Profitable Intermarket-Trades by GUNNER24

The markets always provide us with a variety of informations. Not only long term trends, but also short term, profitable setups result from the intermarket analysis with GUNNER24.

For prolonged periods, the bond markets inform us on the direction the interest rates move which on the other hand have a crucial affect on the stock prices. The prices of commodities give us evidence about the direction of currency value which again fixes decisively the bonds and the interest rates. The US$ in its turn forms extensively the environment of the general price development and mostly determines the trend of the commodities.

At short notice like for instance the announcement of important economic figures or FED Decisions, the emergence of synchronous GUNNER24 Setups makes possible some profitable trades with leveraged products before the publication of those figures or decisions.

In the light of the Pre-FED GUNNER24 Setups last Wednesday 09/23/09, I'd like to illustrate an example how you can combine some GUNNER24 Setups from related markets.

Just now, the stock market, the US$ and gold correlate very close with each other. At the moment, the negative performance of the US$ supports the stock markets and the metals.

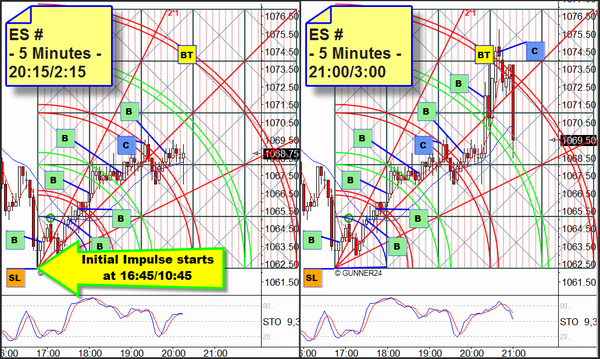

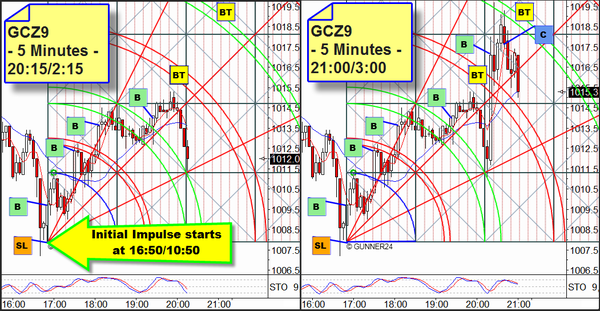

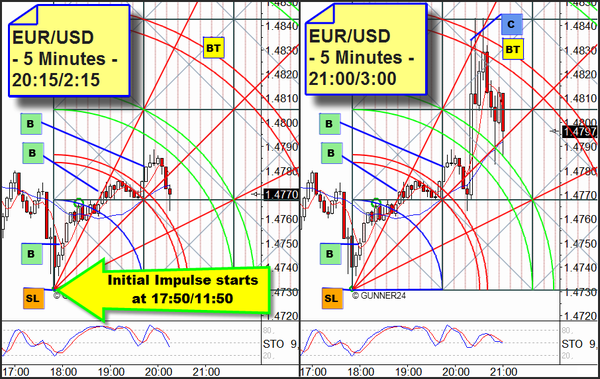

Taking a close look at the 5 minute GUNNER24 Up Setups of ES #, EUR/USD and GC Z9 we'll find out that at first the stock market then immediately gold and later on the pair anticipate rising prices after the FED decision.

The GUNNER24 Up Setups on the level until 20:15/2:15 h are always to be found on the left side of the charts. On the right side of the charts, you see the price performance after the FED Decision until 21:00/3:00 h.

|

The ES # 5 Candle GUNNER24 Up Setup was the one which began first, and at 20:15/2:15, out of the three observed GUNNER24 Setups it has advanced the most as well. By the break of the 3rd double arc, the 2nd main target which is the 5th double arc was activated.

|

At 20:15/2:15 h, price and time are in concordance. Exactly at that time, the 1*2 Gann Angle on the important time line is tested back. By the break of the 3rd double arc an additional buy is taking place which at the 4th double arc is being covered. That covering happened at the first reversal candle, it did not at the first spike candle since actually the 5th double arc was to be reached.

|

In this setup, too, the 3rd double arc is being reached. According to the rule, the longs are covered at the first spike candle.

In order to control how far the prices run within the fast moves, you should always keep watching the higher time frames with the according GUNNER24 Setups. That double check generally helps us to take the correct decisions which in the lower time frame come up.

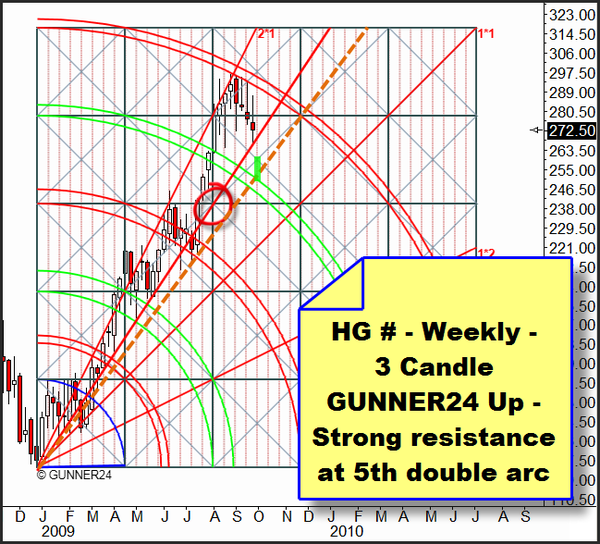

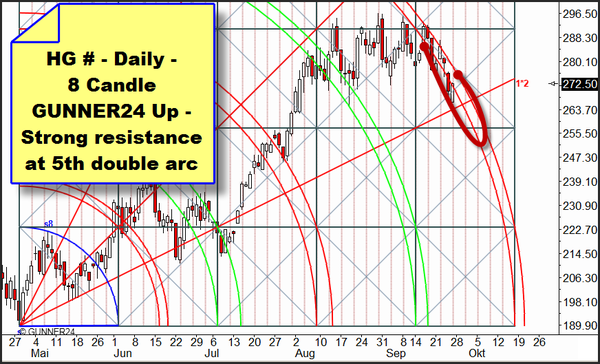

Finally, we will have a look at the HG Copper Continious Contract.

In the weekly chart, with the actual 3 Candle GUNNER24 Up Setup at the end of August copper has reached the main target and is correcting the 8 months lasting brilliant rise. The economic indicator so far has clearly performed due to its seasonality and thus it might find its bottom since the middle of October to the middle of November.

|

Please pay attention the Gann Angle which in the setup is anchored at the red circle where the price reached its low this week and found at least a short term support. If that Gann Angle falls short next week we could expect the low of that swing (green marked) close to the next lower Gann Angle (orange line) at the important time line. If the Gann Angle keeps resisting next week as well thus marking a new swing low we should be able to place a clean 5 Candle Down Setup of the high.

On daily base HG copper clearly follows the 5th double arc downwards. That 5th double arc is going to mark the way next week, too. The short positions should not be turned before a clear break of that double arc upwards. The temporal influence of the 5th double arc will end on 10/19/2009.

|

All the best,

Eduard Altmann