All in all we saw again some solid weekly gains in the US stock markets. The S&P 500 as well as the Dow Jones closed at weekly highs. Even a five year high was delivered by the Dow Jones. Moreover gold and silver are trying to establish a new uptrend. However, by those rises of the last days all these markets are situated now EXACTLY or narrowly before the respective extremely strong weekly GUNNER24 Resistances that involve the potential to force the stock markets into a pretty extended correction and gold like silver into some new tough and sharp downtrend moves this week:

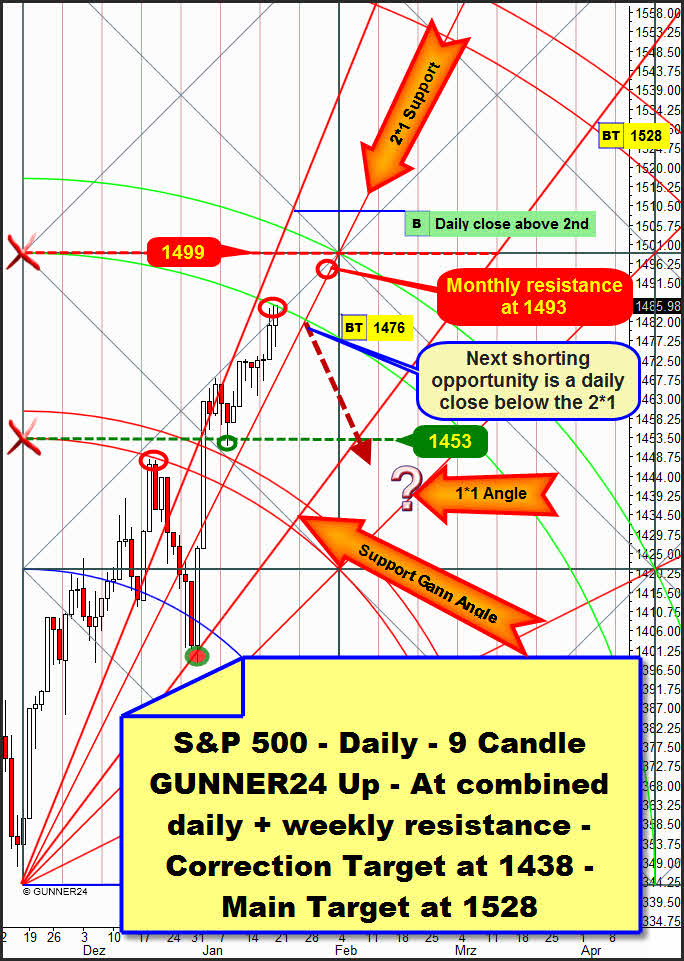

The stock market topping process starts now. The main resistance of the 2nd double arc was reached with the Friday close at 1486.98 points. As analyzed in the last Sunday issue the market seized the opportunity of topping faster than we had supposed in the analysis of December 9, 2012. All the same we covered our weekly long-position at the "safe" long-target of 1476 MIT that was triggered on Thursday by the opening near 1478 points. Profit +62 points = +4.38%.

You may always track here our trades/performance:

www.gunner24.com/trading-performance-us-stock-markets/

It’s always a little ominous to observe the markets on a Friday reaching the important GUNNER24 Magnets at long last almost as if they were hauled by magic. Whereas the index wa near 1478 points at NY lunch time, the next four hours it went straight up to the combined daily and weekly 1486.98 into close.

From my point of view there are only two outcomes left for the market: A) It turns down at once on Tuesday. Watch out! Short-engagements keep on being very dangerous and according to the rules not allowed before the 2*1 Gann Angle visible in the setup above is fallen short of on daily closing base. If the market closes below the 2*1 Gann Angle on two consecutive days, the possible retracement target might be reached at 1438 as analyzed in the last Sunday issue most extensively.

Or B) Tuesday and/or Wednesday close within both lines of the 2nd, concretely above 1486 index points – in that case the monthly 1493 GUNNER24 Target will be supposed to be headed for until the markets turn into their correction – as also analyzed in the last issue:

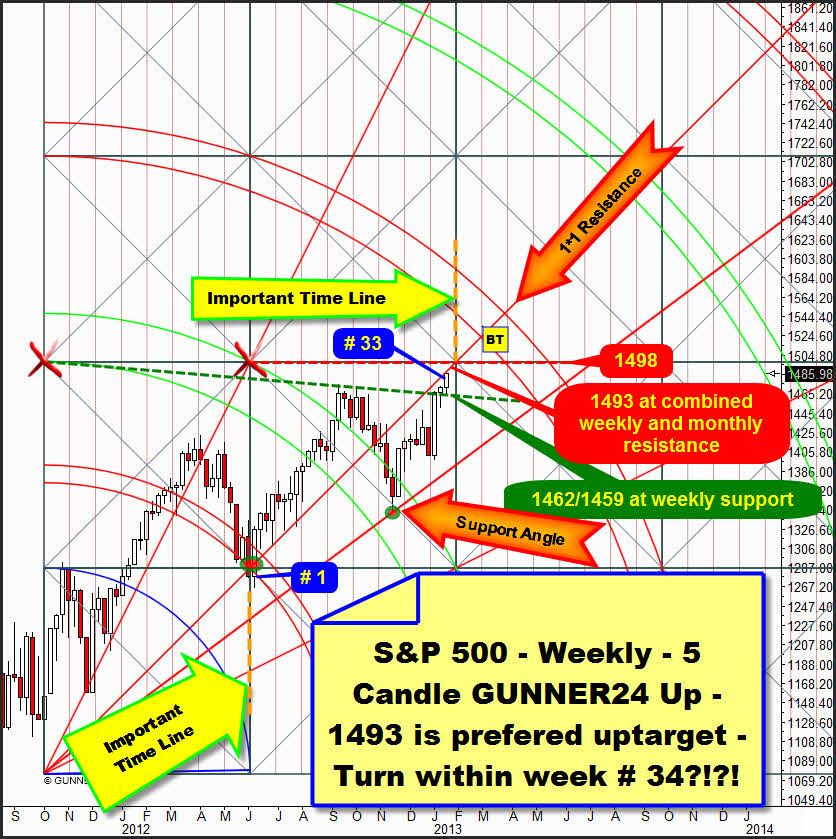

At 1493 the most important monthly magnet will meet the most important weekly magnet. Since the markets like to turn at important time lines the next weekly candle being situated very close to the next important time line, after the touch with this triple Gann magnet (weekly 1*1 Resistance Angle combined with the monthly Resistance Gann Angle and the important time line) the market will be capable to rebound downwards very strongly from/at 1493.

I consider the 1493 to have a good chance for being an important turning point for this swing. It will be a perfect match if next week the market newly marks an essential turn mark at an important time line. For we are making out that an important swing low at an important time line was made at the left limit of the just passed square. Such a rhythm uses to end a cycle frequently.

In addition the Fibonacci count is clearly pointing to an important top for next week. From the important low of the left side of the just passed square to the right side of the just passed square we can count exactly 34 weekly candles!

The 1493 can but doesn’t have to be headed for next week. With the weekly closing exactly at the 1*1 Resistance Gann Angle a combined daily and weekly resistance magnet was reached that may be able to make the market turn down as early as from Tuesday on…

The 1438 correction target worked out in the daily 9 Candle GUNNER24 above, will be finally confirmed and activated if the support line visible in the weekly setup is fallen short of on weekly closing base. This one is lying at 1462 for next week, and for the week after next it’s at 1459. The surroundings of 1460-1455 may thoroughly be the lowest area permitted by the coming correction since the uptrend is super strong still having its main target of 1525 in front.

Long is the only true trade direction till March/April. Short-engagements will have to be hedged by a tight SL. Long-entries on daily and weekly basis will have to be looked for necessarily from 1460 or 1438 respectively.

If in the daily 9 Candle GUNNER24 Up Setup – the chart at the top – a significant daily close above the 2nd double arc occurs we’ll newly go long in the daily time frame. For March 2013 the 1528 keep being main target for this entire upswing in the S&P 500!

If the stock markets start to dive, even for gold and silver the situation will be most likely to get extremely unpleasant. Both metals will face some important weekly resistances next week, just like the S&P 500. By the suction of possible stock-market declines both metals may brutally turn down…

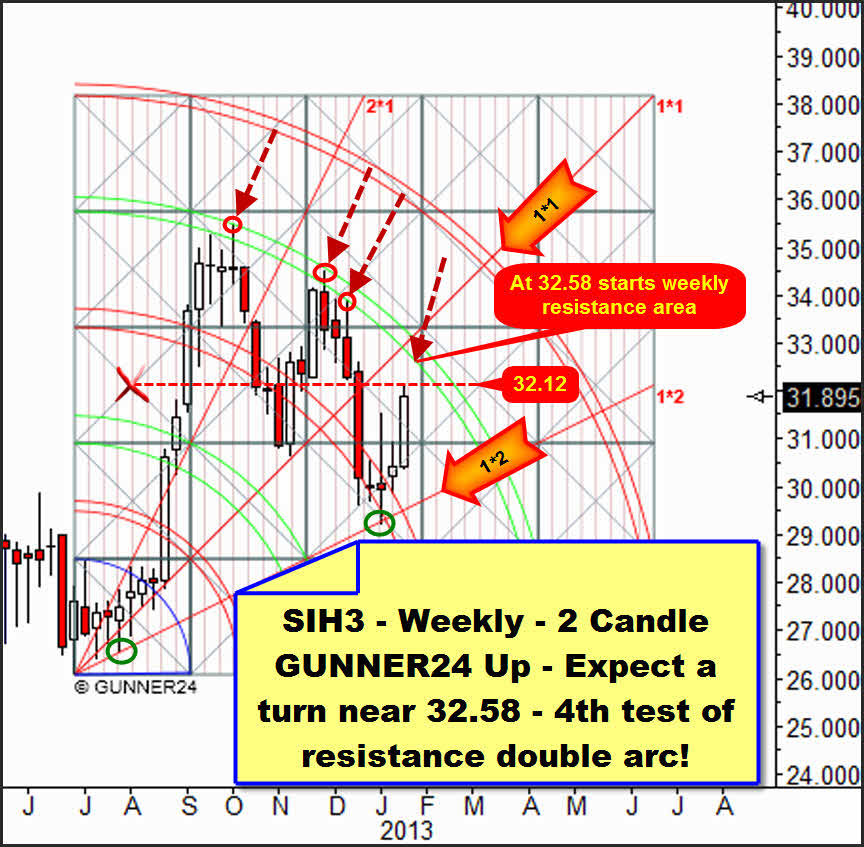

A picture paints a 1000 words I think. Silver is newly approaching its most important weekly resistance – the 4th double arc in the weekly 2 Candle GUNNER24 Up Setup. The last three visits at the 4th always ended unpleasantly for the silver bugs. Silver is following this setup very precisely. After the touch with the 1*2 Gann Angle at the beginning of the month enough rebound energy built up to make the 4th double arc become the target of the actual upswing again.

Besides, on Friday silver rebounded visibly from the center of the just passed square at 32.12. Stocks went up, silver down on Friday afternoon. The GUNNER24 Magnets are being considered…

Well, since the trend is our friend we’ll have to prepare ourselves for severe thunderstorms. There’s actually just one ray of hope for us precious-metal investors: It’s the fact that the next run-up to the 4th double arc will represent the 4th test of this resistance. According to the rules always the 3rd and the 4th test of a magnet are decisive for the trend. If silver succeeds to close above this 4th i.e. above 33 during the next 1-3 weeks, for the lows of the early January a new weekly up-swing will have begun. But if this 4th test ends negative again, some lower lows may be on the agenda, because the test of a Gann magnet that result negatively may often ring in a final exhaustion or – as possibly in this case – the final capitulation!

Technically the 32.58 should have to be the equivalent of the 1493 mark in the S&P 500.

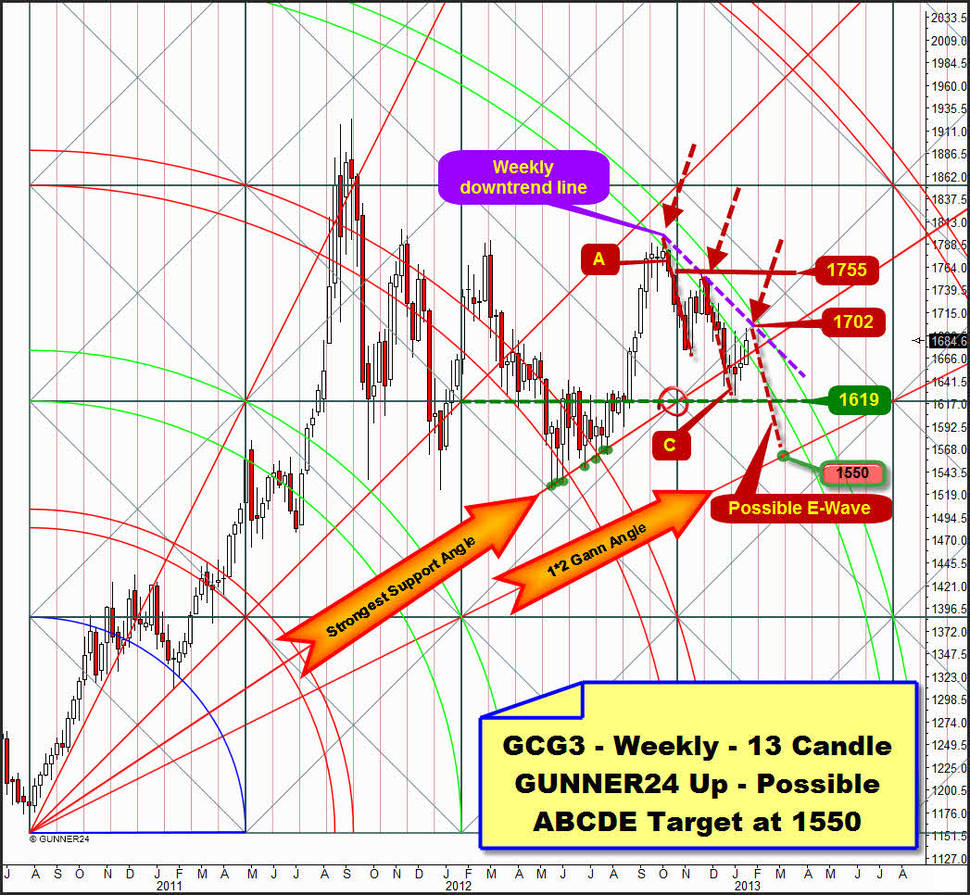

And technically the 1702 in gold is the equivalent of the 32.58 and the 1493, respectively:

For gold as well as for silver I expect a last upswing to happen. At 1702 things will turn critical. On the one hand gold is trading within the 4th. The same occurrence rang in hefty declines twice already. There’s strong resistance. Moreover gold is approaching its weekly downtrend line. This fact by itself is going to be used as a manifest short-trigger by the market participants. As in silver, a decisive test of a GUNNER24 Magnet is due. The third test of the 4th may ring in a capitulation move. And the summary of all these incidents might signify the running out of the current upwave D at 1700-1705.

If ensuing the wave E in terms of time and price results just as the A and the C waves do, gold will meet the most important and strongest Gann Angle support – the 1*2 Gann Angle at 1550. And that one is activated in this weekly setup since gold shoved down two consecutive weekly closings below the Strongest Support Angle.

Gold won’t be long on weekly basis before a visible weekly close above this ominous 4th double arc succeeds – about 1725 during the next 3-4 weeks.

|

„As far as I know", the GUNNER24 Forecasting Method is the globally unique and only technical analysis tool that deals intensely with the comportment of the market at support and resistance marks being able to combine that with price predictions. You’ll learn everything on these really "secret" facts in the Complete GUNNER24 Forecasting and Trading Course. Order now!

Be prepared!

Eduard Altmann