work on the assumption that the resistance of the 2nd and especially that one of the lower line of the 2nd is going to signify strong resistance at the next test as well as at the test after next.

The 226.27 Trump high cemented a horizontal resistance that will have to/be allowed to be valid not only for the entire year 2017 but also for the subsequent years.

Both together – the Trump high and the lower line of the 2nd – unite to become a magnet, a yearly resistance magnet at 226 pts for the end of March 2017. Please have another, closer look at the reached top of the green # 3. It found resistance at a natural Resistance Angle that likewise springs from the 2016 bear low. There, at the red arrow the current bounce tested the Resistance Angle negatively.

As the Resistance Angle is thus confirmed important for the current upswing, likewise this Resistance Angle intersecting the 226 yearly resistance upmagnet in the last trading week of March 2017, the forecast of a backtest to happen by the end of March 2017 solidifies.

In addition, I think that the March 2017 high = 2017 spring high at the 226 yearly upmagnet should be the final high in 2017, the confirmed strong resistance of the 2nd being supposed to force/press down the HUI through the fall.

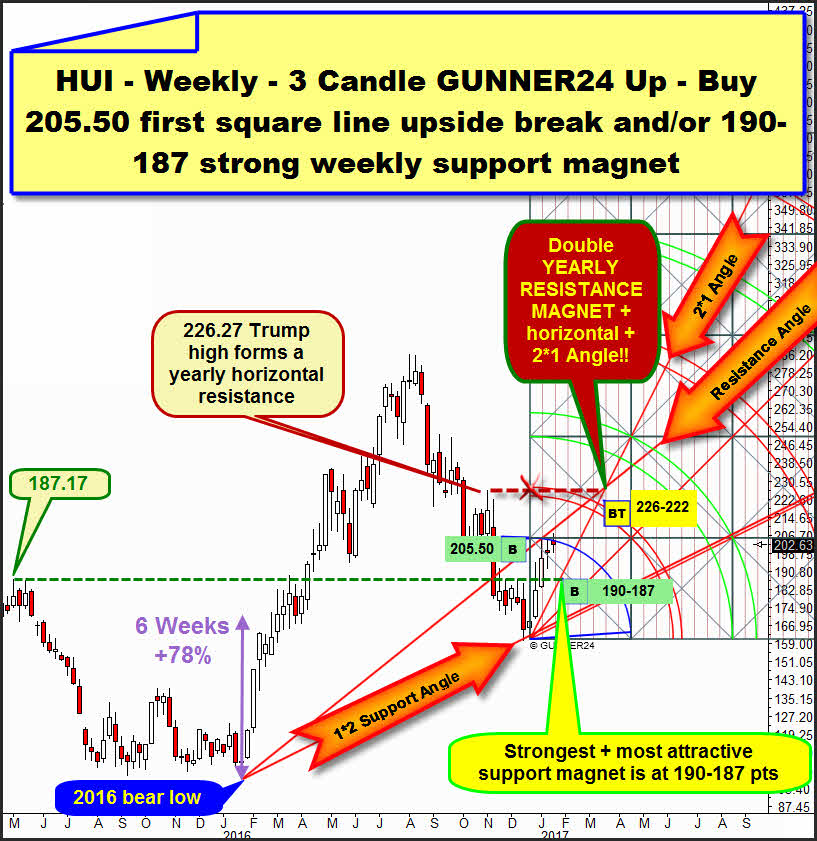

Let’s cast a still more aimed glance to the current bounce move applying a 3 Candle up setup at the low of the green # 1:

Even though the first initial impulse is certainly matter of a 5 week upmove, for the time being we’re working with the 3 week upwards impulse since this measure is supposed/likely to be very signal-safe. That’s what it always comes down to ultimately. We have to make money by trading resp. investing, after all.

The importance for the HUI of the 3 Candle up above seems to me completely confirmed because both the top of # 3 and the top of # 4 can be combined with the Blue Arc of course, besides the open of last week finding resistance at the Blue Arc.

In respect to the 222-226 uptarget, mind furthermore that the yearly 226-226.27 Trump high resistance horizontal captures the intersection point of the upper line of the 1st with the starting point of the setup in a tremendously appropriate way. Thereby, also the existing structure of the current upmove clearly indicates that the yearly 226 upmagnet should have to be reached within the bounce.

I think that the initial impulse has exhausted in the course of last week. So it’s quite possible – 70% of probability – that the HUI will correct now by 2-3 week candles.

The most likely pullback target is the 190-187 area. That’s where the important 187.17 horizontal – being re-conquered within the current upmove and therefore strong support horizontal now – intersects the 2*1 Angle. Technically, a first test of the 2*1 Angle will have to release an extremely sustainable upmove because the HUI was able to achieve a higher 1-year-cycle low just a couple of weeks ago…

==> I think that the HUI is performing handicraft work with a classical ABC-correction move into the 226 pts main target, the A-top having certainly been reached at the high of last week, the B-wave bottom being supposed to arrive at the first test of the 2*1 Angle and the high of the final correction wave C, probably the final high of the year 2017 being expected to crest about 226 pts.

==> At the moment I only believe in a corrective bounce till the 226 pts yearly resistance magnet is worked off finally because the most recently started uptrend is obviously presenting itself in a much weaker way than the powerful upmove into the final 2016 high started at the 2016 bear low.

In 2016, the HUI succeeded in turning in a +performance of a 78% within its first 6 rally weeks, followed by many more upwards weeks. Now, the HUI is showing signs of weakness after just 3-4 weeks of upwards activity really moving only sideways for 2 weeks and achieving not more than a plus of a 29.42% at most during 6 weeks of upwards bounce.

==> If I’m wrong with the 2-3 weeks of pullback into 190-187, you should buy the SECOND!! consecutive daily close above the now shaped 205.50 pts first square line for the 226 uptarget.

The 205.50 is now confirmed weekly resistance horizontal. The so far highest daily close in the bounce was reached at 204.78 pts last Tuesday. I think, that’s why it’s quite safe to increase existing long-positions at the latest with the second consecutive daily closing above 205.50 weekly resistance. Only one daily closing above 205.50 might be a false signal, especially in case it happens in the course of the next 7-8 trading days.

Next strong weekly long signal: Of course, any weekly close above 205.50 will have to be used for increasing/setting up long-positions.

Be prepared!

Eduard Altmann